NFTs

What the NFT Phenomenon Tells Us About the Monetary and Creative Value of Art ‹ Literary Hub

Among the abandoned SoHo storefronts in Manhattan, a gallery lit by candles and computer screens illuminated the cobblestone streets, where a lineup of newly minted millionaires anxiously waded through the winter winds to see what their crypto fortunes could buy. The doors opened on December 9, 2021, to a cavernous space in which dozens of guests sipped champagne and devoured morsels of designer sushi as jazz musicians played. There were venture capitalists and supermodels; basketball stars and their sycophants; film scions and political lobbyists; technophobes and technocrats; technobabes and technorats.

That evening inside Bright Moments Gallery epitomized the new gods and their rituals. They spoke in strange and unfamiliar tongues. Hieroglyphs on the bathroom walls included new terms like “metaverse” and “Ethereum.” Above the toilet was philosophy: “NFTs are the bridge from conceptual art to contractual art.” The messages continued deeper into the gallery, where someone had wallpapered the elevator with hacker mantras like “You can’t spell culture without cult” and “Fear kills growth.”

Tokenization had already exposed the fragility of the traditional system that defined artistic value.

Beyond that elevator was a dark cement basement where Tyler Hobbs stood, flanked by two gallery associates: one holding an iPad and the other looking for security threats in the shadows. Clients would join the artist and enter their online wallet information into the tablet, securing the NFTs that Hobbs had coded into existence over the preceding weeks. This precious art cargo had, with the tap of a screen, turned Hobbs into one of the wealthiest artists you’ve never heard of.

The absurd scene inside Bright Moments Gallery made Hobbs look like a fake. He was a lanky thirty-four-year-old former software engineer from Texas, sitting in an empty cellar below a gallery full of partying supplicants and blank walls. And despite a lack of inventory, attendees upstairs had paid $7 million altogether for ninety-nine original artworks. Rembrandt he was not; Hobbs used code instead of a paintbrush. But he never cared about re-creating the past glories of art history; the romantic vision of a starving artist never held much appeal. Before cryptomania, Hobbs rarely earned money from his artworks. It was nothing more than a passion project. “Digital art was usually a sentence of poverty,” he later explained to me. Nowadays, it’s his bank account.

The first windfall came seven months earlier, when Hobbs started turning his creations into NFTs. He understood that tokens were traded on the blockchain, a decentralized ledger system recording ownership information to prevent thefts and forgeries. The blockchain could also classify NFTs as unique assets, deriving their price based on rarity and demand. Hobbs learned these dynamics the easy way in June 2021, selling 999 NFTs almost immediately after offering them online and earning nearly $400,000 worth of Ethereum cryptocurrency in the process. He claimed that secondary sales, which typically come with artist royalty fees of between 5 and 10 percent in the NFT world, had brought an additional $9 million into his pocket.

Hobbs was just one of dozens—if not hundreds—of amateur artists who suddenly found themselves swimming in crypto cash and struggling to understand their own success as more than a combination of hard-earned recognition and dumb luck. He wanted to believe that society’s equation for determining cultural value and the price of art had changed during the pandemic, as people became more accustomed to living online. He wanted to believe that his sudden windfall was a reward for the years he had spent struggling as a starving artist. In other words, he wanted to believe in the fundamental lie that we all believe: merit equals money.

NFTs united the most conspiratorial corners of the internet: the power brokers and the power hungry, who believed that technology could change the world, one pixel at a time. In their rearview mirror: two financial crises and a raging pandemic that had already killed more than six million people worldwide. Up ahead: the capitalist fantasia of a multibillion-dollar industry summoned by artists and algorithms.

Hobbs found himself working in the zeitgeist of economic and technological forces. The same financial institutions and wealthy investors who had capitalized on the pandemic recession and the 2008 financial crisis were looking at NFTs as a technology that could perpetuate the rampant volatility and speculation that had contributed to their record profits. Selling securities as art was a guise for laundering those dynamics often found in the unregulated art market. These forces succeeded by asking questions that none of us, including government watchdogs, could answer: What is the value of art? And how do you put a price on something that is traditionally seen as priceless?

*

If tulipmania provided an outlet for the social anxieties that succeeded a devastating plague, then the NFT boom fulfilled a similar function during the Covid-19 pandemic. Lockdowns produced a strange alchemy in which virtual life became reality, and a speculative financial boom entangled the economic, political, social, and medical emergencies of the time. The framework that structured civilization nearly collapsed, and we lived between the creaking gears of recovery.

Most people were happy to see the old guard in place during this era of uncertainty. President Joseph R. Biden Jr., was the oldest person to ever win the White House, and Congress was controlled by two politicians who were older than him: House Speaker Nancy Pelosi and Senate minority leader Mitch McConnell. The top-grossing film in movie theaters starred a sixty-year-old intellectual property named Spider-Man, and the most successful song on the radio had first been released by the singer Kate Bush in the 1980s. Even the economic challenges were old, combining the stagflation crisis of the 1970s with the poor debt-to-GDP ratios of the 1940s alongside the overvalued tech companies of 2000 and the sovereign debt problems of 2009.

Life might have continued spinning around the circumference of these historical reference points if uncertainty was not such an effective crucible for change; if the young did not inevitably rise to challenge the old.

So many questions were left unanswered within their vortex of dada that I experienced inside Bright Moments Gallery and elsewhere throughout my journey of writing this book. The prattling of otherwise intelligent businessmen undermined an extensive reporting effort to outline the NFT industry seriously at the critical moment of its ascension. It made no sense. Grown men were infantilizing themselves in the public eye, claiming that cartoon images of pothead monkeys and pixelated alien dudes would spark a new economic age of digital ownership. The claims were so immediately ridiculous that many government regulators dismissed the industry as a short-lived fad that would perish the way Beanie Babies had. And yet! Their increasingly deranged pitch had attracted nearly $30 billion in venture capital within a period of two years. Younger generations also embraced NFTs as a symbol of their own rising power in society and a definitive breaking point with older models of cultural production.

The contradictions were obvious, so my journey of discovery began with a few simple questions: Why were investors willing to debase themselves for digital collectibles? How did the economic conditions of the pandemic fuel a speculative market cycle? Who benefited from a digital culture war? And what role would artists play in determining the future of the internet?

As a reporter with The New York Times, I had already chronicled the market’s development and realized that an even greater story was hidden beneath the headlines. But I also knew that finding the truth would require an extensive investigation unlike anything that would fit neatly into the newspaper’s column inches. So from hundreds of interviews with artists, gallerists, investors, entrepreneurs, academics, fanatics, skeptics, regulators, watchdogs, and even a priest emerged this portrait of the virtual world triumphing over the physical realm.

Then everything crashed. During the succeeding summer months, when I wrote the majority of this book’s twelve chapters, the cryptoeconomy shredded through nearly $2 trillion, and the once-booming market for nonfungible tokens deflated by nearly 97 percent of its record volume. Suddenly there were NFT collectors being charged with insider trading, international manhunts for crypto developers, and thousands of digital heists. I felt like I was back to where my career had begun: tracking down money launderers and fraudsters in the art market.

My purpose recalibrated with the changing fortunes of my subjects, and a growing consensus that the tech sector was headed toward another recession. A vision of a more ambitious story emerged, one that would tell uncomfortable truths about how the wealthy enlisted the starving artists as bannermen in their battle to re-create the pre-2008 financial system, building an army of crypto Rembrandts battling for relevance and survival. Over the last forty years, the contemporary art market has served as an economic laboratory for the rich to develop a shadow banking system of alternative assets and hedged liquidity. NFTs were a by-product of those experiments, providing financial tools branded as digital art that could be monetized at lightspeed. The implication of this exchange has been wide-reaching. Even after the secondary market for NFTs imploded, the underlying technology has become a normalized part of the art world and the financial system; it has also helped innovate other industries, like gaming, music, advertising, health care, and logistics.

The results of what became a three-year investigation are now yours to read. One might consider it only a slim volume in a much longer history of cultural economics, but the story is nonetheless an enthralling case study for those curious to understand the dynamics of speculation, and how the forces of art, technology, and money once conspired to change the world.

Throughout the book, I have carefully reconstructed scenes and incorporated dialogue drawn from my own interviews and

those sourced from publications, financial statements, internal documents, private recordings, investor slideshows, blockchain data, photographs, and videos. Every detail and conversation appearing in these pages has been subjected to fact-checking, and throughout my reporting I have followed the strict rules of journalism that I learned at The New York Times to ensure my

impartiality and credibility. I have never directly participated in the cryptoeconomy and have no financial interest in the artists mentioned here. The revelations within these pages were also shared with the appropriate people, giving them enough time and information to comment on my findings. Finally, I owe an immense debt of gratitude to the many sources who spent hours and hours speaking with me. These conversations were frequent, spread across several years, and often came during challenging life events. It’s a great privilege to have gained their trust, and an immense honor that they have entrusted me to tell this story.

The requisite struggle to bind art and money together into a single concept—the NFT—provoked the most primal feelings of greed, vanity, doubt, and revenge.

What follows is a largely chronological account of the NFT market’s rise, fall, and reboot. There will be important side quests along the way: a discussion of NFT artworks in light of the historical reception of photography; a look at how World of Warcraft determined the mechanics of the cryptoeconomy; a war between the billionaire Kenneth Griffin and the crypto investors attempting to buy a copy of the United States Constitution; the time a Miami businessman set fire to a priceless Frida Kahlo drawing that he wanted to sell as a digital collectible; the role NFTs played in the fraud perpetrated by Sam Bankman-Fried and his company, FTX; and how cryptocurrencies normalized incredibly risky bets in the financial sector during the March 2023 banking crisis.

The story includes a baroque cast of characters whose entrances and exits sometimes feel like they are pulled from a nineteenth-century Russian novel. I have done my best to stage-manage their appearances without straying from the truth. But a certain amount of whiplash should be expected; these are eccentric people skilled at using misinformation and needlessly confusing jargon to convince the public of their superiority. Many use pseudonyms to evade scrutiny—yes, there’s a Vincent Van Dough and a Cozomo de’ Medici. Artists have remained at the center of this story despite the noise, and there are four major artists who can tell the tale of NFTs better than anyone else: Tyler Hobbs, Mike Winkelmann, Justin Aversano, and Erick Calderon.

Each man represented a different kind of starving artist who entered the NFT bubble imagining that his career would be one thing and exited the crash realizing that it had become something entirely different. Their desires were simple at the beginning. One hungered for recognition; another craved wealth. But tokenization had already exposed the fragility of the traditional system that defined artistic value, leaving artists to strike hard bargains with greater economic forces in the technology and finance industries. The requisite struggle to bind art and money together into a single concept—the NFT—provoked the most primal feelings of greed, vanity, doubt, and revenge.

*

Those feelings were palpable inside Bright Moments Gallery as Hobbs took the stage. With every push of a button, he generated another artwork from his algorithm. The jazz band stopped playing, and the crypto hordes quietly sipped their champagne as he grabbed the microphone. He reviewed the newly minted NFTs as they appeared, laughing at the variable quality of the results but always providing his best sales pitch: This one looks great. Now, this is truly something avant-garde. Look at the curves on that one. The code attempts to balance unpredictability and quality, using a series of probability equations to determine the likelihood of characteristics like color, scale, and squiggle. The resulting psychedelic swirl of rectangles that Hobbs calls “flow fields” typically resemble the modernist block paintings of an artist like Piet Mondrian, only if someone dropping acid took a wet squeegee to his 1943 painting Broadway Boogie Woogie.

The new art slowly consumed the blank gallery walls as Hobbs kept pace, minting the NFTs, which were instantaneously assigned to collectors via the smart contracts that they had signed in the basement. The old-school artists who bore witness to the experiment were gobsmacked. “This is the art of our time,” said Tom Sachs, an artist who spearheaded his own financialized art movement almost thirty years ago by incorporating luxury brands like Hermès into sculptures of McDonald’s value meals. “This is the new avant-garde.”

Nobody within this audience of the crypto nouveau riche remembered what had occupied the empty storefront before the Bright Moments Gallery had taken over. Maybe it had once been a traditional gallery? Or maybe it was a Prada store? A furniture store? No, a grocery store? None of that really mattered anymore. The crypto hordes had found their own Rembrandt, and the digital art renaissance was beginning—not with a bang, but with a computerized beep.

__________________________________

From Token Supremacy: The Art of Finance, the Finance of Art, and the Great Crypto Crash of 2022 by Zachary Small. Copyright © 2024. Available from Alfred A. Knopf, an imprint of Knopf Doubleday Publishing Group, a division of Penguin Random House, LLC.

NFTs

RTFKT Announces Project Animus Reveal, Launches Egg Unboxing Event Amid Mixed Reactions | NFT CULTURE | NFT News | Web3 Culture

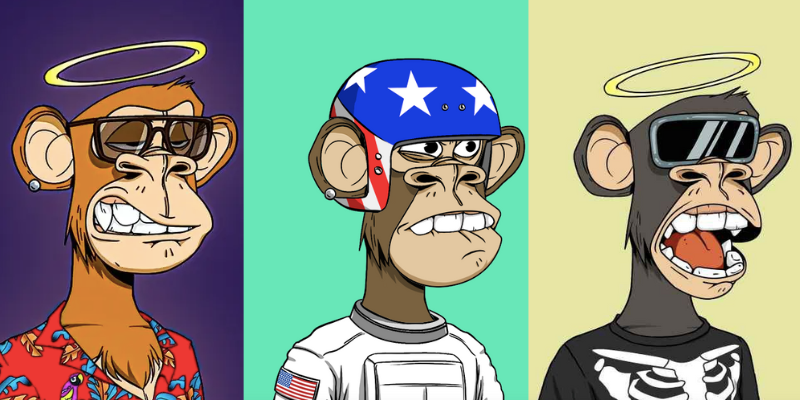

RTFKT, the innovative creator-led company renowned for its cutting-edge sneakers and metaverse collectibles, has officially unveiled its highly anticipated collection, Project Animus. This project marks a significant milestone in RTFKT’s journey, introducing a new dimension to its digital universe after a long period of development. However, the initial market response has been disappointing, with the revealed Animi trading at a floor price of 0.05 ETH, significantly lower than the eggs’ floor price of 0.09 ETH.

The Genesis of the Project Animus

Initially introduced in October 2022, Project Animus introduces a unique ecosystem of digital creatures called Animi. These Animi are designed to enhance Clone X’s avatars, offering an immersive and engaging experience for the community. The recent reveal showcased a diverse range of Animi species, each with distinct design traits and elemental attributes, breaking away from traditional trait-based rarity systems.

A New Digital Frontier: The History and Evolution of Project Animus

The Animus Project is RTFKT’s latest intellectual property, promising to revolutionize the NFT space with its unique digital creatures. The journey kicked off on October 8, 2022, with an interactive teaser event called “The Eggsperience.” This livestream event allowed attendees to explore a virtual Animus Research Facility, generating intrigue and excitement among the community.

Renowned artist Takashi Murakami played a significant role in the project, revealing the first Murakami-themed Animus creature, Saisei, on April 30, 2023. This collaboration added a layer of artistic prestige to the project, further elevating its status within the NFT community.

Animus Egg Incubation: A Journey from Egg to Animi

Clone X NFT holders had the opportunity to claim an Animus Egg until March 1, 2024. This was followed by the Animus Egg Hatching event, which ran from May 7 to June 4, 2024. During this period, holders of several RTFKT NFTs, including Clone X, Space Pod, Loot Pod, Exo Pod, and Lux Pod, were able to use a points-based system to increase their chances of hatching rarer Animi. The limited supply of Project Animus Eggs is capped at 20,000, with no public sale planned.

Mixed market reception

Despite the excitement and innovative features, the market reaction to the reveal of Project Animus has been lukewarm. Animi is currently trading at a floor price of 0.05 ETH, significantly lower than the eggs’ floor price of 0.09 ETH. This discrepancy has led to disappointment among some collectors who had high expectations for the project.

What Awaits Us: The Future of Project Animus

Following the reveal, RTFKT plans to release a collection of exclusive Animus Artist Edition characters. Holders of Clone X Artist Edition NFTs are guaranteed to get one of these special editions. The distribution will include 88 Special Edition Animus, with 8 Mythic (Dragon Sakura), 40 Shiny, and 40 Ghost Animus. The odds of receiving a Special Edition Animus are the same for all Eggs hatched, regardless of the points accumulated.

The remaining Animus characters will be distributed among unhatched Eggs, encompassing Special Edition Animus, as well as Cosmic Animus and Murakami Element from Generation 1, Generation 2, and Generation 3.

Conclusion

RTFKT’s Project Animus represents a bold step forward in the NFT space, combining cutting-edge technology with artistic collaboration to create an immersive and innovative digital ecosystem. However, the initial market reception highlights the challenges of living up to high expectations in the ever-evolving NFT landscape. As the project continues to evolve, it promises to deliver unique experiences and opportunities for its community, solidifying RTFKT’s position as a leader in the metaverse and digital collectibles arena.

Summary: RTFKT has unveiled Project Animus, introducing a unique ecosystem of digital creatures called Animi designed to enhance Clone X avatars. Despite the excitement, market response has been mixed, with Animi trading at a lower floor price than eggs. The project kicked off with an interactive event in October 2022, featuring collaborations with artist Takashi Murakami. Following the reveal, RTFKT will release special edition Animus characters. The total supply of Animus Eggs is limited to 20,000, with no public sale planned.

NFTs

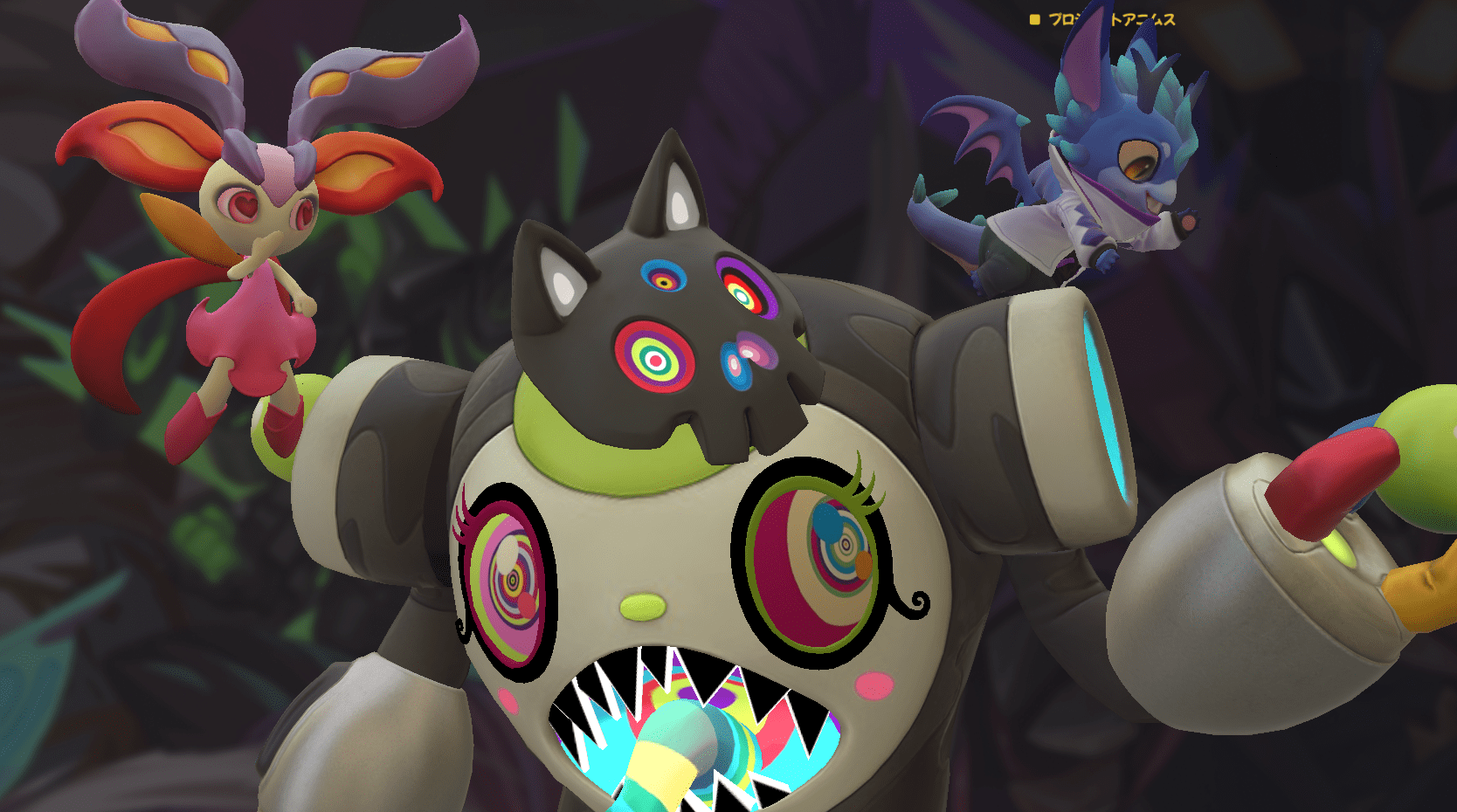

The Olympics have reportedly ditched Mario and Sonic games in favor of mobile and NFTs

The long and historic partnership between Nintendo and Sega to create video games for the Olympics reportedly ended in 2020 as event organizers sought opportunities elsewhere.

Lee Cocker, who served as executive producer on several Mario & Sonic Olympics titles, said Eurogamer the International Olympic Committee let the licensing agreement lapse because it “wanted to look at other partners, NFTs and esports.”

“Basically, the IOC wanted to bring [it] “Turn inward and look for other partners so you can get more money,” Cocker added.

The 2024 Summer Olympics kicked off in Paris last week, but there were no Mario & Sonic games available in time for the event to begin – the first time this has happened since the original release in 2007 to coincide with the 2008 Beijing Summer Olympics.

Over the past two decades, there have been four Mario and Sonic adaptations for the Summer Olympics, as well as two for the Winter Olympics.

This year, instead of a Nintendo/Sega title, the IOC released Olympics Go! Paris 2024, a free-to-play mobile and PC title developed by nWay, which has worked on several Power Rangers games.

Olympics Go! allows players to compete in 12 sports and unlock NFTs from the Paris 2024 digital pin collection.

The original Mario & Sonic at the Olympic Games was announced in March 2007 and marked the first time the two mascots – once archrivals in the console wars of the 1990s – appeared together in a game.

NFTs

DraftKings abruptly shuts down NFT operation, leaving collectors panicking over vast holdings of digital tokens

DraftKings, the daily fantasy sports and sports betting company, abruptly shut down a program called Reignmakers on Tuesday, posting a notice on its website and associated app and sending a mass email to some subset of its user base. Reignmakers, which the company launched in 2021, offered pay-to-play competitions in NFL football, PGA Tour golf and UFC mixed martial arts. The decision to eliminate the entire program, DraftKings says, was not made lightly but was forced “due to recent legal developments.”

DraftKings has yet to specify what “recent legal developments” are troubling its now-dead Reignmakers product. The company was sued in U.S. District Court in 2023 by a Reignmakers player named Justin Dufoe, who accuses the company of dealing in unregistered securities, taking advantage of relatively unsophisticated “retail investors,” and failing to market and support Reignmakers to the degree necessary to return to its users the financial benefits expected. DraftKings filed a motion in September to dismiss Dufoe’s complaint, but that motion was denied on July 2. A scheduling conference was held by the parties on July 29; Reignmakers was permanently shut down on July 30. A DraftKings spokesperson reached by Defector on Wednesday declined to confirm whether Dufoe’s complaint is the “recent legal development” that forced the company’s hand.

Users of the Reignmakers NFL product, who in recent days began murmuring on social channels about a notable lack of DraftKings activity so close to the start of the NFL preseason schedule, were caught off guard and, in some cases, devastated by the news. Members of the DraftKings Discord server, where all Reignmakers-related channels were abruptly shut down and locked following the announcement, flooded a general channel in various states of panic, sharing news, theorizing, lamenting, and, in some cases, openly worrying about whether it would be possible to recoup any decent fraction of the genuinely impressive sums of money they had invested in this DraftKings product.

Reignmakers is nominally a daily fantasy contest—users build lineups of players and then pit those lineups against other users’ lineups for cash prizes—but it’s actually a distributor of nonfungible digital tokens (NFTs), originated and sold by DraftKings, and then frequently resold on a dedicated secondary marketplace also hosted by DraftKings. At the lineup-building level, Reignmakers functions like a card-collecting game, with artificial scarcity driving the prices of the most coveted cards to insane, eye-popping heights. Reignmakers NFTs are tiered and offered in timed drops designed to heighten the sense of scarcity. A user can enter a lower-tier contest using a collection of NFTs that may have cost a few hundred dollars in total (or that were earned by purchasing random packs of NFTs that offer generally low odds of scoring top assets) and throw their lot in with hundreds of casual users competing for relatively unimpressive rewards. Random packs at the lowest tier would have prices as low as a few dollars; mid-tier cards—Star and Elite tiers, I’d guess—could cost a player upwards of $1,000.

But players interested in hunting down the biggest payouts, not just from games but from leaderboard prizes and other assorted prizes, would need to enter higher-tier games, and to enter the higher-tier games, a user’s collection needed to include higher-tier NFTs. DraftKings ensured that these cards were extremely scarce and could only be purchased directly on the marketplace at prices that any reasonable person would consider utterly insane.

For example, the highest-tier Reignmaker contests (called the Reignmakers tier, of course) have in the past been limited to listings with at least two of the highest-tier, rarest NFTs (also the Reignmaker tier) plus three NFTs from the second-highest tier (Legendary). NFTs at these tiers are expensive. Not just expensive in the way that, like, a steak dinner is expensive, but expensive in the way that buying even one of them should trigger a mandatory visit to a gambling addiction counselor, if not sirens and a straitjacket. Back in 2022a Reignmaker-level Ja’Marr Chase NFT from something called the Field Pass Promo Set could be purchased directly from the DraftKings Reignmaker Marketplace for a whopping $32,100.

Reignmakers users purchased NFTs at various levels with the expectation that owning them would convey better odds of winning contests hosted on DraftKings. This was the gamification element of Reignmakers, which emerged several months after DraftKings began trading and minting its NFTs. But as with all NFTs, a very large part of the real appeal for its buyers was the expectation, however insane, that these worthless, virtually worthless, infinitely duplicable digital images would increase in value over time. Now that both the Reignmakers game and the Reignmakers marketplace have been shut down, Reignmakers NFT holders are worried that their investments may have suddenly lost all monetary value. One Discord user described Tuesday as “a bad day to wake up and realize you have $2,000 worth of unopened NFL Rookie Packs”; Another user asked the group if they should expect “a refund” on the $10,000 they’ve already spent on Reignmakers NFTs this year. A pessimistic Reddit user posted tuesday that they would sue DraftKings if they were forced to take a total loss on a Reignmakers NFT collection worth approximately $100,000.

The game (scam?) was built to make numbers like these not only possible, but somewhat easily achievable. A user who intended to compete from a position of strength in multiple overlapping high-profile contests at the same time, and who had been in the blockchain madhouse for a period of years, could easily have spent six figures on Reignmakers NFTs. DraftKings used non-gaming incentives to entice players to spend more and more money, much like casinos give away free suites to players who over-bet on blackjack. Another Reddit user lamented the loss of the additional prizes and ranking bonuses he had hoped to earn in the upcoming NFL season by having a portfolio of NFTs that had reached the highest levels of value and prestige. “I was already loaded up on 2024 creation tokens and rookie debut cards,” said this Reignmakers userwho claimed his portfolio was finally “close to the top 250 overall.”

Dufoe’s complaint says the NFTs minted by DraftKings for Reignmakers qualify as securities, function like securities, and should be regulated as securities. In its motion to dismiss, DraftKings attempted to position its NFTs as game pieces — eye-wateringly expensive, yes, but essentially the same thing as Magic: The Gathering cards or Monopoly hotels. The court, in resolving these arguments, applied what’s known as “the Howey test,” referencing a case from 1946 in which the U.S. Supreme Court established a standard for determining whether a specific instrument qualifies as an investment contract. Judge Dennis J. Casper, in ruling against DraftKings’ motion, concluded that Dufoe could plausibly argue that Reignmakers’ NFT transactions represent “the pooling of assets from multiple investors in such a manner that all share in the profits and risks of the enterprise,” arguing that DraftKings’ absolute control over the game and marketplace effectively binds the financial interests of the company and the buyers, the latter of whom depend on the viability of both for their NFTs to retain any value.

Reignmakers users are different from Monopoly players in at least one crucial way: A person who buys a Monopoly board has no expectation from Hasbro that those little red and green pieces will appreciate in value. It’s a game! No matter what any hysterically conflicted party may say to the contrary, that’s not what NFT collecting is. DraftKings had been selling Reignmakers NFTs for months before they were gamified, and Dufoe, in his complaint, cites public comments made by DraftKings spokespeople that seem to explicitly position Reignmakers NFTs as assets with independent monetary value beyond their utility in Reignmakers contests. Judge Casper, in his ruling on the motion to dismiss, cites a Twitter account associated with a podcast run by DraftKings CEO Matthew Kalish, who in a tweet described NFTs as “the opportunity to invest in startups, artists, operations, and entrepreneurs all at once.” This is probably the kind of thing that NFT peddlers should stop saying. This advice assumes, of course, that NFTs will continue to exist as instruments on the other side of this and other lawsuits.

DraftKings has posted a worryingly sparse FAQ at the bottom of the your ad Tuesday, anticipating but largely failing to address questions from players who see this as yet another in a long line of brutal blockchain rug pulls. In a hilarious reversal of existing Reignmakers policy, Reignmakers users are now allowed by DraftKings to withdraw their Reignmakers NFTs from their DraftKings portfolios and into their personal NFT wallets, where those NFTs will have precisely zero value, to anyone, for the rest of all time. There’s also vague language about Reignmakers users having the option to “relinquish” their NFTs back to DraftKings in exchange for “cash payments,” subject to “certain conditions” and according to an as-yet-unspecified formula that will take into account, among other things, the “size and quality” of a player’s collection.

Reignmakers users are not optimistic. Those who claim to have been victims of other blockchain market crashes are warning their peers on Discord and Reddit to expect payouts that amount to pennies on the dollar; in the absence of any clarifying information, users are unsure whether cashing out their NFTs from Reignmakers to their personal NFT wallets, for reasons that completely pass any and all understanding, would effectively preclude the possibility of delivering these silly digital tokens back to DraftKings. It remains to be seen what exactly DraftKings has in mind with the “certain conditions” attached to the delivery process. There is much that has yet to be resolved. A DraftKings spokesperson contacted by Defector indicated that more time would be needed to answer a list of specific questions and issued a statement noting that it is “in DraftKings’ DNA to innovate and disrupt to provide the best possible gaming experiences for our customers.” The original complaint is embedded below.

Do you know anything about the demise of Reignmakers, either from the consumer side or from the DraftKings side? We’d love to hear from you. Get it in touch!

Recommended

NFTs

There Will Be No More ‘Mario & Sonic’ Olympics Because of NFTs

Nintendo and SEGA have been teaming up with the Olympics for several years now in the popular Mario & sonic in the Olympic Games series, but a new report claims the International Olympic Committee has abandoned the series in favor of new deals in eSports and NFTs.

According to Eurogamer“A veteran behind the series,” Lee Cocker, told the outlet that the IOC chose not to renew its license with SEGA and Nintendo, letting it expire in 2020. “They wanted to look at other partners and NFTs and eSports,” Cocker told Eurogamer. “Basically, the IOC wanted to bring [it] turn inward and look for other partners so they could get more money.”

Mario & Sonic at the Olympic Games is a series that has been running since 2008, with six main games covering the regular and Winter Olympics. In the games, players could control various characters from the Mario and Sonic franchises and compete in Olympic sporting events.

It’s no secret that NFTs are a big part of this year’s Paris 2024 Olympics. Olympics Go! Paris 2024 is a mobile and mobile-connected game your site states that players can “join the excitement of the Paris 2024 Olympic Games with nWay’s officially licensed, commemorative NFT Digital Pins collection honoring Paris 2024!”

As for eSports, Saudi Arabia will host the ESports Olympic Games in 2025. This is part of a partnership with the Saudi National Olympic Committee (NOC) that is expected to last for the next 12 years and is expected to feature regular events.

IOC President Thomas Bach said: “By partnering with the Saudi NOC, we also ensure that Olympic values are respected, in particular with regard to the game titles on the programme, the promotion of gender equality and the engagement with young audiences who are embracing esports.”

In other news, Someone claimed they’re suing Bandai Namco because Elden Ring is too difficult.

-

Videos7 months ago

Videos7 months agoMoney is broke!! The truth about our financial system!

-

News6 months ago

News6 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

News6 months ago

News6 months agoOver 1 million new tokens launched since April

-

Altcoins6 months ago

Altcoins6 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

NFTs7 months ago

NFTs7 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

Videos6 months ago

Videos6 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

Memecoins6 months ago

Memecoins6 months agoChatGPT Analytics That Will Work Better in 2024

-

Videos6 months ago

Videos6 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs7 months ago

NFTs7 months agoTrump endorses Bible line – after selling shoes, NFTs and more

-

Videos6 months ago

Videos6 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!

-

Altcoins6 months ago

Altcoins6 months agoAltcoin Investments to create millionaires in 2024

-

Memecoins6 months ago

Memecoins6 months agoWhen memecoins reign supreme in the ecosystem!