Altcoins

XRP Price Forecast; $0.55 rebound looms as network transactions surge by 120,000

XRP price fell below $0.50 on May 11, down 5% over a 24-hour period, but spikes in network usage suggest the next phase of rebound could be imminent.

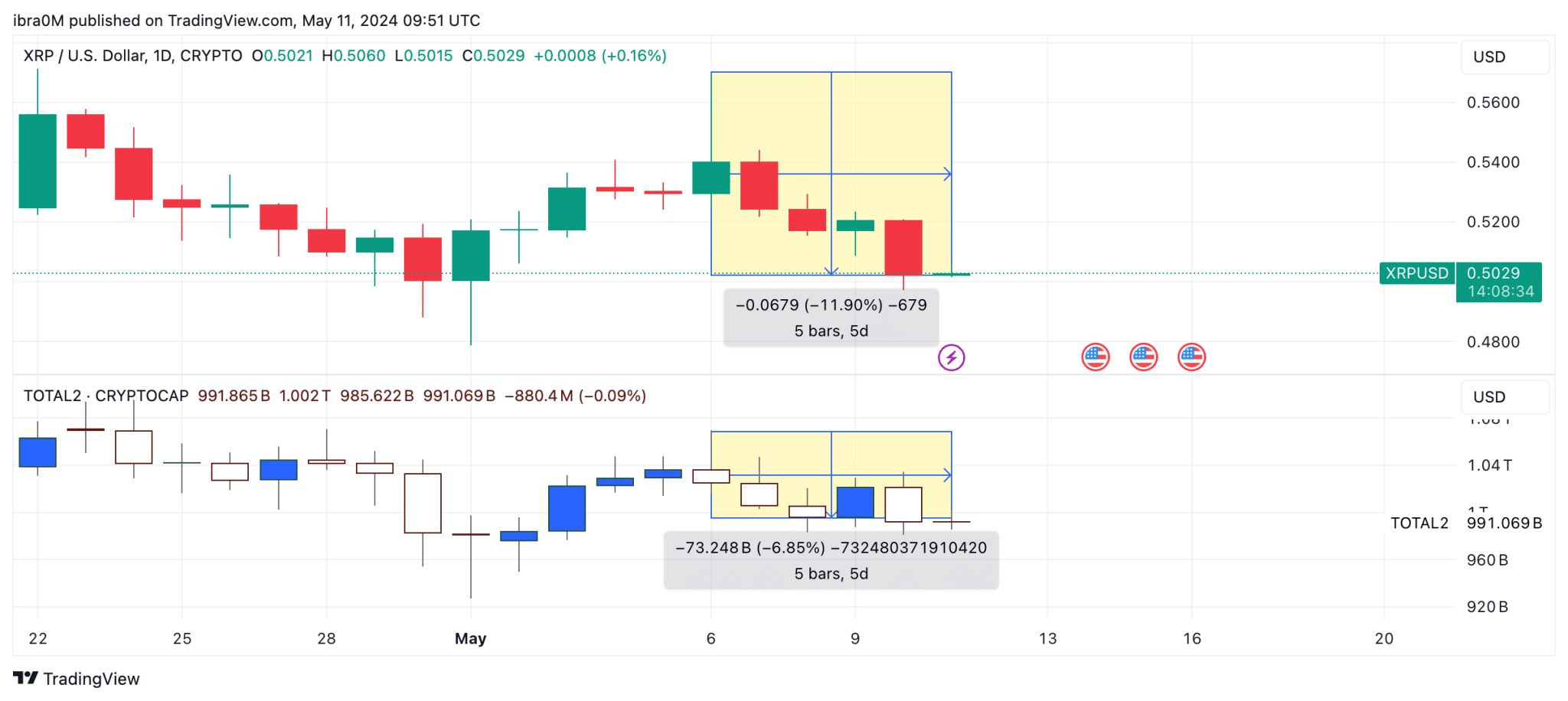

XRP Price Falls 12% as Altcoin Markets Retreat

XRP had a remarkable start to May 2024 and soared 15% between May 1 and 7. But since then, XRP’s price action has been subject to intense volatility, reflecting the broader altcoin market trend.

At the time of writing, May 11, XRP price is precariously above the $0.50 support level. Zooming out, this reflects a 12% decline from Monday’s weekly high of $0.57.

In comparison to the broader altcoin market, which has only declined 7% during this period, XRP’s price has underperformed the market average. This disappointing performance can be attributed to recent developments surrounding Ripple’s long-running lawsuit with the SEC.

Earlier this week, the SEC reaffirmed its recommendation to impose a hefty $2 billion fine on Ripple, after the company appealed to U.S. District Judge Annalisa Torres for a much lenient $10 billion fine. millions of dollars.

Transactions on the XRP network increased by 120,000 this week

Analysts predict the SEC’s $2 billion recommendation will be upheld by the judge. It is likely that negative investor reaction to this development contributed significantly to the 12% decline that saw XPR prices fall below $0.50 on May 11.

Recall that XRP initially beat the market average with a 15% rise in the first week of May. On the positive side, on-chain data trends show that the fundamental bullish catalysts that drove XRP’s price action in early May are still in play despite the bearish headwinds generated by the SEC’s $2 billion snap .

– Advertisement –

A key indicator of this is Santiment’s network transactions chart below, which captures the daily count of all transactions executed on the XRP Ledger blockchain.

The chart below shows that at the start of the price decline on May 7, XRP recorded 224,250 transactions. But since then, the network’s activity has continued to grow. The latest data shows that the XRP Ledger network recorded 352,910 unique transactions on May 10, reflecting an increase of 128,660 transactions during the week.

Historically, a large increase in a blockchain network’s daily transactions has often been bullish for the underlying price of native coins for two main reasons.

A significant increase in daily transactions indicates the growing adoption and usage of the blockchain network. This suggests that more users and entities are actively engaging with the network, using its features and services.

Such increased activity generally reflects confidence in the network’s capabilities and can attract more investors and users, which will ultimately increase demand.

XRP Price Forecast: Rebound to $0.55 Imminent?

The price of XRP is trading for $0.50 apiece at press time on May 11. However, the increase of 130,000 transactions puts XRP price in a prime position for a quick rebound towards $0.55 in the coming days.

Looking at the basis of the Bollinger Band technical indicator, the prospect of XRP price recovery now faces major resistance at the $0.52 level. If the bulls manage to scale this 20-day SMA selling wall, a quick rebound above $0.55 could be on the cards, as expected.

On the contrary, the bears need to force a decline below $0.45 to take control of XRP’s near-term market momentum. However, as the Bollinger Band lower boundary indicators show, the buying wall of support at the $0.49 level could prove intimidating.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-