Memecoins

Memecoins, Staking with a Twist, DeFi Nanciarization of New Verticals

Crypto’s wildest speculators have turned their attention to the latest trends

Bettmann Archives

Having recently reflected Regarding the development of crypto markets since the 2021 bull run, I also reflected on trends in the broader Web3 sector and how much change we’ve seen in just three years.

As headline-grabbing stocks in 2021, NFTs are a good example. Even though cryptocurrency prices soared in early March, NFT

NFT

markets were rocked by sell-offs, with prices falling up to 30% for some once-popular collections. While the format still offers plenty of opportunity for utility, the market hype simply hasn’t carried over into 2024.

Instead, crypto’s wildest speculators have turned their attention to the latest trend: memecoins. However, Karim HaimCEO of the blockchain infrastructure project Web3Intelligence, which develops the Dopamine application, believes that this is much more than just speculation:

“Memecoins mirror the trajectory of NFTs but with distinct nuances. Memecoins have become emblematic of how digital assets can encapsulate and drive engagement around cultural phenomena. More than just speculative assets, memecoins represent in 2024 a democratization of influence previously monopolized by venture capitalists and institutional investors. This shift toward community-driven value creation and marketing is profound, illustrating the potential of decentralized networks to empower individuals and communities.

The news that even hedge funds are to be sensitive to the appeal of dog-themed cryptos, lends considerable credence to his view – and once again highlights the pace and scale of acceptance in recent years.

DeFi, another trend that characterizes the 2021 bull market, has evolved rather than transformed. As LUNA collapses in 2022

MOON

could have sounded the death knell for the sector, the emergence of Ethereum

ETH

staking turned into a timely opportunity. While loans and DEXs were once at the top of the DeFi Leaderboards, these days it’s all about maximizing staking returns with liquid staking on Lido and retaking on EigenLayer. The latter is proving to be catnip for venture capital firms, with restoration-adjacent protocols Aligned Layer and Othentic generating a combined total of $24 million end of April. This follows the epic of EigenLabs 100 million dollars rise earlier this year – one of the tricks that is helped to resuscitate the previously declining Web3 funding scene.

However, a perhaps slower trend is the creeping presence of DeFi in otherwise unrelated sectors, creating previously unexplored avenues for value and revenue creation. GameFi was the first example of this, and it has also risen to prominence in the 2021 market, largely thanks to the popularity of Axie Infinity.

This time around, Web3 games have progressed from their first iteration based on startups experimenting with the technology. Ubisoft said it was work on Web3 Games and plans to release two titles later this year. The company also expanded its gaming team and licensed some of its intellectual property to Web3 gaming companies. The recent viral popularity of Notcoin, a “social clicker” game that has managed to attract an impressive 35 million players, speaks to the appetite for rewards, provided the public can see their value.

However, the DeFi makeover extends to other verticals – SocialFi is an example of a relatively new segment introducing financial elements into social media. Another is SportFi, led by Chiliz

CHZ

, the project that became synonymous with fan tokens during the last bull market thanks to high-profile collaborations with teams including PSG, Juventus and AC Milan. The project now seeks to consolidate its position at the intersection of Web3 and sports, as CEO and founder. Alexandre Dreyfus explain :

“We have integrated and collaborated with several game titles in the areas of football management, metaverse experiences and fitness games. Also worth discussing is the ongoing development of Web3-based fantasy games in collaboration with prominent sports rights holders such as Ligue 1 in France, K League in Korea and the United Arab Emirates.

United Arab Emirates

Pro League. This innovative approach allows traditional brands to venture into the gaming community, opening up additional revenue streams through digital assets and enhanced fan engagement mechanics.

So memecoins, staking with a twist and the DeFi-nancialization of new verticals for 2024 – who’s betting on what will emerge in 2027/2028?

Memecoins

LINK Briefly Touches $15 as Raboo and Pepe Succeed

Disclosure: This article does not constitute investment advice. The content and materials presented on this page are provided for educational purposes only.

AI memecoin Raboo soars while Link falls and Pepe drops sharply, highlighting market volatility.

In the current booming cryptocurrency market, Raboo, an AI-powered memecoin, is making headlines with staggering gains. Link briefly touched $15 earlier this week but has now ceded control to the bears.

However, Pepe is experiencing an unexpected drastic decline after a week of green, highlighting the volatility and challenges present in the same market. These patterns play a vital role in influencing investor sentiment and guiding market dynamics as they develop. Read on to find out which of these coins has the most potential to be among the top 20 cryptocurrencies.

LINK declines after hitting $15

After a daily surge, Chainlink (LINK) saw an intraday sideways move in an effort to stabilize. Chainlink’s price gain was halted at the $14.7 resistance due to consolidation, but the creation of a bullish reversal pattern suggests that a breakout could be imminent.

Chainlink cryptocurrency managed to break out of its current corrective trend at $12.2 during the market recovery in July. The multi-month support in place since January 2024 has prevented LINK positions from improving significantly.

Currently, a high accumulation zone is formed by the close alignment of the horizontal level with the EMA 200W and the 38.2% Fibonacci retracement level. The asset rose from $12.2 to $14.4 in a bullish reversal, and the market capitalization increased to $8.75 billion.

However, LIEN is now trading in the red and is currently selling for $12.62Investors remain optimistic that the price will eventually break through the $15 area after it has been tested.

Pepe: Bulls struggle to take control in the long term

Pepe’s price surged on Wednesday, making it one of the best-performing memecoins in the space. It rose 8.2%, reaching a high of $0.00001308, its highest point on June 26.

Pepe’s rally coincided with futures market open interest hitting its highest level since June 7. The majority of the open interest, nearly $155 million, came from Bitget and OKX. The Pepe token is up more than 72% from its lowest point this month, which may be explained by indications that whales, or large holders, have continued to amass the token.

According to Coinmarketcap, the number of Pepe holders has been increasing this month. On Wednesday, they surpassed 264,000, and if the market continues to rise, this trend could continue. On Monday, there was no obvious trigger that pushed Pepe’s price higher.

However, Pepe’s price has seen a major drop, as is currently the case. traded at $0.00001133 after a 7.98% drop in the last 24 hours. This has led to questions about the authenticity of the initial price increase.

Raboo reaches new milestone in pre-sales

Raboo raised over $2 million in its presale, attracted over 10,400 registered users and over 3,000 token holders, among other notable achievements. This exceptional result shows that investors are very interested and confident in Raboo’s innovative strategy.

Raboo’s unique AI-powered meme concept and Post-to-Earn technology, which allows users to generate monetary revenue from their social media posts, sets it apart in the Memecoin market. This feature increases user engagement while providing real-world value.

According to analysts, Raboo has the potential to become a top 20 cryptocurrency with a 233% growth during the pre-sale and 100x growth after launch. Raboo’s community-driven strategy, coupled with its strong engagement tactics and flash sale that offers two-tiered bonuses, has generated a vibrant and engaged user base. Raboo therefore presents a strong investment opportunity, especially given its strategic goal of competing with established memecoins.

Conclusion

Joining the Raboo revolution seems to be the next big thing, especially for meme lovers. The fact that the presale is still open is the best part. Since Stage 4 RABT tokens are selling out quickly, the only way to ensure investors acquire tokens is to buy them early.

Each token costs $0.0048, and in addition to the 233% pre-sale profits, investors could potentially make 100x more profit when the coin launches.

For more information, visit Raboo Presale Site or follow the project on Telegram Or X for the latest updates.

Disclosure: This content is provided by a third party. crypto.news does not endorse any products mentioned on this page. Users should do their own research before taking any action related to the company.

Memecoins

Top 3 Meme Coins Under $2 To Buy Before It’s Too Late

Meme coins are like comets. They are bright and shiny assets that have the obvious ability to soar and reach unprecedented highs. With the volatility factors in the cryptocurrency market, these coins often surge and then weaken to reach stable lows. Perhaps this is why the appeal of meme coins has always inspired investors to go all out in their ambitions and goals. Taking calculated risks is what the cryptocurrency world is all about. With these factors in mind, here are our three meme coin recommendations that one should hold on to before they skyrocket and become unaffordable for users.

Read also : Cardano: ADA Aims for $1 Upgrade After Chang Hard Fork, Now 33% Complete

Three Meme Coins Under $2 To Keep Before You Lose Them

Image source: WatcherGuru

Image source: WatcherGuru

Cryptocurrency #1: Shiba Inu

Shiba Inu has always been an exclusive part of the meme coin conversation. The term meme coin was largely popularized by SHIB. That being said, the crypto is a suitable coin to buy under $2 because it is home to a wide variety of experiments that are sure to help its price recover. For instance, new updates on Shibarium, as well as the introduction of the blockchain version of Shiba Eternity Game, are some of the things that users are eagerly waiting for an update on. Furthermore, SHIB’s burning mechanism, which constantly burns tokens to stabilize the price of SHIB, is also helping the token gain momentum.

By CoinpediaSHIB could surge to $0.00006697 by the end of 2024.

“If the price continues to climb above $0.00003682, it could reach the target of $0.00006697 in 2024. However, if the SHIB price reverses, it could undoubtedly drop to $0.000010. Overall, the outlook for SHIB is positive, although there is still a downside risk.”

Cryptocurrency #2: Pepe

Pepe is a frog-themed token on Ethereum. Currently valued at $0.00001186, the token is expected to capitalize on the current Ethereum ETF wave, which could help the token reach new price highs.

Pepe saw a significant price surge in May when the token rode the GME rally to surge 90%. With such promising stats, the token is capable of generating exceptional returns.

According to CoinpediaPepe could reach $0.00000327396 by the end of 2024.

In short, according to our Pepecoin price prediction, the PEPE price in 2024 is expected to be between $0.00000055 and $0.00000327396. And the average price of PEPE is expected to be around $0.0000546198.

Cryptocurrency #3: BONK

The current year’s bull run has greatly helped Solana spawn new meme coins. The chain is currently home to a diverse set of meme coins, all of which have performed well in recent times. BONK, however, has been one such coin that has captured the attention of the industry as a whole.

Read also : Shiba Inu Weekend Price Prediction: Is SHIB Claiming a New ATH?

BONK has seen a spectacular rise in price since its inception, increasing by almost 25,525.57%. This development is indicative of its strength and courage, rekindling hope in the hearts of cryptocurrency investors.

According to CoinpediaBONK could rise to nearly $0.00085 by the end of 2024.

“If the cryptocurrency market continues to grow in 2024, fueled by the expected rise in the cryptocurrency market, BONK can successfully reach a wider audience. Moreover, with the growing community, the price of BONK could potentially reach $0.00085.”

Memecoins

Moonmemecoin Announces Pre-Sale Event Starting August 18: A New Era for Memecoins

LOS ANGELES, July 26, 2024 (GLOBE NEWSWIRE) — Moonmemecoin is excited to announce the highly anticipated pre-sale of its innovative cryptocurrency, set to begin on August 18, 2024. This event marks a significant milestone in the memecoin landscape, providing enthusiasts and investors a unique opportunity to acquire Moonmemecoin at the lowest price before its official listing on major exchanges.

Moonmemecoin is set to introduce a new wave of decentralized cryptocurrency, empowering its community just like Bitcoin. The project focuses on community-driven growth, with all power and decision-making in the hands of its users. This approach aligns with the core principles of decentralization, ensuring transparency, inclusiveness, and fair distribution.

The pre-sale event, held on Moonmemecoin.iooffers early adopters the opportunity to invest in Moonmemecoin at a preferential rate. This strategic pricing is intended to reward early supporters and foster a strong community base before the coin is officially listed on major cryptocurrency exchanges. Investors can look forward to a promising future as Moonmemecoin aims to be listed on CoinMarketCap and among the top 10 cryptocurrency exchanges in the world.

Moonmemecoin Presale Highlights:

- Presale date: The pre-sale begins on August 18, 2024, offering a limited-time opportunity to acquire Moonmemecoin at the most favorable price.

- Decentralized vision: Like Bitcoin, Moonmemecoin is committed to decentralization, placing all power and control in the hands of its community members.

- Upcoming announcements: Moonmemecoin is set to be listed on CoinMarketCap and aims to be among the top 10 cryptocurrency exchanges, increasing its visibility and accessibility.

- Community-centered approach: The project prioritizes community involvement, ensuring that Moonmemecoin’s growth and success is driven by its users.

- Exclusive pre-sale benefits: Early participants in the pre-sale will benefit from the lowest prices, thus positioning themselves advantageously for future trading and investment opportunities.

Moonmemecoin is more than just a cryptocurrency; it represents a movement towards true decentralization and community empowerment in the memecoin space. The upcoming presale is an invitation for investors and enthusiasts to join a dynamic and innovative project that aims to redefine the memecoin landscape.

For more information and to participate in the presale, visit www.moonmemecoin.io.

About Moonmemecoin

Moonmemecoin is a decentralized cryptocurrency designed to empower its community through transparent and inclusive decision-making processes. Inspired by the success of Bitcoin, Moonmemecoin is dedicated to fostering a community-driven approach to growth and development. With an upcoming presale and plans to list on major exchanges, Moonmemecoin is poised to make a significant impact in the memecoin world.

Media contact:

Rachel Harris

Pulse Media

info@pulsemediapr.com

Twitter: https://x.com/Moonmemeco32909

Telegram: https://t.me/+Ge9LJraGcAQwZGQ0

A photo accompanying this release is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a71734a0-62ba-448b-998d-b8ca3e90eecf

Memecoins

Solana Celebrity Tokens Down 94%, MOTHER Holders React

Recently, the crypto community has witnessed the rise of a new memecoin frenzy with celebrity-endorsed cryptocurrencies. Solana-based tokens have seen massive gains, but have mostly become pump-and-dump scams.

Nearly two months later, most of these tokens’ prices have declined significantly from their all-time highs. However, the MOTHER community, one of the most successful celebrity memecoins, has defended its crypto champion against criticism.

The Rise of Solana-Based Celebrity Memecoins

In late May, Olympic athlete and reality TV star Caitlyn Jenner spear its Solana-based JENNER token. The news surprised the crypto community, which initially suspected that the gold medalist had been hacked.

Jenner was then joined by rapper Rich The Kid and his RICH token. Both memecoins were met with suspicion by the community and were immediately investigated.

Users were quick to point out that the orchestrator behind the memecoins was a “crypto influencer” named Sahil Arora. Arora was known to be an alleged serial scammer who had previously launched several tokens, including influencer memecoins.

According to reports, these tokens were part of a pump-and-dump scam that left most investors empty-handed. Jenner initially confirmed working with the alleged scammer, but eventually cut short all associations.

After Jenner, several other celebrities have launched tokens with Arora’s help, including Lil Pump, Davido, Trippie Red and MoneyBagg Yo. Australian rapper Iggy Azalea has also been related to Arora’s scam when launching his Mother Iggy (MOTHER) token.

Despite the allegations, Azalea assured her followers that she had joined the crypto community and launched MOTHER to stop Arora’s attempts to use her image to scam people.

Since then, the industry has seen many other celebrity token launches, some linked to Arora and others being alleged hacks. The list includes figures such as MetallicaAndrew Tate, Hulk Hogan, 50 Cent and many more.

Many celebrity tokens launched in the last two months have seen massive price gains. JENNER saw its ATH increase by 51,000%, while MOTHER increased by 5,552%.

MOTHER performance in the weekly chart. Source: MOTHERUSDT on TradingView

MOTHER performance in the weekly chart. Source: MOTHERUSDT on TradingView

Celebrity Tokens Fall

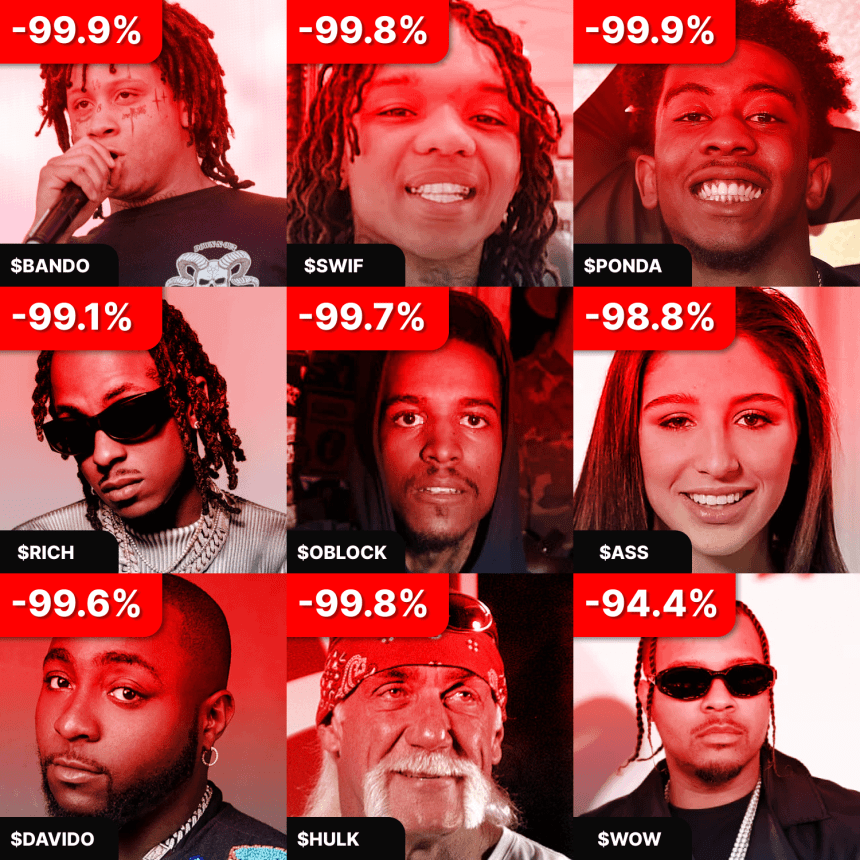

Online reports revealed The 30 Solana memecoins launched since May have fallen an average of 94%. According to Web3 strategist Slorg, even the best-performing celebrity tokens “are down over 70%” from their ATH prices.

Inspired by Andrew Tate DAD ranks as the smallest loser among tokens, down 73.2%. Meanwhile, JENNER and MOTHER follow closely with declines of 75% and 78.7%.

Just a month after their launch, “exactly half of them are down over 99%, and another 7 are down over 90%.” Additionally, 22 of the 30 tokens have a market cap of less than $1 million, and only 4 have a market cap of over $10 million.

Celebrity tokens fell 94% one month after launch. Source: Slorg on X

Celebrity tokens fell 94% one month after launch. Source: Slorg on X

Although most of the tokens have been abandoned, some celebrities continue to promote them, occasionally posting about them. But with “only 40% of them tweeting about the token at least once in the past week, most have followed the same trajectory, with an initial surge and then nothing.”

Some community members have called the celebrity meta “pure exploitation, engagement farming of their fan base.” However, the MOTHER community has defended the token following the report.

A user X declared that “Iggy should be included in this group” because she seems to be “working her butt off, hasn’t sold a single token, spends hours communicating with holders.” Another user called MOTHER’s launch “an example of what we would hope for from a celebrity.” affirmed that the token “would be an excellent model to follow.”

At the time of writing, MOTHER is down 23.1% over the last 24 hours, trading at $0.059. Its current price, however, represents an increase of 103.6% over the weekly timeframe.

Featured image from Wikipedia.com, chart from TradingView.com

-

Videos3 months ago

Videos3 months agoMoney is broke!! The truth about our financial system!

-

News2 months ago

News2 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

Altcoins2 months ago

Altcoins2 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Videos2 months ago

Videos2 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News2 months ago

News2 months agoOver 1 million new tokens launched since April

-

Videos2 months ago

Videos2 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs3 months ago

NFTs3 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

NFTs2 months ago

NFTs2 months agoSolana NFTs jump 30% in 24 hours: what’s behind the increase?

-

Memecoins2 months ago

Memecoins2 months agoSolana Dev hospitalized with third-degree burns while trying to pump Meme Coin

-

Videos3 months ago

Videos3 months agoCryptocurrency Market Update: Where Are We NOW?! What’s next?

-

Memecoins2 months ago

Memecoins2 months agoWhen memecoins reign supreme in the ecosystem!

-

Videos2 months ago

Videos2 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!