Altcoins

Solana Dominates Altcoin Inflows as Investors Buy Last Week’s Dip

Key points to remember

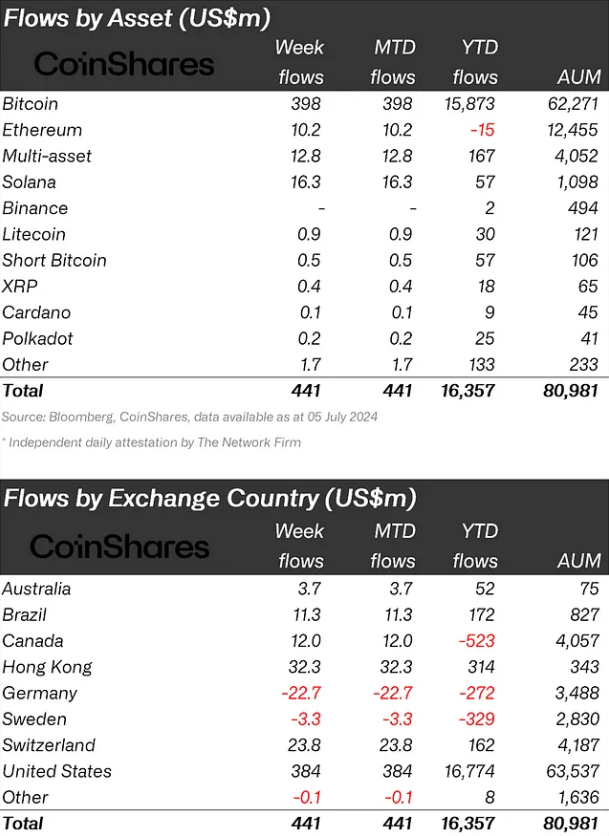

- Cryptocurrency investment products saw inflows of $441 million, with Bitcoin accounting for 90% of the total.

- Solana has become the top performing altcoin, with $57 million in inflows since the start of the year.

Share this article

Cryptocurrency investment products saw inflows of $441 million last week as investors viewed recent price weakness as a buying opportunity. according to to asset management firm CoinShares. Selling pressure from Mt. Gox and the German government likely caused the surge in interest after three straight weeks of outflows.

Bitcoin dominates with $398 million in inflows, or 90% of the total. Despite this considerable dominance, CoinShares’ report highlights that this figure is relatively low, indicating that investors have decided to diversify their investments into altcoins.

Solana emerged as the top-performing altcoin in terms of flows, with $16 million in the past week and bringing its year-to-date (YTD) inflows to $57 million. Ethereum saw $10 million in inflows, but remains the only crypto-indexed exchange-traded product (ETP) with net outflows YTD.

Regionally, the United States led the way with capital inflows of $384 million. Hong Kong, Switzerland and Canada also recorded notable inflows of $32 million, $24 million and $12 million respectively. Germany was the exception, with capital outflows of $23 million.

Blockchain stocks continued to see outflows, however, with another $8 million in the past week, bringing YTD outflows to $556 million.

ETP volumes remained relatively low at $7.9 billion for the week, reflecting typical seasonal trends. This represents a 17% lower participation rate than the total trusted exchange market.

Share this article