News

FTX raised billions more than it needed to repay bankruptcy victims

Failed cryptocurrency exchange FTX took in billions of dollars more than it needed to fully repay customers who lost funds in the November 2022 crash.

In a rare twist on typical US bankruptcy proceedings, FTX, whose recent fall resulted in a 25-year prison sentence for its former CEO, Sam Bankman-Fried — also has enough money to cover the interest, second Bloomberg.

Once it finishes selling all its assets, FTX will have up to $16.3 billion in cash to deploy compared to about $6.4 billion at the start of the year, the company said in a statement.

The company owes more than 2 million customers and other non-government creditors about $11 billion.

“In any failure, this is just an incredible achievement,” said FTX CEO John Ray, who took over the company when it collapsed.

Lower-ranking creditors traditionally receive only pennies on the dollar for their stakes in bankrupt companies, Bloomberg reported, but FTX has benefited from strong rallies in crypto tokens like Solana, which was approved by Bankman-Fried.

Once all of its assets are sold, Sam Bankman-Fried’s FTX will have up to $16.3 billion in cash to distribute to clients who lost funds in the November 2022 crash, enough to repay victims in full, plus interest . Christopher Sadowski

Even if FTX pays off its debts in full, plus interest, there won’t be much left for shareholders, according to documents reviewed by Bloomberg filed Tuesday evening in federal court in Wilmington, Del., where the FTX case is located. is managed.

In bankruptcy, the owners of the business cannot collect anything until all debts are paid in full.

In this case, U.S. regulators and the Internal Revenue Service have claims large enough to sweep away shareholders, Bloomberg reported.

Major holders of FTX shares include venture capital firm Sequoia Capital, private equity firm Thoma Bravo, Singapore’s Temasek Holdings and the Ontario Teachers Pension Plan, according to a court filing last year, according to Bloomberg.

Celebrities like Tom Brady and his ex-wife Gisele Bundchen also hold common stock.

Creditors also missed out on a massive surge in cryptocurrency prices this year because their claims are set to date when FTX files its insolvency case in 2022 under U.S. bankruptcy rules.

Since then, cryptocurrency prices have increased significantly.

John Ray took over as CEO of FTX when it collapsed. “All we can do as a bankruptcy team is monetize the value and distribute it,” he said, noting that no other bankruptcy case has involved so many claimants. REUTERS

“I’m actually only getting 25% of my Bitcoin back, and that will take many years,” said U.K.-based Arush Sehgal, a member of the FTX unsecured creditors’ committee who had more than $4 million stuck on the exchange went under when it was.

However, the news is lately driving up the price of credit applications, with some now trading at more than 100% of face value, sources told Bloomberg.

Many of these credits traded for as little as 3 cents on the dollar soon after filing for bankruptcy.

Bankman-Fried promised, after the collapse of his company, that he wanted to repay the victims in full.

“All we can do as a bankruptcy team is monetize the value and distribute it,” Ray said, according to Bloomberg, noting that no other bankruptcy case has involved so many claimants. “We cannot create coins and tokens that do not exist. And this is the best alternative.”

“I’ve never seen a case with 2 million customers,” Ray added. “I’ve never seen anything like it.”

Bankman-Fried is serving a 25-year prison sentence for stealing FTX user funds to cover an $8 billion debt at sister company and hedge fund Alameda Research in bankruptcy. Alec Tabak

The judge who handled the case, However, US District Judge Lewis Kaplan had said so during sentencing: “Defendant’s assertion that FTX’s customers and creditors will be paid in full is misleading. It’s logically flawed, it’s speculative.”

Car rental giant Hertz and American Airlines are among other large US companies that have gone through recent bankruptcy and managed to recover all their money from creditors.

Bankman-Fried advised Solana and the decentralized blockchain platform it trades on, which bears the same name, to the prison guards at the Metropolitan Detention Center in Brooklynbefore the 25-year sentence he received for stealing FTX user funds to cover an $8 billion debt at failed sister company and hedge fund Alameda Research.

According to Bloomberg, FTX has also sold dozens of its assets, including various venture capital projects such as a stake in artificial intelligence company Anthropic, in order to amass more cash and repay investors in full.

News

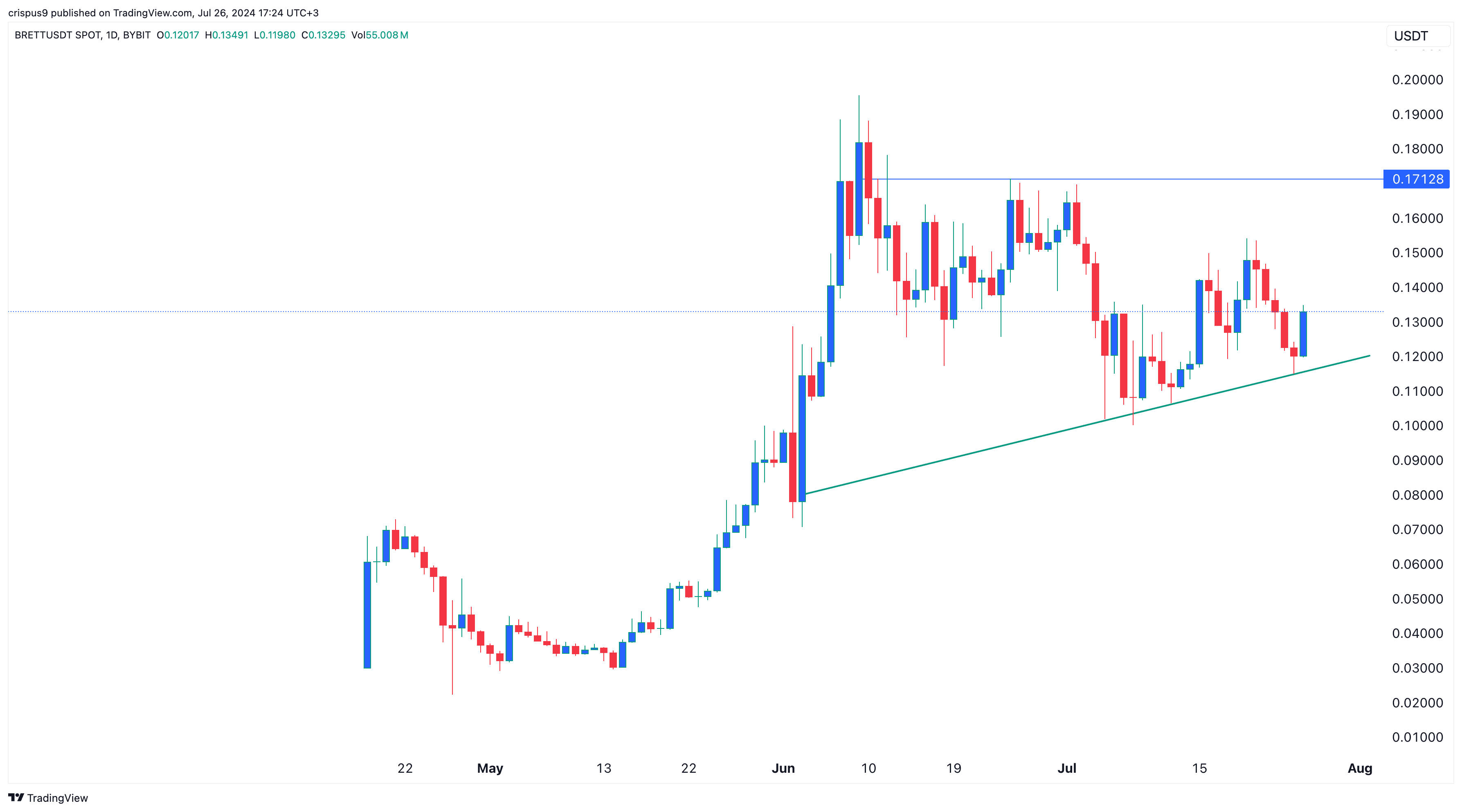

Brett Token Price Soars 12%; Analyst Expects Further 30% Upside

Brett, the largest meme coin in Blockchain Base, rose more than 12% on Friday, as sentiment in the cryptocurrency and stock sectors improved.

Brett (BRETT) the token rose to $0.133, up 31% from its low this month. Some traders believe the meme coin has more upside potential in the future.

Analyst is bullish on Brett

In an X-post, Michael van de Poppe, a trader with over 721,000 followers, said he is optimistic that the token will rise to $0.1712, up 30% from Friday’s trading level.

I’ve been a day trader for a long time and memes are a great way to gain that perspective.

Lots of volume.

And there’s a lot of volatility.When it comes to $BRETTI would look for long positions in this area between $0.125-0.1325 and $0.170 as a clear identification of a potential bull run. photo.twitter.com/hWmSjCZGJa

— Michaël van de Poppe (@CryptoMichNL) July 26, 2024

If he is right, Brett’s market cap will surpass Floki’s (FLOKI), which has a market capitalization of $1.7 billion.

Brett’s bounce came at the start of the Bitcoin 2024 conference today. In a statement at the event, Robert Kennedy, an independent presidential candidate, noted that he is a big supporter of Bitcoin (BTC).

The main protagonist of the event will be Donald Trump, leading in most polls, included in Polymarket. Trump is expected to reiterate his support for cryptocurrencies. Analysts are divided on whether he will announce a Bitcoin reserve at this event.

Blockchain Base is doing well

Brett token also recovered as Base blockchain ecosystems continued to perform well. Launched in 2023 by Coinbase, Base has accumulated over $1.6 billion in DeFi assets, making it the sixth largest chain in the industry. It has surpassed popular networks like Cardano (ADA), Avalanche (AVAILABLE) and Polygon (MATIC).

At the same time, Brett and other altcoins jumped as the U.S. stock market rebounded, signaling that investors have embraced risk-on sentiment. The Dow Jones Industrial Average rose more than 600 points, while the S&P 500 and Nasdaq 100 jumped more than 80 basis points.

Brett Price Chart | Source: Trading View

Technically, Brett formed a morning star pattern, which is a popular reversal sign. In the past, the coin has risen by double digits when it has formed this pattern. For example, it formed on July 12 and then rose by 40%.

On the other hand, this bounce could be a dead cat bounce, where an asset briefly rises and then resumes its downtrend.

News

Top 5 PolitiFi Tokens to Buy Now for MAX Profits

With the US presidential election fast approaching, the cryptocurrency world is buzzing with new trends. In addition to the well-known cartoon-themed meme coins, a new category is making waves: PolitiFi tokens. Did you see that coming?

These politically themed crypto tokens are gaining attention, especially those centered around former President Donald Trump. Today, we explore the 5 trending Trump-themed PolitiFi tokens.

Stock up to benefit later!

1. Trump (Magazine)

Launched about a year ago, the Trump-themed MAGA token has caused quite a stir in the cryptocurrency ecosystem. Inspired by Donald Trump’s slogan “Make America Great Again,” the MAGA token has produced an astonishing 35 million percent return since its inception. Currently trading at $5.65, it has fallen 8.80 percent in the past 24 hours.

Despite this, the token’s trading volume increased by 23.23%, bringing its market cap to $248 million and securing the 220th spot on CoinMarketCap.

Source: Dexscreener

Source: Dexscreener

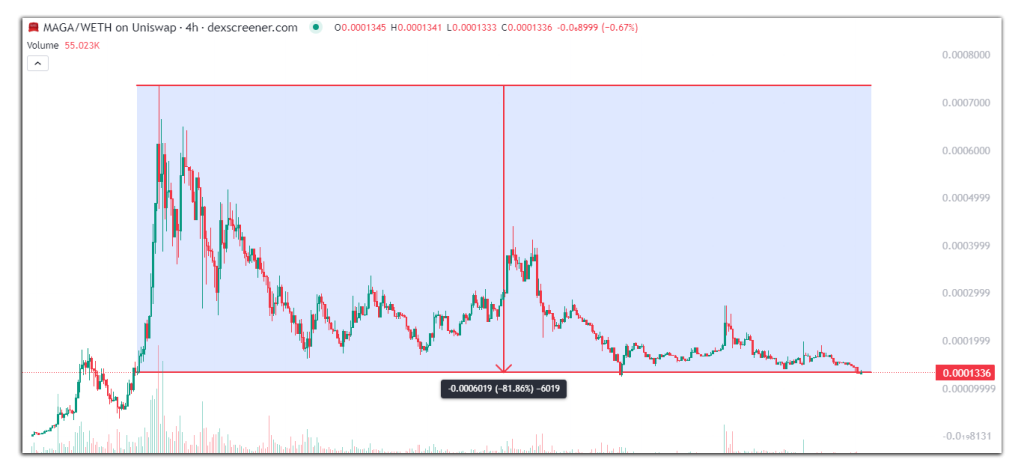

2. MAGA (MAGA)

Another token with the same ticker, MAGA, is also trending in the PolitiFi category. With 390 billion tokens in circulation, this MAGA token has seen a 11.08% price drop over the past 24 hours, but an 81.39% increase in trading volume. Currently trading at $0.0001337, it is ranked 21st on Dexscreener’s trending list and 522nd on CoinMarketCap. Despite being only two months old, it has provided early adopters with a remarkable profit of 313,373.62% at its all-time high of $0.0007354.

Source: Dexscreener

Source: Dexscreener

3. Super Trump Coin (STRUMP)

Super Trump Coin, a meme token depicting Donald Trump as Superman, has a circulating supply of 1.8 billion tokens. Over the past 24 hours, its trading volume has increased by 39.88%. Currently trading at $0.01112, it has dropped by 6.07% over the past 24 hours, but holds a CoinMarketCap rating of 776. From its all-time high of $0.03085, it has dropped by 64.06%. Despite this, its impressive short-term returns have made it a favorite among Trump crypto enthusiasts.

Source: Dexscreener

Source: Dexscreener

4. MAGA Vice President (MVP)

Launched just four months ago, MAGA VP has yet to break into the top 1000 cryptocurrencies on CoinMarketCap, currently ranked 1231st. With a value of $0.128, its trading volume has increased by 21.79% over the past 24 hours, with a market cap of $5.3 million. While it is up 110% at its current price, it is down 83.24% from its all-time high of $0.7706.

Source: Dexscreener

Source: Dexscreener

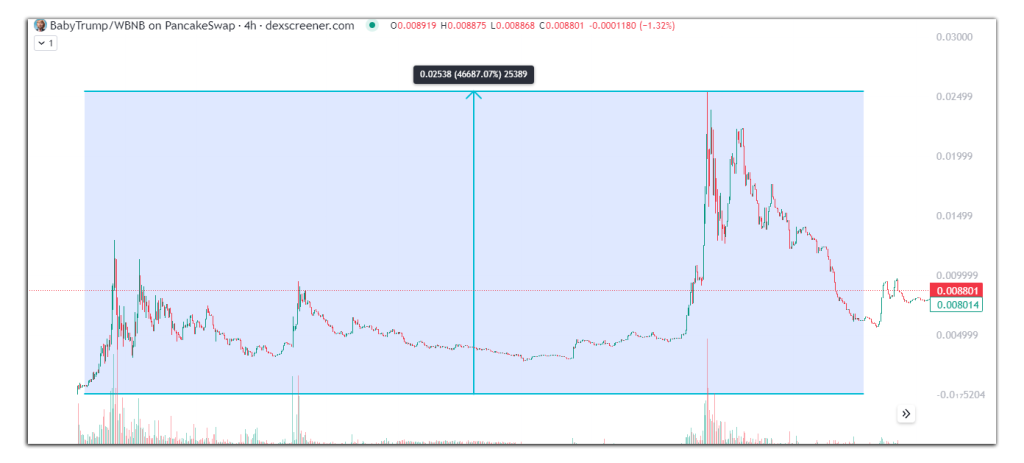

5. Little Trump

One of the most unique Trump-themed tokens is Baby Trump, which depicts Donald Trump as a baby president. With a circulating supply of 406 million tokens, it has a market cap of $3.5 million at a trading price of $0.008616. Although its price has dropped 9.45% in the last 24 hours, its trading volume has increased by 4.29%. At its peak, Baby Trump’s market cap was $11 million.

Notably, Baby Trump is the only token among the five analyzed to be based on the BNB Smart Chain, while the others are based on the Ethereum network.

Source: Dexscreener

Source: Dexscreener

It’s an exciting time for cryptocurrencies

The current political climate in the United States is spawning a new wave of meme tokens themed around various political figures. Among them, Trump-themed PolitiFi tokens are experiencing the most significant surge in popularity. Support for Donald Trump in the crypto community seems to be a driving force behind the success of these tokens.

Do you think Trump-themed PolitiFi tokens are here to stay or just a passing trend? Share your thoughts.

News

Binance Completes Render (RNDR) Token Swap and Rebranding to Render (RENDER)

Lorenzo JengarJul 26, 2024 10:26 AM

Binance has successfully completed the token swap and rebranding of Render (RNDR) to Render (RENDER), opening new trading pairs and enabling deposits and withdrawals.

Binance, a leading cryptocurrency exchange, has successfully completed the token swap and rebranding of Render (RNDR) to Render (RENDER), according to an official announcement from the company. The transition marks a significant milestone for the platform and its users, as deposits and withdrawals for the new RENDER tokens are now open.

New trading pairs and availability

Following the rebranding, Binance has opened spot trading for several new pairs involving RENDER. These pairs include RENDER/BTC, RENDER/USDT, RENDER/FDUSD, RENDER/USDC, RENDER/TRY, RENDER/EUR, and RENDER/BRL. Trading began on July 26, 2024, at 08:00 (UTC). Users engaging in Spot Copy Trading wallets can add these pairs by enabling them in the Personal Pair Preference section of the Spot Copy Trading settings.

Token Distribution and User Instructions

The token exchange was conducted at a ratio of 1 RNDR to 1 RENDER. Users can view the token distribution history via their Binance wallet history. Additionally, there are new RENDER token deposit addresses available for users to obtain.

It is important to note that deposits and withdrawals of the old RNDR tokens are no longer supported. Users are advised to update their wallet addresses and ensure that all transactions involve the new RENDER tokens to avoid any issues.

General information and disclaimers

Binance noted that there may be discrepancies in translated versions of this announcement and that users should refer to the original English version for more accurate information.

For more detailed information, users can refer to the official announcement on Binance website. Source.

As always, Binance reminds users to be cautious with their investment decisions. The platform is not responsible for any losses incurred due to market volatility. Users should consider their own financial situation and consult independent financial advisors if necessary.

Image source: Shutterstock

News

Crypto AI RENDER token soars 15.6% after rebranding. Can it hit $10?

Today, Render Network finalized the migration and upgrade of the cryptographic AI token RENDER. Following the highly anticipated rebranding, the AI token has seen positive price action, rising over 15% in the past day. Investors and market observers have expressed optimism about the rebranded token and believe it could hit $10 soon.

From RNDR to RENDER

Last year, the Render Network Foundation moved from Ethereum (ETH), where it was originally launched, to Solana (SOL). The move followed a community vote that approved two major upgrades to the network.

According to announcementThe move to Solana was “proposed for faster transactions, cheaper fees, and the project’s need to achieve more ambitious goals with more data and on-chain transactions.” The community also voted to rename the token from RNDR to RENDER, which will be finalized in 2024.

This month, the foundation informed users that many cryptocurrency exchanges, including Binance, Kraken, OKX, Crypto.com, and KuCoin, would automatically replace RNDR tokens with the rebranded token at a 1:1 ratio.

Monday, the RNDR The delisting from cryptocurrency exchanges began ahead of the scheduled migration on July 26. Exchanges halted most operations with the token, negatively impacting its performance over the course of the week.

Furthermore, whales apparently contributed impact on the token price. Online reports revealed that some notable holders sold their RNDR following the news, dragging the price from above the $7 support level to below the $6.5 price range.

The token continued to plummet in the following days, falling below the $6 mark, a 17% drop in four days. However, the long-awaited migration and listing of the new RENDER token seems to have kick-started a price recovery.

AI Token Skyrockets 17% After Listing on Binance

The newly renamed cryptocurrency AI Tokens has surged over 17% today after being listed by cryptocurrency exchange Binance. On Friday, the exchange announced that RENDER had been added to Binance Simple Earn, Buy Crypto, and Binance Convert.

Additionally, he revealed that Binance Margin and Futures options will be available today for the AI token. Meanwhile, the Auto-Invest option will be added on Monday, July 29. On that date, cryptocurrency exchange Kraken will also list RENDER and delist RNDR.

Investors and market observers have expressed optimism for the rebranding and listing on Binance. One user X said that as the project enters this new era, “RENDER token with this new chart of lows around $6.5 has the potential to reach unimaginable heights.”

Coinboss Cryptocurrency Analyst consider that the token could “pinball” if it makes a clean break above the $7 resistance level. A successful retest of the target could potentially lead the token to reclaim the $11 mark, further fueling a surge above RNDR’s all-time high (ATH) of $13.53.

Another cryptographic analyst pseudonym you think RENDER may soon hit $10, saying: “Thanks for the fud. See you above $10.” Some users also believe that investors will regret missing the “best buying opportunity.”

Over the past 24 hours, the AI crypto token has seen a remarkable 140% increase in market activity, with a daily trading volume of $83.1 million. At the time of writing, RENDER is trading at $6.89, up 15.6% from the previous day.

RENDER Performance on 3-day chart. Source: RENDERUSDT on Trading View

RENDER Performance on 3-day chart. Source: RENDERUSDT on Trading View

Featured image from Unsplash.com, chart from TradingView.com

-

Videos3 months ago

Videos3 months agoMoney is broke!! The truth about our financial system!

-

News2 months ago

News2 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

Altcoins2 months ago

Altcoins2 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Videos2 months ago

Videos2 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News2 months ago

News2 months agoOver 1 million new tokens launched since April

-

Videos2 months ago

Videos2 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs3 months ago

NFTs3 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

NFTs2 months ago

NFTs2 months agoSolana NFTs jump 30% in 24 hours: what’s behind the increase?

-

Memecoins2 months ago

Memecoins2 months agoSolana Dev hospitalized with third-degree burns while trying to pump Meme Coin

-

Videos3 months ago

Videos3 months agoCryptocurrency Market Update: Where Are We NOW?! What’s next?

-

Memecoins2 months ago

Memecoins2 months agoWhen memecoins reign supreme in the ecosystem!

-

Videos2 months ago

Videos2 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!