News

Gala Games Attacker Returns Ethereum After $240 Million Token Exploit

Behind him is the yet unidentified attacker Monday’s $240 million Gala Games token exploit returned the Ethereum (ETH) gained from the sale of some tokens, as Gala deals with the consequences of the attack and how to address the remaining questions.

It was around 5,913 ETH, or around $22 million sent back from the attacker’s wallet to a Gala wallet Tuesday morning, representing funds earned from the sale of 600 million GALA tokens on a decentralized exchange Uniswap shortly after Monday’s exploit.

In Gala’s Discord server on Tuesday, CEO Eric “Benefactor” Schiermeyer said the company will “likely buy and burn” GALA tokens using recovered ETH, a move that could potentially drive the token’s price higher after the drop on Monday.

On Monday, Schiermeyer wrote in an announcement on Discord that the cryptocurrency gaming startup believed it knew who was behind the attack and said it was working with authorities to bring the attacker to justice. The person in question has yet to be publicly identified, and Gala Games declined to comment beyond the published statements.

Gala published a blog post recounting the attack and the countermeasures taken by the company on Tuesday. On Monday, a wallet with administrative access to the GALA token minting contract minted 5 billion GALA tokens, or about $240 million at the time of the exploit, and then began selling them on the open market.

After about 45 minutes, Gala was able to stop the wallet from making any further sales thanks to a feature built into last fall’s v2 contract update. The attacker managed to sell 600 million GALA tokens before this happened, and the price of GALA plummeted 20% during that period as the market struggled with the token surge.

“We want to assure our community that $GALA’s minting capabilities on GalaChain remain secure and uncompromised,” the post reads. “Our internal controls and multisig security protocols are designed to protect against such incidents, and we continually improve them to stay ahead of potential threats.”

However, while the company said the contract is secure, Schiermeyer had already written on Monday that Gala had “matched” regarding access to those features.

“We messed up our internal controls…this should not have happened and we are taking steps to ensure it never happens again,” he wrote Monday.

What about the other 4.4 billion GALA tokens? This is almost 9% of the total supply of 50 billion GALA tokens, which are currently frozen in the attacker’s wallet. Schiermeyer wrote on Monday that they would be considered “effectively burned,” since they are inaccessible and cannot be spent.

In other words, the Gala ecosystem would consider them out of circulation. But now it appears that Schiermeyer’s classification was premature and the community of Gala network node operators will have a chance to vote on the issue.

“A new vote on the governance of the Founder’s Node ecosystem will soon decide whether the blacklisted GALA will be considered burned as it relates to GALA’s dynamic supply distribution model as described in the Gala Ecosystem Project“, the post reads.

By Ryan Ozawa.

News

Trump seeks cryptocurrency industry support at bitcoin conference

NASHVILLE — There were stacks upon stacks of bright orange coins, a crypto-themed stock car, a plethora of miniature rockets and spacemen meant to embody the hope that prices might someday shoot “to the moon.”

It was all standard fare for an annual conference that bills itself as the world’s largest gathering of bitcoin enthusiasts. But the usual trappings accompanied something more political: klaxon-red hats emblazoned with the slogan “Make bitcoin Great Again.”

Many of the nation’s leading cryptocurrency companies, executives, investors and fanatics are beginning to unite around former president Donald Trump’s bid for the White House, hoping that their public embrace — and increasingly generous campaign checks — might entice and elect a candidate who will spare the industry from federal regulation.

Under President Biden, the U.S. government has aggressively cracked down on crypto, seeking to protect average Americans from scams and ensure the largely anonymous tokens do not enable illicit activities. But the fierce oversight has chafed crypto advocates and angered wealthy political benefactors in Silicon Valley. To ward off new federal probes, environmental protections and financial safeguards, they have gravitated toward Trump — even if they don’t always like him — in the hopes he can win and deliver them relief in Washington.

“I think what people are excited about is, if Trump comes in with a new circle, and Cabinet members, and people, that it’s going to change, and change for the better,” said Marshall Beard, the chief operating officer at Gemini, a crypto trading platform and banking service. He described himself as apolitical, but his company’s founders, billionaire investors Tyler and Cameron Winklevoss, have donated heavily in support of Trump.

Trump has gladly accepted the entreaties: Newly awash in crypto cash, he has celebrated bitcoin and other digital tokens, marking a stunning shift from his time in office, when Trump proclaimed he was “not a fan” of bitcoin and linked such assets to drug sales. The early uptick in fundraising support has troubled some Democrats, who have scrambled to show they are not hostile to the industry.

But Trump’s conversion will be on stark display Saturday, when he speaks directly to the thousands of bitcoin owners, traders and investors who have descended this year on Nashville. Many in attendance expect the former president to announce he wants the U.S. government to stockpile its own reserves of the currency, a radical idea that is bound to send the price of bitcoin skyrocketing — just hours after Trump holds a high-dollar fundraiser with the nation’s crypto elite.

Even before Trump arrived, there were hints of his growing support across the sprawling Music City Center, the site of this year’s bitcoin Conference. A smattering of “Make bitcoin Great Again” hats — some in Trump’s signature style, others in bitcoin orange — dotted the rows of booths where crypto entrepreneurs hawked new tokens, investing tips and “tax avoidance strategies,” in the words of one firm, which parked near its kiosk a ruby-red motorcycle adorned with the play on Trump’s slogan. (Staff there declined to be interviewed.)

Outside, a digital sign truck periodically circled, flashing photos of Trump and his new running mate, Sen. JD Vance (R-Ohio), a longtime crypto advocate who has reported owning as much as $250,000 in bitcoin. The vehicle pitched passersby on “MAGA VP,” a type of “memecoin” — unaffiliated with the campaign — that aims to help the former president’s most fervent supporters earn money. It teased that customers who purchased $50 of the token would “win a special prize.”

“At this party, today, it seems like there’s a leaning toward Trump, and I think it’s an appreciation for the first major presidential candidate to come along and say this might be actually a really good idea,” said Mike Belshe, the chief executive of BitGo, which offers a crypto wallet service. He plans to host a fundraiser reception for Vance in Palo Alto, Calif., next week, according to an invite later obtained by The Washington Post.

The support for Trump underscored the rapid political awakening underway in the crypto industry. Stung by a series of major scandals — and facing the prospect of tough regulation in Washington — crypto companies, executives and investors have shelled out $121 million this election in a bid to defeat potential foes and elect new friends in Washington, according to the money-in-politics watchdog OpenSecrets.

“We’ve seen tens of millions of dollars pouring in, in an attempt to make sure anti-regulation politicians are the ones who take power,” said Lisa Gilbert, co-president of Public Citizen, a left-leaning watchdog group.

For many crypto titans, the catalyst for action came two years ago, after the downfall of FTX, previously the world’s third-largest crypto marketplace. Many Democrats, including Sen. Elizabeth Warren (Mass.), immediately demanded stringent new rules, while the Securities and Exchange Commission, led by Chairman Gary Gensler, filed a battery of lawsuits alleging the best-known crypto firms had failed to follow basic federal investor protections.

Often, the targets of SEC scrutiny — including Coinbase, a digital asset marketplace, and Ripple, which offers the popular XRP token — blasted the cases as evidence of Gensler’s bias against the industry. They coupled their court battles with an expensive lobbying campaign designed to neuter the SEC and stave off other regulations, including rules meant to prevent terrorist groups from trafficking in crypto. And crypto executives and investors began pouring money into the 2024 election, launching three super PACs that have run ads targeting congressional candidates who oppose digital currencies.

This year, David Bailey — the chief executive of BTC Inc., which organized the conference in Nashville — personally approached Trump in the hopes he might reverse his views on crypto. Major Silicon Valley donors, including investors David Sacks and Chamath Palihapitiya, hosted lucrative fundraisers for the former president in June. Elon Musk, a crypto booster and owner of X, formerly Twitter, endorsed Trump after the former president’s near-assassination in July; the venture capital duo Marc Andreessen and Ben Horowitz soon revealed their support, too.

With every check and endorsement, Trump appeared to grow more receptive. On his social media site, Truth Social, he described himself in May as “VERY POSITIVE AND OPEN MINDED TO CRYPTOCURRENCY COMPANIES.” Two months later, he touted crypto as an official part of the 2024 GOP platform, which declared the party would “end Democrats’ unlawful and un-American Crypto crackdown.”

“If there’s a politician that sees the potential of the industry, and wants it to thrive, generally the voters and donations are going to go in that direction,” said Brian Morgenstern, who oversees policy for the crypto giant Riot Platforms.

Riot is a bitcoin miner: It manages the vast, energy-intensive machines running complex calculations to generate individual tokens. The industry has warred with the Biden administration, and Riot successfully sued the Energy Department after it demanded bitcoin miners turn over data about their energy usage.

Executives from Riot and other companies directly appealed to Trump in June, who told them that “he understands quite clearly why people are looking for alternatives to legacy financial systems,” Morgenstern recalled in Nashville this week. He previously served under Trump at the Treasury Department, back when the then-president had been critical of crypto.

After the meeting, Trump commemorated the gathering on Truth Social: “VOTE FOR TRUMP!” he began. “Biden’s hatred of bitcoin only helps China, Russia, and the Radical Communist Left. We want all the remaining bitcoin to be MADE IN THE USA!!!”

Despite his earlier opposition, some crypto devotees seemed to welcome Trump’s attention.

At an unattended expo booth on Friday, the image of a bloodied Trump pumping his fist after this month’s assassination attempt had been altered so that it appeared he was holding up a bitcoin. Gawkers stopped to snap photos of the rotating illustration, which was superimposed atop the usual rocket logo for Moonshot, a company that manufactures key components for bitcoin mining.

“Hopefully we’re starting to see winds change in the United States, and maybe we’ll get some change with a new president,” mused Ray Kamrath, the chief commercial officer at Bakkt, a crypto trading platform, during a panel discussion later about the future of regulation.

Kamrath expressed hope that the next year might finally resolve the issue of whether some cryptocurrencies are securities, and in the process, shield more of the industry from the SEC.

“Let’s just enjoy for a moment that crypto, bitcoin, is a bona fide election year issue in the United States,” responded Bobby Zagotta, the U.S. chief executive officer of Bitstamp, a crypto marketplace, to a smattering of applause. In an interview afterward, Zagotta said he sensed the “Trump mania just walking the floor.”

A crowd of a few hundred had erupted in celebration a day earlier, when Luke Rudkowski, the founder of the group We Are Change, noted on a panel that Trump had publicly promised to release Ross Ulbricht from prison. A longtime darling of the crypto community, Ulbricht faces a life sentence for convictions related to his creation and operation of Silk Road, a dark web marketplace often used to buy and sell illicit goods.

“It’s happening with Donald Trump; he’s speaking up for it,” said Rudkowski, whose group has been faulted by the Southern Poverty Law Center for spreading conspiracy theories.

Eager to reap the financial benefits of his new, growing base of support, the Trump campaign plans to hold at least two fundraisers in Nashville. To attend the Saturday reception, take a photo with Trump and join his policy roundtable, donors must write checks for $844,600 to his reelection and other Republican campaign committees, according to an invitation obtained by The Post. Already, Trump’s aides have boasted about raising roughly $4 million in various cryptocurrencies, including bitcoin.

Sensing Trump’s fundraising edge, other politicians have looked to court crypto’s cash: On street corners outside the convention hall, Sen. Marsha Blackburn (Tenn.) stationed trucks with digital signs that pitched her as a “bitcoin champion” — and directed viewers to a donation website (in dollars or cryptocurrency). Robert F. Kennedy Jr, who is running as an independent in the 2024 presidential race, made his own appeal Friday, telling a packed auditorium he would unveil a host of policies that would see the U.S. government purchase and warehouse bitcoin.

“I’m very happy to learn I’m not the only one talking about bitcoin in this year’s election,” said Kennedy, who appeared at the same conference last year. He later added: “I hope President Trump’s commitment is about more than political expediency.”

But Trump’s inroads in particular have spooked some national Democrats, who do not want to be seen as wholly opposed to crypto. A small group of party officials even huddled privately earlier this month to discuss how to better engage with the politically ascendant industry, having spent years cultivating relationships — and cashing checks — from the broader, liberal-leaning Silicon Valley tech set.

“The challenge the Democrats have is name[d] Gary Gensler,” Mark Cuban, a prominent tech investor, said in an email. “He is pushing a new technology out of the USA. That is not a strong position for a party looking to win.”

Rep. Ro Khanna (D-Calif.), who represents a slice of the Bay Area, convened the gathering with senior aides to Biden and top tech investors including Cuban and Anthony Scaramucci, who served briefly under Trump but since has defected to support Biden and now Vice President Harris. Scaramucci later said that some participants specifically called for firing Gensler and blocking the renomination of Caroline Crenshaw for another term as an SEC commissioner, arguing they have stuck an unfairly defiant tone against crypto. Spokespeople for the White House, as well as Gensler and Crenshaw, did not comment for this story.

“I’ll put it simply: After years in the desert, and in a regulatory drought in the Biden administration, I think they see an advocate,” Scaramucci said of Trump.

The outreach has only intensified after Harris replaced Biden as the party’s presumptive nominee, elevating a longtime California politico with deep roots in the tech sector. Some fervent crypto supporters tried to make a last-minute pitch for Harris to appear alongside Trump in Nashville, but she ultimately did not. Her campaign did not respond to a request for comment.

“With the changing of the top of the ticket, it’s an opportunity to reevaluate, reset,” said Brad Garlinghouse, the chief executive of Ripple.

Garlinghouse said he had not yet endorsed or donated to either candidate, but he signaled that many in his industry had supported Trump primarily out of necessity.

“I don’t think this is about choosing one party over another,” he continued. “I think the Republicans, led by Donald Trump, are playing chess, and I think the Democrats are playing checkers.”

News

Meme Tokens Surpass Bitcoin in Turkish Trading Activity This Year

The Turkish cryptocurrency market has seen significant growth in recent years. Currently, more than half of the population invests in cryptocurrencies, according to surveys and polls.

This is evident from the fact that the Turkish Lira (TRY) is the fourth most used fiat currency in cryptocurrencies. Several macroeconomic factors are fueling this crypto adoption in the country. Therefore, stablecoins and meme coins have emerged as the favorites of Turkish investors, even surpassing Bitcoin.

Stablecoins and meme coins dominate Turkish trade

According to the latest relationship According to Kaiko, Turkey’s inflationary conditions have significantly increased stablecoin usage in recent years. In 2024, the research firm found that USDT-TRY dominates as the largest trading pair by volume on Binance, reaching over $22 billion, more than five times larger than the next largest pair, PEPE-USDT, which has $4 billion.

Notably, meme tokens have surpassed Bitcoin in terms of trading volume this year, indicating that Turkish traders are also turning to more speculative cryptocurrencies to hedge against currency fluctuations and make profits.

The increased usage of stablecoins is further reflected in the main Bitcoin trading pairs on BTCTurk, which are BTC-USDT and BTC-TRY.

One of the main reasons driving the adoption of cryptocurrencies is Turkey’s fight against double-digit inflation and the currency devaluation for years, with an average inflation rate above 40% over the past five years. In response, the central bank adopted an unorthodox monetary policy, cutting rates until June 2023. However, this worsened the devaluation of the Turkish lira, which lost more than 300% of its value from the end of 2020 to the end of 2023.

Turkey’s decision to normalize its monetary policy after the 2023 elections failed to restore confidence in the TRY, whose value continued to decline in 2024, albeit less rapidly.

Binance Sees Strong Expansion in Türkiye

Amid economic challenges, Binance has strengthened its position as one of the two largest trading platforms for Turkish traders, thanks to deep liquidity and low fees. As part of a large-scale zero-fee campaign, it offered zero fees for BTC-TRY trading between July 2022 and March 2023.

Offering a wide range of TRY-denominated trading pairs and aggressively adding new pairs in recent years have helped Binance maintain its leadership in the country despite the 2022 cryptocurrency bear market. Binance introduced 61 new TRY trading pairs in 2024 alone, bringing the total number to over 200.

Other exchanges, such as Gate.io, KuCoin, and OKX, have jumped into the Turkish crypto ecosystem, but their overall market share remains less than 1%.

News

Top 5 PolitiFi Tokens to Buy Now for MAX Profits

With the US presidential election fast approaching, the cryptocurrency world is buzzing with new trends. In addition to the well-known cartoon-themed meme coins, a new category is making waves: PolitiFi tokens. Did you see that coming?

These politically themed crypto tokens are gaining attention, especially those centered around former President Donald Trump. Today, we explore the 5 trending Trump-themed PolitiFi tokens.

Stock up to benefit later!

1. Trump (Magazine)

Launched about a year ago, the Trump-themed MAGA token has caused quite a stir in the cryptocurrency ecosystem. Inspired by Donald Trump’s slogan “Make America Great Again,” the MAGA token has produced an astonishing 35 million percent return since its inception. Currently trading at $5.65, it has fallen 8.80 percent in the past 24 hours.

Despite this, the token’s trading volume increased by 23.23%, bringing its market cap to $248 million and securing the 220th spot on CoinMarketCap.

Source: Dexscreener

2. MAGA (MAGA)

Another token with the same ticker, MAGA, is also trending in the PolitiFi category. With 390 billion tokens in circulation, this MAGA token has seen a 11.08% price drop over the past 24 hours, but an 81.39% increase in trading volume. Currently trading at $0.0001337, it is ranked 21st on Dexscreener’s trending list and 522nd on CoinMarketCap. Despite being only two months old, it has provided early adopters with a remarkable profit of 313,373.62% at its all-time high of $0.0007354.

Source: Dexscreener

3. Super Trump Coin (STRUMP)

Super Trump Coin, a meme token depicting Donald Trump as Superman, has a circulating supply of 1.8 billion tokens. Over the past 24 hours, its trading volume has increased by 39.88%. Currently trading at $0.01112, it has dropped by 6.07% over the past 24 hours, but holds a CoinMarketCap rating of 776. From its all-time high of $0.03085, it has dropped by 64.06%. Despite this, its impressive short-term returns have made it a favorite among Trump crypto enthusiasts.

Source: Dexscreener

4. MAGA Vice President (MVP)

Launched just four months ago, MAGA VP has yet to break into the top 1000 cryptocurrencies on CoinMarketCap, currently ranked 1231st. With a value of $0.128, its trading volume has increased by 21.79% over the past 24 hours, with a market cap of $5.3 million. While it is up 110% at its current price, it is down 83.24% from its all-time high of $0.7706.

Source: Dexscreener

5. Little Trump

One of the most unique Trump-themed tokens is Baby Trump, which depicts Donald Trump as a baby president. With a circulating supply of 406 million tokens, it has a market cap of $3.5 million at a trading price of $0.008616. Although its price has dropped 9.45% in the last 24 hours, its trading volume has increased by 4.29%. At its peak, Baby Trump’s market cap was $11 million.

Notably, Baby Trump is the only token among the five analyzed to be based on the BNB Smart Chain, while the others are based on the Ethereum network.

Source: Dexscreener

It’s an exciting time for cryptocurrencies

The current political climate in the United States is spawning a new wave of meme tokens themed around various political figures. Among them, Trump-themed PolitiFi tokens are experiencing the most significant surge in popularity. Support for Donald Trump in the crypto community seems to be a driving force behind the success of these tokens.

Do you think Trump-themed PolitiFi tokens are here to stay or just a passing trend? Share your thoughts.

News

Brett Token Price Soars 12%; Analyst Expects Further 30% Upside

Brett, the largest meme coin in Blockchain Base, rose more than 12% on Friday, as sentiment in the cryptocurrency and stock sectors improved.

Brett (BRETT) the token rose to $0.133, up 31% from its low this month. Some traders believe the meme coin has more upside potential in the future.

Analyst is bullish on Brett

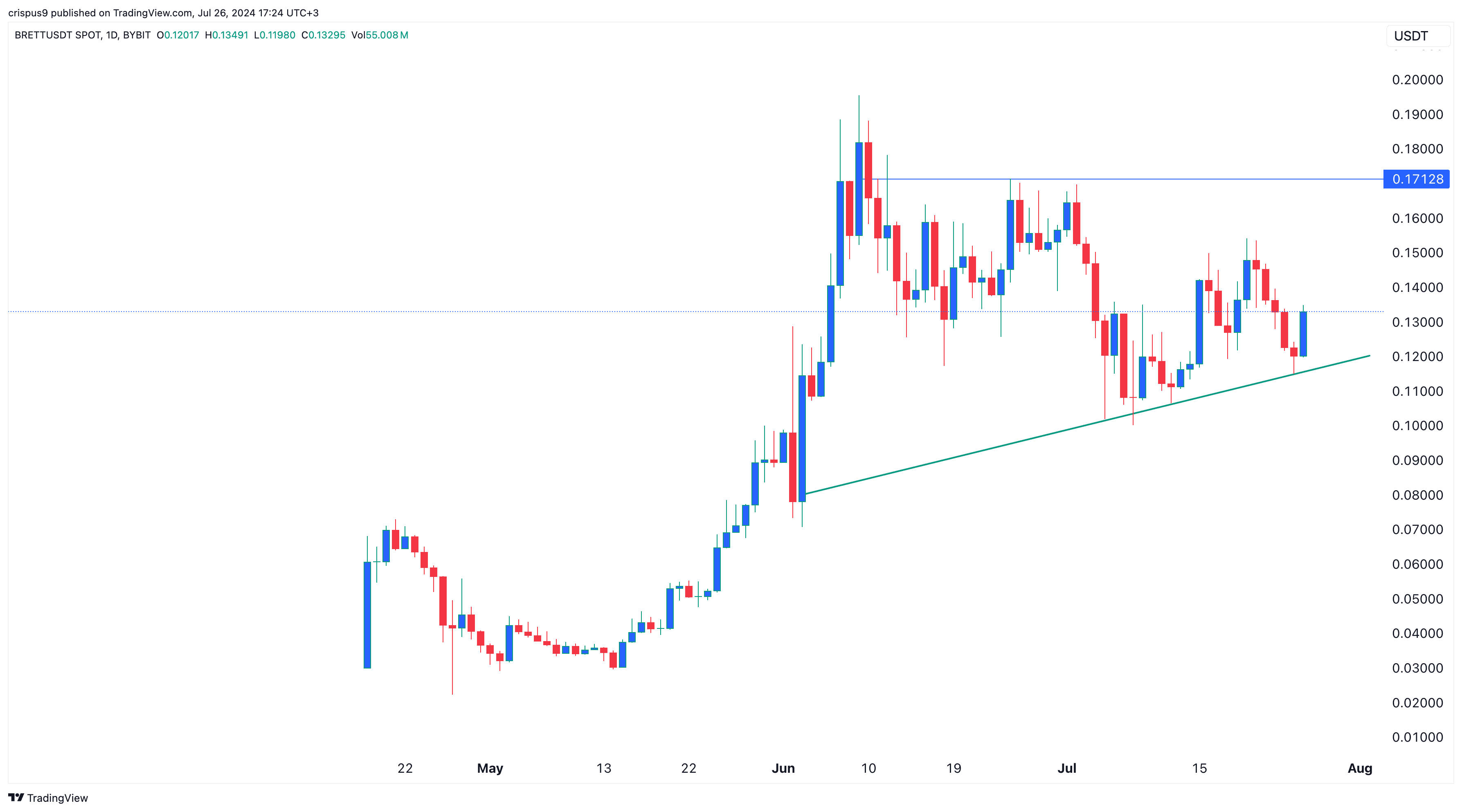

In an X-post, Michael van de Poppe, a trader with over 721,000 followers, said he is optimistic that the token will rise to $0.1712, up 30% from Friday’s trading level.

I’ve been a day trader for a long time and memes are a great way to gain that perspective.

Lots of volume.

And there’s a lot of volatility.When it comes to $BRETTI would look for long positions in this area between $0.125-0.1325 and $0.170 as a clear identification of a potential bull run. photo.twitter.com/hWmSjCZGJa

— Michaël van de Poppe (@CryptoMichNL) July 26, 2024

If he is right, Brett’s market cap will surpass Floki’s (FLOKI), which has a market capitalization of $1.7 billion.

Brett’s bounce came at the start of the Bitcoin 2024 conference today. In a statement at the event, Robert Kennedy, an independent presidential candidate, noted that he is a big supporter of Bitcoin (BTC).

The main protagonist of the event will be Donald Trump, leading in most polls, included in Polymarket. Trump is expected to reiterate his support for cryptocurrencies. Analysts are divided on whether he will announce a Bitcoin reserve at this event.

Blockchain Base is doing well

Brett token also recovered as Base blockchain ecosystems continued to perform well. Launched in 2023 by Coinbase, Base has accumulated over $1.6 billion in DeFi assets, making it the sixth largest chain in the industry. It has surpassed popular networks like Cardano (ADA), Avalanche (AVAILABLE) and Polygon (MATIC).

At the same time, Brett and other altcoins jumped as the U.S. stock market rebounded, signaling that investors have embraced risk-on sentiment. The Dow Jones Industrial Average rose more than 600 points, while the S&P 500 and Nasdaq 100 jumped more than 80 basis points.

Brett Price Chart | Source: Trading View

Technically, Brett formed a morning star pattern, which is a popular reversal sign. In the past, the coin has risen by double digits when it has formed this pattern. For example, it formed on July 12 and then rose by 40%.

On the other hand, this bounce could be a dead cat bounce, where an asset briefly rises and then resumes its downtrend.

-

Videos3 months ago

Videos3 months agoMoney is broke!! The truth about our financial system!

-

News2 months ago

News2 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

Altcoins2 months ago

Altcoins2 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Videos2 months ago

Videos2 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News2 months ago

News2 months agoOver 1 million new tokens launched since April

-

Videos2 months ago

Videos2 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs3 months ago

NFTs3 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

NFTs2 months ago

NFTs2 months agoSolana NFTs jump 30% in 24 hours: what’s behind the increase?

-

Memecoins2 months ago

Memecoins2 months agoSolana Dev hospitalized with third-degree burns while trying to pump Meme Coin

-

Videos3 months ago

Videos3 months agoCryptocurrency Market Update: Where Are We NOW?! What’s next?

-

Memecoins2 months ago

Memecoins2 months agoWhen memecoins reign supreme in the ecosystem!

-

Videos2 months ago

Videos2 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!