News

What Is Ethereum and How Does It Work?

What Is Ethereum?

Ethereum is a decentralized global software platform powered by blockchain technology. It is most commonly known by investors for its native cryptocurrency, ether (ETH), and by developers for its use in blockchain and decentralized finance application development.

Anyone can use Ethereum—it’s designed to be scalable, programmable, secure, and decentralized—to create any secured digital technology. Its token is designed to pay for work done supporting the blockchain, but participants can also use it to pay for tangible goods and services if accepted.

Key Takeaways

- Ethereum is a blockchain-based development platform known for its cryptocurrency, ether (ETH).

- The blockchain technology that powers Ethereum enables secure digital ledgers to be publicly created and maintained.

- Bitcoin and Ethereum have many similarities but different long-term visions and limitations.

- Ethereum uses a proof-of-stake transaction validation mechanism.

- Ethereum is the foundation for many emerging technological advances based on blockchain.

Investopedia / Michela Buttignol

History of Ethereum

Vitalik Buterin, credited with conceiving Ethereum, published a white paper introducing it in 2014. The Ethereum platform was launched in 2015 by Buterin and Joe Lubin, founder of the blockchain software company ConsenSys.

The founders of Ethereum were among the first to consider the full potential of blockchain technology beyond just enabling a secure virtual payment method.

Since the launch of Ethereum, ether as a cryptocurrency has risen to become the second-largest cryptocurrency by market value. It is outranked only by Bitcoin.

A Historic Split

One notable event in Ethereum’s history is the hard fork, or split, of Ethereum and Ethereum Classic. In 2016, a group of network participants gained control of the smart contracts used by a project called The DAO to steal more than $50 million worth of ether.

The raid’s success was attributed to the involvement of a third-party developer for the new project. Most of the Ethereum community opted to reverse the theft by invalidating the existing Ethereum blockchain and approving a blockchain with a revised history.

However, a fraction of the community chose to maintain the original version of the Ethereum blockchain. That unaltered version of Ethereum permanently split to become Ethereum Classic (ETC).

Proof-of-Stake Transistion

Initially, Ethereum used a competitive proof-of-work validation process similar to that of Bitcoin. After several years of development, Ethereum finally switched to proof-of-stake in 2022, which uses much less processing power and energy.

Dencun Upgrade

The Dencun hard fork was activated on March 13, 2024. This hard fork introduced proto-danksharding (named in honor of the proposers, Protolambda and Dankrad Feist) to the Ethereum mainchain. Proto-danksharding is a stepping stone for future upgrades to the Ethereum blockchain.

How Does Ethereum Work?

Blockchain Technology

Ethereum uses a blockchain, which is a distributed ledger (like a database). Information is stored in blocks, each containing encoded data from the block before it and the new information. This creates an encoded chain of information that cannot be changed. Throughout the blockchain network, an identical copy of the blockchain is distributed.

Each cell, or block, is created with new ether tokens awarded to the validator for the work required to validate the information in one block and propose a new one. The ether is assigned to the validator’s address.

Once a new block is proposed, it is validated by a network of automated programs that reach a consensus on the validity of transaction information. On the Ethereum blockchain, consensus is reached after the data and hash are passed between the consensus layer and the execution layer. Enough validators must demonstrate that they all had the same comparative results, and the block becomes finalized.

Proof-of-Stake Validation Process

Proof-of-stake differs from proof-of-work in that it doesn’t require the energy-intensive computing referred to as mining to validate blocks. It uses a finalization protocol called Casper-FFG and the algorithm LMD Ghost, combined into a consensus mechanism called Gasper. Gasper monitors consensus and defines how validators receive rewards for work or are punished for dishonesty or lack of activity.

Solo validators must stake 32 ETH to activate their validation ability. Individuals can stake smaller amounts of ETH, but they are required to join a validation pool and share any rewards. A validator creates a new block and attests that the information is valid in a process called attestation. The block is broadcast to other validators called a committee, which verifies it and votes for its validity.

Validators who act dishonestly are punished under proof-of-stake. Those who attempt to attack the network are identified by Gasper, which flags the blocks to accept and reject based on the validators’ votes.

Dishonest validators are punished by having their staked ETH burned and removed from the network. “Burning” is the term for sending crypto to a wallet without private keys, effectively taking it out of circulation.

Wallets

Ethereum owners use wallets to store their ether. A wallet is a digital interface that lets you access your cryptocurrency. Your wallet has an address, which can be thought of as an email address in that it is where users send ether, much like they would an email.

Ether is not stored in your wallet. Your wallet holds private keys you use as you would a password when you initiate a transaction. You receive a private key for each ether you own. This key is essential for accessing your ether—you can’t use it without it. That’s why you hear so much about securing keys using different storage methods.

The smallest unit or denomination of ether is a wei. There are seven total denominations: Wei, Kwei, Mwei, Gwei, micro-ether (Twei), milli-ether (Pwei), ether.

Ethereum vs. Bitcoin

Ethereum is often compared to Bitcoin. While the two cryptocurrencies have many similarities, there are some important distinctions.

Ethereum is described by founders and developers as “the world’s programmable blockchain,” positioning itself as a distributed virtual computer on which applications can be developed. The Bitcoin blockchain, by contrast, was created only to support the bitcoin cryptocurrency as a payment method.

The maximum number of bitcoins that can enter circulation is 21 million. The amount of ETH that can be created is unlimited, although the time it takes to process a block of ETH limits how much can be minted each year. The number of Ethereum coins in circulation as of April 2024 is just over 120 million.

Another significant difference between Ethereum and Bitcoin is how the respective networks treat transaction processing fees. These fees, known as gas on the Ethereum network, are paid by the participants in Ethereum transactions and burned by the network. The fees associated with Bitcoin transactions are paid to Bitcoin miners.

Ethereum, as of April 2024, uses a proof-of-stake consensus mechanism. Bitcoin uses the energy-intensive proof-of-work consensus, which requires miners to compete for rewards.

The Future of Ethereum

Ethereum’s transition to the proof-of-stake protocol, which enabled users to validate transactions and mint new ETH based on their ether holdings, was part of a significant upgrade to the Ethereum platform. However, Ethereum now has two layers. The first layer is the execution layer, where transactions and validations occur. The second layer is the consensus layer, where attestations and the consensus chain are maintained.

The upgrade added capacity to the Ethereum network to support its growth, which will eventually help to address chronic network congestion problems that have driven up gas fees.

Scalability Solutions

To address scalability, Ethereum is continuing to develop a scalability solution called “danksharding.” Sharding was a planned concept that would allow portions (shards) of the blockchain to be stored on nodes rather than the entire blockchain. However, sharding was replaced with plans for danksharding, where transactions are processed off-chain, rolled up (summarized using data availability sampling), and posted to the main chain via a BLOB (Binary Large Object).

Danksharding, using BLOBs, rollups, and data availability sampling, is expected to greatly reduce costs and increase transaction processing speeds when eventually combined in a future update.

Development Roadmap

Lastly, Ethereum publishes a roadmap for future plans. As of April 2024, four primary categories were listed for future work. Those changes will push for:

- Cheaper transactions: Ethereum notes that rollups are too expensive and force users to place too much trust in their operators.

- Extra security: Ethereum notes it wants to be prepared for future types of attacks.

- Better user experiences: Ethereum wants better support for smart contracts and lightweight nodes.

- Future-proofing: Ethereum notes wanting to proactively solve problems that have yet to present themselves.

Web3

Web3 is still a concept, but it is generally theorized that it will be powered by Ethereum because many of the applications being developed for the “future of the internet” use it.

Use in Gaming

Ethereum is also being implemented into gaming and virtual reality. Decentraland is a virtual world that uses the Ethereum blockchain to secure items contained within it. Virtual land, avatars, wearables, buildings, and environments are all tokenized through the blockchain to create ownership.

Axie Infinity is another game that uses blockchain technology and has its own cryptocurrency called Smooth Love Potion (SLP). SLP is used for rewards and transactions within the game.

Non-Fungible Tokens

Non-fungible tokens (NFTs) gained popularity in 2021. NFTs are tokenized digital items created using Ethereum. Generally speaking, tokenization gives one digital asset an identifying token with a private key. The key gives only the owner access to the token.

The NFT can be traded or sold and is a transaction on the blockchain. The network verifies the transaction, and ownership is transferred.

NFTs are being developed for all sorts of assets. For example, sports fans can buy a sports token—also called fan tokens—of their favorite athletes, which can be treated like trading cards. Some of these NFTs are pictures that resemble a trading card, and some of them are videos of a memorable or historic moment in the athlete’s career.

The applications you may use in the metaverse, such as your wallet, a dApp, or the virtual world and buildings you visit, are likely to have been built on Ethereum.

The Development of DAOs

Decentralized Autonomous Organizations (DAOs) are a collaborative method for making decisions across a distributed network. They have been created for many uses, from Web 3 development to gaming and venture capital.

Here’s how DAOs are generally designed: Imagine that you created a venture capital fund and raised money through fundraising, but you want decision-making to be decentralized and distributions to be automatic and transparent.

A DAO could use smart contracts and applications to gather the votes from the fund members, buy into ventures based on the majority of the group’s votes, and automatically distribute any returns. The transactions could be viewed by all parties, and there would be no third-party involvement in handling any funds.

What Will Ethereum Be Worth in 2030?

There are many predictions about ether’s price, but they are speculation at best. There are too many factors at work in cryptocurrency valuation to accurately predict prices in one week, let alone several years.

Why Did Ethereum Drop?

Ether’s price rises and falls for many reasons throughout a trading day and week. Market sentiments, regulatory developments, news, hype, and more all influence its price.

How Much Is One Ethereum Coin Worth?

Ether’s price changes quickly, but on April 21, 2024, it was about $3,156.

The Bottom Line

Ethereum is a decentralized blockchain and development platform. It allows developers to build and deploy applications and smart contracts. Ethereum utilizes its native cryptocurrency, ether (ETH), for transactions and incentivizes network participants through proof-of-stake (PoS) validation.

The role that cryptocurrency will play in the future is still vague. However, Ethereum appears to have a significant, upcoming role in personal and corporate finance and many aspects of modern life.

The comments, opinions, and analyses expressed on Investopedia are for informational purposes online. Read our warranty and liability disclaimer for more info.

News

Meme Tokens Surpass Bitcoin in Turkish Trading Activity This Year

The Turkish cryptocurrency market has seen significant growth in recent years. Currently, more than half of the population invests in cryptocurrencies, according to surveys and polls.

This is evident from the fact that the Turkish Lira (TRY) is the fourth most used fiat currency in cryptocurrencies. Several macroeconomic factors are fueling this crypto adoption in the country. Therefore, stablecoins and meme coins have emerged as the favorites of Turkish investors, even surpassing Bitcoin.

Stablecoins and meme coins dominate Turkish trade

According to the latest relationship According to Kaiko, Turkey’s inflationary conditions have significantly increased stablecoin usage in recent years. In 2024, the research firm found that USDT-TRY dominates as the largest trading pair by volume on Binance, reaching over $22 billion, more than five times larger than the next largest pair, PEPE-USDT, which has $4 billion.

Notably, meme tokens have surpassed Bitcoin in terms of trading volume this year, indicating that Turkish traders are also turning to more speculative cryptocurrencies to hedge against currency fluctuations and make profits.

The increased usage of stablecoins is further reflected in the main Bitcoin trading pairs on BTCTurk, which are BTC-USDT and BTC-TRY.

One of the main reasons driving the adoption of cryptocurrencies is Turkey’s fight against double-digit inflation and the currency devaluation for years, with an average inflation rate above 40% over the past five years. In response, the central bank adopted an unorthodox monetary policy, cutting rates until June 2023. However, this worsened the devaluation of the Turkish lira, which lost more than 300% of its value from the end of 2020 to the end of 2023.

Turkey’s decision to normalize its monetary policy after the 2023 elections failed to restore confidence in the TRY, whose value continued to decline in 2024, albeit less rapidly.

Binance Sees Strong Expansion in Türkiye

Amid economic challenges, Binance has strengthened its position as one of the two largest trading platforms for Turkish traders, thanks to deep liquidity and low fees. As part of a large-scale zero-fee campaign, it offered zero fees for BTC-TRY trading between July 2022 and March 2023.

Offering a wide range of TRY-denominated trading pairs and aggressively adding new pairs in recent years have helped Binance maintain its leadership in the country despite the 2022 cryptocurrency bear market. Binance introduced 61 new TRY trading pairs in 2024 alone, bringing the total number to over 200.

Other exchanges, such as Gate.io, KuCoin, and OKX, have jumped into the Turkish crypto ecosystem, but their overall market share remains less than 1%.

News

Top 5 PolitiFi Tokens to Buy Now for MAX Profits

With the US presidential election fast approaching, the cryptocurrency world is buzzing with new trends. In addition to the well-known cartoon-themed meme coins, a new category is making waves: PolitiFi tokens. Did you see that coming?

These politically themed crypto tokens are gaining attention, especially those centered around former President Donald Trump. Today, we explore the 5 trending Trump-themed PolitiFi tokens.

Stock up to benefit later!

1. Trump (Magazine)

Launched about a year ago, the Trump-themed MAGA token has caused quite a stir in the cryptocurrency ecosystem. Inspired by Donald Trump’s slogan “Make America Great Again,” the MAGA token has produced an astonishing 35 million percent return since its inception. Currently trading at $5.65, it has fallen 8.80 percent in the past 24 hours.

Despite this, the token’s trading volume increased by 23.23%, bringing its market cap to $248 million and securing the 220th spot on CoinMarketCap.

Source: Dexscreener

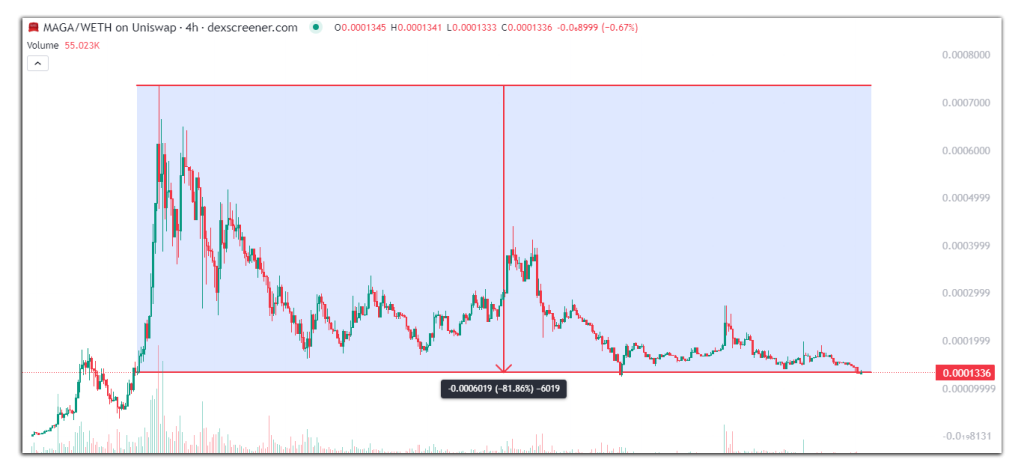

2. MAGA (MAGA)

Another token with the same ticker, MAGA, is also trending in the PolitiFi category. With 390 billion tokens in circulation, this MAGA token has seen a 11.08% price drop over the past 24 hours, but an 81.39% increase in trading volume. Currently trading at $0.0001337, it is ranked 21st on Dexscreener’s trending list and 522nd on CoinMarketCap. Despite being only two months old, it has provided early adopters with a remarkable profit of 313,373.62% at its all-time high of $0.0007354.

Source: Dexscreener

3. Super Trump Coin (STRUMP)

Super Trump Coin, a meme token depicting Donald Trump as Superman, has a circulating supply of 1.8 billion tokens. Over the past 24 hours, its trading volume has increased by 39.88%. Currently trading at $0.01112, it has dropped by 6.07% over the past 24 hours, but holds a CoinMarketCap rating of 776. From its all-time high of $0.03085, it has dropped by 64.06%. Despite this, its impressive short-term returns have made it a favorite among Trump crypto enthusiasts.

Source: Dexscreener

4. MAGA Vice President (MVP)

Launched just four months ago, MAGA VP has yet to break into the top 1000 cryptocurrencies on CoinMarketCap, currently ranked 1231st. With a value of $0.128, its trading volume has increased by 21.79% over the past 24 hours, with a market cap of $5.3 million. While it is up 110% at its current price, it is down 83.24% from its all-time high of $0.7706.

Source: Dexscreener

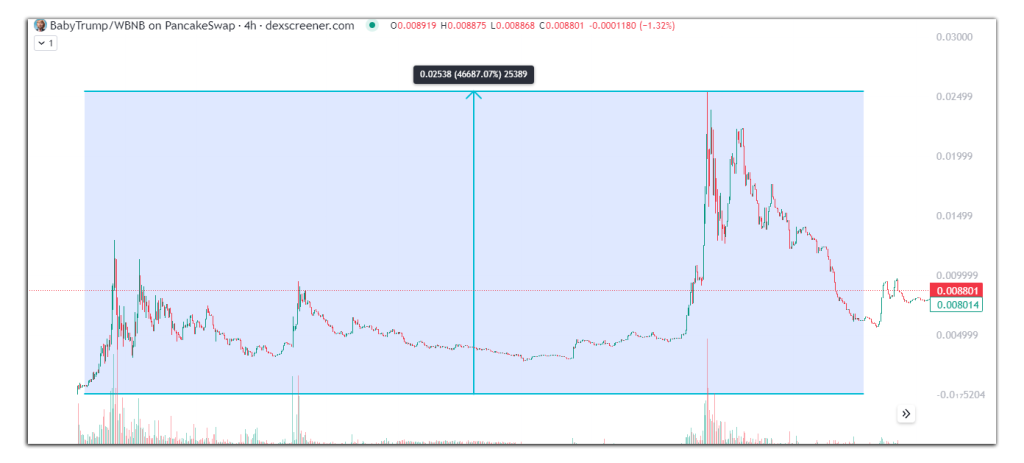

5. Little Trump

One of the most unique Trump-themed tokens is Baby Trump, which depicts Donald Trump as a baby president. With a circulating supply of 406 million tokens, it has a market cap of $3.5 million at a trading price of $0.008616. Although its price has dropped 9.45% in the last 24 hours, its trading volume has increased by 4.29%. At its peak, Baby Trump’s market cap was $11 million.

Notably, Baby Trump is the only token among the five analyzed to be based on the BNB Smart Chain, while the others are based on the Ethereum network.

Source: Dexscreener

It’s an exciting time for cryptocurrencies

The current political climate in the United States is spawning a new wave of meme tokens themed around various political figures. Among them, Trump-themed PolitiFi tokens are experiencing the most significant surge in popularity. Support for Donald Trump in the crypto community seems to be a driving force behind the success of these tokens.

Do you think Trump-themed PolitiFi tokens are here to stay or just a passing trend? Share your thoughts.

News

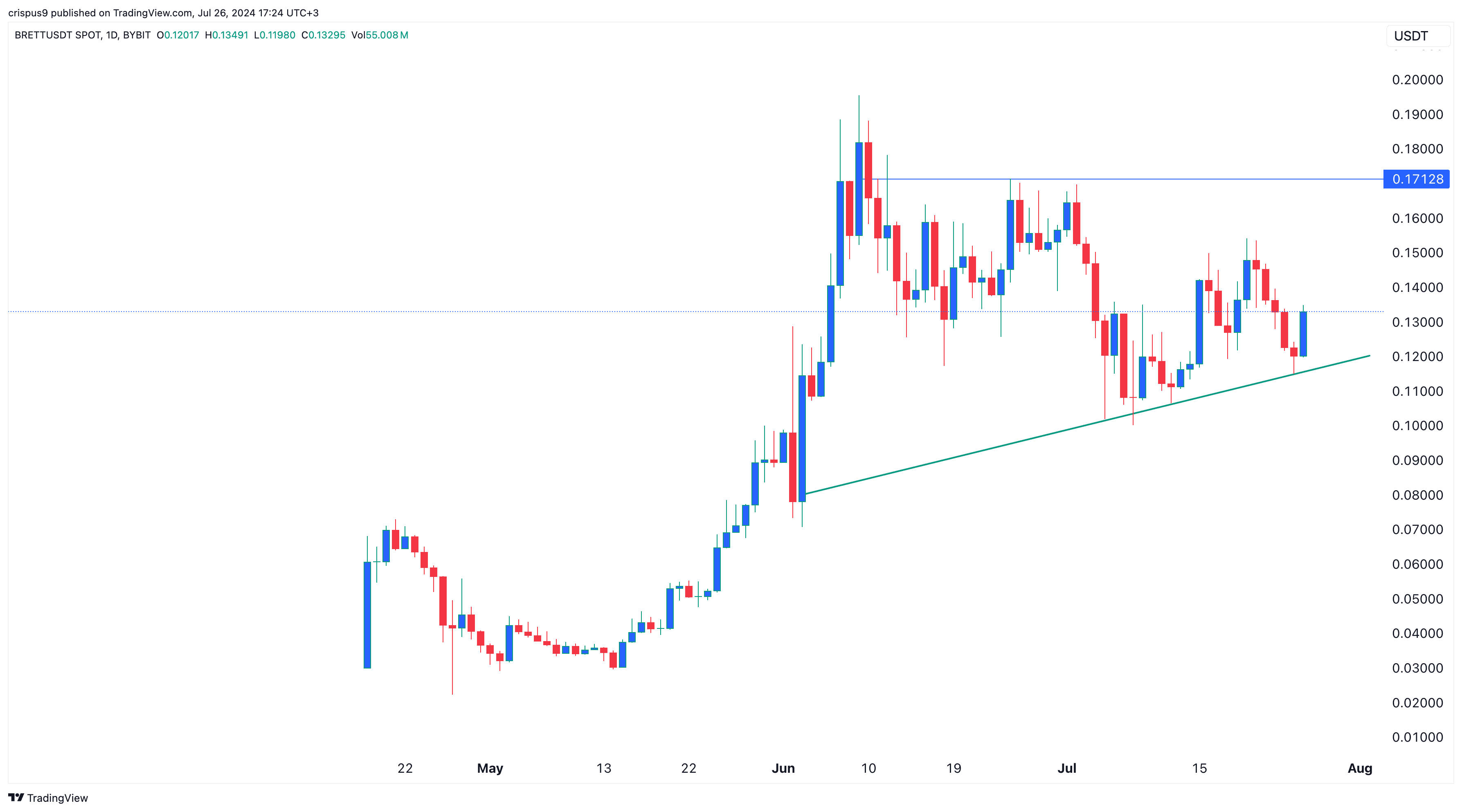

Brett Token Price Soars 12%; Analyst Expects Further 30% Upside

Brett, the largest meme coin in Blockchain Base, rose more than 12% on Friday, as sentiment in the cryptocurrency and stock sectors improved.

Brett (BRETT) the token rose to $0.133, up 31% from its low this month. Some traders believe the meme coin has more upside potential in the future.

Analyst is bullish on Brett

In an X-post, Michael van de Poppe, a trader with over 721,000 followers, said he is optimistic that the token will rise to $0.1712, up 30% from Friday’s trading level.

I’ve been a day trader for a long time and memes are a great way to gain that perspective.

Lots of volume.

And there’s a lot of volatility.When it comes to $BRETTI would look for long positions in this area between $0.125-0.1325 and $0.170 as a clear identification of a potential bull run. photo.twitter.com/hWmSjCZGJa

— Michaël van de Poppe (@CryptoMichNL) July 26, 2024

If he is right, Brett’s market cap will surpass Floki’s (FLOKI), which has a market capitalization of $1.7 billion.

Brett’s bounce came at the start of the Bitcoin 2024 conference today. In a statement at the event, Robert Kennedy, an independent presidential candidate, noted that he is a big supporter of Bitcoin (BTC).

The main protagonist of the event will be Donald Trump, leading in most polls, included in Polymarket. Trump is expected to reiterate his support for cryptocurrencies. Analysts are divided on whether he will announce a Bitcoin reserve at this event.

Blockchain Base is doing well

Brett token also recovered as Base blockchain ecosystems continued to perform well. Launched in 2023 by Coinbase, Base has accumulated over $1.6 billion in DeFi assets, making it the sixth largest chain in the industry. It has surpassed popular networks like Cardano (ADA), Avalanche (AVAILABLE) and Polygon (MATIC).

At the same time, Brett and other altcoins jumped as the U.S. stock market rebounded, signaling that investors have embraced risk-on sentiment. The Dow Jones Industrial Average rose more than 600 points, while the S&P 500 and Nasdaq 100 jumped more than 80 basis points.

Brett Price Chart | Source: Trading View

Technically, Brett formed a morning star pattern, which is a popular reversal sign. In the past, the coin has risen by double digits when it has formed this pattern. For example, it formed on July 12 and then rose by 40%.

On the other hand, this bounce could be a dead cat bounce, where an asset briefly rises and then resumes its downtrend.

News

Top 5 PolitiFi Tokens to Buy Now for MAX Profits

With the US presidential election fast approaching, the cryptocurrency world is buzzing with new trends. In addition to the well-known cartoon-themed meme coins, a new category is making waves: PolitiFi tokens. Did you see that coming?

These politically themed crypto tokens are gaining attention, especially those centered around former President Donald Trump. Today, we explore the 5 trending Trump-themed PolitiFi tokens.

Stock up to benefit later!

1. Trump (Magazine)

Launched about a year ago, the Trump-themed MAGA token has caused quite a stir in the cryptocurrency ecosystem. Inspired by Donald Trump’s slogan “Make America Great Again,” the MAGA token has produced an astonishing 35 million percent return since its inception. Currently trading at $5.65, it has fallen 8.80 percent in the past 24 hours.

Despite this, the token’s trading volume increased by 23.23%, bringing its market cap to $248 million and securing the 220th spot on CoinMarketCap.

Source: Dexscreener

Source: Dexscreener

2. MAGA (MAGA)

Another token with the same ticker, MAGA, is also trending in the PolitiFi category. With 390 billion tokens in circulation, this MAGA token has seen a 11.08% price drop over the past 24 hours, but an 81.39% increase in trading volume. Currently trading at $0.0001337, it is ranked 21st on Dexscreener’s trending list and 522nd on CoinMarketCap. Despite being only two months old, it has provided early adopters with a remarkable profit of 313,373.62% at its all-time high of $0.0007354.

Source: Dexscreener

Source: Dexscreener

3. Super Trump Coin (STRUMP)

Super Trump Coin, a meme token depicting Donald Trump as Superman, has a circulating supply of 1.8 billion tokens. Over the past 24 hours, its trading volume has increased by 39.88%. Currently trading at $0.01112, it has dropped by 6.07% over the past 24 hours, but holds a CoinMarketCap rating of 776. From its all-time high of $0.03085, it has dropped by 64.06%. Despite this, its impressive short-term returns have made it a favorite among Trump crypto enthusiasts.

Source: Dexscreener

Source: Dexscreener

4. MAGA Vice President (MVP)

Launched just four months ago, MAGA VP has yet to break into the top 1000 cryptocurrencies on CoinMarketCap, currently ranked 1231st. With a value of $0.128, its trading volume has increased by 21.79% over the past 24 hours, with a market cap of $5.3 million. While it is up 110% at its current price, it is down 83.24% from its all-time high of $0.7706.

Source: Dexscreener

Source: Dexscreener

5. Little Trump

One of the most unique Trump-themed tokens is Baby Trump, which depicts Donald Trump as a baby president. With a circulating supply of 406 million tokens, it has a market cap of $3.5 million at a trading price of $0.008616. Although its price has dropped 9.45% in the last 24 hours, its trading volume has increased by 4.29%. At its peak, Baby Trump’s market cap was $11 million.

Notably, Baby Trump is the only token among the five analyzed to be based on the BNB Smart Chain, while the others are based on the Ethereum network.

Source: Dexscreener

Source: Dexscreener

It’s an exciting time for cryptocurrencies

The current political climate in the United States is spawning a new wave of meme tokens themed around various political figures. Among them, Trump-themed PolitiFi tokens are experiencing the most significant surge in popularity. Support for Donald Trump in the crypto community seems to be a driving force behind the success of these tokens.

Do you think Trump-themed PolitiFi tokens are here to stay or just a passing trend? Share your thoughts.

-

Videos3 months ago

Videos3 months agoMoney is broke!! The truth about our financial system!

-

News2 months ago

News2 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

Altcoins2 months ago

Altcoins2 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Videos2 months ago

Videos2 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News2 months ago

News2 months agoOver 1 million new tokens launched since April

-

Videos2 months ago

Videos2 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs3 months ago

NFTs3 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

NFTs2 months ago

NFTs2 months agoSolana NFTs jump 30% in 24 hours: what’s behind the increase?

-

Memecoins2 months ago

Memecoins2 months agoSolana Dev hospitalized with third-degree burns while trying to pump Meme Coin

-

Videos3 months ago

Videos3 months agoCryptocurrency Market Update: Where Are We NOW?! What’s next?

-

Memecoins2 months ago

Memecoins2 months agoWhen memecoins reign supreme in the ecosystem!

-

Videos2 months ago

Videos2 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!