News

What is Liquid Staking? Liquid Staking Explained for Beginners

In blockchain technology, ensuring the validity of transactions and the creation of new blocks is vital. Proof-of-Stake (PoS) blockchains revolutionized this process by requiring participants to lock up a portion of their cryptocurrency holdings as collateral. This practice, known as crypto staking, was implemented to fortify the network’s security.

However, when individuals staked their cryptocurrency, it became temporarily inaccessible for other purposes within the blockchain ecosystem. This safeguard was necessary to incentivize validators tasked with verifying transactions to uphold the network’s integrity.

In the event of misbehavior or misconduct, validators risked losing their staked funds, thus ensuring their adherence to protocol guidelines.

As blockchain technology evolved, a problem emerged. While staking strengthened network security, it also immobilized a significant portion of crypto assets, limiting their utility in other blockchain applications.

So, that’s how liquid staking appeared, and a solution was devised to address this challenge.

Liquid staking provided a means to maintain blockchain security while unlocking the potential of staked assets for utilization in decentralized liquid staking protocols and other blockchain applications.

But how did this innovative concept come to completion, and what mechanisms underpin its functionality? Let’s delve into the narrative of liquid staking and explore its transformative impact on blockchain technology.

What is Liquid Staking?

Liquid staking is the process of staking crypto assets in a way that allows HODLers to retain the liquidity of their tokens while still earning rewards for participating in the network’s consensus mechanism.

Basically, liquid staking is like traditional staking, but you can access your staked crypto tokens anytime.

Liquid staking came about because people didn’t like locking up their crypto for a long time. They wanted to be able to use it whenever they needed it.

So, the liquid staking solutions aim to address this issue by allowing staked tokens to be used as collateral or traded on secondary markets while still earning staking rewards. This is achieved through various mechanisms, such as tokenization or the use of derivatives, which represent staked assets and can be freely transferred or traded.

How Does Liquid Staking Work?

In traditional staking, users lock up their crypto assets to help secure a proof-of-stake (PoS) blockchain network and earn rewards in return. However, the locked assets are inaccessible during the staking period.

Liquid staking offers a more flexible alternative. Through liquid staking, users just deposit their crypto tokens with a liquid staking service provider.

Further, the provider takes the tokens and pools them with other users’ deposits. This creates a larger stake, improving the proof-of-stake blockchain’s efficiency and security. They then delegate this stake to validators.

In return for the deposit, the provider mints new LSTs (liquid staking tokens). The tokens represent your original stake plus any rewards it accumulates over time. Essentially, it’s a receipt for the staked tokens.

As the validators process transactions, they earn rewards for securing the network. The liquid staking provider distributes a portion of these rewards proportionally according to the LST holding.

What are Liquid Staking Tokens (LSTs)?

Since we briefly touched on the topic earlier, let’s dive deeper into liquid staking tokens (LSTs) to understand these receipt tokens better.

As mentioned, LSTs, also known as liquid tokens or liquid staking derivatives (LSDs), are essentially digital receipts that confirm your ownership of a staked digital asset. Their value is directly tied to that of the original asset.

Like other blockchain assets, LSTs have a wide range of applications within the decentralized finance (DeFi) ecosystem. For instance, you can trade them or exchange them for other cryptocurrencies.

Furthermore, LSTs can be used for lending purposes and even as collateral for borrowing other tokens. Essentially, they are tokenized assets with numerous potential uses. There are countless possibilities for their utilization, making it impractical to cover all of them in this article.

A notable example is Ethereum: Following ‘The Merge,’ the blockchain introduced a Proof of Stake (PoS) consensus mechanism, allowing token holders to stake their ETH and earn rewards while retaining the flexibility to use their assets. This is how stETH came into existence.

Advantages and Disadvantages of Liquid Staking

| Feature | Description | Benefit/Risk |

| Liquidity | Earn staking rewards while still having access to your assets. You can trade or use them in DeFi applications through tradable tokens called Liquid Staking Tokens (LSTs). | Benefit |

| DeFi Participation | LSTs unlock the doors to various DeFi applications like lending platforms and prediction markets. This allows you to potentially earn additional yield on top of your staking rewards. | Benefit |

| Increased Returns | By combining staking rewards with potential DeFi yield, you can achieve a compounding effect and significantly boost your overall returns. | Benefit |

| Accessibility | Liquid staking removes technical barriers and minimum stake requirements. You can participate with any amount of tokens, making it a more accessible option for everyone. | Benefit |

| Security | Liquid staking inherits slashing risk from the validators chosen by the provider. If these validators misbehave, your staked assets could be penalized. | Risk |

| Centralization | There’s a potential risk of a single provider accumulating a dominant share of staked assets in a network, which could lead to centralization and reduce the overall decentralization of the network. | Risk |

| Regulation | Crypto staking regulations are still evolving, and there’s some uncertainty about how they might impact your participation in liquid staking, especially depending on your location. | Risk |

| Governance | When you stake your tokens through a liquid staking platform, you might give up some control over your assets. This could include sacrificing your voting rights in on-chain governance proposals related to the underlying token. | Risk |

Advantages of Liquid Staking

If you’ve read all of the above, you might probably say that the biggest advantage of liquid staking is related to the accessibility it offers, and you’re right; unlike traditional staking, liquid staking offers increased flexibility.

But there are also a lot of other advantages, so let’s explore some of the unique advantages it brings:

1. Unlocked Liquidity – Traditional staking involves locking up your tokens, restricting their immediate use. Liquid staking solves this by issuing tradable liquid staking tokens (LSTs). These tokens represent your staked assets and can be readily bought, sold, or used in DeFi applications. This injects liquidity into your holdings, allowing for more strategic capital allocation.

2. Composability in DeFi – LSTs open doors to the exciting world of DeFi. They function as Lego blocks for your crypto portfolio. You can leverage them in various DeFi protocols:

- Lending Platforms – Deposit your LSTs as collateral and borrow other cryptocurrencies, amplifying your returns.

- Prediction Markets – Stake your LSTs to predict future events and potentially earn high yields.

3. Reward Stacking – Liquid staking lets you enjoy the best of both worlds:

- Staking Rewards – You continue to earn rewards for securing the blockchain network through your staked assets.

- DeFi Yield – LSTs can be used in DeFi protocols, potentially generating additional yield on top of your staking rewards. This creates a compounding effect, boosting your overall returns.

4. Lower Barrier to Entry – Traditional staking often requires significant technical knowledge and resources. For example, running a validator node on Ethereum necessitates a minimum stake of 32 ETH. Liquid staking eliminates these hurdles. You can participate in staking with any amount through a liquid staking provider, making it highly accessible for everyone.

Disadvantages of Liquid Staking

1. Slashing Risk – In Proof-of-Stake (PoS) networks, validators verify transactions and maintain network security. However, for malicious behavior or negligence (going offline for extended periods), validators can face penalties called “slashing.” This slashing results in a portion of their staked tokens being destroyed. Since liquid staking enables users to delegate their stake to validators chosen by the provider, their tokens are also susceptible to slashing if the provider selects unreliable validators.

2. Centralization Concerns – Liquid staking providers often pool user tokens together to create a larger staking pool. While this improves efficiency, it can also lead to centralization if a single provider accumulates a dominant share of the staked assets in a particular network. To mitigate this risk, it’s advisable to choose platforms that promote a distributed network of validators.

3. Regulatory Uncertainty – The cryptocurrency industry is a relatively new and rapidly evolving space. Regulations surrounding crypto staking are still under development in many jurisdictions. It’s crucial to stay informed about any legal or regulatory changes that might impact your participation in liquid staking, especially in your specific location.

4. Reduced Governance Rights – When you stake your tokens through a liquid staking platform, you might relinquish some control over your assets. This could include sacrificing your voting rights in on-chain governance proposals related to the underlying token. While convenience comes with liquid staking, it’s important to weigh the potential trade-off in terms of your participation in the governance of your chosen cryptocurrency.

Examples of Liquid Staking Platforms or Liquid Staking Services

1. Lido Finance

As of April 25, 2023, Lido is the largest liquid staking protocol, boasting a Total Value Locked (TVL) surpassing $29.592 billion. Participants have the opportunity to stake their tokens and receive daily rewards without the need to lock them or manage their infrastructure.

Lido extends its offerings across multiple blockchain ecosystems, including Ethereum, Polygon, and Solana, by providing stETH (staked ETH) LSTs, stMATIC, and stSOL, respectively.

2. Rocket Pool

Rocket Pool is another famous liquid staking protocol within the Ethereum ecosystem, boasting a Total Value Locked (TVL) exceeding $3.818 billion.

Notably, Rocket Pool offers accessibility without imposing a minimum deposit requirement for users seeking access to its rETH LSTs. However, individuals interested in operating a minipool validator must adhere to specific criteria, including a minimum deposit of 8 ETH alongside 2.4 ETH worth of RPL tokens.

3. Coinbase Prime

In addition to decentralized liquid staking protocols like Lido and Rocket Pool, centralized entities such as exchanges can also provide liquid staking services to their users. The fundamental contrast lies in the custody arrangement: decentralized services are non-custodial, whereas centralized services retain full control over users’ staked assets. While decentralized services face vulnerability to smart contract exploits, centralized services carry their own set of risks.

Coinbase Prime has partnered with Liquid Collective to introduce liquid staking for Ethereum (ETH). Users deposit ETH into Liquid Collective’s smart contract, where it’s staked. In return, they receive LsETH tokens, representing their staked ETH. These tokens can be traded and used in DeFi. The value of LsETH is determined by factors like staked ETH, rewards, and penalties, which are updated daily.

FAQ

What is a Liquid Staking Token (LST)?

A Liquid Staking Token is a tradable cryptocurrency that represents your stake in a Proof-of-Stake (PoS) blockchain. When you stake your coins on a PoS network to earn rewards, you traditionally wouldn’t be able to access them until the staking period ends. LSTs solve this by acting like a receipt for your stake. You receive these tokens in exchange for your original cryptocurrency, allowing you to trade, sell, or even use them in DeFi applications while your original stake continues to earn rewards in the background. Essentially, LSTs unlock the liquidity of your staked assets.

How Do I Start with Liquid Staking?

Here’s a simplified process on how to start liquid staking:

- Choose a Reputable Platform (e.g., Lido, Rocket Pool) that supports liquid staking and your crypto and has strong security.

- Fund Your Platform Wallet by transferring your desired crypto.

- Pick Your Stake Amount, considering any minimums.

- Start Staking following the platform’s instructions. You’ll receive LSTs representing your staked assets, allowing you to earn rewards with some flexibility.

What are Traditional Staking Methods?

These staking methods typically enable users to lock up their cryptocurrency holdings to participate in the consensus mechanism of a blockchain network. This can be done by either running a node or delegating their tokens to a validator.

Does Lido and Rocket Pool Support Liquid Staking?

Yes, both Lido and Rocket Pool support liquid staking using their platforms.

Conclusion

So, liquid staking combines the perks of staking with the flexibility of accessing your crypto when needed. This means stakers can get more out of their assets while still being able to use them when required, which could save them from missing out on other opportunities.

As more projects adopt liquid staking and platforms like Lido, Rocket Pool, Coinbase Prime, and Binance make it easier to use, the future looks bright for this method.

However, users need to do their homework, understand the risks involved, and monitor any changes in the rules. With these steps in mind, liquid staking can be a valuable tool for anyone wanting to explore the many possibilities in the world of cryptocurrencies.

* The information in this article and the links provided are for general information purposes only

and should not constitute any financial or investment advice. We advise you to do your own research

or consult a professional before making financial decisions. Please acknowledge that we are not

responsible for any loss caused by any information present on this website.

News

Meme Tokens Surpass Bitcoin in Turkish Trading Activity This Year

The Turkish cryptocurrency market has seen significant growth in recent years. Currently, more than half of the population invests in cryptocurrencies, according to surveys and polls.

This is evident from the fact that the Turkish Lira (TRY) is the fourth most used fiat currency in cryptocurrencies. Several macroeconomic factors are fueling this crypto adoption in the country. Therefore, stablecoins and meme coins have emerged as the favorites of Turkish investors, even surpassing Bitcoin.

Stablecoins and meme coins dominate Turkish trade

According to the latest relationship According to Kaiko, Turkey’s inflationary conditions have significantly increased stablecoin usage in recent years. In 2024, the research firm found that USDT-TRY dominates as the largest trading pair by volume on Binance, reaching over $22 billion, more than five times larger than the next largest pair, PEPE-USDT, which has $4 billion.

Notably, meme tokens have surpassed Bitcoin in terms of trading volume this year, indicating that Turkish traders are also turning to more speculative cryptocurrencies to hedge against currency fluctuations and make profits.

The increased usage of stablecoins is further reflected in the main Bitcoin trading pairs on BTCTurk, which are BTC-USDT and BTC-TRY.

One of the main reasons driving the adoption of cryptocurrencies is Turkey’s fight against double-digit inflation and the currency devaluation for years, with an average inflation rate above 40% over the past five years. In response, the central bank adopted an unorthodox monetary policy, cutting rates until June 2023. However, this worsened the devaluation of the Turkish lira, which lost more than 300% of its value from the end of 2020 to the end of 2023.

Turkey’s decision to normalize its monetary policy after the 2023 elections failed to restore confidence in the TRY, whose value continued to decline in 2024, albeit less rapidly.

Binance Sees Strong Expansion in Türkiye

Amid economic challenges, Binance has strengthened its position as one of the two largest trading platforms for Turkish traders, thanks to deep liquidity and low fees. As part of a large-scale zero-fee campaign, it offered zero fees for BTC-TRY trading between July 2022 and March 2023.

Offering a wide range of TRY-denominated trading pairs and aggressively adding new pairs in recent years have helped Binance maintain its leadership in the country despite the 2022 cryptocurrency bear market. Binance introduced 61 new TRY trading pairs in 2024 alone, bringing the total number to over 200.

Other exchanges, such as Gate.io, KuCoin, and OKX, have jumped into the Turkish crypto ecosystem, but their overall market share remains less than 1%.

News

Top 5 PolitiFi Tokens to Buy Now for MAX Profits

With the US presidential election fast approaching, the cryptocurrency world is buzzing with new trends. In addition to the well-known cartoon-themed meme coins, a new category is making waves: PolitiFi tokens. Did you see that coming?

These politically themed crypto tokens are gaining attention, especially those centered around former President Donald Trump. Today, we explore the 5 trending Trump-themed PolitiFi tokens.

Stock up to benefit later!

1. Trump (Magazine)

Launched about a year ago, the Trump-themed MAGA token has caused quite a stir in the cryptocurrency ecosystem. Inspired by Donald Trump’s slogan “Make America Great Again,” the MAGA token has produced an astonishing 35 million percent return since its inception. Currently trading at $5.65, it has fallen 8.80 percent in the past 24 hours.

Despite this, the token’s trading volume increased by 23.23%, bringing its market cap to $248 million and securing the 220th spot on CoinMarketCap.

Source: Dexscreener

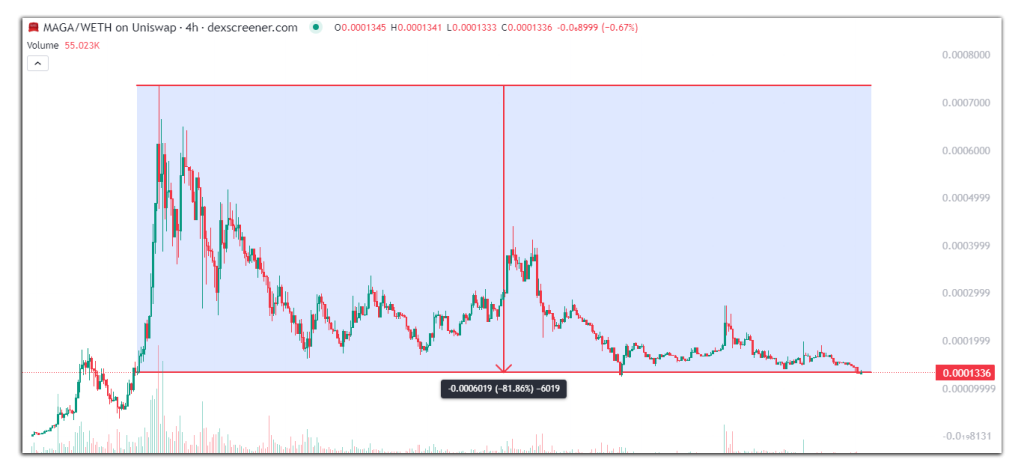

2. MAGA (MAGA)

Another token with the same ticker, MAGA, is also trending in the PolitiFi category. With 390 billion tokens in circulation, this MAGA token has seen a 11.08% price drop over the past 24 hours, but an 81.39% increase in trading volume. Currently trading at $0.0001337, it is ranked 21st on Dexscreener’s trending list and 522nd on CoinMarketCap. Despite being only two months old, it has provided early adopters with a remarkable profit of 313,373.62% at its all-time high of $0.0007354.

Source: Dexscreener

3. Super Trump Coin (STRUMP)

Super Trump Coin, a meme token depicting Donald Trump as Superman, has a circulating supply of 1.8 billion tokens. Over the past 24 hours, its trading volume has increased by 39.88%. Currently trading at $0.01112, it has dropped by 6.07% over the past 24 hours, but holds a CoinMarketCap rating of 776. From its all-time high of $0.03085, it has dropped by 64.06%. Despite this, its impressive short-term returns have made it a favorite among Trump crypto enthusiasts.

Source: Dexscreener

4. MAGA Vice President (MVP)

Launched just four months ago, MAGA VP has yet to break into the top 1000 cryptocurrencies on CoinMarketCap, currently ranked 1231st. With a value of $0.128, its trading volume has increased by 21.79% over the past 24 hours, with a market cap of $5.3 million. While it is up 110% at its current price, it is down 83.24% from its all-time high of $0.7706.

Source: Dexscreener

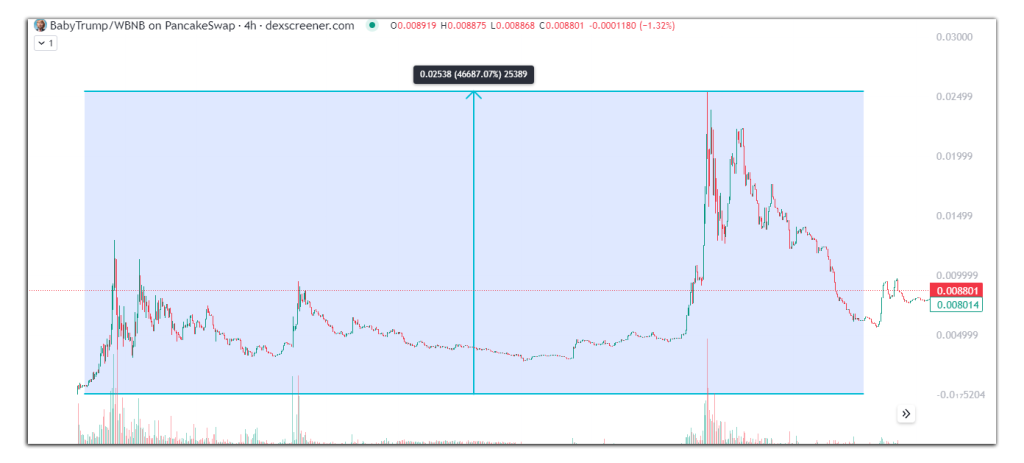

5. Little Trump

One of the most unique Trump-themed tokens is Baby Trump, which depicts Donald Trump as a baby president. With a circulating supply of 406 million tokens, it has a market cap of $3.5 million at a trading price of $0.008616. Although its price has dropped 9.45% in the last 24 hours, its trading volume has increased by 4.29%. At its peak, Baby Trump’s market cap was $11 million.

Notably, Baby Trump is the only token among the five analyzed to be based on the BNB Smart Chain, while the others are based on the Ethereum network.

Source: Dexscreener

It’s an exciting time for cryptocurrencies

The current political climate in the United States is spawning a new wave of meme tokens themed around various political figures. Among them, Trump-themed PolitiFi tokens are experiencing the most significant surge in popularity. Support for Donald Trump in the crypto community seems to be a driving force behind the success of these tokens.

Do you think Trump-themed PolitiFi tokens are here to stay or just a passing trend? Share your thoughts.

News

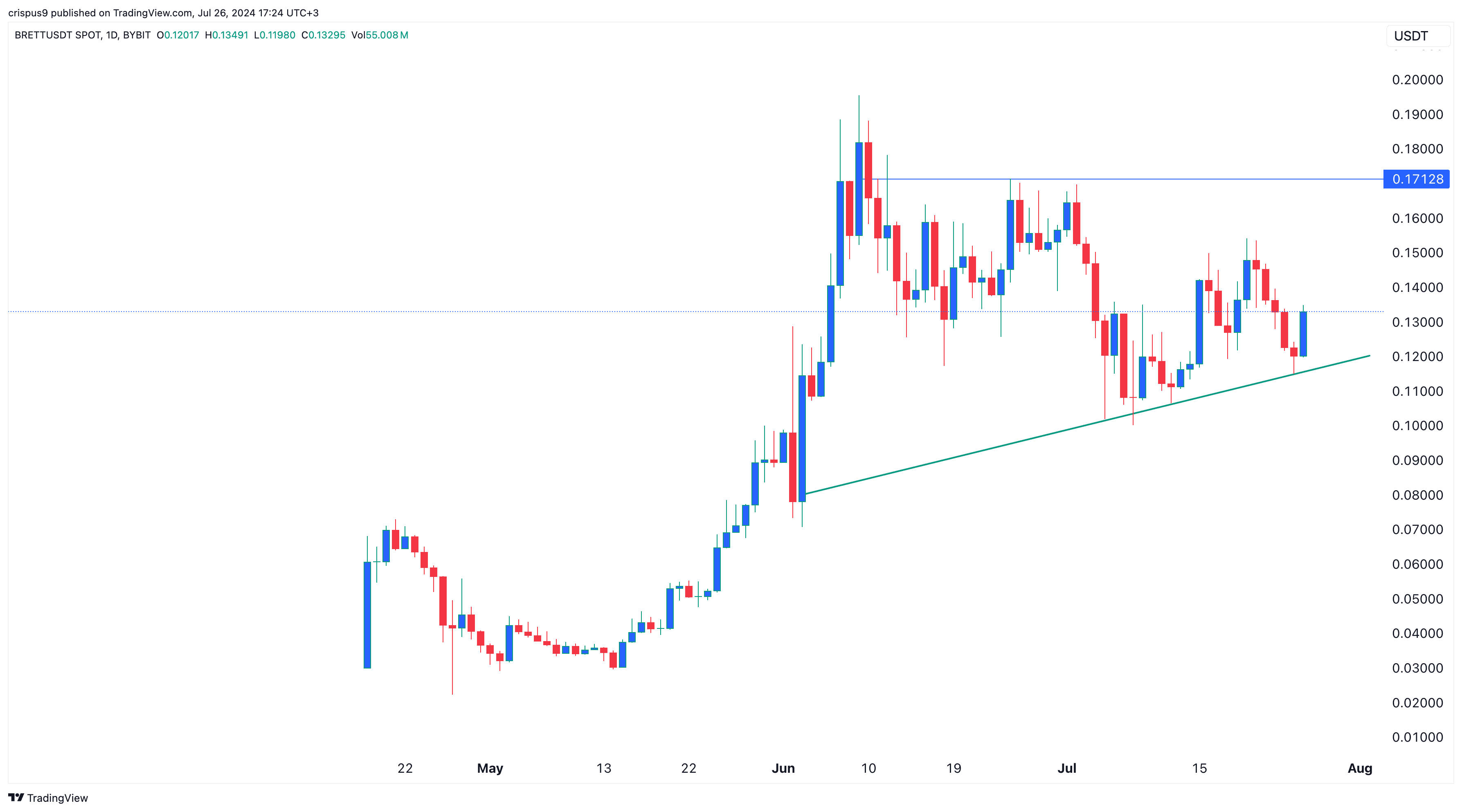

Brett Token Price Soars 12%; Analyst Expects Further 30% Upside

Brett, the largest meme coin in Blockchain Base, rose more than 12% on Friday, as sentiment in the cryptocurrency and stock sectors improved.

Brett (BRETT) the token rose to $0.133, up 31% from its low this month. Some traders believe the meme coin has more upside potential in the future.

Analyst is bullish on Brett

In an X-post, Michael van de Poppe, a trader with over 721,000 followers, said he is optimistic that the token will rise to $0.1712, up 30% from Friday’s trading level.

I’ve been a day trader for a long time and memes are a great way to gain that perspective.

Lots of volume.

And there’s a lot of volatility.When it comes to $BRETTI would look for long positions in this area between $0.125-0.1325 and $0.170 as a clear identification of a potential bull run. photo.twitter.com/hWmSjCZGJa

— Michaël van de Poppe (@CryptoMichNL) July 26, 2024

If he is right, Brett’s market cap will surpass Floki’s (FLOKI), which has a market capitalization of $1.7 billion.

Brett’s bounce came at the start of the Bitcoin 2024 conference today. In a statement at the event, Robert Kennedy, an independent presidential candidate, noted that he is a big supporter of Bitcoin (BTC).

The main protagonist of the event will be Donald Trump, leading in most polls, included in Polymarket. Trump is expected to reiterate his support for cryptocurrencies. Analysts are divided on whether he will announce a Bitcoin reserve at this event.

Blockchain Base is doing well

Brett token also recovered as Base blockchain ecosystems continued to perform well. Launched in 2023 by Coinbase, Base has accumulated over $1.6 billion in DeFi assets, making it the sixth largest chain in the industry. It has surpassed popular networks like Cardano (ADA), Avalanche (AVAILABLE) and Polygon (MATIC).

At the same time, Brett and other altcoins jumped as the U.S. stock market rebounded, signaling that investors have embraced risk-on sentiment. The Dow Jones Industrial Average rose more than 600 points, while the S&P 500 and Nasdaq 100 jumped more than 80 basis points.

Brett Price Chart | Source: Trading View

Technically, Brett formed a morning star pattern, which is a popular reversal sign. In the past, the coin has risen by double digits when it has formed this pattern. For example, it formed on July 12 and then rose by 40%.

On the other hand, this bounce could be a dead cat bounce, where an asset briefly rises and then resumes its downtrend.

News

Top 5 PolitiFi Tokens to Buy Now for MAX Profits

With the US presidential election fast approaching, the cryptocurrency world is buzzing with new trends. In addition to the well-known cartoon-themed meme coins, a new category is making waves: PolitiFi tokens. Did you see that coming?

These politically themed crypto tokens are gaining attention, especially those centered around former President Donald Trump. Today, we explore the 5 trending Trump-themed PolitiFi tokens.

Stock up to benefit later!

1. Trump (Magazine)

Launched about a year ago, the Trump-themed MAGA token has caused quite a stir in the cryptocurrency ecosystem. Inspired by Donald Trump’s slogan “Make America Great Again,” the MAGA token has produced an astonishing 35 million percent return since its inception. Currently trading at $5.65, it has fallen 8.80 percent in the past 24 hours.

Despite this, the token’s trading volume increased by 23.23%, bringing its market cap to $248 million and securing the 220th spot on CoinMarketCap.

Source: Dexscreener

Source: Dexscreener

2. MAGA (MAGA)

Another token with the same ticker, MAGA, is also trending in the PolitiFi category. With 390 billion tokens in circulation, this MAGA token has seen a 11.08% price drop over the past 24 hours, but an 81.39% increase in trading volume. Currently trading at $0.0001337, it is ranked 21st on Dexscreener’s trending list and 522nd on CoinMarketCap. Despite being only two months old, it has provided early adopters with a remarkable profit of 313,373.62% at its all-time high of $0.0007354.

Source: Dexscreener

Source: Dexscreener

3. Super Trump Coin (STRUMP)

Super Trump Coin, a meme token depicting Donald Trump as Superman, has a circulating supply of 1.8 billion tokens. Over the past 24 hours, its trading volume has increased by 39.88%. Currently trading at $0.01112, it has dropped by 6.07% over the past 24 hours, but holds a CoinMarketCap rating of 776. From its all-time high of $0.03085, it has dropped by 64.06%. Despite this, its impressive short-term returns have made it a favorite among Trump crypto enthusiasts.

Source: Dexscreener

Source: Dexscreener

4. MAGA Vice President (MVP)

Launched just four months ago, MAGA VP has yet to break into the top 1000 cryptocurrencies on CoinMarketCap, currently ranked 1231st. With a value of $0.128, its trading volume has increased by 21.79% over the past 24 hours, with a market cap of $5.3 million. While it is up 110% at its current price, it is down 83.24% from its all-time high of $0.7706.

Source: Dexscreener

Source: Dexscreener

5. Little Trump

One of the most unique Trump-themed tokens is Baby Trump, which depicts Donald Trump as a baby president. With a circulating supply of 406 million tokens, it has a market cap of $3.5 million at a trading price of $0.008616. Although its price has dropped 9.45% in the last 24 hours, its trading volume has increased by 4.29%. At its peak, Baby Trump’s market cap was $11 million.

Notably, Baby Trump is the only token among the five analyzed to be based on the BNB Smart Chain, while the others are based on the Ethereum network.

Source: Dexscreener

Source: Dexscreener

It’s an exciting time for cryptocurrencies

The current political climate in the United States is spawning a new wave of meme tokens themed around various political figures. Among them, Trump-themed PolitiFi tokens are experiencing the most significant surge in popularity. Support for Donald Trump in the crypto community seems to be a driving force behind the success of these tokens.

Do you think Trump-themed PolitiFi tokens are here to stay or just a passing trend? Share your thoughts.

-

Videos3 months ago

Videos3 months agoMoney is broke!! The truth about our financial system!

-

News2 months ago

News2 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

Altcoins2 months ago

Altcoins2 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Videos2 months ago

Videos2 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News2 months ago

News2 months agoOver 1 million new tokens launched since April

-

Videos2 months ago

Videos2 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs3 months ago

NFTs3 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

NFTs2 months ago

NFTs2 months agoSolana NFTs jump 30% in 24 hours: what’s behind the increase?

-

Memecoins2 months ago

Memecoins2 months agoSolana Dev hospitalized with third-degree burns while trying to pump Meme Coin

-

Videos3 months ago

Videos3 months agoCryptocurrency Market Update: Where Are We NOW?! What’s next?

-

Memecoins2 months ago

Memecoins2 months agoWhen memecoins reign supreme in the ecosystem!

-

Videos2 months ago

Videos2 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!