News

Gaming Token Market Cap Exceeds $30 Billion: What’s Driving This Frenzy?

What factors are pushing the market capitalization of gaming tokens above $30 billion, and which tokens are driving this surge?

Crypto gaming tokens are having their moment in the sun, generating excitement among traders with a wave of positive market sentiments.

Over the past week, the market capitalization of crypto gaming tokens has increased by nearly 11%, reaching over $30 billion as of June 6, according to CoinMarketCap.

What’s really happening?

The meteoric rise of Notcoin

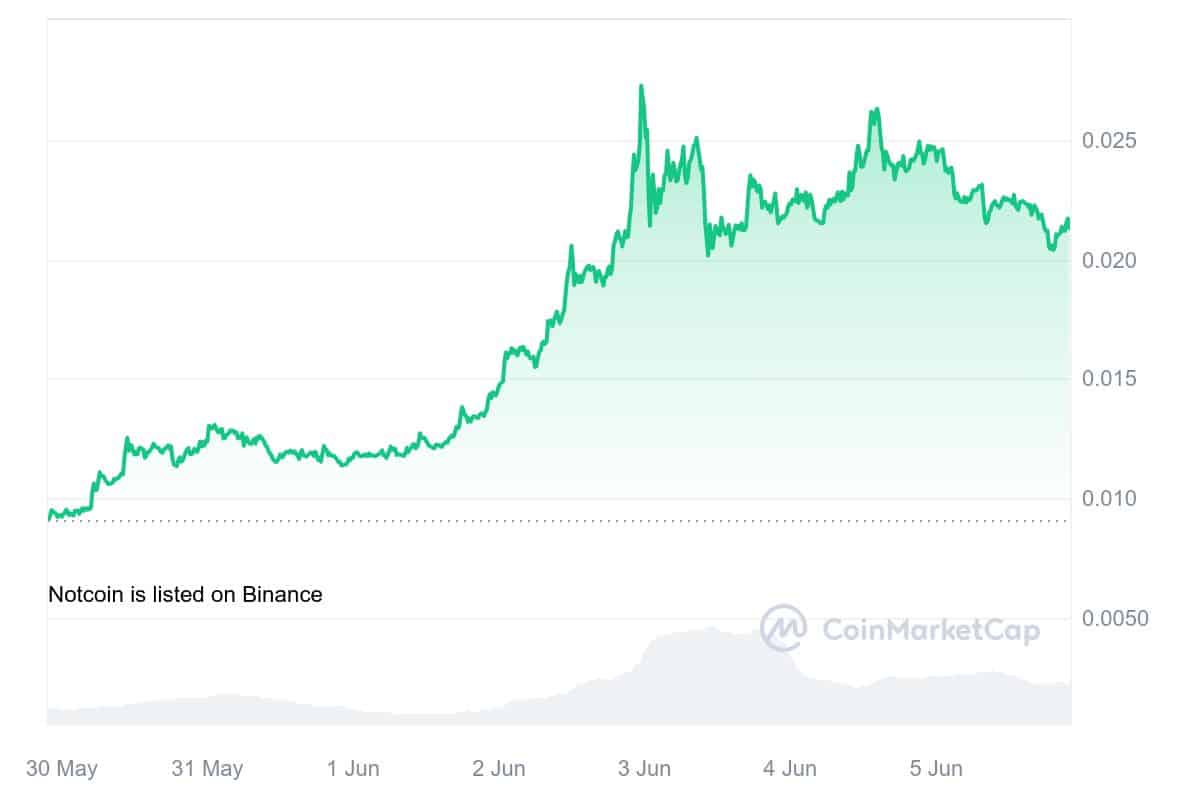

Leading this charge is Notcoin (NOT), which saw an incredible 135% increase in value, now trading at $0.02187.

Notcoin One Week Price Chart | Source: CoinMarketCap

Amid this wave, Notcoin’s market capitalization rose to $2.24 billion, placing it comfortably among the top 50 cryptocurrencies by market capitalization.

With 24-hour trading volumes in excess of With $1.8 billion, it also ranks 9th among the most traded cryptocurrencies.

A key factor behind Notcoin’s rise is its integration with Telegram. This partnership allows Telegram’s vast user base – over 1.5 billion registered users and more than 800 million active users – to easily access and use Notcoin.

What sets it apart from it’s the game to earn (P2E) model introduced by Notcoin on Telegram. Users can engage in various games and activities directly in the Telegram app and earn Notcoins as rewards.

Floki’s steady climb

Hot on Notcoin’s heels is Floki (FLOKI), which has gained over 30% in the past week and is up over 64% in the past month, trading at $0.000315.

FLOKI One-Week Price Chart | Source: CoinMarketCap

The recent increase in Floki’s value can be attributed to a move by cryptocurrency trading firm DWF Labs. They announced plans to purchase $12 million worth of FLOKI tokens from the open market and Floki treasury.

So bullish on $FLOKI.

One of the best looking charts out there as it targets it's ATH of 2021. Just a matter of time now.

The real fun starts after that because of price discovery.👀🔥

DWF Labs has also recently invested 12M in the ecosystem.✅

Probably nothing. Send it. https://t.co/gXvG2hFmMA pic.twitter.com/6ViFPjfsDS

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) June 4, 2024

This move follows a previous commitment made in February 2024, in which DWF Labs bought FLOKI tokens worth $10 million, resulting in a 50% price increase the following week.

The Floki team is also preparing to launch the mainnet version of its flagship product, the Valhalla Metaverse game, later this year. DWF’s significant investments are expected to support this venture and provide the liquidity needed for growth.

Bustling crypto gaming market

The crypto gaming market is buzzing, driven by recent developments and substantial investments.

The big move of the Xai Foundation to integrate traditional Web2 developers in the cryptocurrency world are a great example. They are partnering with venture capital firm Outlier Ventures to launch the Xai Tokenomics Bootcamp.

This bootcamp is designed to help developers transition from traditional to blockchain-based gaming models, focusing on game asset ownership, token usage, player rewards, and improved security.

Meanwhile, the first quarter of 2024 was favorable for the cryptocurrency market. The culmination of the cryptocurrency industry’s long battle with the SEC and its approval Spot Bitcoin ETF in the United States they have reinvigorated investor sentiment.

Positive vibes have spilled over into the Web3 gaming industry. Second DappRadarIn the first quarter alone, investments reached $288 million, with April seeing investments rise to $988 million, the highest monthly investment since January 2021.

Meanwhile, the average unique active wallets for gaming dApps nearly reached 3 million per day in April, a record-breaking figure, nearly 28% of the entire dApp industry.

Big players like a16z, Bitcraft Ventures and Ubisoft Studios are investing money in this space, demonstrating their strong belief in the future of Web3 gaming.

This surge in investment is reminiscent of the beginning of 2021, when new technologies were popular NFTs AND DeFi the protocols have attracted enormous interest. What’s making people talk about it?

Decoding the Buzz: Ethereum Account Abstraction and Layer 3 Solutions

This time, the buzz is about Ethereum (ET) new technology called Account abstraction and the rise of Layer-3 blockchain solutions.

Account abstraction replaces traditional wallets with programmable smart contracts, making the user experience smoother and more secure. It eliminates the need for opening sentences and allows for familiar login methods like email or Google accounts. Furthermore, it introduces sponsored transactions, reducing the burden of gas tariffs.

Layer-3, or application-specific blockchain, solutions make transactions faster and cheaper. Combined with account abstraction, these technologies promise a smooth, free gaming experience that’s as good, if not better, than traditional Web2 games.

Therefore, broader trends indicate that the current bull market could also spread gains towards the crypto gaming market, and we could likely see more pumps in the days to come. However, trade wisely and never invest more than you can afford to lose.

Disclosure: This article does not constitute investment advice. The contents and materials on this page are for educational purposes only.