Altcoins

Top 10 Intriguing Reasons Reduced Bitcoin Supply Spark Altcoins: Halving As A Catalyst

The recent Bitcoin halving, where the reward for mining new bitcoins is cut in half, has ignited a debate. Will this event, designed to limit Bitcoin’s supply, lead to a surge in development and adoption of alternative cryptocurrencies (altcoins)? Let’s delve into the potential catalytic effect of the halving on the altcoin landscape.

Scarcity Breeds Innovation?

The core argument suggests that a reduced Bitcoin supply, caused by the halving, could lead to several outcomes that benefit altcoins:

- Increased Transaction Costs: As Bitcoin becomes scarcer, transaction fees are likely to rise. This could incentivize users to explore alternative cryptocurrencies with lower transaction costs for everyday use. Altcoins with faster transaction processing times and lower fees could become more attractive.

- Shifting Investment Focus: With a limited supply of new Bitcoins available, investors seeking high returns might turn their attention to altcoins with greater growth potential. This could lead to increased funding and development for promising altcoin projects.

- Diversification Strategies: Investors wary of putting all their eggs in one basket might seek to diversify their crypto holdings. This could lead to increased investment in a wider range of altcoins, promoting innovation and competition within the broader ecosystem.

Also, read – Bitcoin Halving and Market Buzz Fuel Startup Surge: Is it A Crypto Spring?

Top 10 reasons Reduced Bitcoin Supply Sparks Altcoins Growth

The Bitcoin halving – a pre-programmed event that cuts the block reward for miners in half roughly every four years – is a pivotal moment in the cryptocurrency space. While the primary focus often lies on Bitcoin’s price movements post-halving, a fascinating secondary effect emerges: a potential surge in altcoin interest and growth. Here’s a deep dive into 10 intriguing reasons why a Bitcoin halving can act as a catalyst for altcoins:

1. Increased Network Traffic and Transaction Fees:

- Post-halving, with fewer Bitcoins being mined, the processing power dedicated to the Bitcoin network might not be as profitable. This could incentivize miners to migrate to altcoin networks with lower transaction fees, bolstering their security and potentially leading to increased altcoin adoption.

2. Investor Attention Spills Over:

- The heightened media attention and investor interest surrounding Bitcoin halving events can create a ripple effect. As Bitcoin prices potentially rise, a portion of these new investors might explore alternative cryptocurrencies, seeking better returns or specific functionalities that Bitcoin itself lacks.

3. The Search for Yield:

- With the reduced issuance of new Bitcoins post-halving, the overall supply becomes more scarce. This can make Bitcoin a less attractive investment for yield-hungry investors, who might then turn to altcoins with staking or lending mechanisms offering more lucrative returns.

4. Innovation Breeds Opportunity:

- Bitcoin’s dominance doesn’t encompass every use case within the crypto space. Altcoins often cater to specific niches, like privacy-focused currencies (Monero, Zcash) or smart contract platforms (Ethereum, Solana). A rising tide of investor interest post-halving can provide a springboard for innovative altcoins to gain traction.

5. Spotlight on Scalability Challenges:

- Bitcoin’s scalability limitations, potentially amplified by the increased network traffic post-halving, can push users towards altcoins with faster transaction speeds and lower fees. This incentivizes the development of Layer-2 scaling solutions for Bitcoin and strengthens the case for scalable altcoin networks.

6. Rise of Decentralized Finance (DeFi):

- DeFi applications built on top of smart contract platforms like Ethereum offer innovative financial services like lending, borrowing, and decentralized exchanges. A surge in DeFi activity post-halving, driven by increased investor interest in the crypto space, can benefit DeFi-focused altcoins.

7. Diversification Strategies:

- As Bitcoin’s price potentially rises post-halving, some investors might choose to diversify their crypto portfolios to hedge their bets. This can lead to increased investment in altcoins, offering a broader exposure to the cryptocurrency market.

8. The “Rising Tide Lifts All Boats” Effect:

- A bullish sentiment surrounding Bitcoin post-halving can generate a positive outlook for the entire cryptocurrency market. This can lead to a general increase in investor confidence and capital inflows, potentially benefiting altcoins across various sectors.

9. Short-Term Price Volatility in Bitcoin:

- The price movements surrounding Bitcoin halving events can be volatile. This short-term volatility might deter some risk-averse investors from entering the Bitcoin market, leading them to explore more stable altcoins.

10. Regulatory Landscape and Institutional Interest:

- Regulatory clarity and increased institutional interest in the crypto space post-halving can benefit the entire market, including altcoins. As the industry matures, altcoins with strong fundamentals and clear use cases might attract significant investment from these new entrants.

Current Affairs Pointers:

- The upcoming Bitcoin halving, expected in 2024, is already creating a buzz in the crypto community.

- Altcoin projects focused on scalability solutions (like Solana and Polygon) and DeFi applications (like Aave and Uniswap) are well-positioned to potentially benefit from the increased investor interest post-halving.

- Regulatory bodies worldwide are actively discussing and developing frameworks for overseeing the cryptocurrency industry. Clearer regulations could create a more favorable environment for altcoin adoption.

It’s important to remember:

- The cryptocurrency market is inherently unpredictable, and past performance doesn’t guarantee future results.

- Investors should conduct thorough research before investing in any cryptocurrency, including altcoins.

By understanding the potential catalysts triggered by Bitcoin halving events, investors and crypto enthusiasts can gain valuable insights into the ever-evolving dynamics of the altcoin market.

Absolutely, here’s the continuation of the text addressing the counter-arguments:

The Counter-Arguments: Not a Guaranteed Boon

While the potential for altcoin growth following a Bitcoin halving is intriguing, it’s crucial to acknowledge that this isn’t a guaranteed outcome. Here are some factors to consider:

-

Bitcoin Still Dominates: Bitcoin remains the undisputed king of cryptocurrencies, holding a significant market share and brand recognition. Even with a reduced issuance, Bitcoin’s potential price appreciation post-halving could continue to attract the majority of investor interest, leaving less room for altcoin growth.

-

Altcoin Project Maturity: Not all altcoin projects are created equal. For altcoins to capitalize on the potential surge in investor interest, they need to demonstrate strong fundamentals, a clear value proposition, and a working product. Investors are likely to be more discerning, especially with increased institutional participation.

-

Regulation and Uncertainty: The regulatory landscape surrounding cryptocurrencies remains uncertain. Stringent regulations could stifle innovation and hinder the growth of the entire market, including altcoins.

-

Competition Within Altcoins: The altcoin market itself is highly competitive, with numerous projects vying for investor attention. Standing out from the crowd requires a unique value proposition and a strong development team to deliver on its promises.

-

Market Sentiment and Unforeseen Events: Overall market sentiment plays a significant role. If a broader economic downturn coincides with the halving, it could dampen investor enthusiasm for riskier assets like cryptocurrencies, impacting altcoins more severely due to their lower market capitalization.

Navigating the Uncertainties

Despite these counter-arguments, the potential for altcoin growth following a Bitcoin halving remains a compelling narrative. By understanding both the potential catalysts and the inherent risks, investors and crypto enthusiasts can approach the market with a more informed perspective.

Here are some key takeaways:

- Conduct Thorough Research: Don’t blindly invest in any altcoin. Research the project’s team, technology, roadmap, and overall market fit.

- Invest Within Your Risk Tolerance: The cryptocurrency market is volatile. Only invest what you can afford to lose.

- Diversification is Key: Spread your investments across different cryptocurrencies, including established projects and promising altcoins, to manage risk.

- Stay Informed: Keep yourself updated on the latest developments in the cryptocurrency space, including regulatory changes and market trends.

By following these principles, you can position yourself to potentially benefit from the opportunities that a Bitcoin halving might present within the dynamic world of altcoins.

Beyond the Halving: A More Diversified Future

While the Bitcoin halving can act as a catalyst for altcoin growth, the future of the cryptocurrency market is likely to be a more diversified landscape, not necessarily a zero-sum game between Bitcoin and altcoins. Here are some trends to consider:

- Interoperability and Collaboration: As the industry matures, we might witness increased interoperability between blockchains. This would allow different cryptocurrencies to work together seamlessly, fostering collaboration and innovation across the ecosystem.

- Focus on Use Cases: The most successful cryptocurrencies, both Bitcoin and altcoins, will be those that solve real-world problems and offer clear use cases. For example, Decentralized Finance (DeFi) applications built on altcoin platforms like Ethereum demonstrate the potential of cryptocurrencies to revolutionize the financial sector.

- The Rise of CBDCs: Central Bank Digital Currencies (CBDCs) issued by governments could potentially co-exist with private cryptocurrencies like Bitcoin and altcoins. CBDCs might offer advantages like faster transaction processing and greater security, while private cryptocurrencies provide a decentralized alternative with censorship resistance.

- Regulation Fostering Innovation: Clear and well-defined regulations can create a more stable environment for the cryptocurrency industry, attracting new businesses and investors. This could benefit both established projects like Bitcoin and innovative altcoins with strong fundamentals.

- The Evolving Role of Bitcoin: Bitcoin’s role within the crypto ecosystem might evolve. It could potentially become a digital store of value, similar to gold, while altcoins cater to specific functionalities and use cases.

The future of the cryptocurrency space is brimming with potential. By understanding the potential impact of Bitcoin halving events, the evolving dynamics between Bitcoin and altcoins, and the broader trends shaping the industry, investors and enthusiasts can navigate this exciting and ever-changing landscape. Conducting thorough research, maintaining a diversified portfolio, and staying informed are crucial for success in this dynamic market. The cryptocurrency revolution is still unfolding, and the possibilities for the future are vast.

Conclusion: A Catalyst, Not a Crystal Ball

The Bitcoin halving presents a fascinating phenomenon within the cryptocurrency space. While the primary focus often centers on Bitcoin itself, the potential impact on altcoins is an intriguing secondary effect. This event can act as a catalyst for innovation and investment within the altcoin market, attracting new projects and fostering the development of solutions that address specific needs.

However, it’s crucial to remember that the halving’s impact on altcoins isn’t a foregone conclusion. Several factors, including regulatory uncertainty, competition within the altcoin space itself, and broader market sentiment, can influence the outcome. Ultimately, the success of altcoins hinges on their ability to:

- Address Real Needs: Do these projects solve a genuine problem or offer a unique value proposition?

- Offer Technological Advancements: Do they bring innovative solutions to the table, addressing scalability, security, or user experience concerns?

- Build a Strong User Base: Can they cultivate a thriving community of users and developers who actively contribute to the project’s growth?

The future of the crypto market lies not in a zero-sum game between Bitcoin and altcoins, but in fostering a diverse ecosystem where both play complementary roles. Bitcoin might evolve into a digital store of value, while altcoins cater to specific functionalities and use cases. Interoperability between blockchains could foster collaboration and innovation across the entire crypto landscape.

The halving might be a spark that ignites investor interest and innovation within the altcoin space. However, it’s the underlying focus on utility, addressing real-world problems, and building a strong user base that will drive the flames of progress in the long run. By understanding both the potential opportunities and inherent risks associated with the halving, investors and crypto enthusiasts can approach the market with a more informed perspective and navigate this dynamic and exciting space with greater confidence.

Altcoins

Altcoins with huge potential Bonk and Mpeppe (MPEPE)

The cryptocurrency market is full of potential, and two altcoins that have recently caught the attention of investors are Bonk (BONK) and Mpeppe (MPEPE)Both of these tokens offer unique features and promising growth prospects that set them apart in the crowded altcoin space. In this article, we will explore what makes Bonk (BONK) and Mpeppe (MPEPE) attractive investment opportunities and how they could shape the future of the cryptocurrency market.

Bonk (BONK): The viral sensation

Bonk (BONK) burst onto the scene with a playful and viral take on cryptocurrency. Here’s a closer look at what’s made Bonk (BONK) a sure bet in the altcoin space.

The Viral Marketing Strategy

Bonk (BONK) Bonk has harnessed the power of internet memes and viral marketing to quickly gain popularity. Its branding, which features a humorous and engaging mascot, has resonated with the crypto community and beyond. By harnessing the viral nature of meme culture, Bonk (BONK) has quickly established a strong presence and captured the imagination of a wide audience.

Merging meme culture and blockchain innovation

Mpeppe (MPEPE) is emerging as a new and exciting player in the altcoin market. With its unique blend of features and innovative approach, Mpeppe (MPEPE) is attracting the attention of investors and cryptocurrency enthusiasts.

Mpeppe (MPEPE) combines the fun and relatable aspects of meme culture with advanced blockchain technology. Inspired by football and blockchain innovation, Mpeppe (MPEPE) offers a distinctive brand identity that appeals to a wide audience. This fusion of entertainment and technology sets Mpeppe (MPEPE) apart from other altcoins and offers an attractive investment opportunity.

Community impact

The strength of each cryptocurrency’s community will play a vital role in its future trajectory. Bonk (BONK) and Mpeppe (MPEPE) Cryptocurrencies build strong, engaged communities, but how they foster and grow those communities will determine their long-term success. Active, supportive communities can generate lasting interest and value, making them essential to the future of every cryptocurrency.

Conclusion: Invest in Bonk and Mpeppe

Bonk (BONK) and Mpeppe (MPEPE) represent exciting opportunities in the altcoin market. While Bonk (BONK) has established itself through its viral marketing and strong community support, Mpeppe (MPEPE) offers a unique blend of meme culture and advanced blockchain features. Both coins have the potential to make a significant impact in the cryptocurrency space.

For investors looking to explore high-potential altcoins, keeping an eye on Bonk (BONK) and Mpeppe (MPEPE) offers interesting opportunities. As the market evolves, these tokens could play a significant role in the future of cryptocurrencies, making them attractive options for those looking for growth and innovation in the altcoin space.

For more information on the Mpeppe presale (MPEPE):

Visit Mpeppe (MPEPE)

Join us and become a member of the community:

Altcoins

Top 6 Altcoins Expected to EXPLODE Before 2025: Buy Now!

As we approach 2025, the cryptocurrency market is poised for a major shift. According to Austin, an analyst at Altcoin Daily, potential policy changes could trigger a major surge in altcoins. A potential change in the Federal Reserve’s policy rate in September could lead to substantial growth in the cryptocurrency market, benefiting Ethereum, Solana, and several promising new altcoins.

Here’s a look at some altcoins priced between $1 and $2 that could offer good returns during the current market downturn. Dive right in.

Top 6 Altcoins to Watch

Aethir: The Decentralized GPU Marketplace

Aethir is becoming a key player in decentralized cloud infrastructure for gaming and AI. With over $36 million in annual revenue, Aethir is meeting the growing demand for GPU computing from large tech companies like Google and Microsoft. By utilizing underutilized GPUs, Aethir is making a significant impact in the tech world. Current Price: $0.07176.

Ondo: The Best Bet in the RWA Sector

Ondo is transforming the way financial assets are tokenized with its real asset protocols. The ONDO token, used for Ondo DAO and Flux Finance, offers a 5.3% annual dividend in USDY. Despite a recent 35% price drop, ONDO’s price action suggests a potential breakout. With less selling pressure and an increase in off-exchange holdings, the outlook appears positive. Current price: $0.9251.

Lukso: Blockchain for Creators and Social Networks

Lukso is creating a unique blockchain focused on connecting creators, brands, and users. As an alternative to Ethereum, Lukso offers universal profiles and gasless transactions, making blockchain technology more accessible. With a strong vision and strong leadership, Lukso is poised for wider adoption. Current Price: $1.71.

AIT Protocol: Decentralized AI Data Annotation

The AIT protocol addresses the need for decentralization of work in AI data annotation. It connects human trainers with AI model owners through a decentralized marketplace, thereby improving AI models. Its growing adoption in Asia and strategic investments suggest that it could be a major disruptor in the AI space. Current price: $0.1169.

Foxy (Linea): A meme piece with level 2 potential

Foxy, a cryptocurrency associated with Linea’s Ethereum layer 2 scaling, has received support from ConsenSys. It stands out in Ethereum layer 2 due to its MetaMask integration and fast transactions. With Linea’s growing adoption and low transaction costs, Foxy is well-positioned for growth. Current price: $0.01116.

Off-grid: Emerging Altcoin in Video Gaming

Finally, Off The Grid, developed by Godzilla, is generating excitement in the crypto gaming sector. Although it has not yet launched, it has received positive feedback from industry experts, suggesting strong potential. Other infrastructure projects like Immutable and games such as Xers and Star Heroes are also worth considering for those interested in crypto gaming.

Who’s excited about the potential altcoin rally?

Altcoins

Bitcoin Dominance Hits 3-Year High: Is Altcoin Season Coming?

As Bitcoin dominance hits a three-year high of 56%, analysts are predicting the potential start of an altcoin season. Although Bitcoin’s current valuation has fallen below $63,600, the high dominance level suggests a significant shift in the market.

Experts point out that Bitcoin dominance is a key factor in predicting altcoin trends. If Bitcoin holds its price while its dominance declines, it could signal a flow of investment into altcoins. This triggers what many call an “altcoin season.”

Conversely, if Bitcoin price and dominance fall simultaneously, it usually indicates a broader market correction rather than an altcoin boom.

What Factors Suggest an Imminent Altcoin Season?

Markus Thielen of 10X Research noted that Bitcoin Price Tends to Stabilize in August. Therefore, a stable Bitcoin price, coupled with declining dominance, may create the ideal conditions for altcoins to thrive.

Learn more: Bitcoin Dominance Chart: What Is It and Why Does It Matter?

Bitcoin Domination. Source: TradingView

In addition, Ki Young Ju, founder of the chain analysis CryptoQuant platform has highlighted increasing activities by crypto whales that appear to be preparing for an altcoin rally.

“Limit buy order volume for altcoins, excluding Bitcoin and Ethereum, is increasing, indicating that strong buy walls are being put in place” said.

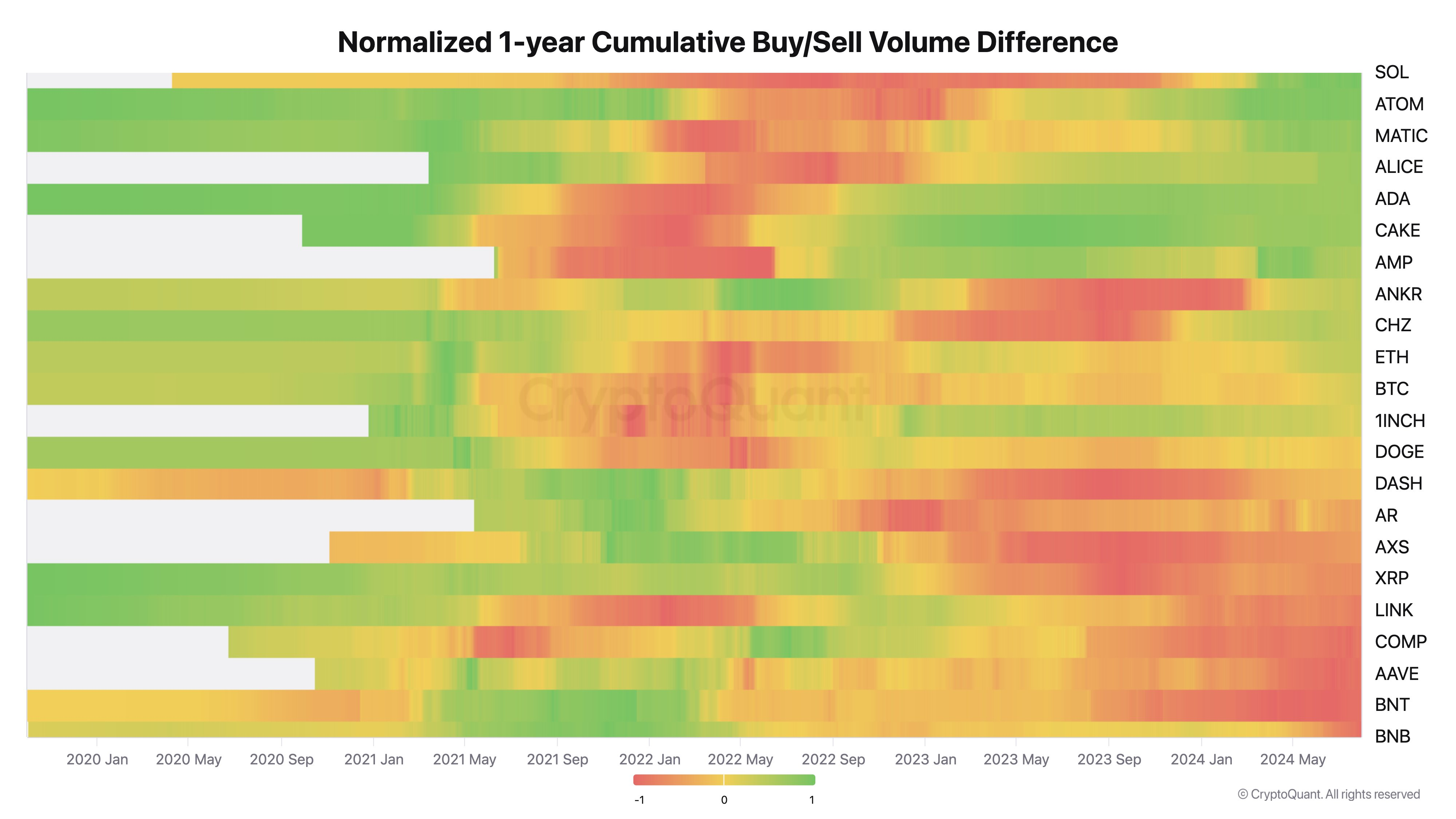

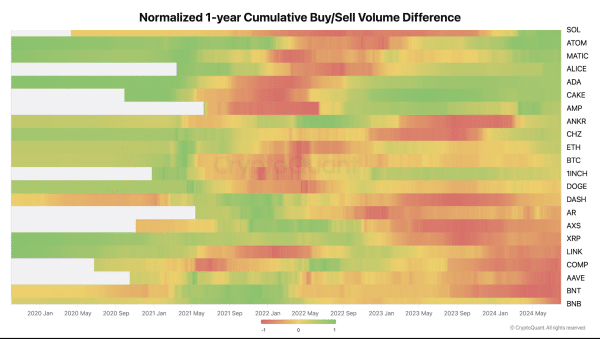

Ju explained that limit orders, which are preferred by institutions for large trades to minimize price impact, create “quote volume.” His analysis, which includes a graph of the 1-year normalized cumulative buy/sell volume difference, indicates that altcoins like Solana (SOL)Cosmos (ATOM) and Polygon (MATIC) experience significant accumulation activities.

“The indicator is calculated by taking the cumulative sum of the difference between the buy and sell quote volumes, using a one-year rolling window. If there is an upward trend, it means the buy volume of the quotes is increasing, indicating stronger buy walls,” Ju explained.

Normalized cumulative difference over 1 year between purchase and sale volumes. Source: CryptoQuant

Normalized cumulative difference over 1 year between purchase and sale volumes. Source: CryptoQuant

This bullish sentiment is reflected in the trends following recent developments in crypto financial products. Crypto Vikings, a renowned analyst, suggests that current market conditions are conducive to altcoin season.

“Many alts are down 60-80% in the last couple of months, and many of them have already bottomed and are in a good buy zone. Bitcoin Domination is also facing major resistance relative to where the massive altcoin season began each cycle,” Crypto Vikings declared.

Sentiment is increasingly optimistic, as many believe that the disillusionment that follows periods of prolonged economic downturn opens the way to profitable investments.

Another trader, Mags, noted that altcoins are only up 58% after breaking a 525-day accumulation. Therefore, he predicts a possible continuation of the altcoin rally after a reaccumulation consolidation.

“Permanent bears will tell you that altcoins are done and in a distribution phase. But if you look at the chart, altcoins are only up 58% since they broke out after 525 days of accumulation. Do you really think a breakout after 525 days of consolidation will end after only a 58% move?” wrote on X (Twitter).

Learn more: 11 Cryptos to Add to Your Portfolio Before Altcoin Season

On the other hand, Brian Quinlivan, senior analyst at Santiment, told BeInCrypto that there is a lack of enthusiasm for the altcoin season due to the recent price drops.

“As far as mentions of altcoin season go, we’re not really seeing any significant enthusiasm from traders about it. Traders have at least been a little bit more vocal since we started seeing prices drop over the last three days,” Quinlivan told BeInCrypto.

Disclaimer

In accordance with the Trust Project This price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAnd Disclaimer have been updated.

Altcoins

On-chain data confirms whales are preparing for altcoin surge with increased buy orders

Ki Young Ju, CEO of analytics platform CryptoQuant, believes whales are preparing for an upcoming surge in altcoins.

In a recent revelation about X, Ju underlines that the volume of limit buy orders for altcoins, excluding Bitcoin and Ethereum, is increasing. This pattern suggests the formation of substantial buy walls, highlighting significant buying pressure from large-scale investors.

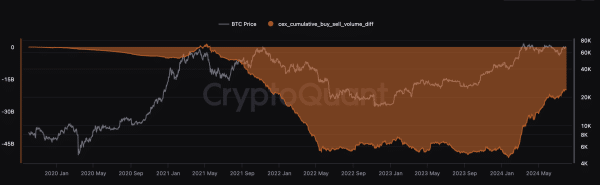

Ju’s chart identifies two main phases in limit order volume for altcoins: the limit sell phase and the limit buy phase. The limit sell phase saw a notable increase in cumulative sell orders in 2022, demonstrating strong selling pressure from whales and other market participants. This phase coincided with a period of falling altcoin prices due to unfavorable market conditions.

Then, the limit buying phase began, marked by a significant increase in cumulative buy orders. This indicates a period of strategic accumulation where whales establish substantial buy walls.

According to Ju, the increase in buying volume suggests confidence in the future conditions of the altcoin market. This buying pressure creates strong support levels, indicating that whales are preparing for a positive change in the market.

Buying pressure on specific altcoins

Ju also provided a heatmap of the 1-year normalized cumulative buy/sell volume difference for various altcoins, showing the buying and selling pressure over time. Solana (SOL) has seen alternating strong buying and selling phases, with recent activity showing increased buying interest. Cosmos (ATOM) and Polygon (MATIC) have also shown increased buying pressure despite mixed activity trends.

Cardano (ADA) and PancakeSwap (CAKE) have shown balanced buying and selling phases, with recent trends proving increased buying pressure. Coins like AMP and ANKR have also demonstrated increased buying activity. The heatmap reveals that most altcoins are seeing increased buying pressure as whales and large investors accumulate altcoins in anticipation of a rally.

Meanwhile, coins experiencing selling pressure, as indicated by the predominantly red areas on the heatmap, include DOGE, DASH, AXS, XRP, COMP, and AAVE, BNT.

Bitcoin whales are also buying

It is important to note that while whales are accumulating altcoins, Bitcoin whales are also active. Crypto Basic note an increase in buyer activity on Binance, which aligns with an increase in the buy/sell ratio of takers and whale movements. Analyst Ali Martinez highlighted the ratio fluctuations from below 0.8 to above 1.7 between July 27 and 31. Ratios above 1.0 indicate aggressive buying, often preceding price rallies.

From July 27 to July 28, the ratio remained mostly above 1.0, corresponding to the rise in Bitcoin price from around $66,500 to over $67,000. A spike to around 1.5 led to a sharp increase in price to around $68,500. However, on July 30 and 31, the ratio fell below 1.0 several times, corresponding to a drop in price to around $66,000, before a final spike to 1.7 indicated another slight increase in price.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

-

Videos7 months ago

Videos7 months agoMoney is broke!! The truth about our financial system!

-

News6 months ago

News6 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

News6 months ago

News6 months agoOver 1 million new tokens launched since April

-

Altcoins6 months ago

Altcoins6 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

NFTs7 months ago

NFTs7 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

Videos6 months ago

Videos6 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

Memecoins6 months ago

Memecoins6 months agoChatGPT Analytics That Will Work Better in 2024

-

Videos6 months ago

Videos6 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs7 months ago

NFTs7 months agoTrump endorses Bible line – after selling shoes, NFTs and more

-

Videos6 months ago

Videos6 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!

-

Altcoins6 months ago

Altcoins6 months agoAltcoin Investments to create millionaires in 2024

-

Memecoins6 months ago

Memecoins6 months agoWhen memecoins reign supreme in the ecosystem!