Altcoins

what awaits Ethereum and other cryptos?

What factors are driving the downtrend in altcoins and when can we expect a turnaround?

Over the past month, the crypto market, especially altcoinsfaced a prolonged downturn, with many considerable losses.

Ethereum (ETH), the second largest crypto by market capitalizationhas lost almost 10% of its value over the past 30 days, trading at around $2,960 as of May 13.

However, the ordinals (COMPUTER) was hit the hardest, falling 40% and now trading at just $36.80.

This market slowdown aligns with global economic trends, such as recent decision by the Federal Reserve (Fed) to maintain its interest rates between 5.25% and 5.50%.

The Fed’s cautious approach to monetary policy, aimed at combating inflation and economic growth, may have created uncertainty among crypto investors, leading them to favor more established assets like Bitcoin (BTC).

BTC has largely traded above $60,000 levels during this downturn, with BTC dominance even reaching a peak of almost 57% in April, a significant increase from last year’s levels of 45-46%. As of May 13, BTC dominance stood at over 55%.

BTC Dominance Chart | Source: TradingView

Furthermore, the Fed’s announcement concerning its strategy of reducing bond holdings, which slows the pace of the flow of maturing bond products without reinvestment, could indicate possible economic challenges ahead.

This signal may have further reduced investor confidence in altcoins, diverting attention and capital away from riskier assets.

As the cryptocurrency market faces this downturn, the question arises: when will altcoins rebound? Let’s explore.

What do the experts think?

Analysts have offered various perspectives on the current state of the altcoin market. Here’s what they think

Patrick H. | CryptelligenceX

Patric H. remains optimistic on the overall market, anticipating a continuation of the bull market until mid-Q3/Q4 2024.

🚨Contrarian opinion: The substance is not in it.

May is going to be emotionally difficult for many #Bitcoin And #Altcoins investors.

Over the next 2-6 weeks we will see the final shake-up before the breakout.

🧵Here’s what to expect in this turbulent phase.

—Patric H. | CryptelligenceX (@CryptelligenceX) April 30, 2024

However, he warns of a phase of turbulence in the short term, particularly in May. He predicts a final shake-up in the next 2-6 weeks, which could return to $52,000 for Bitcoin and $2 trillion for the total market cap.

He attributes the delay in hitting the bottom to the lack of sufficient pain in the market, indicating that sentiment remains too euphoric.

Patric advises monitoring the Fear and Greed Index for signs of a shift toward “fear.” He also mentions to watch for sentiment divergences and trading volumes, which could suggest a potential reversal.

Benjamin Cowen

Benjamin Cowen draws a parallel with the previous cycle, noting that ALT/BTC pairs tend to capitulate just before rate cuts. It suggests that ALT/BTC pairs could fall another 40% from current levels over the coming months.

In the last cycle, we saw #ALT /#BTC pairs capitulate just before rate cuts.

Maybe this time is no different? This would mean that ALT/BTC pairs would fall by another 40% over the next few months.

Short-term counter-trends do not invalidate this view. pic.twitter.com/BK3VIrCBJ2

–Benjamin Cowen (@intocryptovere) April 30, 2024

Cowen attributes altcoins’ current struggles to a decline in social interest, comparing the current market movement to that of 2019.

Altcoins continue to struggle as social risk is in freefall. People just don’t seem to care.

This whole move still feels close to 2019 to me. Social interest also fell just before the rate cuts arrived, and then ALT/BTC pairs finally bottomed as the Fed pivoted. pic.twitter.com/SEKbLRMTaX

–Benjamin Cowen (@intocryptovere) April 29, 2024

He points out that social interest has declined before rate cuts in the past, hinting at a potential bottom for ALT/BTC pairs coinciding with a turning point in Fed policy.

Michael van de Poppe

Michaël van de Poppe notes that altcoins are experiencing a steady correction in USD valuations, but BTC valuations are falling sharply, approaching cycle lows.

THE #Altcoin market capitalization is experiencing a regular correction (in USD valuations).

BTC valuations are falling sharply and are at the bottom of the cycle.

Undervaluation versus reality.

Now is not the time to turn away from cryptocurrencies, but to attack the markets by taking higher risks. pic.twitter.com/h298e63ory

– Michaël van de Poppe (@CryptoMichNL) May 12, 2024

He suggests that this undervaluation presents an opportunity to attack markets with higher risk rather than shy away from crypto.

What should we learn from it?

These analyzes suggest a cautious outlook for the altcoin market in the near term, indicating that more corrections may be ahead.

However, they also point to a possible upward trend in the medium and long term. This means you must remain vigilant and flexible as the market changes.

The next few weeks will be important for the altcoin market, with factors such as sentiment, trading volumes and external economic events likely to have a key impact.

Potential catalysts for market recovery

The crypto market is at a critical juncture, with potential catalysts that could restore normalcy and reignite bullish sentiment.

A major development is the progress of the Financial Innovation and Technology for the 21st Century Act (FIT21) of the United States House of Representatives, which goals bring regulatory clarity to digital assets.

If passed (could be in May itself), the bill could establish federal standards for digital assets, clarify the jurisdiction of regulatory bodies like the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC), and establish a regulatory framework. for digital asset markets.

The crypto industry has long sought clearer regulation, and the FIT21 Act could provide much-needed certainty to market participants and investors, potentially boosting confidence and investment in the sector.

Additionally, the bill’s provisions allowing secondary market trading of digital products and imposing requirements on registered entities could improve market transparency and integrity.

Another potential market driver is the SEC’s upcoming decision regarding VanEck’s ETH spot exchange-traded fund (ETF). applicationscheduled for May 23, 2024. A favorable decision could trigger an ETH price rally, similar to the ETF-driven Bitcoin rally earlier in 2024.

Concerns remain regarding the SEC’s classification of ETH as a commodity or security, which could impact the approval of spot ETH ETFs.

Current sentiment around the launch of spot ETH ETFs in the United States is largely pessimistic, with concerns surrounding regulatory uncertainty and the position of the SEC under Chairman Gary Gensler.

Nonetheless, industry experts believe that a spot ETH ETF will eventually get the green light, like the spot BTC ETFs, which were initially rejected before prevailing in a lawsuit against the SEC.

In the short term, a rejection of the ETH spot ETF could trigger increased price volatility and a decline in ETH prices as the market absorbs the news.

Meanwhile, regulatory clarity and approval of spot ETH ETFs could propel the altcoin market recovery and uptrends in the coming months.

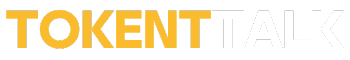

ETH Price Analysis

As of May 13, Ethereum was trading at around $2,970. ETH has been on a downward trend, raising concerns that it could fall below the $2,500 mark.

The recent ETH price trend has been bearish, with weekly trading opens lower than the previous week’s close, suggesting a lack of bullish momentum.

ETH Price Analysis | Source: TradingView

Over the previous 24 hours, ETH/USD traded positively, surpassing the $2,900 levels but facing solid resistance around the EMA50 at $2,990. For a downtrend to resume, ETH must break below $2,900, potentially heading towards the $2,800 and $2,620 levels.

On the other hand, further upside and a breakout of $2,990 could lead to further gains up to $3,130.

The expected trading range for ETH is between $2,800 (support) and $3,050 (resistance), with the trend remaining bearish.

Analysis of ETH suggests that prices could face continued downward pressure, which would also impact other altcoins in the market.

Altcoins

Analyst Says Ethereum-Based Altcoin “Looks Strong As Hell,” Outlines Path Ahead For Bitcoin And Solana

A widely followed crypto analyst and trader believes a memecoin is headed for the next leg higher.

Pseudonymous crypto trader Altcoin Sherpa tell his 216,400 followers on the social media platform X that Pepe (PEPE) market fundamentals appear solid.

“PEPE: I never got a chance to add $0.00001111, but I’m still in it. He seems pretty strong. I’m still a big fan of memes in general.”

Source: Altcoin Sherpa/X

Pepe is trading at $0.00001128 at the time of writing, down 8% in the last 24 hours.

Then the analyst said Ethereum (ETH) rival of Solana (GROUND) has greater upside potential due to network activity.

“SOL: Go long on Solana. Why? Because SOL memes continue to take off and everyone is denominated in Solana. Being in the trenches of crap money really helps you understand this stuff better. I expect a pullback soon, but this would be the bottom to buy in my opinion.”

Source: Altcoin Sherpa/X

Looking at the analyst’s chart, he suggests that SOL could eventually reach $205.

Solana is trading at $166 at the time of writing, down 6.7% in the past 24 hours.

Finally, the analyst said that Bitcoin (Bitcoin) appears to be in an uptrend but could retest the $63,000 level.

“BTC: Price still looks pretty strong to me. If you really want a dip to get in, look for $63,000 around the 200 four-hour exponential moving average (EMA). For now, things should continue in my opinion.”

Source: Altcoin Sherpa/X

At the time of writing, Bitcoin is trading at $64,596, down nearly 2% in the past 24 hours.

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated image: DALLE3

Altcoins

XRP, ADA, and Other Altcoins to Accumulate Ahead of Trump’s Nashville Speech

Bitcoin has recovered most of its losses from the week as traders eagerly await former U.S. President Donald Trump’s appearance at the Bitcoin 2024 conference in Nashville, Tennessee. Interestingly, Bitcoin gained over 1% today as Trump appears to have changed his stance on digital currencies this election cycle.

Analysts Buzz About Altcoins said that this week, crypto whales have been quietly accumulating several altcoins, showing confidence in their short-term potential despite recent performance declines. Here are the top altcoins:

Arbitration:

Current price: $0.72

Whale activity:Despite its significant decline since the start of the year, Arbitrum has seen an 87% increase in net inflow from large holders over the past week. This suggests that whales believe in the token’s long-term potential. Arbitrum, a Layer 2 scaling solution for Ethereum, aims to improve transaction speeds and reduce costs on the Ethereum network. The recent accumulation of whales could indicate confidence in its technology and future adoption.

XRP:

Current price: $0.59

Whale activity:According to Santiment, the number of addresses holding between 100 million and 1 billion XRP tokens has increased since July 23. This shows that the supply has increased from 38% to 40%, which is a sign of growing confidence among large holders. XRP has benefited from recent legal victories and market sentiment, making it an attractive option for whales.

Cardan:

Current price: $0.41

Whale activity:Cardano saw a staggering 10,878% increase in large holder inflows in a single day, surpassing the 5 billion mark. This indicates a significant level of confidence among whales in ADA’s recovery potential. Cardano’s recent upgrades and continued development have been positively received by the market, contributing to its attractiveness.

Chain link

Current price: $13.55

Whale activity: Chainlink recently integrated its Cross-Chain Interoperability Protocol (CCIP) with TrueFi on the Ethereum and Arbitrum blockchain platforms. TrueFi, backed by Coinbase and Chainlink, provides transparent and real-time financial data, improving the decentralized finance (DeFi) ecosystem. This integration could drive increased adoption and usage of Chainlink, making it a popular choice among whales.

Altcoins

Ethereum (ETH) ETF Fails to Spark Altcoin Season, Market Rebounds Above $1 Trillion

The rebound in altcoin market cap to $1 trillion slightly changes the positive dynamics for the much-anticipated altcoin season in Q3 2024.

Bulls took control of today’s session, pushing the total cryptocurrency market cap to $2.39 trillion, up 4% in 24 hours at press time. Total trading volume stands at $82.2 billion, up 4.4% in 24 hours, at the time of writing.

The Ethereum ETF was supposed to be the flagship of the altcoin season, but the response so far suggests nothing in its favor.

Altcoin market cap is moving in a flag pattern, a steady rise above $1.56T could trigger the altcoin rally and lead to the altcoin season with favorable market conditions.

Ethereum ETF Potential Stabilizes

The Ethereum ETF got off to a strong start with $1 billion in trading volume on its first day with massive inflows and outflows. This activity attracted a lot of money to Ethereum but failed to circulate among other altcoins.

With the launch of Ethereum, market sentiments were poised to trigger the altcoin season, but the cooling volume of the ETH ETF and the distributed interest in the BTC ETF could not muster enough power.

While the price of Ethereum (ETH) is yet to react, experts predict that the price will see a massive surge between $4,000 and $7,000. At the time of writing, ETH is trading at $3,271 with a 24-hour growth of 3.08%.

Altcoin Season Indicator Kills All Hopes.

The required demand for the altcoin season has not been met by the cryptocurrency markets and this can be seen in the Altseason Season Index indicator which is below the threshold of 25.

A push above 75 will mark the start of altcoin season.

Source Blockchain Center

Furthermore, analyzing the performance of the top 50 assets in 90 days shows that only 11 of them have outperformed BTC.

To kick off the official altcoin season, at least 75% of assets must outperform Bitcoin.

An increase in inflows and the return of investors in September and October could potentially trigger the altcoin season we have all been waiting for.

Altcoins

Why Altcoins Like Toncoin and Pepe Stumbled This Week

Crypto consumers around the world got excited about the launch of Ethereum spot ETFs! In fact, that wasn’t the case.

Many crypto watchers expected this week to be as hot as the summer season for cryptocurrencies and tokens. After all, the man who could be our next vice president is a well-known crypto advocate (and former venture capitalist), and a new financial instrument tied to a prominent cryptocurrency has debuted.

But somehow the stars didn’t align, and for the most part, the altcoin market crashed. Both utility and meme cryptocurrencies fell during the period, according to data compiled by S&P Global Markets Insights. Yourcoin (TONNE 0.78%), for example, fell by almost 8% over the week, while Peas (POINT 1.62%) and Shiba Inu (SHIB 3.42%) did not do much better, with losses around 7%. Grandpa (PEPE 2.99%) fell by 6%.

Are Hopes for a Cryptocurrency Ally Fading?

That high-profile crypto fan is, needless to say, Republican vice presidential nominee JD Vance. News of his rise to the bottom half of that party’s ticket has crypto fans excited; if Vance and running mate Donald Trump win, the cryptocurrency industry could have a pretty powerful advocate firmly ensconced in the White House for several crucial years.

The excitement faded with Joe Biden’s announcement that he would not seek reelection. Vice President Kamala Harris confidently stepped up to the plate, and at least initially seemed to have a strong sense of purpose and savvy for the vice presidential job. At the same time, doubts seemed to be growing about Vance’s suitability as a No. 2 candidate. This naturally made crypto enthusiasts less enthusiastic about the upcoming election.

This should have been at least somewhat mitigated by the kick-off of Ethereum place exchange traded funds (ETFs). After all, when Bitcoin ETFs were launched earlier this year and sparked a surge in interest in the leading cryptocurrency. This made perfect sense, as a crypto spot ETF is an elegant way for an investor to put money into such assets without having to own them directly.

Of course, few people expected such a craze for Ethereum ETFs. These instruments are no longer a novelty, and Ethereum does not have quite the fame and fascination of its big brother. Still, like Bitcoin ETFs, the Ethereum variant offers the market a quick and easy entry into the currency. And Ethereum is a more versatile instrument than Bitcoin and has more potential, in my opinion, so it is quite surprising that the new ETFs have not been more successful.

Perhaps it’s “crypto ETF fatigue,” or perhaps many investors are only interested in these instruments if they have “Bitcoin” in their title.

Signs of life at the end of the week

That being said, heading into Friday afternoon, there seemed to be something of a rebound in Cryptoland. Bitcoin recovered from the bottom and many altcoins also gained (like Ethereum, which by early evening was up 3%). This may be the start of a new bull run now that the market is recovering from the Harris Effect and the damp squib of the Ethereum ETF launch.

Next week is sure to be an interesting one in the cryptocurrency market; watch this space for more.

Eric Volkman has positions in Bitcoin and Ethereum. The Motley Fool has positions in and recommends Bitcoin and Ethereum. The Motley Fool recommends TON. The Motley Fool has a disclosure policy.

-

Videos3 months ago

Videos3 months agoMoney is broke!! The truth about our financial system!

-

News2 months ago

News2 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

Altcoins2 months ago

Altcoins2 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Videos2 months ago

Videos2 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News2 months ago

News2 months agoOver 1 million new tokens launched since April

-

Videos2 months ago

Videos2 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs3 months ago

NFTs3 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

NFTs2 months ago

NFTs2 months agoSolana NFTs jump 30% in 24 hours: what’s behind the increase?

-

Memecoins2 months ago

Memecoins2 months agoSolana Dev hospitalized with third-degree burns while trying to pump Meme Coin

-

Videos3 months ago

Videos3 months agoCryptocurrency Market Update: Where Are We NOW?! What’s next?

-

Memecoins2 months ago

Memecoins2 months agoWhen memecoins reign supreme in the ecosystem!

-

Videos2 months ago

Videos2 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!