News

How have token unlocks affected cryptocurrency prices?

June 2024 was a pivotal month for the cryptocurrency market, with over $800 million in tokens unlocked. This influx of liquidity is creating waves in various digital assets, impacting market prices, investor sentiment, and overall market stability.

Think June is just another summer month? Think again!

While we are excited for the new month, June 2024 will see huge token unlocks in the cryptocurrency market.

Continue reading 👇

There are some major breakouts that could potentially impact the markets. The… photo.twitter.com/xD5H6mhSOX

— SAYRAAH #WID 📈📉📊 (@thesarahidahosa) June 3, 2024

Token unlocks are crucial moments in the lifecycle of a cryptocurrency project. They mark the release of previously locked tokens or Tokens acquired in circulation. This can lead to significant changes in market dynamics, as the sudden availability of large tokens can affect supply, demand, and price movements.

Arbitrum Unlock

Referee, a[{” attribute=”” tabindex=”0″ role=”link”>Ethereum layer-2 network, unlocked 92.65 million ARB tokens worth approximately $105.62 million on June 16. This unlock represented 3.2% of its circulating supply. The release was divided as follows: Team, Future Team plus Advisors: 56.13 million ARB ($63.98 million), and Investors: 36.52 million ARB ($41.63 million). The introduction of these previously unavailable tokens to the public market led to price volatility. At time of writing, Arbitrum trades at $0.824, showing a notable monthly 29.94% decline from its price of $0.94 on June 11, according to CoinMarketCap data.

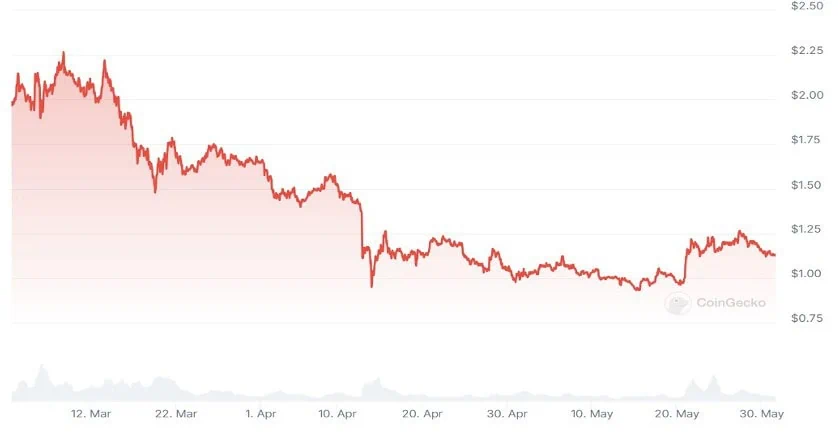

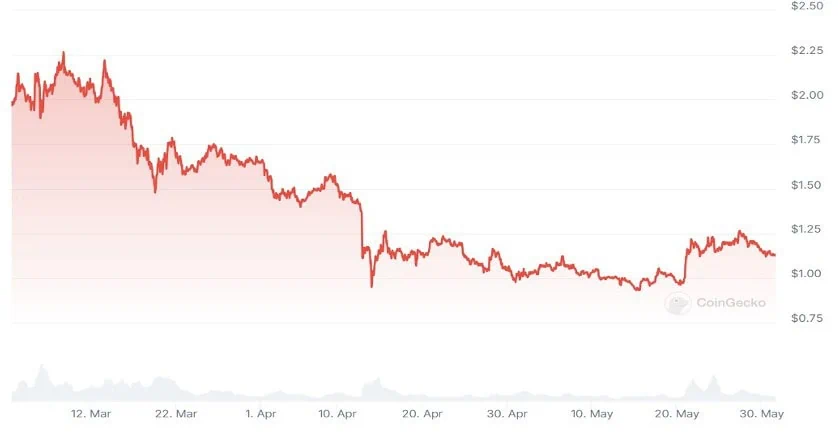

Source: CoinGecko (A 3-month price chart for layer-2 network Arbitrum)

Aptos: A Significant Market Player

Next on the list is the Layer-1 blockchain project Aptos (APT), which distributed 11.31 million tokens on June 12. The unlock represented 2.59% of its circulating supply, worth approximately $102.69 million. Despite the unlocking, Aptos has experienced a slight uptick in its monthly and year-to-date performance, with gains of 3.9% and 6%, respectively.

The release was divided as follows: Foundation: 1.33 million APT ($12.11 million), Community: 3.21 million APT ($29.15 million), Core contributors: 3.96 million APT ($35.94 million), and Investors: 2.81 million APT ($25.50 million). As of the time of writing, Aptos is trading at $6.991, a 25.74% 30-day decrease from its price of $8.023 on June 11. This suggests that the token unlock had a similarly negative impact on the price of both ARB and APT, which we’ll analyze further in a subsequent section of this piece.

🚨 Unlocks Alert: Unlocking $105.63M in $APT

From May 2024 to October 2026,@Aptos unlocks 11.31M tokens around the 11th and 12th of every month.

Founder/Team – 35% 🌟

Community – 28%

Private Investors – 25%

Reserve – 12%Set your calendar and prepare for unlocks. 🗓️ pic.twitter.com/DlVsi9Q5ix

— Token Unlocks (@Token_Unlocks) May 30, 2024

Starknet

Starknet unlocked 64 million tokens on June 15, valued at approximately $78.08 million. These unlocks represented 5.61% of STRK’s circulating supply. Similarly, the release was broken down between early contributors and investors: 33.57 million STRK ($40.95 million) and 30.43 million STRK ($37.13 million), respectively. Starknet’s live trade is at $0.705, showing a 37.87% decrease in 30 days from its price of $0.94 on June 16, supporting the same trend of price drop observed with ARB and APT.

Potential Market Impacts

When a significant number of tokens are unlocked and potentially sold on the market, it can create a supply shock. This sudden increase in available tokens can lead to a decrease in price due to the basic economic principle of supply and demand. For instance, for all three cryptocurrencies unlocked this June (i.e., ARB, APT, and STRK), amongst others, there is a notably short-term price drop, possibly because a significant portion of these tokens are being sold.

Looking ahead, the price of ARB is expected to reach $2.60 by the end of 2024; APT is predicted to reach a high of $11.96 by the same period, while STRK is expected to reach between $1.75 to $2.00 throughout 2024, according to Changelly blog statistics.

It’s also important to note that not all token unlocks lead to price drops. If the project has positive momentum or the demand for the token is high, the price may remain stable or even increase despite the unlock.

Investor Sentiment

Token unlocks can significantly impact investor sentiment. On one hand, they can lead to uncertainty and fear due to the potential for increased price volatility. On the other hand, they can also be viewed positively as they often represent a milestone in a project’s roadmap and can attract new investors looking to buy at a potentially lower price point.

In the case of ARB, APT, and STRK, the reaction of the investor community is largely dependent on factors such as the projects’ recent developments, their communication regarding the unlocks, and the overall state of the crypto market. For instance, if Starknet has been making significant progress in its development and has been transparent about its token unlock plans, this could potentially boost investor sentiment.

Market Stability

Large-scale token unlocks can contribute to increased market volatility, especially if they coincide with other market-moving events. However, they are common in the crypto space and are typically factored into the market’s expectations.

2) Insights

The main insight that caught our eyes is the massive unlock of $APE happening on 17 March, 2023.

11% of the circulating supply (worth $203m) is set to unlock.$APE holders be careful.

Position yourselves accordingly. pic.twitter.com/kMPBMLI4vA

— Loch (@loch_chain) March 14, 2023

While this influx of liquidity from projects like ARB, APT, STRK, and all others this June has potentially created waves across various digital assets, it is gradually building up to increased market volatility and, therefore, a pointer to the dynamism and growth of the crypto market.

Previous Token Unlocks

Token unlocks have historically had significant impacts on the crypto market. Here are a few examples:

Aptos, The Sandbox, and Avalanche (February 2024): In February 2024, nearly $1 billion worth of tokens were unlocked from projects like Optimism, Avalanche, The Sandbox, Aptos, and Sui. Specifically, Aptos unlocked 24.84 million APT tokens worth approximately $229.54 million on February 11. The Sandbox unlocked 205.59 million SAND tokens, which made up 9.19% of the circulating supply. Avalanche had the highest token unlock with 9.54 million AVAX tokens, valued at $344.17 million, set to unlock on February 22. The introduction of these tokens into the circulating supply had an impact on the token’s price. For instance, the price of APT tokens plummeted by 17.94% and 14.10%, respectively, after the previous unlocks.

Notable token unlocks in February 2024:

– 27 projects unlocking tokens, totaling over $870 million.

– Avalanche (AVAX), Aptos (APT), The Sandbox (SAND), and dYdX (DYDX) have the largest token unlocks.Prominent unlock dates:

– 01/02: dYdX (DYDX) unlocks 33.33 million tokens…

— Diana.ETH (@DianaEth_) February 1, 2024

$APE (March 2023): ApeCoin had a significant token unlock event on March 17, 2023, where 40.6 million APE tokens, about 4% of the total supply, were released onto the market. This unlock was worth an estimated $215 million. As a result of this unlock, the price of APE plunged from an intraday high of just over $5.70 to a low of $5.15, a drop of approximately 9.7%.

2) Insights

The main insight that caught our eyes is the massive unlock of $APE happening on 17 March, 2023.

11% of the circulating supply (worth $203m) is set to unlock.$APE holders be careful.

Position yourselves accordingly. pic.twitter.com/kMPBMLI4vA

— Loch (@loch_chain) March 14, 2023

General Analysis: A research study looked at over 5000 events where tokens were unlocked. The study found interesting patterns that showed how the supply of tokens and market feelings are delicately balanced.

The study found that when a small number of tokens are unlocked, causing a slight increase in the total number of tokens available (from 0% to 1%), it doesn’t really affect the price of the tokens.

However, when a larger number of tokens are unlocked, causing the total number of tokens available to increase by more than 1%, it tends to have a noticeable negative effect. This means that as more and more tokens are unlocked, the price of the tokens tends to go down. This is likely because the increase in supply of tokens exceeds the demand for them, leading to a decrease in price.

These examples illustrate how token unlocks can influence the crypto market. However, it’s important to note that the impact of token unlocks can vary based on various factors, including the overall state of the market, the specific project involved, and investor sentiment at the time of the unlock.

The major token unlocks in June 2024 are having significant impacts on the crypto market. While these events have triggered increased market volatility, they also present unique opportunities for investors. As the saying goes, “Every cloud has a silver lining,” in this case, the silver lining could be the potential for high returns for savvy investors who can navigate the choppy waters of token unlocks. However, as always in the crypto world, each investor must do their own research (DYOR) and make informed decisions.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.