News

Top crypto VC Polychain says former general partner entered into undisclosed collateral deal with portfolio company

Cryptocurrency venture capital giant Polychain has accused former employee Niraj Pant of making a secret deal with portfolio company Eclipse Labs that violated the fund’s policies.

According to three sources familiar with the matter and internal Eclipse documents reviewed by CoinDesk, former Eclipse Labs CEO Neel Somani quietly awarded Pant 5% of an upcoming Eclipse cryptocurrency token in September 2022, just days after Pant tapped Polychain to lead the company’s $6 million pre-seed funding round.

The allocation was eventually reduced to 1.33%, or $13.3 million at the token’s most recent fully diluted valuation in a private investment round. (The company’s latest funding round valued the token at a fully diluted value (FDV) of $1 billion, according to a source close to Eclipse Labs.)

Polychain was founded by Olaf Carlson-Wee, the first employee of cryptocurrency exchange Coinbase, and is one of the largest and most well-known venture capital firms in the cryptocurrency space, with over $11 billion in assets under management. Pant served as a general partner from 2017 to 2023, tasked with directing the firm’s venture capital toward promising cryptocurrency startups.

Pant has since become a prominent figure in the cryptocurrency industry, and is currently the co-founder of blockchain AI startup Ritual, another investment in Polychain’s portfolio.

Eclipse Labs creates a blockchain that combines technology from popular Solana and Ethereum networks. After leading Eclipse’s pre-seed funding round in August 2022, Polychain continued to participate in its $50M Series A Funding Round in March 2024.

Pant led the pre-seed deal, and a CoinDesk investigation found that he was allocated roughly as many Eclipse cryptocurrency tokens as Polychain itself at around the same time. The deal was not disclosed to most of Eclipse’s executives, advisors or major investors, according to CoinDesk’s sources.

Pant insists the deal was completely kosher because it wasn’t finalized until September 2022, the month after Polychain had already invested in Eclipse. He shared legal documents with CoinDesk showing his “advisory” allocation of Eclipse tokens was revised to 1.33% in 2024, but declined to comment on the size of his original stake or why it was changed.

Polychain told CoinDesk it was unaware that Pant had a financial stake in Eclipse until he left the firm in 2023. The fund said it would have to disclose the deal according to its policieswhich are intended to protect the company and its investors from conflicts of interest.

“Polychain was not aware of the financial relationship between Eclipse and Niraj Pant until after his departure from the company,” a Polychain spokesperson said in an email to CoinDesk. “Polychain has robust policies and procedures in place regarding employees in advisory roles. After Mr. Pant’s departure from Polychain, the company became aware that he had violated its policies and investigated the matter.”

Polychain’s statement to CoinDesk offers a rare glimpse into the sausage-making process of the cozy world of crypto VC firms and the projects they fund. Venture capital firms rarely publicly discuss personnel matters or deal structures, and Polychain did not publicly disclose Pant’s policy violation until CoinDesk contacted for this story.

The revelation could deepen the controversial narrative surrounding Somani, who he stepped aside as CEO of Eclipse in May, amid sexual harassment allegations. Somani has denied the allegations and declined to comment for this story.

Two sources close to Eclipse who spoke to CoinDesk on condition of anonymity say that Somani had promised Pant his 5% advisory stake in Eclipse tokens before the pre-seed deal has even been closed.

According to documents reviewed by CoinDesk, Pant’s stake was larger than that of any Eclipse investor except Polychain, which was also allocated 5% of Eclipse’s token. Pant’s stake exceeded allocations to other advisors, investors and all Eclipse employees except current and former CEOs.

According to two people familiar with the matter, Somani told his inner circle that the generous token grant was intended to incentivize Pant to secure Polychain’s money and the veteran VC’s coveted backing.

According to Polychain officials, the deal was not disclosed to the venture capital firm or its limited partners at the time.

The episode also offers a look at the transactions that have become typical of the cryptocurrency industry’s unique fundraising norms, with digital tokens often granted alongside or instead of any equity. Blockchain apps, digital assets, and decentralized ledgers are often touted as a more transparent alternative to traditional finance, but the ownership structures of many leading projects and cryptocurrencies remain opaque.

Eclipse Labs is creating a layer-2 blockchain that offers users a faster, cheaper way to transact on the Ethereum network. The network’s main attraction is that it borrows elements of the popular Solana blockchain to power key parts of its technical design, a detail that has helped it gain traction in two of the largest blockchain communities.

In the case of Eclipse’s fundraising, token allocations were crucial because few investors received equity in the project. Most were simply promised a share of the Eclipse token, a cryptocurrency that doesn’t yet exist and that Eclipse hasn’t even publicly announced.

This setup is not unusual. Crypto investors often offer cash for tokens rather than traditional stocks, and companies rarely disclose these arrangements publicly, for fear of providing ammunition to financial regulators in their fight to classify cryptocurrencies as investment securities.

“Eclipse Labs does not publicly disclose investor ownership percentages,” an Eclipse Labs spokesperson told CoinDesk.

According to internal token allocation tables reviewed by CoinDesk, Eclipse employees, investors and advisors have already been pledged nearly 50% of the supply of a future Eclipse token.

Pant insists his consulting deal with Eclipse was transparent. He shared legal documents with CoinDesk showing he is set to receive a 1.33% stake in Eclipse’s token.

That amount, revised from a previous total that Pant had not disclosed, is less than the 5 percent that Pant was initially promised, documents and people familiar with the matter reveal, but it is still more than that of every other Eclipse adviser and nearly all of its investors and employees.

The consulting agreement shared by Pant is dated April 29, 2024, after he left Polychain, and signed by two parties: Neel Somani, on behalf of Eclipse Labs; and Niraj Pant, on behalf of “The Psychological Operations Co.”

Under the agreement, Psychological Operations Co. would receive a grant of Eclipse tokens in exchange for “periodic synchronization meetings via teleconference” as requested by Eclipse. The agreement itself says nothing about Polychain or its pre-seed investment in Eclipse.

The version of the agreement provided to CoinDesk by Pant says it is an “amendment” to a previous advisory agreement dated Sept. 8, 2022, a few weeks after Eclipse closed its pre-seed round and while he was still a general partner at Polychain.

Pant refused to share the original agreement.

Regardless of whether Pant’s consulting was finalized prior to the pre-seed deal, if his initial consulting with Eclipse began while he was still at Polychain (as his filings attest), then he may still have been required to disclose it under the company’s ethics policies, which the company outlined in a lengthy filing with the U.S. Securities and Exchange Commission.

In a official policy repository with the SEC, Polychain writes: “In order to monitor for any conflicts of interest, Polychain employees are required to pre-authorize certain transactions contemplated in their personal accounts that may have the appearance of impropriety and must disclose on an initial and annual basis the holdings of all personal accounts, as well as all transactions on a quarterly basis.”

The situation is particularly noteworthy because Pant is not only a former Polychain employee, but also the founder and CEO of Ritual, one of Polychain’s hottest portfolio companies.

After leaving Polychain and founding Ritual last year, Pant has quickly become a fixture of the blockchain industry. speaker circuitconsidered a thought leader on the intersection of cryptocurrency and AI. Ritual, which aims to decentralize the training of AI models, falls into a category of blockchain-meets-AI projects that have evolved into a venture in their own right. Last November, it raised $25 million from Polychain and others.

Polychain declined to comment on whether its relationship with Ritual changed as a result of Pant’s alleged policy violation or whether it had learned of the violation before investing in Ritual.

Despite the alleged policy violation, Polychain’s investment in Eclipse could still pay off. According to a source close to the fund, its stake in Eclipse has increased in value 10-fold since the company first invested in 2022.

News

Top 5 Crypto Pre-Sales for August 2024

Have you heard about cryptocurrencies in 2011? Was Bitcoin so popular back then? Well, yes, some forward-thinking people saw its potential early and invested in BTC back then. Investors were skeptical about this new financial element; however, many took the risk and invested what they could risk in the cryptocurrency market.

Going through the list of top presales, we have identified and studied five of the main candidates that can change the game on the trading charts. These new opportunities promise the best returns and a great chance to buy tokens at affordable prices. While 5thScape is at the top of our recommendation, projects like DarkLume and Artemis Coin are pioneers in their respective categories.

Top 5 Crypto Pre-Sales to Add to Your Watchlist in 2024

Below we present the top five cryptocurrency pre-sales that you should consider adding to your investment watchlist.

- 5th Landscape (5SCAPE) – King of digital VR gaming with AR/VR elements

- Dark light (DLUME) – Virtual Metaverse for Social Exploration

- SpacePay (SPY) – Versatile Financial Payment Gateway for Seamless Transactions

- EarthMeta (EMT) – Replicating our planet on a virtual platform

- Artemis Coin (ARTMS) – NFT Marketplace for Digital Real Estate Investment

In-Depth Review: The Best Crypto Pre-Sales of 2024

Now, let’s take a closer look at these pre-sale events and how they can help investors make significant profits this year.

5th Landscape (5SCAPE)

The 5thScape project combines emerging technology using the fundamentals of virtual and augmented reality on the Ethereum platform using its native currency as 5SCAPE. Users of the token experience increased security and interactive gameplay in the digital space.

Here are the potential reasons why investors are admiring the 5thScape ecosystem:

Immersive Gameplay: With over five game titles, the platform is ready to amaze the audience with games ranging from archery, sports, battle and high-speed racing.

Innovative VR Content: 5thScape’s progress in the crypto-gaming space will contribute to the development of educational resources and other VR content on the website.

Motion Control Gadgets: This project is working hard to introduce VR devices such as headsets and gaming chairs with precise controls and high-resolution soundscapes to achieve the best immersive feeling while exploring the ecosystem.

Practical utility: 5SCAPE tokens stimulate participation in various activities and convert the ecosystem into economic value for investors.

Staking Opportunities: Acquiring 5SCAPE tokens after listing on exchanges can generate higher earnings

Free Giveaways and Prizes: The distribution of free coins and VR subscriptions attract investors.

Visit 5thScape for more details>>

Dark Light (DLUME)

We just saw how 5thScape captures investors with its AR/VR digital landscape. DarkLume works on similar VR principles but has a completely new VR metaverse. Its presale is about to hit the $1 million mark and simultaneously increase fund inflows.

What are the specifics that allow DarkLume to lead the metaverse industry?

Native currency: The project has DLUME as a digital currency that can be used for in-game purchases or upgrades. These utility tokens also give their holders the right to vote on the development and expansion of the project.

Benefits of staking: Investors who want to hold and earn from this currency expect to multiply their funds after the stock market listing.

Exploratory Metaverse: Once you enter this world, there is no turning back. There are so many opportunities to find recreational activities and relieve stress. Walking through lush landscapes and stargazing at night can be a memorable experience. If you are a party animal, DarkLume’s virtual discos and clubs will win you over.

Visit DarkLume for more details>>

Payment for space (SPY)

Traditional financial setups face many challenges in daily transactions and are also expensive. To solve these concerns, Maxwell Bunting founded SpacePay by combining cryptocurrency payments and blockchain technology. The London-based startup makes online shopping and payments more seamless by integrating its network with existing card terminals, allowing users to make payments in any digital currency. Merchants can choose to receive payments in conventional currency without having to pay exorbitantly.

SpacePay has designed a user-friendly and convenient interface that supports over 325 crypto wallets. SPY, the native token of this platform, serves to enable all transactions within its ecosystem. Tokens can also be used to generate passive income through staking and additional community rewards.

EarthMeta (EMT)

EarthMeta is a virtual metaverse created to replicate our planet, Earth. It is listed as one of the best crypto pre-sales of 2024, with a focus on creating new NFT platforms and virtual assets in premium cities. The startup encourages users to own and govern virtual landscapes.

Cities are then further broken down into smaller assets such as landmarks, buildings, monuments, parks, schools, and more. NFTs can now be bought and sold in the project’s marketplace. Governors are eligible to earn 1% fees per transaction within their city. EMT token holders can also generate more at once with custom API integrations and participation in DAO activities.

Artemis (ARTMS)

Today we have covered a number of financial projects that you can consider along with 5thScape, the most promising VR coins of the decade. Artemis (ARTMS) is a financial platform that allows investors to transact and trade using its digital asset, ARTMS. Users can also lend, borrow, stake, save, and generate rewards from yield farming.

The project is about to enter Phase 4 of development which will see the launch of the Artemis Crypto System. This system is customized to facilitate a large number of secure and transparent crypto transactions. Cryptocurrency enthusiasts and professional entities can buy and sell products such as smartphones, bicycles and internet services using crypto payments. Early investors have great advantages until the project is available at a discounted price in the pre-sale.

Read this before investing in the next cryptocurrency market

Experienced investors know the factors to consider before investing in this dynamic market. Here are some points that beginners should remember before securing a position in the cryptocurrency universe.

- It is essential to verify the project details and the founders.

- Read and understand the whitepaper for all the technical information about the ICO, the roadmap and the mission of the project.

- The project roadmap will provide greater clarity on milestones and results achieved.

- Review the fundamentals of the new technologies involved in the development of the platform.

- Before investing in any cryptocurrency, carefully evaluate the benefits and risks to avoid losses and build a profitable portfolio.

Conclusion

5thScape ICO Offers Tokens at Deeply Discounted Prices. Once the presale is over, the token price will skyrocket 434% from the first round and promise 600x returns to early investors. Who wouldn’t want to be part of an innovative and growing VR ecosystem? Check your details, review all the documents and start investing in 5thScape now.

Time flies, and so does the $100,000 prize.

News

Best Upcoming Cryptocurrencies for Long-Term Profits: Turn $100 Into $1000 With These Picks

Have you ever wondered how much return Bitcoin has given to investors who bought this gold cryptocurrency a decade ago? In 2014, Bitcoin reached its significant milestone of $1,000 in the first month. Currently, it is trading at around $64k, which is an astonishing 6300% increase in the span of 10 years. No stock, no ETF could ever give you such monumental returns. This simply proves that the cryptocurrency market turns your dreams of investment returns into reality.

While the established giants are not giving so much returns now, the ball is in the court of upcoming cryptocurrencies that are based on the development of projects to provide up to 1000x returns in the near future. In this article, we will explore 5 upcoming cryptocurrencies for long-term earnings that can turn your $100 into $1000 – the only key is strategic investing with a lot of patience!

Best Upcoming Cryptocurrencies For Long Term Profits

Below we list the top 5 cryptocurrencies for long-term gains, which are set to give you returns of up to 1000 times in the coming times.

- 5th Landscape (5LANDSCAPE)

- Dark light (DISGUST)

- BlockDAG (BDAG)

- eTukTuk (TUK)

- WienerAI (WAI)

Take a deeper look at the background of these 5 upcoming cryptocurrencies for long-term gains and see why they could be viable options for your cryptocurrency portfolio.

1. 5° Landscape (5SCAPE)

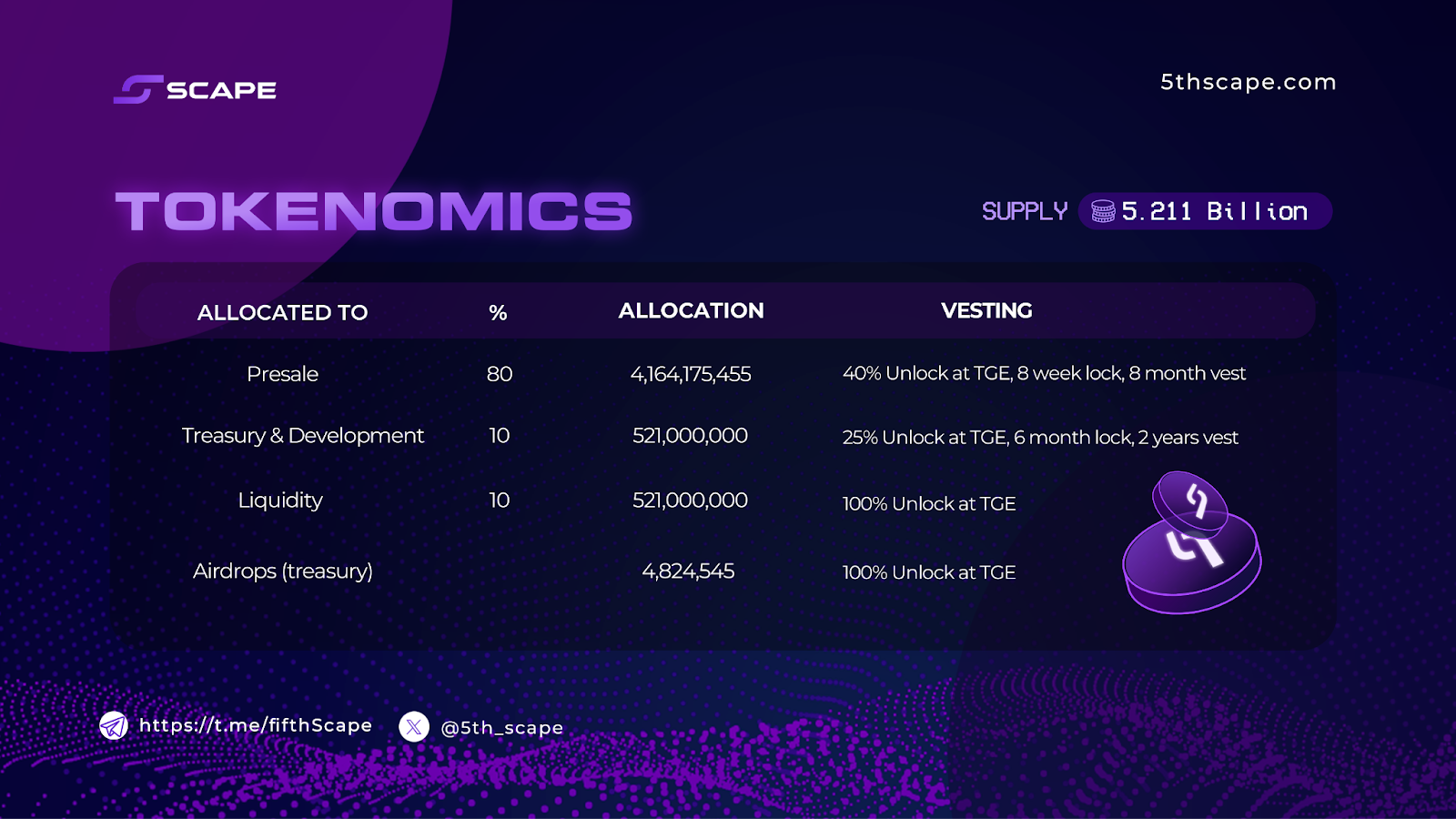

5thScape is changing the face of entertainment by merging augmented and virtual reality with blockchain technology, offering a VR content ecosystem unlike any other destination on the internet. Its native token, 5SCAPE, is the cornerstone of this innovative ecosystem. With a limited supply of 5.21 billion tokens, 5SCAPE offers early investors a unique opportunity to participate in the growth of a potentially transformative platform.

Combining the immersive experiences of VR technology with a cryptocurrency that has a real-world use case, 5thScape presents a compelling investment proposition. The project’s focus on providing unparalleled user experiences, coupled with its potential to generate substantial returns, makes 5SCAPE an ideal new cryptocurrency to have in your portfolio for long-term gains.

Click here to invest in 5thScape today >>

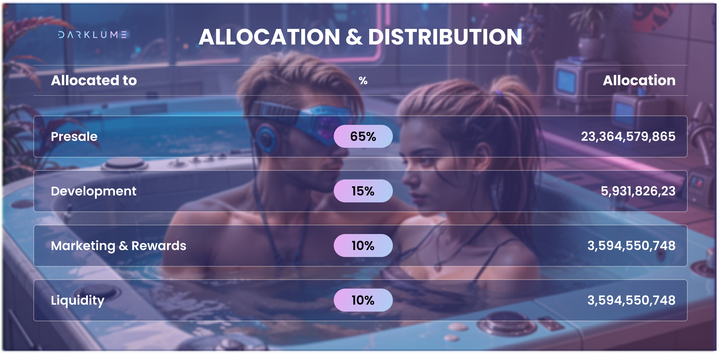

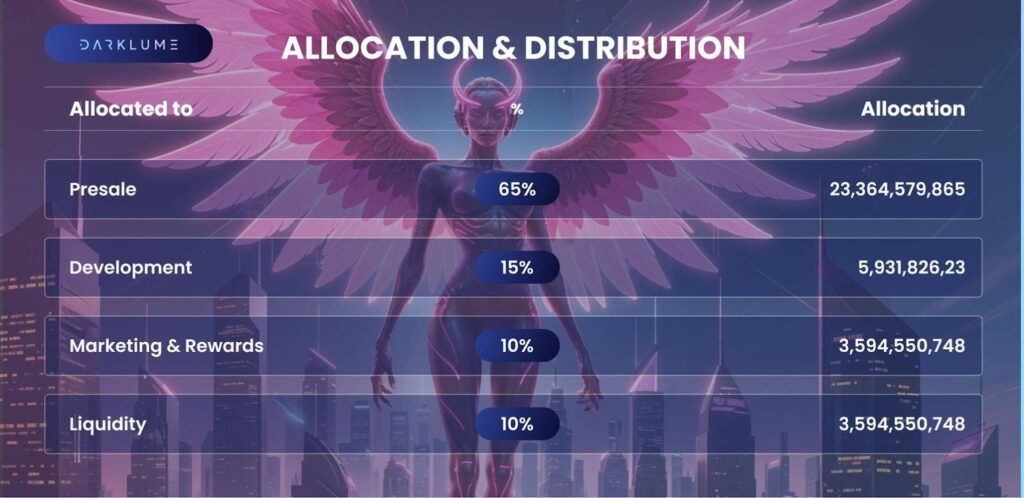

2. DarkLume (DLUME)

DarkLume is a meticulously crafted metaverse where users can experience a lavish digital lifestyle. At its core is the DLUME token, the currency that powers this virtual economy. By owning DLUME, users gain access to exclusive experiences, from owning virtual properties to attending high-society events and hosting virtual celebrations with their friends.

The metaverse is divided into virtual countries, each with its own citizenship requirements. To become a citizen, users must possess a specific amount of DLUME. Maintaining citizenship involves paying taxes in DLUME and creating a sense of community and responsibility among users.

Unlike other metaverse platforms that are limited to digital interactions only, DarkLume offers a wide range of activities, from leisure and entertainment to social interactions and exciting experiences. The platform’s focus on luxury ensures that every aspect of the metaverse is designed to exceed expectations. As DarkLume continues to grow, its DLUME token is expected to be in high demand. The metaverse concept is supported by renowned names such as Mark Zuckerberg and Satya Nadella. As it is the future of immersive socialization, the DLUME token is expected to appreciate in value over time.

Explore DarkLume’s website to learn more

3. BlockDAG (BDAG)

BlockDAG is an innovative blockchain platform that uses a Directed Acyclic Graph (DAG) structure together with blockchain technology to offer fast transaction speeds, lower fees, and better scalability.

Unlike traditional blockchains that process transactions sequentially, BlockDAG processes them in parallel, which allows it to handle a much higher transaction volume. This approach makes BlockDAG an ideal platform for applications that require high throughput and low latency, such as DeFi, gaming, and IoT. Its presale has been a great success so far, and BlockDAG’s adaptability may be an optimistic sign for early investors in the BDAG token.

4. eTukTuk (TUK)

eTukTuk is a new leading crypto project that combines sustainable transportation with blockchain technology. Its main goal is to electrify the famous “tuk-tuk” industry, reducing carbon emissions that cause environmental damage while creating a thriving ecosystem. Its TUK token powers the entire platform.

One of the most notable features of eTukTuk is its Play-to-Earn (P2E) gameplay. Players can earn TUK tokens by completing challenges and missions in the game. This gamified approach not only makes the platform engaging but also incentivizes user participation in building the eTukTuk ecosystem. The primary utility of the TUK token is as a mode of payment for tuk-tuk drivers who use EV charging stations for their vehicles installed across Sri Lanka. The project will soon expand to other countries.

Overall, the value proposition of the TUK crypto token is strengthened by its utility within the platform. It can be used to purchase electric tuk-tuks, charge them at the network’s charging stations, and access various platform services. As eTukTuk adoption grows, demand for TUK tokens is expected to increase, potentially resulting in significant appreciation in the token’s value.

5. WienerAI (WAI)

WienerAI is a new blockchain-based platform that uses next-generation artificial intelligence (AI) technology to transform the cryptocurrency trading space. Its flagship product is an AI trading bot (with a sausage-themed mascot) designed to analyze market trends, identify potential opportunities, and execute trades with zero errors. With the power of AI, WienerAI provides users with a market edge in the complex and dynamic world of investing.

The platform’s native WAI token is a digital asset that underpins the entire ecosystem. Token holders can enjoy various benefits, including discounted trading fees, priority access to new features, and even a share of the platform’s profits. As WienerAI gains traction and its AI trading bot proves successful, the continued flow of demand for the WAI token will fuel its price.

Final Thoughts: Best Cryptocurrencies for Long-Term Profits

Each cryptocurrency project explored in this article brings a unique and innovative perspective to the blockchain industry. From the immersive worlds of 5thScape and DarkLume to the efficiency gains of BlockDAG and the sustainability focus of eTukTuk, not to mention WienerAI’s AI-powered trading bot with a new approach to investing, these projects are pushing the boundaries of what’s possible with blockchain technology.

While all of these projects are promising, 5thScape and DarkLume stand out as particularly interesting investment opportunities. The combination of 5thScape’s robust VR ecosystem tokenomics and unique AR/VR offeringstogether with the fantasy world of the DarkLume metaversehas the potential to appeal to a wide range of investors who may be entertainment lovers, not just cryptocurrency enthusiasts. Given their current presale stages, acquiring 5SCAPE and DLUME tokens at these early-bird prices could prove to be a strategic move for those seeking substantial returns.

This is a sponsored article. The opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on the information presented in this article.

News

Avalanche Predicts ‘Most Bullish Unlock’ in Broader Market $1 Billion in Token Release

Token Unlocks data shows that several crypto projects:AvalancheWormhole, Aptos, SandboxArbitrum, Optimism and others are set to unlock around $1 billion worth of tokens in August.

Approximately $260 million will be allocated in the first three days of the month.

Crypto projects often schedule token unlocks to control the asset supply and prevent market oversaturation. This gradual release helps avoid significant sell-offs by early investors or team members who hold large amounts of crypto assets.

Wormhole and Avalanche to Release Over $400 Million in Tokens

The biggest news this month will be Wormhole and Avalanche.

On August 3rd, Hole in the walla cross-chain messaging protocol, will release 600 million tokens worth $151.67 million, or 33.33% of its circulating supply.

Avalanche will follow on August 20, unlocking 9.54 million AVAX tokens worth approximately $251 million, or 2.42% of its circulating supply.

The Token Unlocks dashboard shows that 4.5 million AVAX, worth $118.53 million, will go to the Avalanche team, 2.25 million AVAX, worth $59.27 million, will go to strategic partners, and the remainder will go to the Foundation and as an airdrop.

Farid Rached, former head of ecosystem growth at Avalanche, underlined that this planned unlock would be the most bullish in its history because “it is the last big step for the team and public/private investors.”

Other important unlocks

Sui, a layer 1 network, will unlock 64 million tokens worth $50 million, or 2.56% of its circulating supply, on August 1.

Similarly, decentralized exchange dYdX will issue 8.33 million tokens worth nearly $11 million, or 3.65% of its circulating supply. These tokens will be distributed to investors, founders, staff, and future employees.

Aptos will unlock 11.31 million APT tokens worth $74.64 million on August 12. These will be allocated to the Aptos community, top contributors, the foundation, and investors, with top contributors receiving the largest share: 3.96 million APT worth $26 million.

On August 14, Sandbox will release 205.6 million SAND tokens worth $66.75 million. This issuance will be split between the team, advisors, and a corporate reserve.

Finally, Ethereum’s layer 2 networks Referee AND Optimism will collectively unlock over $110 million worth of tokens by August 16 and 31, respectively.

Mentioned in this article

Latest Alpha Market Report

News

Big Tech Beats Bitcoin (BTC) as Trump’s Trade Cancellation Weakens Token

Bitcoin has failed to join the cross-asset rally fueled by dovish comments from the Federal Reserve, as the tight US election race casts doubt on Donald Trump’s ability to implement his pro-cryptocurrency agenda.

The digital asset slipped 2.4% on Wednesday, tracking a Fed-fueled surge in an index of the Magnificent Seven large-cap tech stocks by one of the widest margins in 2024. The token fell further on Thursday, changing hands at $63,750 by 6:10 a.m. in London.

-

Videos6 months ago

Videos6 months agoMoney is broke!! The truth about our financial system!

-

News5 months ago

News5 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

Altcoins5 months ago

Altcoins5 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

News5 months ago

News5 months agoOver 1 million new tokens launched since April

-

Videos5 months ago

Videos5 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

NFTs6 months ago

NFTs6 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

Videos5 months ago

Videos5 months agoRecession soon?? What this means for you and your wallet!!

-

Videos5 months ago

Videos5 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!

-

NFTs6 months ago

NFTs6 months agoTrump endorses Bible line – after selling shoes, NFTs and more

-

Memecoins5 months ago

Memecoins5 months agoChatGPT Analytics That Will Work Better in 2024

-

Memecoins5 months ago

Memecoins5 months agoWhen memecoins reign supreme in the ecosystem!

-

NFTs5 months ago

NFTs5 months agoSolana NFTs jump 30% in 24 hours: what’s behind the increase?