News

What is tokenization? How it works and how to invest in it

Learn how tokenization impacts the traditional financial ecosystem by digitizing assets.

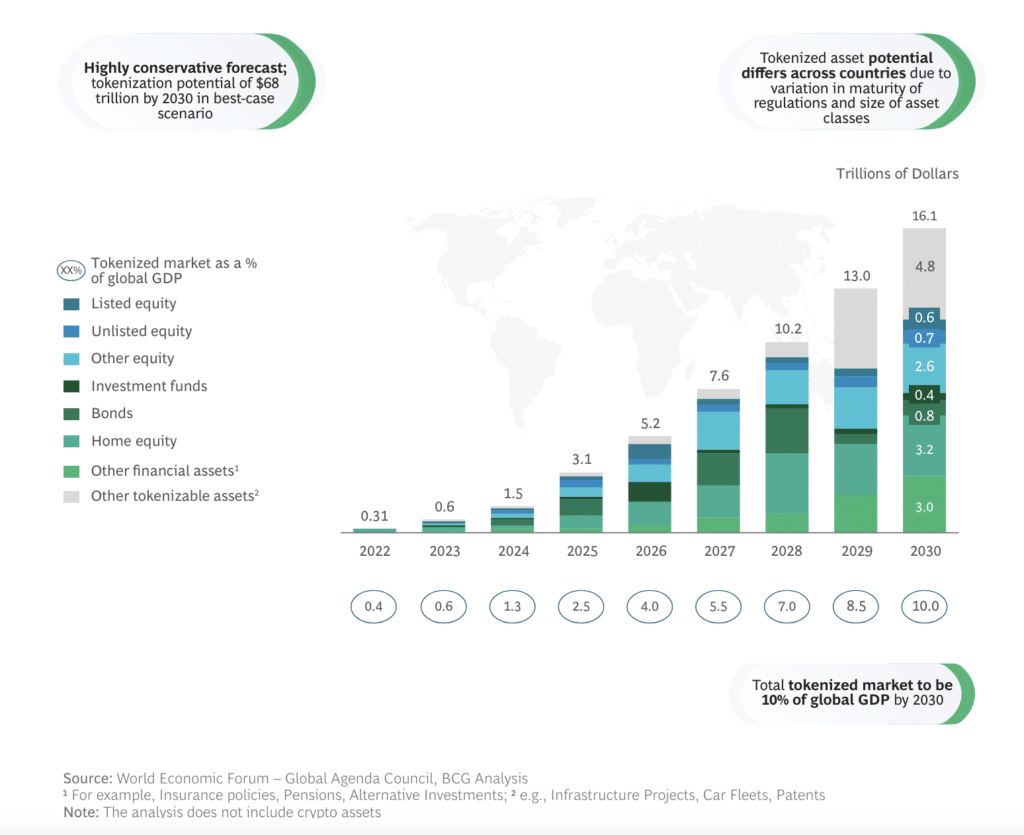

According to a relationship from digital asset management company 21.co, tokenizationThe market for could expand to $10 trillion by the end of the decade, driven by the growing adoption of blockchain by traditional financial institutions.

Likewise, a relationship of the Boston Consulting Group predicts that the market for tokenized assets could reach $16 trillion by 2030.

Source: Boston Consulting Group

One of the key drivers behind the growth of tokenization is its potential to transform existing financial infrastructure, increasing efficiency, reducing costs and optimizing supply chains.

However, the potential of tokenization goes beyond traditional financial instruments. In the future, we could see a wide range of tokenized assets, including bonds, stocks, art, cars, commodities, and even fine wines.

This expansion into new asset classes has the potential to make investing more accessible and bring new liquidity to markets that have traditionally been complex and slow.

So, let’s find out what tokenization is and why it matters.

Tokenization Explained: What is Tokenization in Cryptocurrencies?

Tokenization in cryptocurrencies refers to the conversion of real-world assets, such as actionsbonds, real estate or even physical assets, into digital tokens on a blockchain.

These tokens represent ownership or a stake in the underlying asset and can be exchanged or transferred easily and securely.

What is the purpose of tokenization? Typically, tokenization aims to introduce liquidity into traditionally illiquid markets. Assets that were once difficult to buy or sell can be instantly traded on blockchain-based platforms through tokenization, reducing transaction costs and increasing market efficiency.

How does tokenization work?

Here is a detailed overview of how tokenization typically works:

- Resource selection: An issuer selects an asset to tokenize. This could be anything from real estate to stocks, bonds or commodities.

- Tokenization process: The asset is divided into digital tokens, each representing a fraction of the underlying asset. This process is often facilitated by smart contracts, which are self-executing contracts with the terms of the agreement written directly in code.

- Emission: Tokens are issued on a blockchain, where they can be bought, sold or traded. Each token is unique and contains metadata describing the asset it represents.

- Trade and property: Once issued, tokens can be traded on blockchain-based platforms. Ownership of tokens is recorded on the blockchain, providing a transparent and immutable record of ownership.

- Redemption: Token holders may have the option to redeem their tokens for the underlying asset. This process is generally governed by the terms set out in the smart contract.

- Regulatory compliance: Throughout the process, issuers typically ensure compliance with relevant regulations, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Benefits of tokenization

By converting real-world assets into digital tokens on a blockchain, tokenization offers the following benefits:

- Increasing accessibility: Tokenization enables fractional ownership, allowing small investors to access assets that were once out of reach due to high costs or barriers to entry.

- Improve liquidity: Tokenization makes traditionally illiquid assets, such as real estate or fine art, more liquid by allowing them to be traded on blockchain-based platforms, thus reducing transaction times and costs.

- Improve efficiency: By eliminating intermediaries and streamlining processes, tokenization can increase the efficiency of asset transfer and management, reducing costs and administrative burdens.

- Enable borderless transactions: Blockchain-based tokens can be traded globally, allowing for cross-border transactions without the need for intermediaries or complex regulatory processes.

- Improve security: Blockchain provides a secure and transparent ledger to track ownership and transactions, reducing the risk of fraud and ensuring the integrity of asset ownership.

How to invest in tokenization

Investing in tokenization offers a range of opportunities for those looking to diversify their portfolios. Here are several practical ways on how to invest in tokenization technology

- Buy tokenized shares: Buy tokenized shares of popular companies like Google or Meta on cryptocurrency exchanges. These digital assets represent traditional stocks and offer benefits such as 24/7 trading and fractional ownership.

- Invest in tokenization initiatives: Consider purchasing crypto tokens issued by tokenization-focused projects. Research the project team, token liquidity and progress before investing. Look for projects with a strong use case and growth potential.

- Acquire Tier 1 Tokens: Consider purchasing layer 1 (L1) blockchain tokens from platforms that allow tokenization, such as Ethereum (ET), Solana (SOL), Avalanche (AVAX) and BNB chain (BNB). These tokens form the foundation of their respective blockchain networks and could see increased demand as tokenization grows.

- Investing in Exchange Traded Products (ETPs): Some platforms offer ETPs that they provide exposure to tokenized assets. These products can provide a cost-effective way to invest in tokenization technology.

Tokenization platforms

These platforms provide the infrastructure and tools needed to tokenize real-world assets and facilitate their trading and management on blockchain networks. Here you are Some Important tokenization platforms:

- Claimed: Backed is building an on-chain infrastructure for capital markets, offering tokenized securities that represent real-world assets such as bonds, stocks and ETFs.

- Maple tree: Maple is an on-chain marketplace focused on providing high-quality lending opportunities to institutional and accredited investors, meeting their liquidity, risk and return requirements.

- Matrixdock: Matrixdock is a digital asset platform that offers institutional and accredited investors transparent access to tokenized RWAs, ensuring an immutable record of ownership and daily proof of reserve.

- Ondo: Ondo offers on-chain financial products such as tokenized notes backed by short-term U.S. Treasury securities and bank demand deposits.

- Multifaceted network: Polymath is a tokenized securities creation platform, offering issuers a streamlined process to digitize securities on the blockchain.

- Securitise: Securitize is a compliance platform for digitizing securities on the blockchain, ensuring that tokenized securities comply with regulatory requirements.

Risks and challenges of tokenization

Investing in tokenization offers interesting opportunities, but it also comes with risks and challenges that you should be aware of:

- Regulatory risks: Tokenization is a relatively new concept and the regulations surrounding it are still evolving. Changes in regulations could impact the value and legality of tokenized assets.

- Market Volatility: The cryptocurrency market is known for its volatility, with token prices often experiencing wild fluctuations. You should be prepared for the possibility of sudden price changes.

- Security Risks: Digital assets are subject to hacking attacks and other security breaches. You should take precautions to protect your assets, such as using secure wallets and exchanges.

- Lack of liquidity: Some tokenized assets may have limited liquidity, making it difficult to buy or sell them at desired prices.

- Technological risks: The blockchain is still evolving and there are risks associated with bugs, anomalies and other technical issues that could impact tokenized assets.

Going by the hype, the tokenization market could continue to grow, with more tokenized assets and greater blockchain adoption.

However, you should proceed with caution and carefully consider the risks involved before investing in tokenization.

News

Brett Token Price Soars 12%; Analyst Expects Further 30% Upside

Brett, the largest meme coin in Blockchain Base, rose more than 12% on Friday, as sentiment in the cryptocurrency and stock sectors improved.

Brett (BRETT) the token rose to $0.133, up 31% from its low this month. Some traders believe the meme coin has more upside potential in the future.

Analyst is bullish on Brett

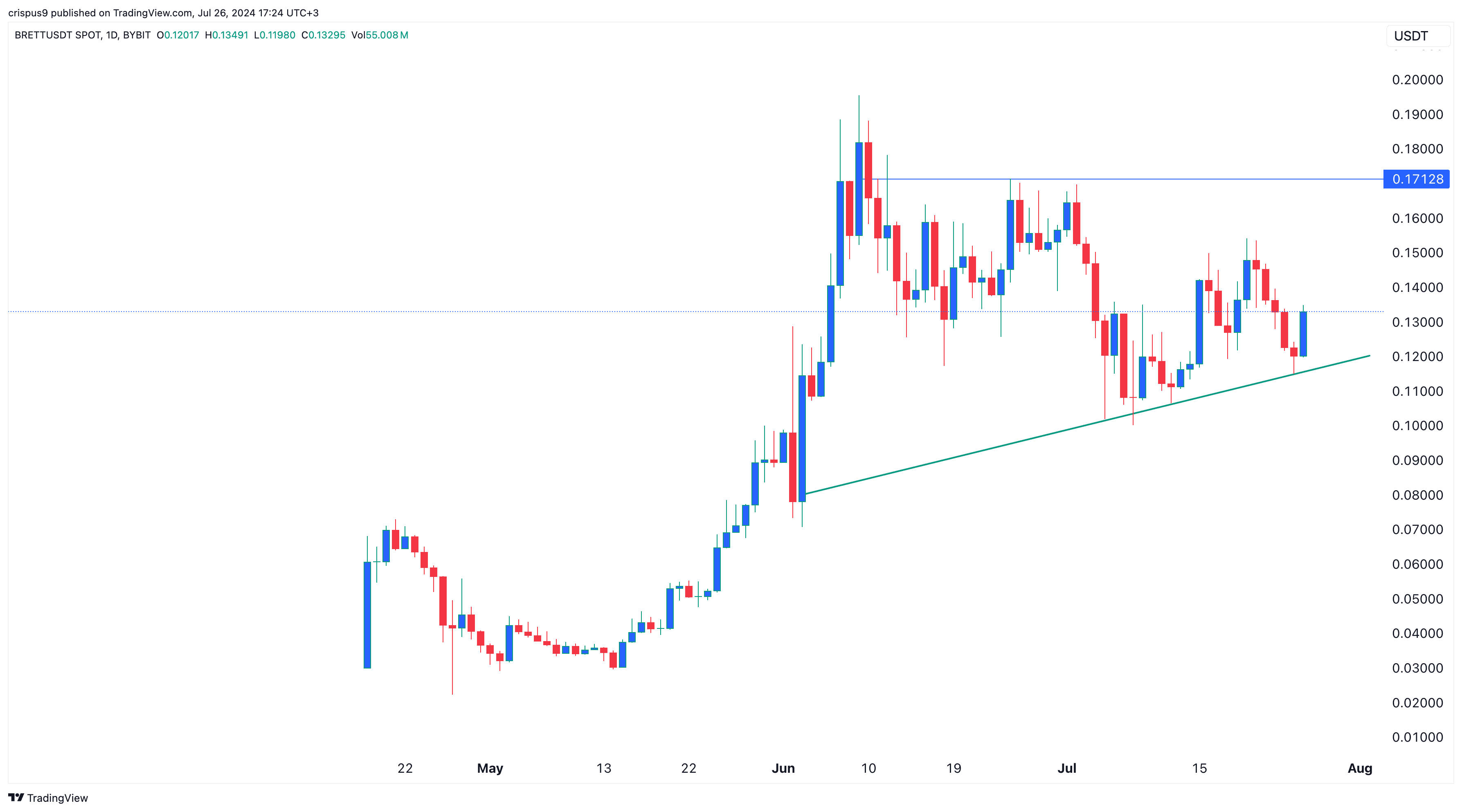

In an X-post, Michael van de Poppe, a trader with over 721,000 followers, said he is optimistic that the token will rise to $0.1712, up 30% from Friday’s trading level.

I’ve been a day trader for a long time and memes are a great way to gain that perspective.

Lots of volume.

And there’s a lot of volatility.When it comes to $BRETTI would look for long positions in this area between $0.125-0.1325 and $0.170 as a clear identification of a potential bull run. photo.twitter.com/hWmSjCZGJa

— Michaël van de Poppe (@CryptoMichNL) July 26, 2024

If he is right, Brett’s market cap will surpass Floki’s (FLOKI), which has a market capitalization of $1.7 billion.

Brett’s bounce came at the start of the Bitcoin 2024 conference today. In a statement at the event, Robert Kennedy, an independent presidential candidate, noted that he is a big supporter of Bitcoin (BTC).

The main protagonist of the event will be Donald Trump, leading in most polls, included in Polymarket. Trump is expected to reiterate his support for cryptocurrencies. Analysts are divided on whether he will announce a Bitcoin reserve at this event.

Blockchain Base is doing well

Brett token also recovered as Base blockchain ecosystems continued to perform well. Launched in 2023 by Coinbase, Base has accumulated over $1.6 billion in DeFi assets, making it the sixth largest chain in the industry. It has surpassed popular networks like Cardano (ADA), Avalanche (AVAILABLE) and Polygon (MATIC).

At the same time, Brett and other altcoins jumped as the U.S. stock market rebounded, signaling that investors have embraced risk-on sentiment. The Dow Jones Industrial Average rose more than 600 points, while the S&P 500 and Nasdaq 100 jumped more than 80 basis points.

Brett Price Chart | Source: Trading View

Technically, Brett formed a morning star pattern, which is a popular reversal sign. In the past, the coin has risen by double digits when it has formed this pattern. For example, it formed on July 12 and then rose by 40%.

On the other hand, this bounce could be a dead cat bounce, where an asset briefly rises and then resumes its downtrend.

News

Top 5 PolitiFi Tokens to Buy Now for MAX Profits

With the US presidential election fast approaching, the cryptocurrency world is buzzing with new trends. In addition to the well-known cartoon-themed meme coins, a new category is making waves: PolitiFi tokens. Did you see that coming?

These politically themed crypto tokens are gaining attention, especially those centered around former President Donald Trump. Today, we explore the 5 trending Trump-themed PolitiFi tokens.

Stock up to benefit later!

1. Trump (Magazine)

Launched about a year ago, the Trump-themed MAGA token has caused quite a stir in the cryptocurrency ecosystem. Inspired by Donald Trump’s slogan “Make America Great Again,” the MAGA token has produced an astonishing 35 million percent return since its inception. Currently trading at $5.65, it has fallen 8.80 percent in the past 24 hours.

Despite this, the token’s trading volume increased by 23.23%, bringing its market cap to $248 million and securing the 220th spot on CoinMarketCap.

Source: Dexscreener

Source: Dexscreener

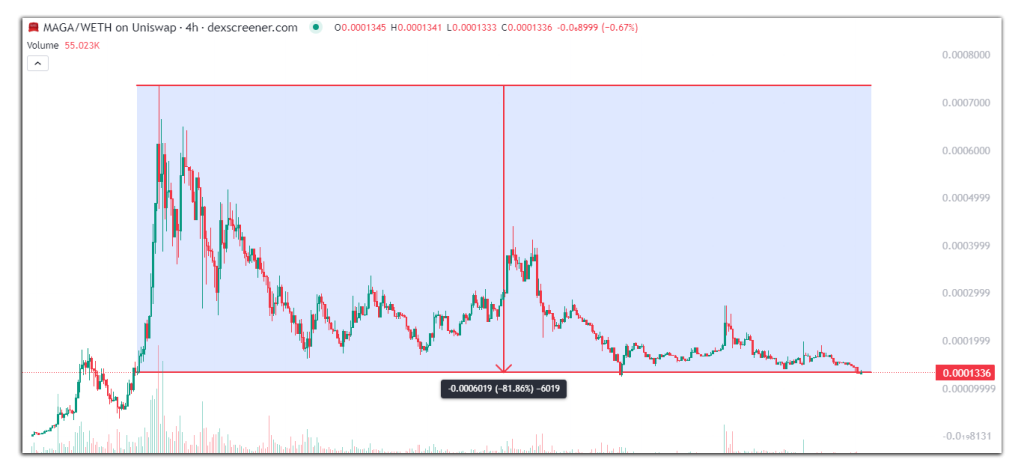

2. MAGA (MAGA)

Another token with the same ticker, MAGA, is also trending in the PolitiFi category. With 390 billion tokens in circulation, this MAGA token has seen a 11.08% price drop over the past 24 hours, but an 81.39% increase in trading volume. Currently trading at $0.0001337, it is ranked 21st on Dexscreener’s trending list and 522nd on CoinMarketCap. Despite being only two months old, it has provided early adopters with a remarkable profit of 313,373.62% at its all-time high of $0.0007354.

Source: Dexscreener

Source: Dexscreener

3. Super Trump Coin (STRUMP)

Super Trump Coin, a meme token depicting Donald Trump as Superman, has a circulating supply of 1.8 billion tokens. Over the past 24 hours, its trading volume has increased by 39.88%. Currently trading at $0.01112, it has dropped by 6.07% over the past 24 hours, but holds a CoinMarketCap rating of 776. From its all-time high of $0.03085, it has dropped by 64.06%. Despite this, its impressive short-term returns have made it a favorite among Trump crypto enthusiasts.

Source: Dexscreener

Source: Dexscreener

4. MAGA Vice President (MVP)

Launched just four months ago, MAGA VP has yet to break into the top 1000 cryptocurrencies on CoinMarketCap, currently ranked 1231st. With a value of $0.128, its trading volume has increased by 21.79% over the past 24 hours, with a market cap of $5.3 million. While it is up 110% at its current price, it is down 83.24% from its all-time high of $0.7706.

Source: Dexscreener

Source: Dexscreener

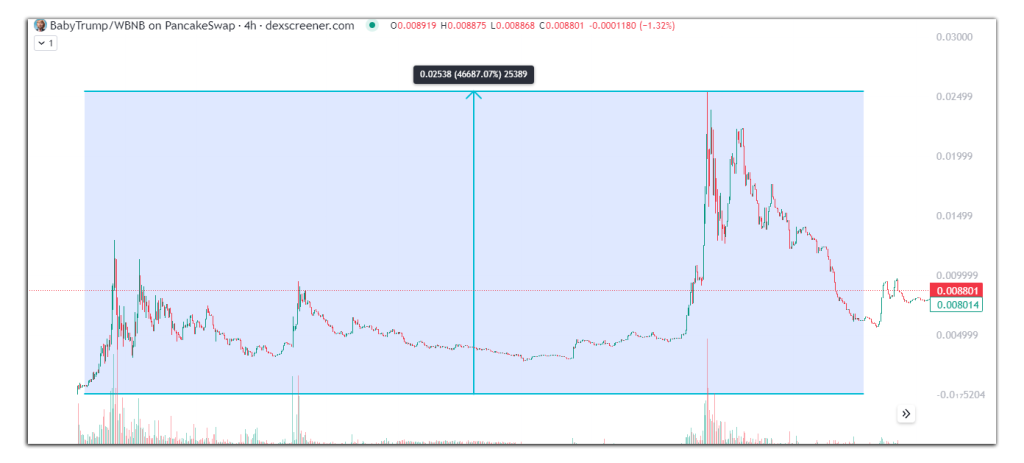

5. Little Trump

One of the most unique Trump-themed tokens is Baby Trump, which depicts Donald Trump as a baby president. With a circulating supply of 406 million tokens, it has a market cap of $3.5 million at a trading price of $0.008616. Although its price has dropped 9.45% in the last 24 hours, its trading volume has increased by 4.29%. At its peak, Baby Trump’s market cap was $11 million.

Notably, Baby Trump is the only token among the five analyzed to be based on the BNB Smart Chain, while the others are based on the Ethereum network.

Source: Dexscreener

Source: Dexscreener

It’s an exciting time for cryptocurrencies

The current political climate in the United States is spawning a new wave of meme tokens themed around various political figures. Among them, Trump-themed PolitiFi tokens are experiencing the most significant surge in popularity. Support for Donald Trump in the crypto community seems to be a driving force behind the success of these tokens.

Do you think Trump-themed PolitiFi tokens are here to stay or just a passing trend? Share your thoughts.

News

Binance Completes Render (RNDR) Token Swap and Rebranding to Render (RENDER)

Lorenzo JengarJul 26, 2024 10:26 AM

Binance has successfully completed the token swap and rebranding of Render (RNDR) to Render (RENDER), opening new trading pairs and enabling deposits and withdrawals.

Binance, a leading cryptocurrency exchange, has successfully completed the token swap and rebranding of Render (RNDR) to Render (RENDER), according to an official announcement from the company. The transition marks a significant milestone for the platform and its users, as deposits and withdrawals for the new RENDER tokens are now open.

New trading pairs and availability

Following the rebranding, Binance has opened spot trading for several new pairs involving RENDER. These pairs include RENDER/BTC, RENDER/USDT, RENDER/FDUSD, RENDER/USDC, RENDER/TRY, RENDER/EUR, and RENDER/BRL. Trading began on July 26, 2024, at 08:00 (UTC). Users engaging in Spot Copy Trading wallets can add these pairs by enabling them in the Personal Pair Preference section of the Spot Copy Trading settings.

Token Distribution and User Instructions

The token exchange was conducted at a ratio of 1 RNDR to 1 RENDER. Users can view the token distribution history via their Binance wallet history. Additionally, there are new RENDER token deposit addresses available for users to obtain.

It is important to note that deposits and withdrawals of the old RNDR tokens are no longer supported. Users are advised to update their wallet addresses and ensure that all transactions involve the new RENDER tokens to avoid any issues.

General information and disclaimers

Binance noted that there may be discrepancies in translated versions of this announcement and that users should refer to the original English version for more accurate information.

For more detailed information, users can refer to the official announcement on Binance website. Source.

As always, Binance reminds users to be cautious with their investment decisions. The platform is not responsible for any losses incurred due to market volatility. Users should consider their own financial situation and consult independent financial advisors if necessary.

Image source: Shutterstock

News

Crypto AI RENDER token soars 15.6% after rebranding. Can it hit $10?

Today, Render Network finalized the migration and upgrade of the cryptographic AI token RENDER. Following the highly anticipated rebranding, the AI token has seen positive price action, rising over 15% in the past day. Investors and market observers have expressed optimism about the rebranded token and believe it could hit $10 soon.

From RNDR to RENDER

Last year, the Render Network Foundation moved from Ethereum (ETH), where it was originally launched, to Solana (SOL). The move followed a community vote that approved two major upgrades to the network.

According to announcementThe move to Solana was “proposed for faster transactions, cheaper fees, and the project’s need to achieve more ambitious goals with more data and on-chain transactions.” The community also voted to rename the token from RNDR to RENDER, which will be finalized in 2024.

This month, the foundation informed users that many cryptocurrency exchanges, including Binance, Kraken, OKX, Crypto.com, and KuCoin, would automatically replace RNDR tokens with the rebranded token at a 1:1 ratio.

Monday, the RNDR The delisting from cryptocurrency exchanges began ahead of the scheduled migration on July 26. Exchanges halted most operations with the token, negatively impacting its performance over the course of the week.

Furthermore, whales apparently contributed impact on the token price. Online reports revealed that some notable holders sold their RNDR following the news, dragging the price from above the $7 support level to below the $6.5 price range.

The token continued to plummet in the following days, falling below the $6 mark, a 17% drop in four days. However, the long-awaited migration and listing of the new RENDER token seems to have kick-started a price recovery.

AI Token Skyrockets 17% After Listing on Binance

The newly renamed cryptocurrency AI Tokens has surged over 17% today after being listed by cryptocurrency exchange Binance. On Friday, the exchange announced that RENDER had been added to Binance Simple Earn, Buy Crypto, and Binance Convert.

Additionally, he revealed that Binance Margin and Futures options will be available today for the AI token. Meanwhile, the Auto-Invest option will be added on Monday, July 29. On that date, cryptocurrency exchange Kraken will also list RENDER and delist RNDR.

Investors and market observers have expressed optimism for the rebranding and listing on Binance. One user X said that as the project enters this new era, “RENDER token with this new chart of lows around $6.5 has the potential to reach unimaginable heights.”

Coinboss Cryptocurrency Analyst consider that the token could “pinball” if it makes a clean break above the $7 resistance level. A successful retest of the target could potentially lead the token to reclaim the $11 mark, further fueling a surge above RNDR’s all-time high (ATH) of $13.53.

Another cryptographic analyst pseudonym you think RENDER may soon hit $10, saying: “Thanks for the fud. See you above $10.” Some users also believe that investors will regret missing the “best buying opportunity.”

Over the past 24 hours, the AI crypto token has seen a remarkable 140% increase in market activity, with a daily trading volume of $83.1 million. At the time of writing, RENDER is trading at $6.89, up 15.6% from the previous day.

RENDER Performance on 3-day chart. Source: RENDERUSDT on Trading View

RENDER Performance on 3-day chart. Source: RENDERUSDT on Trading View

Featured image from Unsplash.com, chart from TradingView.com

-

Videos3 months ago

Videos3 months agoMoney is broke!! The truth about our financial system!

-

News2 months ago

News2 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

Altcoins2 months ago

Altcoins2 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Videos2 months ago

Videos2 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News2 months ago

News2 months agoOver 1 million new tokens launched since April

-

Videos2 months ago

Videos2 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs3 months ago

NFTs3 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

NFTs2 months ago

NFTs2 months agoSolana NFTs jump 30% in 24 hours: what’s behind the increase?

-

Memecoins2 months ago

Memecoins2 months agoSolana Dev hospitalized with third-degree burns while trying to pump Meme Coin

-

Videos3 months ago

Videos3 months agoCryptocurrency Market Update: Where Are We NOW?! What’s next?

-

Memecoins2 months ago

Memecoins2 months agoWhen memecoins reign supreme in the ecosystem!

-

Videos2 months ago

Videos2 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!