News

Staking Crypto: A Beginner’s Guide on How to Stake Crypto in 2024

Key Takeaways:

- For individual investors, staking crypto is a much more accessible and overall better alternative to mining.

- There are multiple staking methods available for you to choose from, including pooled staking and liquid staking services.

- The simplest way to start staking as a beginner is through an online user-friendly crypto exchange like Coinbase.

Staking crypto assets can seem like a daunting process, but it’s much easier than mining or trading. By using centralized exchanges or staking platforms, most investors find it much easier to jump into staking to generate wealth.

This beginner’s guide covers the basics of staking: methods, platforms, and the best crypto to stake for solid yields.

What’s Inside?

- Learn how to stake popular tokens like Ethereum, Cardano, and Solana right from your couch.

- Discover the best platforms and rates for some of our favorite staking tokens.

- A step-by-step guide to starting staking on Coinbase, Binance, and even your hardware wallet.

- Risks & Rewards: Yes, there’s fine print. We cover that, too.

How Do You Stake Crypto?

The simplest way to start staking as a beginner is via an online crypto exchange or platform. These resources provide users with tools and interfaces that make staking crypto straightforward.

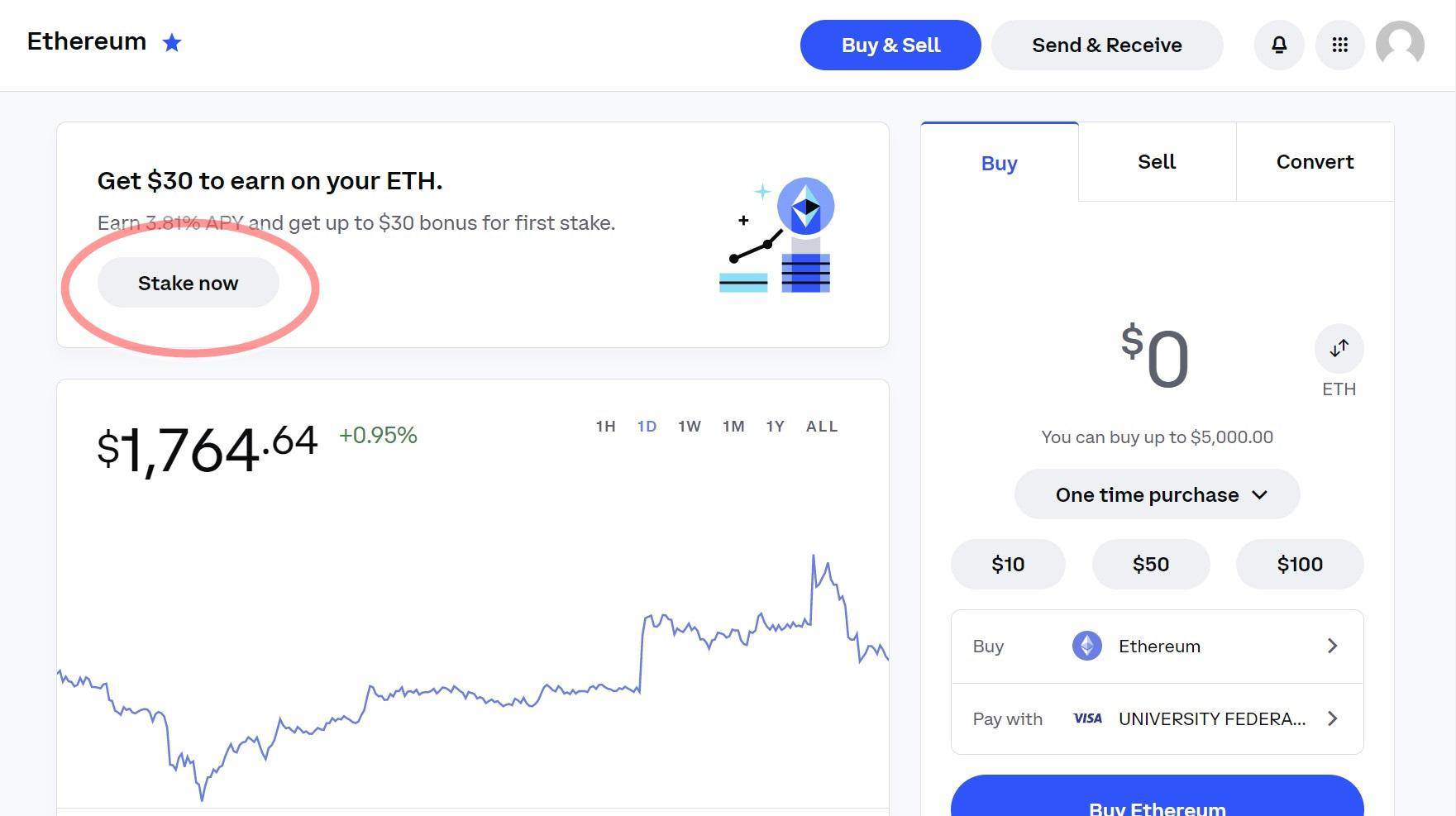

Here’s an easy-to-follow guide to getting started with staking using Coinbase:

On Coinbase you can easily stake ETH right from your homepage. Click the ‘Stake now’ button to get started.

On Coinbase you can easily stake ETH right from your homepage. Click the ‘Stake now’ button to get started.

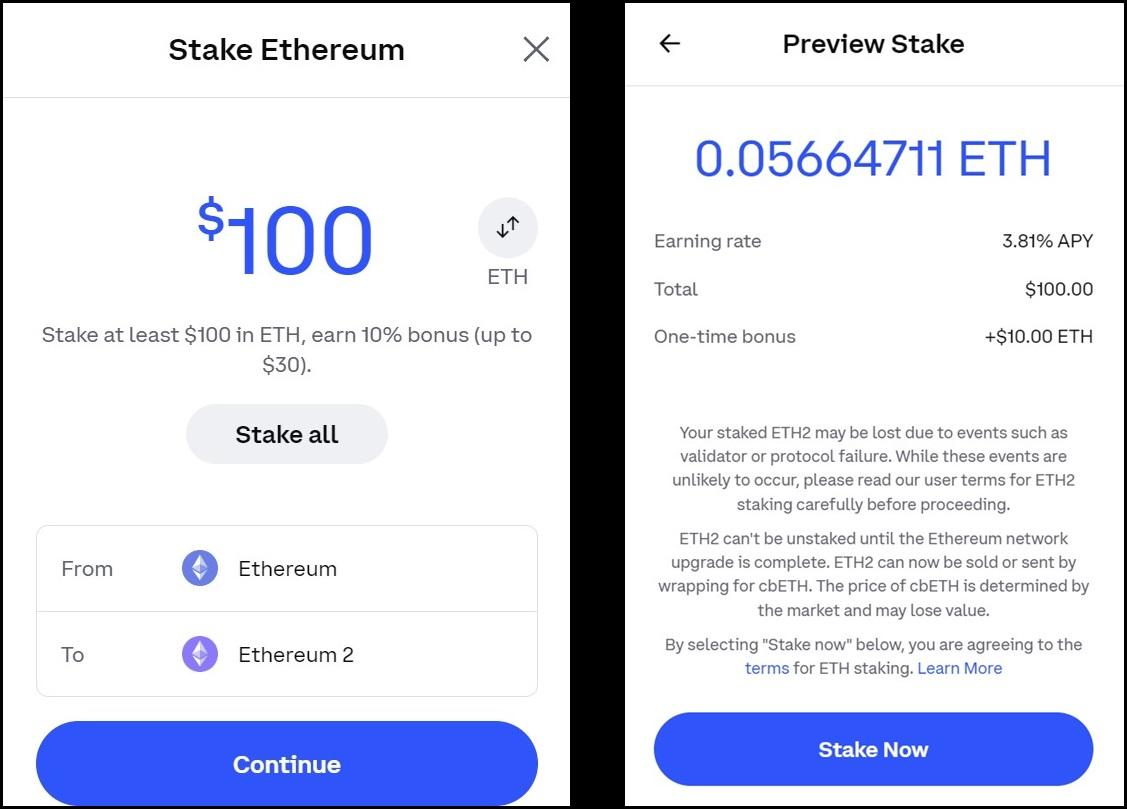

Enter the amount to stake, continue, and then confirm your stake.

Enter the amount to stake, continue, and then confirm your stake.

What is Staking Crypto?

Staking crypto is a process where investors can earn more cryptocurrency by supporting validation, specifically on “Proof of Stake” blockchains.

In a PoS blockchain, active users put up a small amount of crypto (the “stake”) to be considered for block verification. The chain will then select a random staker to authenticate a block and earn more crypto in return.

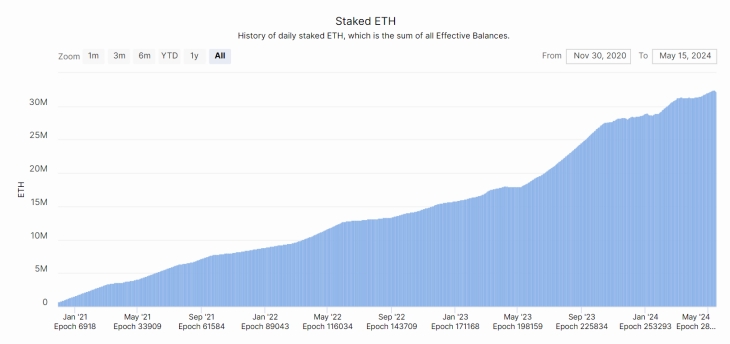

With the rising popularity of staking, however, it takes more and more crypto to participate effectively:

Source: Beaconcha.in

Source: Beaconcha.in

Staking is using your crypto to earn passive returns by locking some of that crypto into a staking wallet that the exchange uses to validate on-chain transactions. This process is much like earning “interest,” but rather than earning interest through a bond or a bank account, you earn it on the exchange.

Commonly, the staking process involves leaving the crypto in the wallet for a predetermined time. During this time, the network uses the locked cryptocurrency to verify transactions and maintain the security of the blockchain. In exchange for providing this service, crypto holders earn more cryptocurrency as a reward (i.e., “staking rewards”).

Staking is an alternative to the energy-consuming and tedious validation processes found on Proof of Work chains like bitcoin. You can earn interest income on cryptocurrency holdings without trading or mining it actively.

Proof of Stake vs. Proof of Work

Staking is possible exclusively on blockchains that employ the Proof of Stake (PoS) consensus algorithm. This mechanism lets network participants agree on which transactions should be validated and added to newly created blocks.

Unlike bitcoin’s Proof of Work (PoW) algorithm, which raises the question “Can you stake bitcoin?” (the answer is no), the PoS consensus method is a more energy-efficient, eco-friendly alternative to PoW mining.

If you have PoS crypto investments sitting idle, staking is an option to earn additional income. It is similar to earning interest on a fixed deposit but with the potential for higher interest and risk.

How Crypto Staking Works

Staking involves holding a certain amount of cryptocurrency in a specific digital wallet and locking it in place for a predetermined amount of time. This process requires user resources to support stability and security across the chain, as staking wallets support the longevity of transaction verification.

To stake, users commit a certain amount of cryptocurrency to the network to participate in cryptocurrency staking. For example, a minimum of 32 ETH is required to stake on the Ethereum chain. The network then selects validators from among staking participants to confirm blocks of transactions. The more cryptocurrency users commit, the higher their chances of being chosen as a validator.

As each block is added to the blockchain, new coins are created and distributed as rewards to the validator of the block. Typically, these rewards are paid in the same cryptocurrency that the participants have staked.

Staking rewards vary depending on factors like the amount, the length of time the cryptocurrency is staked, and the demand for the cryptocurrency.

Different Ways of Staking

There are four primary ways in which you can participate in coin staking:

Delegation

The first and easiest way is delegating, a popular option for smaller crypto investors who don’t want to spend the money and effort to operate a validator. Rather than investing a large sum, smaller users delegate their coins to a validator (such as an exchange or staking platform), which pools the staking funds from multiple investors.

Investors then receive a portion of the staking rewards earned by the validator in exchange for their delegation. The rewards depend on the amount of the delegated cryptocurrency and the share it represents from the validator’s total stake.

Delegating implies entrusting your cryptocurrency to a third party. Therefore, it’s essential to perform due diligence and pick a trustworthy validator or node with a good track record and reputation in the network.

Pooled Staking

The second method is to stake your tokens through a pooled staking service. Many include Stake.fish (covered in more detail below) and RocketPool. Pooled staking functions similarly to a delegated approach in that a pool of crypto exists for staking purposes. However, this approach combines multiple validators into a pool to achieve greater staking rewards. The greater the number of tokens held in a single pool, the greater the chance that the pool will receive a staking reward. Pools are more advanced when compared to delegation but are worth investigating.

Liquid Staking

A third method for staking, becoming increasingly popular, is liquid staking services (also called liquid staking derivatives, or LSDs). Liquid staking through a platform like Lido (covered in more detail below) allows token holders to receive staking rewards while retaining access to their tokens. This provides greater flexibility and efficiency when staking. That said, liquid staking may be beyond those completely new to staking.

Validator Nodes

The fourth and most advanced method for staking is as a validator. You run your staking node using advanced technical skills and your hardware (which must always be kept online). The advantage is higher rewards and voting/controlling rights on some blockchains.

But becoming a validator takes work; you must invest higher sums just to qualify. And, of course, there’s the technical knowledge required. Running a validator node is certainly not for most beginners.

Popular Staking Tokens

Below are six of the more popular tokens we see staked by investors. Their popularity stems from several factors, including the project’s strength, the APY offered, and the token’s large market cap and liquidity.

The tokens discussed here are listed in order of the total percentage of tokens staked.

Ethereum 2.0 (ETH2)

After years of anticipation, Ethereum finally upgraded to PoS, with the Merge upgrade in September 2022. Many expected the shift to help the blockchain overtake bitcoin as the most valuable crypto. Still, whether Ethereum manages to dominate the crypto market remains to be seen. At this writing, ETH has a market cap of over $356 billion, about 29% of bitcoins.

Validator nodes on the new PoS blockchain require 32 ETH tokens and a lock-up of 365 days. Delegate staking pools don’t have any minimum requirements or lock-up periods, making them ideal for beginners. APYs for ETH staking will vary from one platform to another. We have many of the top staking platforms and ETH APYs here.

Binance (BNB)

Binance (BNB)

Binance is the world’s largest cryptocurrency exchange. The platform launched a native token in 2017. With a $596 per coin value and a market cap of $88 billion, the Binance token is only behind bitcoin, Ethereum, and USDT on the list of largest cryptos.

To get started with BNB delegation pools, a minimum of 1 BNB is needed. However, you will need a whopping 10,000 BNB tokens to run a validator node. Both options have a minimum lock-up of 7 days, although longer periods result in higher reward rates.

Polkadot (DOT)

Polkadot (DOT)

Polkadot uses a complex architecture of multiple chains to avoid the high fees and congestion plaguing other blockchains like Ethereum. Launched in 2020, the blockchain has zoomed to the top 15 cryptos list with a market cap of $9.7 billion.

Staking on this blockchain uses the native token DOT. The amount of DOT needed to stake is dynamic. based on factors like how much stake is being put behind each validator, the size of the active set, and how many validators are waiting in the pool. The current requirement is 553 DOT.

To join a delegated pool, you need a minimum of 1 token and a lock-up period of 28 days for what have historically been high APYs.

Solana (SOL)

Solana (SOL)

This particular blockchain launched heavily on decentralized finance (DeFi). The SOL tokens were first publicly launched in 2020 for $0.22. In 2021, SOL was worth close to $250, placing it in the list of the top crypto with a market cap of $74 billion. SOL was hit by the “crypto winter,” but it remains one of the largest cryptocurrencies, with a $65 billion market cap.

No minimum limit is required to run a validator node on the Solana blockchain. Both delegator pools and validators have a lock-up of 2 days. The shared rewards from a pool can bring in around 6% APY.

Cardano (ADA)

Cardano (ADA)

Cardano is another “Ethereum-killer” that has been around for nearly a decade. This PoS blockchain with smart contracts and improved scalability was launched in 2015. As of this writing, it is one of the top ten largest cryptos in market cap, with $16 billion.

Staking on ADA has several advantages – minimum limits or lock-in periods are not required. Users who join any large and reputable delegated pool can start earning rewards with minimum fuss. The APY for Cardano staking is around 3%.

Tezos (XTZ)

Tezos (XTZ)

Launched in 2014, Tezos is a programmable cryptocurrency supporting smart contracts. It has a self-amending mechanism to avoid “hard forks” or compatibility divergence in two versions of the same blockchain. While the total market cap is a bit low at $894 million, many investors feel it has future potential.

To become a full validator or “baker” on the Tezos blockchain, you need a minimum of 6,000 XTZ and an initial lock-up period of 14 days. But if you don’t have enough tokens to spare, you can participate in the delegator pools for annual percentage yields (APY) of around 6%.

Where to Get Started with Coin Staking

There are three main places where you can stake PoS cryptos:

- Centralized Exchanges (CEX) – Most leading cryptocurrency exchanges, such as Binance and Coinbase, provide easy staking as an option to their users. This option is quite simple and allows you to take advantage of any useful features or regards the platform offers.

- Staking Platforms – These online “staking-as-a-service” platforms focus entirely on crypto staking pools in exchange for a commission. While less comprehensive than an exchange, these allow you to focus on staking.

- Hardware Wallets – This method using offline crypto wallets/hardware wallets is called cold staking.

Let’s take a closer look at some popular coin-staking options from these three categories:

Centralized Exchanges

Binance (CEX)

Binance (CEX)

Binance is the largest and most popular crypto exchange worldwide. Apart from staking its native Binance Coin, you can pick from over 21 POS staking options, with APYs up to 23.5% or more. Staking information for Binance can be found here.

Coinbase (CEX)

Coinbase (CEX)

Established in 2012, Coinbase is a fully-regulated crypto exchange in the United States. The platform offers staking on all major PoS cryptos like ETH2 and Tezos. The NASDAQ-listed company is a top alternative to Binance, especially for US customers. Get started by opening a Coinbase account and visiting their Earn page for available assets to stake.

Hardware Wallets

Ledger

Ledger

Ledger is the most popular brand for hardware crypto wallets. Using the Ledger Live app, you can connect to different Web3 services, many of which allow staking. The rewards are delivered on the Ledger Live app or to an external wallet. This makes most of the popular tokens available for staking through your Ledger wallet, including Ethereum, Polkadot, and Solana.

Trezor

Trezor

Created in the Czech Republic in 2011, Trezor is the world’s first digital cryptocurrency hardware wallet. Trezor also supports crypto staking, but not directly. Instead, you can connect the Trezor to a wallet like Exodus as a staking interface. More advanced users can connect the Trezor to a staking service like Allnodes.

Staking Services

Lido

Lido

Lido is a secure protocol for liquid staking that is designed to support multiple PoS cryptocurrencies, including Ethereum (ETH), Solana (SOL), Polygon (MATIC), Polkadot (DOT), and Kusama (KSM). Lido, launched in 2020, aims to solve the problem of the PoS staking ecosystem: illiquidity.

As a rule, once a crypto user starts staking, the assets are typically locked up and cannot be used or traded until the period ends. Lido aims to address this by allowing users to stake their cryptocurrency and receive a so-called “liquid staking token” (stToken) in return. Liquid staking tokens can eventually be traded or put to work in decentralized finance (DeFi) applications.

This makes it easier for users to participate in staking and access the benefits of staking rewards without sacrificing liquidity.

While Lido supports multiple PoS blockchains, the staking service focuses on Ethereum, the second-largest cryptocurrency by market cap, dominating the DeFi space.

Stake.fish

Stake.fish

Stake.fish is a staking platform for cryptocurrencies where crypto holders can pool their assets and earn rewards. Stake.fish supports staking on 18 PoS blockchains, including Cardano, Cosmos, Ethereum, Polkadot, Polygon, Solana, and Tezos. At the time of writing, over 1, 005, 792 ETH is staked with the platform.

Launched in 2018, stake.fish has attracted over $3 billion worth of cryptocurrency for staking from both retail and institutional investors.

How to Stake Cryptocurrency: Step-by-Step Guide

The steps for staking will vary depending on the platform/method you prefer. However, the initial steps remain the same across all methods. Here are the simple general steps on how to stake cryptocurrency:

Basic Steps

- Choose a Crypto Asset to Stake: Look at factors like APY rewards, minimum stake, lock-up periods, and other aspects of the crypto asset. Do adequate research before picking up unknown/obscure cryptos.

- Decide on a Validator or Delegator: The validator requirements are quite steep for some crypto assets. They also require desktop PC hardware with 24/7 internet connectivity. Setting up the node also requires advanced skills. Most beginners will choose the delegation route. In this case, choosing a delegator with a good history and reputation is best.

For Crypto Exchanges

- Create an account: Visit the crypto exchange and sign up for an account. Link your crypto wallet to your account.

- Buy Stakeable Assets: If you don’t already have particular coins or tokens in your wallet, buy them from the exchange.

- Go to Staking Page: Find the dedicated staking page for the crypto on the online exchange. Coinbase is here, and Binance here.

- Enter Staking Information: Using the platform’s interface, set your staking amount and settings. Some exchanges offer different pools with varying lock-ups, APYs, and other special features.

For Private Staking (Crypto Wallets)

- Download App: Software wallets support staking directly on the app. Some examples are Exodus and Trust Wallet.

- Pick an Asset that Supports Staking: Most PoS blockchains, such as Ethereum, Cardano, or Solana, will support staking. Make sure to hold your crypto assets on the app.

- Set Stake: Launch staking by tapping “earn now” or “start earning.” You can calculate potential rewards directly on the app.

Delegating (Platforms)

- Select a staking platform, such as Lido or Stake.fish. Some platforms, such as Stake.fish, require registration, so register.

- Go to the staking page that lists all supported coins for staking. Choose a crypto asset that you want to stake.

- Connect a wallet where you have your cryptocurrency stored. Some staking platforms, such as Lido, support multiple wallets, including MetaMask, Ledger, Trust Wallet, and Exodus.

- Start the staking process after confirming the amount and checking the reward rate.

Mining vs. Staking

For individual investors, staking is a much better alternative to crypto mining. The energy issues associated with mining are one of the major reasons why Ethereum shifted to PoS. After the shift, the Ethereum blockchain saw its energy costs reduced by 99%.

The following table illustrates the main differences between mining and staking on cryptos from an investor perspective:

Mining vs Staking for Investors

| Mining Pros | Mining Cons |

| Potential for High Returns: Successful mining operations can yield significant profits, especially when the value of the mined cryptocurrency appreciates over time. | High Initial Investment: Setting up a mining operation requires a significant initial investment in specialized hardware, software, and infrastructure, which can be costly. |

| Diversification of Investment Portfolio: Mining provides an opportunity for investors to diversify their investment portfolio, potentially reducing overall portfolio risk. | Operational Costs: Besides initial setup costs, miners incur ongoing operational expenses such as electricity, cooling, maintenance, and internet connectivity, which can eat into profits. |

| Passive Income Generation: Once established, a well-configured mining rig operates continually, and so in some way acts as a consistent source of passive income. | Environmental Concerns: Some investors may have reservations about the environmental impact of mining due to its substantial energy consumption. |

| Staking Pros | Staking Cons |

| Lower Entry Barrier: PoS staking typically requires less initial investment compared to mining, as it doesn’t involve purchasing expensive hardware equipment. | Dependency on Third Parties: Delegating staking to third-party services introduces counterparty risk, as investors must trust these entities to manage their staked assets securely and distribute rewards fairly. |

| Potential for Passive Income: By staking cryptocurrencies, investors can earn rewards without actively trading or monitoring markets. | Market Volatility: The value of staked assets may fluctuate due to market volatility, affecting the overall returns earned through staking rewards. |

| Lower Energy Consumption: Unlike mining, PoS staking requires significantly less energy, making it more cost-effective and environmentally friendly. | Reduced Liquidity: In some forms of staking, staked assets are often locked up for a period, limiting investors’ ability to react to market changes or seize other investment opportunities. |

The STAKEaway: How to Stake Crypto and Make Money

Staking doesn’t involve steep upfront/running costs of mining: no GPUs or mining rigs are required. It does not spike your energy bills and is extremely eco-friendly. For beginners, the best way to try staking is via an online platform.

Like all crypto-related investments, staking has a fair degree of volatility and risk. Pick established crypto assets, and avoid less-known altcoins to minimize risk exposure.

To learn the basics, consider starting small with popular assets like Ethereum (ETH) or Cardano (ADA). Then, do thorough research and always exercise caution when investing/staking crypto assets.

To learn more about earning money on crypto investments, including the best staking rates, subscribe to our Bitcoin Market Journal newsletter.

Crypto Staking Frequently Asked Questions

What is staking in cryptocurrency?

Staking refers to participating in a proof-of-stake consensus mechanism by holding a specific amount of cryptocurrency in a wallet to support the network’s operations.

How does staking work?

Once you stake your coins, they are ‘locked’ for a certain period and used to validate transactions and create new blocks. In return, you earn staking rewards.

What are the benefits of staking?

- Passive Income: You can earn additional coins as staking rewards.

- Low Entry Barrier: Generally, you don’t need specialized hardware as you would for mining.

- Energy Efficiency: It is more eco-friendly compared to PoW systems.

- Network Security: By staking coins, you contribute to the network’s robustness.

What are the risks involved?

- Locked Funds: Your staked coins are not liquid, meaning you can’t sell or transfer them until the staking period is over (though LSDs attempt to address this downside).

- Slashing: In some PoS networks, misbehaving nodes may lose some of their staked coins.

- Market Volatility: The value of your staked coins can fluctuate, affecting your returns.

How to stake cryptocurrency?

- Do Research: Learn about the specific cryptocurrency you are interested in staking.

- Choose a Wallet: Opt for a staking-compatible wallet.

- Transfer Funds: Move your coins to your staking wallet.

- Follow Staking Instructions: Each cryptocurrency and platform will have its unique staking process, often outlined in their official website.

Can I unstake my coins?

Yes, but it may require waiting before you can access your staked coins. The time and conditions may vary based on the cryptocurrency.

Is staking better than trading?

Staking and trading are different strategies with their own risk-to-reward profiles. Staking is generally more passive and less risky than active trading but may offer lower potential returns.

What’s the minimum amount required for staking?

This varies from one cryptocurrency to another. Some might allow you to stake with as little as one coin, while others may require a more substantial minimum investment.

How does staking compare to bonds?

Staking and bonds offer passive income but differ in risk and regulatory oversight. Bonds are generally lower-risk and well-regulated, while staking offers potentially higher returns but with more volatility and less regulation.

Can you stake Bitcoin?

No, you cannot stake Bitcoin as it uses a Proof-of-Work consensus mechanism, not Proof-of-Stake. However, some financial services offer to ‘stake’ your Bitcoin for you, but this is more akin to lending rather than true blockchain staking.

News

Top 5 Crypto Pre-Sales for August 2024

Have you heard about cryptocurrencies in 2011? Was Bitcoin so popular back then? Well, yes, some forward-thinking people saw its potential early and invested in BTC back then. Investors were skeptical about this new financial element; however, many took the risk and invested what they could risk in the cryptocurrency market.

Going through the list of top presales, we have identified and studied five of the main candidates that can change the game on the trading charts. These new opportunities promise the best returns and a great chance to buy tokens at affordable prices. While 5thScape is at the top of our recommendation, projects like DarkLume and Artemis Coin are pioneers in their respective categories.

Top 5 Crypto Pre-Sales to Add to Your Watchlist in 2024

Below we present the top five cryptocurrency pre-sales that you should consider adding to your investment watchlist.

- 5th Landscape (5SCAPE) – King of digital VR gaming with AR/VR elements

- Dark light (DLUME) – Virtual Metaverse for Social Exploration

- SpacePay (SPY) – Versatile Financial Payment Gateway for Seamless Transactions

- EarthMeta (EMT) – Replicating our planet on a virtual platform

- Artemis Coin (ARTMS) – NFT Marketplace for Digital Real Estate Investment

In-Depth Review: The Best Crypto Pre-Sales of 2024

Now, let’s take a closer look at these pre-sale events and how they can help investors make significant profits this year.

5th Landscape (5SCAPE)

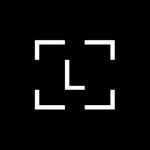

The 5thScape project combines emerging technology using the fundamentals of virtual and augmented reality on the Ethereum platform using its native currency as 5SCAPE. Users of the token experience increased security and interactive gameplay in the digital space.

Here are the potential reasons why investors are admiring the 5thScape ecosystem:

Immersive Gameplay: With over five game titles, the platform is ready to amaze the audience with games ranging from archery, sports, battle and high-speed racing.

Innovative VR Content: 5thScape’s progress in the crypto-gaming space will contribute to the development of educational resources and other VR content on the website.

Motion Control Gadgets: This project is working hard to introduce VR devices such as headsets and gaming chairs with precise controls and high-resolution soundscapes to achieve the best immersive feeling while exploring the ecosystem.

Practical utility: 5SCAPE tokens stimulate participation in various activities and convert the ecosystem into economic value for investors.

Staking Opportunities: Acquiring 5SCAPE tokens after listing on exchanges can generate higher earnings

Free Giveaways and Prizes: The distribution of free coins and VR subscriptions attract investors.

Visit 5thScape for more details>>

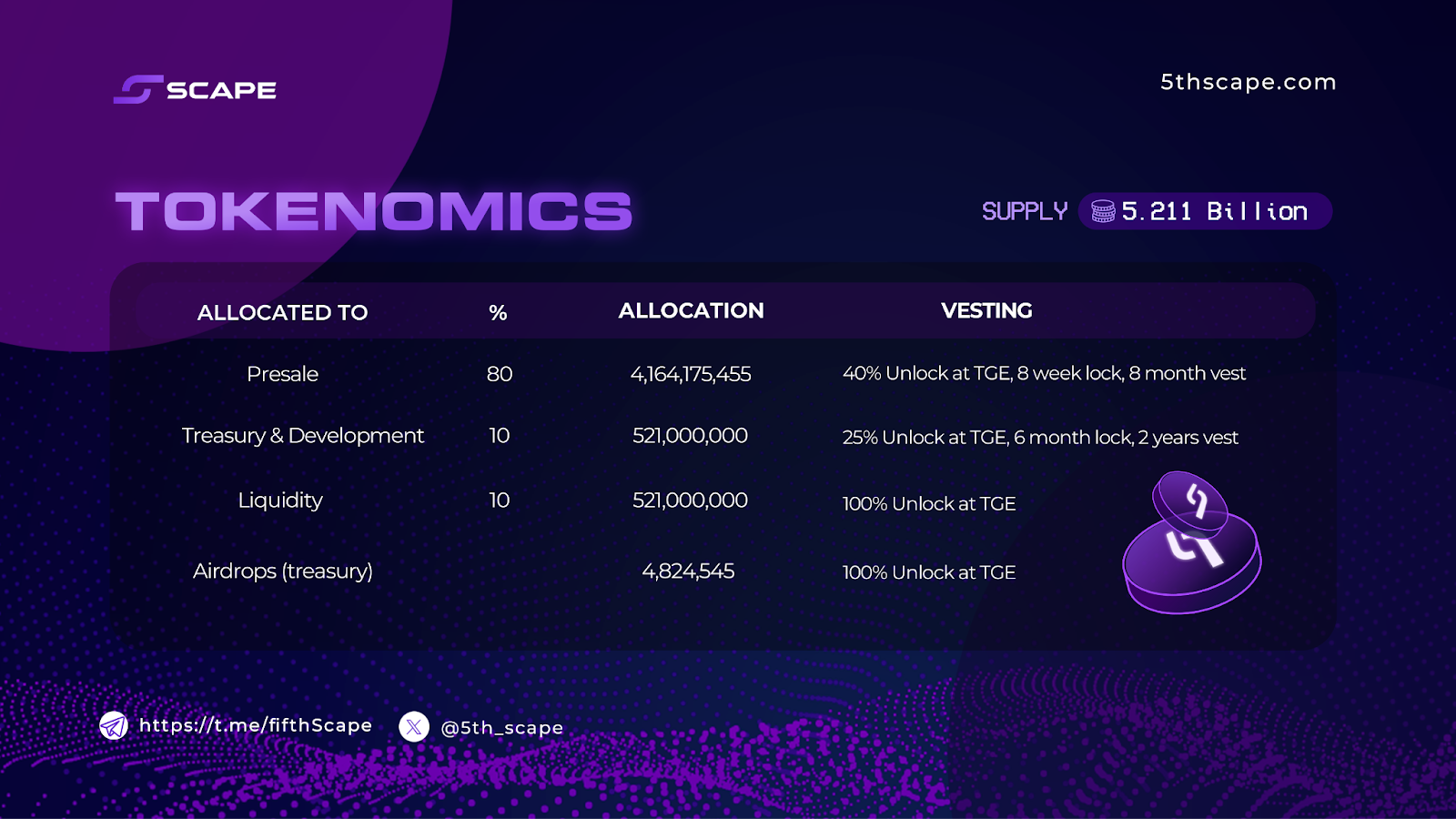

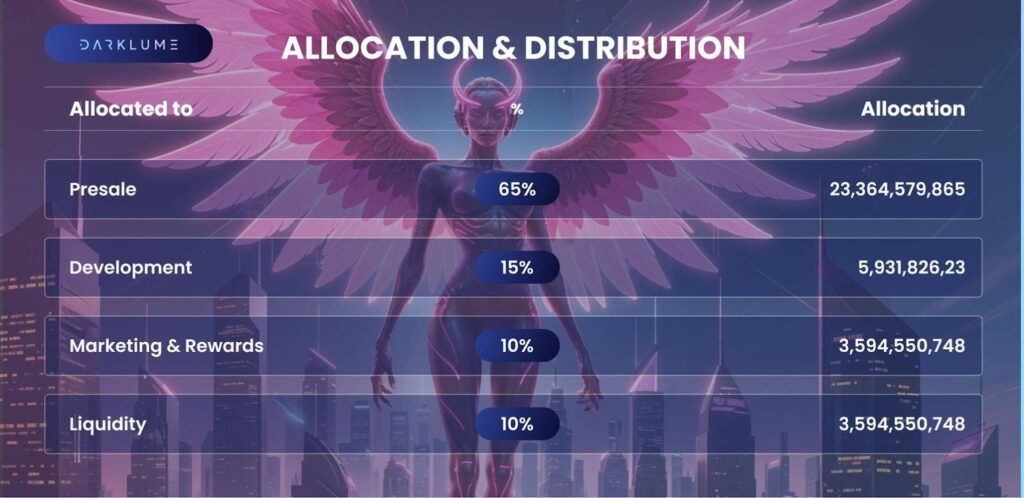

Dark Light (DLUME)

We just saw how 5thScape captures investors with its AR/VR digital landscape. DarkLume works on similar VR principles but has a completely new VR metaverse. Its presale is about to hit the $1 million mark and simultaneously increase fund inflows.

What are the specifics that allow DarkLume to lead the metaverse industry?

Native currency: The project has DLUME as a digital currency that can be used for in-game purchases or upgrades. These utility tokens also give their holders the right to vote on the development and expansion of the project.

Benefits of staking: Investors who want to hold and earn from this currency expect to multiply their funds after the stock market listing.

Exploratory Metaverse: Once you enter this world, there is no turning back. There are so many opportunities to find recreational activities and relieve stress. Walking through lush landscapes and stargazing at night can be a memorable experience. If you are a party animal, DarkLume’s virtual discos and clubs will win you over.

Visit DarkLume for more details>>

Payment for space (SPY)

Traditional financial setups face many challenges in daily transactions and are also expensive. To solve these concerns, Maxwell Bunting founded SpacePay by combining cryptocurrency payments and blockchain technology. The London-based startup makes online shopping and payments more seamless by integrating its network with existing card terminals, allowing users to make payments in any digital currency. Merchants can choose to receive payments in conventional currency without having to pay exorbitantly.

SpacePay has designed a user-friendly and convenient interface that supports over 325 crypto wallets. SPY, the native token of this platform, serves to enable all transactions within its ecosystem. Tokens can also be used to generate passive income through staking and additional community rewards.

EarthMeta (EMT)

EarthMeta is a virtual metaverse created to replicate our planet, Earth. It is listed as one of the best crypto pre-sales of 2024, with a focus on creating new NFT platforms and virtual assets in premium cities. The startup encourages users to own and govern virtual landscapes.

Cities are then further broken down into smaller assets such as landmarks, buildings, monuments, parks, schools, and more. NFTs can now be bought and sold in the project’s marketplace. Governors are eligible to earn 1% fees per transaction within their city. EMT token holders can also generate more at once with custom API integrations and participation in DAO activities.

Artemis (ARTMS)

Today we have covered a number of financial projects that you can consider along with 5thScape, the most promising VR coins of the decade. Artemis (ARTMS) is a financial platform that allows investors to transact and trade using its digital asset, ARTMS. Users can also lend, borrow, stake, save, and generate rewards from yield farming.

The project is about to enter Phase 4 of development which will see the launch of the Artemis Crypto System. This system is customized to facilitate a large number of secure and transparent crypto transactions. Cryptocurrency enthusiasts and professional entities can buy and sell products such as smartphones, bicycles and internet services using crypto payments. Early investors have great advantages until the project is available at a discounted price in the pre-sale.

Read this before investing in the next cryptocurrency market

Experienced investors know the factors to consider before investing in this dynamic market. Here are some points that beginners should remember before securing a position in the cryptocurrency universe.

- It is essential to verify the project details and the founders.

- Read and understand the whitepaper for all the technical information about the ICO, the roadmap and the mission of the project.

- The project roadmap will provide greater clarity on milestones and results achieved.

- Review the fundamentals of the new technologies involved in the development of the platform.

- Before investing in any cryptocurrency, carefully evaluate the benefits and risks to avoid losses and build a profitable portfolio.

Conclusion

5thScape ICO Offers Tokens at Deeply Discounted Prices. Once the presale is over, the token price will skyrocket 434% from the first round and promise 600x returns to early investors. Who wouldn’t want to be part of an innovative and growing VR ecosystem? Check your details, review all the documents and start investing in 5thScape now.

Time flies, and so does the $100,000 prize.

News

Best Upcoming Cryptocurrencies for Long-Term Profits: Turn $100 Into $1000 With These Picks

Have you ever wondered how much return Bitcoin has given to investors who bought this gold cryptocurrency a decade ago? In 2014, Bitcoin reached its significant milestone of $1,000 in the first month. Currently, it is trading at around $64k, which is an astonishing 6300% increase in the span of 10 years. No stock, no ETF could ever give you such monumental returns. This simply proves that the cryptocurrency market turns your dreams of investment returns into reality.

While the established giants are not giving so much returns now, the ball is in the court of upcoming cryptocurrencies that are based on the development of projects to provide up to 1000x returns in the near future. In this article, we will explore 5 upcoming cryptocurrencies for long-term earnings that can turn your $100 into $1000 – the only key is strategic investing with a lot of patience!

Best Upcoming Cryptocurrencies For Long Term Profits

Below we list the top 5 cryptocurrencies for long-term gains, which are set to give you returns of up to 1000 times in the coming times.

- 5th Landscape (5LANDSCAPE)

- Dark light (DISGUST)

- BlockDAG (BDAG)

- eTukTuk (TUK)

- WienerAI (WAI)

Take a deeper look at the background of these 5 upcoming cryptocurrencies for long-term gains and see why they could be viable options for your cryptocurrency portfolio.

1. 5° Landscape (5SCAPE)

5thScape is changing the face of entertainment by merging augmented and virtual reality with blockchain technology, offering a VR content ecosystem unlike any other destination on the internet. Its native token, 5SCAPE, is the cornerstone of this innovative ecosystem. With a limited supply of 5.21 billion tokens, 5SCAPE offers early investors a unique opportunity to participate in the growth of a potentially transformative platform.

Combining the immersive experiences of VR technology with a cryptocurrency that has a real-world use case, 5thScape presents a compelling investment proposition. The project’s focus on providing unparalleled user experiences, coupled with its potential to generate substantial returns, makes 5SCAPE an ideal new cryptocurrency to have in your portfolio for long-term gains.

Click here to invest in 5thScape today >>

2. DarkLume (DLUME)

DarkLume is a meticulously crafted metaverse where users can experience a lavish digital lifestyle. At its core is the DLUME token, the currency that powers this virtual economy. By owning DLUME, users gain access to exclusive experiences, from owning virtual properties to attending high-society events and hosting virtual celebrations with their friends.

The metaverse is divided into virtual countries, each with its own citizenship requirements. To become a citizen, users must possess a specific amount of DLUME. Maintaining citizenship involves paying taxes in DLUME and creating a sense of community and responsibility among users.

Unlike other metaverse platforms that are limited to digital interactions only, DarkLume offers a wide range of activities, from leisure and entertainment to social interactions and exciting experiences. The platform’s focus on luxury ensures that every aspect of the metaverse is designed to exceed expectations. As DarkLume continues to grow, its DLUME token is expected to be in high demand. The metaverse concept is supported by renowned names such as Mark Zuckerberg and Satya Nadella. As it is the future of immersive socialization, the DLUME token is expected to appreciate in value over time.

Explore DarkLume’s website to learn more

3. BlockDAG (BDAG)

BlockDAG is an innovative blockchain platform that uses a Directed Acyclic Graph (DAG) structure together with blockchain technology to offer fast transaction speeds, lower fees, and better scalability.

Unlike traditional blockchains that process transactions sequentially, BlockDAG processes them in parallel, which allows it to handle a much higher transaction volume. This approach makes BlockDAG an ideal platform for applications that require high throughput and low latency, such as DeFi, gaming, and IoT. Its presale has been a great success so far, and BlockDAG’s adaptability may be an optimistic sign for early investors in the BDAG token.

4. eTukTuk (TUK)

eTukTuk is a new leading crypto project that combines sustainable transportation with blockchain technology. Its main goal is to electrify the famous “tuk-tuk” industry, reducing carbon emissions that cause environmental damage while creating a thriving ecosystem. Its TUK token powers the entire platform.

One of the most notable features of eTukTuk is its Play-to-Earn (P2E) gameplay. Players can earn TUK tokens by completing challenges and missions in the game. This gamified approach not only makes the platform engaging but also incentivizes user participation in building the eTukTuk ecosystem. The primary utility of the TUK token is as a mode of payment for tuk-tuk drivers who use EV charging stations for their vehicles installed across Sri Lanka. The project will soon expand to other countries.

Overall, the value proposition of the TUK crypto token is strengthened by its utility within the platform. It can be used to purchase electric tuk-tuks, charge them at the network’s charging stations, and access various platform services. As eTukTuk adoption grows, demand for TUK tokens is expected to increase, potentially resulting in significant appreciation in the token’s value.

5. WienerAI (WAI)

WienerAI is a new blockchain-based platform that uses next-generation artificial intelligence (AI) technology to transform the cryptocurrency trading space. Its flagship product is an AI trading bot (with a sausage-themed mascot) designed to analyze market trends, identify potential opportunities, and execute trades with zero errors. With the power of AI, WienerAI provides users with a market edge in the complex and dynamic world of investing.

The platform’s native WAI token is a digital asset that underpins the entire ecosystem. Token holders can enjoy various benefits, including discounted trading fees, priority access to new features, and even a share of the platform’s profits. As WienerAI gains traction and its AI trading bot proves successful, the continued flow of demand for the WAI token will fuel its price.

Final Thoughts: Best Cryptocurrencies for Long-Term Profits

Each cryptocurrency project explored in this article brings a unique and innovative perspective to the blockchain industry. From the immersive worlds of 5thScape and DarkLume to the efficiency gains of BlockDAG and the sustainability focus of eTukTuk, not to mention WienerAI’s AI-powered trading bot with a new approach to investing, these projects are pushing the boundaries of what’s possible with blockchain technology.

While all of these projects are promising, 5thScape and DarkLume stand out as particularly interesting investment opportunities. The combination of 5thScape’s robust VR ecosystem tokenomics and unique AR/VR offeringstogether with the fantasy world of the DarkLume metaversehas the potential to appeal to a wide range of investors who may be entertainment lovers, not just cryptocurrency enthusiasts. Given their current presale stages, acquiring 5SCAPE and DLUME tokens at these early-bird prices could prove to be a strategic move for those seeking substantial returns.

This is a sponsored article. The opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on the information presented in this article.

News

Avalanche Predicts ‘Most Bullish Unlock’ in Broader Market $1 Billion in Token Release

Token Unlocks data shows that several crypto projects:AvalancheWormhole, Aptos, SandboxArbitrum, Optimism and others are set to unlock around $1 billion worth of tokens in August.

Approximately $260 million will be allocated in the first three days of the month.

Crypto projects often schedule token unlocks to control the asset supply and prevent market oversaturation. This gradual release helps avoid significant sell-offs by early investors or team members who hold large amounts of crypto assets.

Wormhole and Avalanche to Release Over $400 Million in Tokens

The biggest news this month will be Wormhole and Avalanche.

On August 3rd, Hole in the walla cross-chain messaging protocol, will release 600 million tokens worth $151.67 million, or 33.33% of its circulating supply.

Avalanche will follow on August 20, unlocking 9.54 million AVAX tokens worth approximately $251 million, or 2.42% of its circulating supply.

The Token Unlocks dashboard shows that 4.5 million AVAX, worth $118.53 million, will go to the Avalanche team, 2.25 million AVAX, worth $59.27 million, will go to strategic partners, and the remainder will go to the Foundation and as an airdrop.

Farid Rached, former head of ecosystem growth at Avalanche, underlined that this planned unlock would be the most bullish in its history because “it is the last big step for the team and public/private investors.”

Other important unlocks

Sui, a layer 1 network, will unlock 64 million tokens worth $50 million, or 2.56% of its circulating supply, on August 1.

Similarly, decentralized exchange dYdX will issue 8.33 million tokens worth nearly $11 million, or 3.65% of its circulating supply. These tokens will be distributed to investors, founders, staff, and future employees.

Aptos will unlock 11.31 million APT tokens worth $74.64 million on August 12. These will be allocated to the Aptos community, top contributors, the foundation, and investors, with top contributors receiving the largest share: 3.96 million APT worth $26 million.

On August 14, Sandbox will release 205.6 million SAND tokens worth $66.75 million. This issuance will be split between the team, advisors, and a corporate reserve.

Finally, Ethereum’s layer 2 networks Referee AND Optimism will collectively unlock over $110 million worth of tokens by August 16 and 31, respectively.

Mentioned in this article

Latest Alpha Market Report

News

Big Tech Beats Bitcoin (BTC) as Trump’s Trade Cancellation Weakens Token

Bitcoin has failed to join the cross-asset rally fueled by dovish comments from the Federal Reserve, as the tight US election race casts doubt on Donald Trump’s ability to implement his pro-cryptocurrency agenda.

The digital asset slipped 2.4% on Wednesday, tracking a Fed-fueled surge in an index of the Magnificent Seven large-cap tech stocks by one of the widest margins in 2024. The token fell further on Thursday, changing hands at $63,750 by 6:10 a.m. in London.

-

Videos7 months ago

Videos7 months agoMoney is broke!! The truth about our financial system!

-

News6 months ago

News6 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

News6 months ago

News6 months agoOver 1 million new tokens launched since April

-

Altcoins6 months ago

Altcoins6 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

NFTs7 months ago

NFTs7 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

Videos6 months ago

Videos6 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

Memecoins6 months ago

Memecoins6 months agoChatGPT Analytics That Will Work Better in 2024

-

Videos6 months ago

Videos6 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs7 months ago

NFTs7 months agoTrump endorses Bible line – after selling shoes, NFTs and more

-

Videos6 months ago

Videos6 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!

-

Altcoins6 months ago

Altcoins6 months agoAltcoin Investments to create millionaires in 2024

-

Memecoins6 months ago

Memecoins6 months agoWhen memecoins reign supreme in the ecosystem!