Altcoins

FET Vs Render: Which AI Altcoin to Buy, Sell or Hold in May?

As the cryptocurrency market recovers, AI coins have attracted a lot of interest from investors looking to take advantage of the possibilities offered by AI technologies. With a collective market capitalization of approximately $36.6 billion, AI Altcoins experienced a significant increase in trading volume of 18.27% in the last 24 hours, providing numerous opportunities for strategic investments. In this article we explore the contrast between Recover.ai (FET) and Rendering network (RNDR) in terms of buying, selling and selling potential in May.

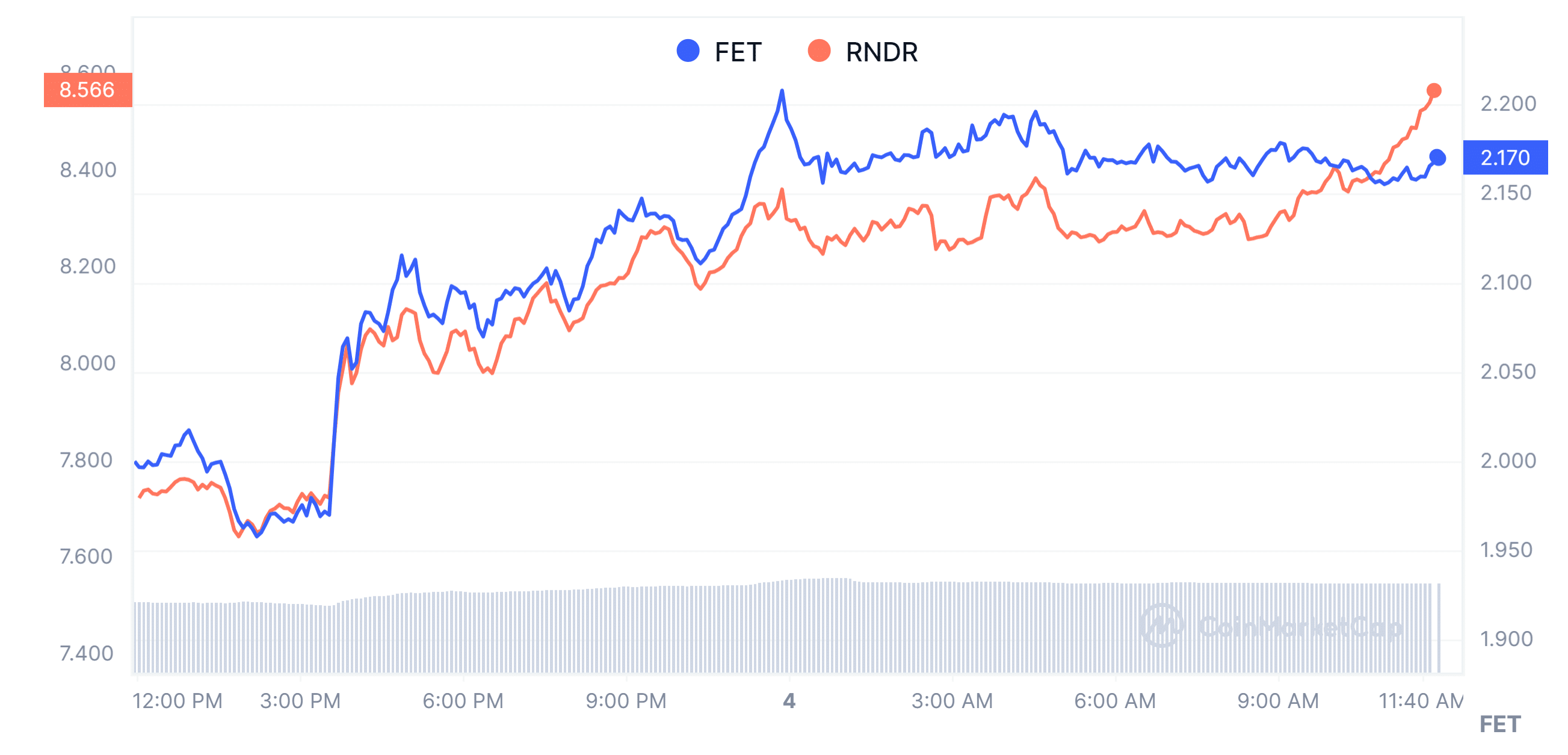

FET vs Render: Market Performance

Fetch.ai (FET) is currently trading at $2.17, showing a significant increase of 8.51% from the last day. However, its results from the previous month show a different picture, with a significant drop of 19.03%.

Despite the recent decline, Fetch.ai has shown long-term growth, increasing by 577.40% over the past year. With a market capitalization of $1.8 billion, FET is currently ranked 55th in the market, according to CoinMarketCap.

The token’s trading volume over the past day is $207.37 million, an increase of 27.13%, with a total circulating supply of 848,193,896 FET.

Focusing on Render (RNDR), the token is currently valued at $8.52, showing an increase of 10.42% over the past day and a rise of 7.92% over the past week.

However, like Fetch.ai, the Render token has faced challenges over the past month, seeing a 10.34% decline in value. Despite this setback, Render is showing significant growth over the past year, up 285.90%. With a market capitalization of $3,297,764,778, Render secures its position at 35th in the market, according to CoinMarketCap.

The token’s trading volume over the last 24 hours stands at $154,117,048, which represents approximately 4.63% of its market capitalization. The circulating supply of Render stands at 386,976,473 RNDR.

Although Fetch.ai and Render have both experienced short-term fluctuations, their long-term trajectories reflect substantial growth potential. As investors evaluate the opportunities presented by these tokens, a comprehensive understanding of their underlying technologies and market dynamics will be essential to making informed decisions.

FET Vs Render: Buy, Sell or Hodl

When considering potential investment strategies for Fetch.ai and Render in May, it is important to analyze different technical indicators to understand their market sentiments and possible directions.

From the FET, the evaluation shows a mix of results. Although the short-term EMAs suggest a buying trend, the longer-term EMAs show a selling trend, resulting in somewhat unclear sentiment. The MACD level indicates decreasing momentum, in line with bearish signals from the EMAs.

Nonetheless, the Relative Strength Index (RSI) is currently in a neutral position, suggesting balanced market sentiment. Analyzing Fibonacci support and resistance levels, Fetch.ai shows potential support around $1.38 and resistance near $2.87.

Will pass Render token, technical analysis presents a more positive point of view. The majority of its short- and long-term EMAs are showing an uptrend, reflecting a positive outlook in the moving averages. The bullish sentiment is supported by the MACD level, indicating a positive market trend.

Likewise, the RSI is currently at a neutral level, suggesting fair sentiment with no clear signs of excessive buying or selling. When it comes to Fibonacci levels, Render Token has higher support and resistance levels than Fetch.ai, suggesting the potential for larger price changes.

In comparison, the Render token appears to be showing more robust bullish signals across different technical indicators, making it potentially more advantageous for purchasing or holding positions in May. Nonetheless, investors should proceed with caution and research thoroughly, considering aspects such as fundamental analysis and overall market trends before making investment choices.

Altcoins

XRP, ADA, and Other Altcoins to Accumulate Ahead of Trump’s Nashville Speech

Bitcoin has recovered most of its losses from the week as traders eagerly await former U.S. President Donald Trump’s appearance at the Bitcoin 2024 conference in Nashville, Tennessee. Interestingly, Bitcoin gained over 1% today as Trump appears to have changed his stance on digital currencies this election cycle.

Analysts Buzz About Altcoins said that this week, crypto whales have been quietly accumulating several altcoins, showing confidence in their short-term potential despite recent performance declines. Here are the top altcoins:

Arbitration:

Current price: $0.72

Whale activity:Despite its significant decline since the start of the year, Arbitrum has seen an 87% increase in net inflow from large holders over the past week. This suggests that whales believe in the token’s long-term potential. Arbitrum, a Layer 2 scaling solution for Ethereum, aims to improve transaction speeds and reduce costs on the Ethereum network. The recent accumulation of whales could indicate confidence in its technology and future adoption.

XRP:

Current price: $0.59

Whale activity:According to Santiment, the number of addresses holding between 100 million and 1 billion XRP tokens has increased since July 23. This shows that the supply has increased from 38% to 40%, which is a sign of growing confidence among large holders. XRP has benefited from recent legal victories and market sentiment, making it an attractive option for whales.

Cardan:

Current price: $0.41

Whale activity:Cardano saw a staggering 10,878% increase in large holder inflows in a single day, surpassing the 5 billion mark. This indicates a significant level of confidence among whales in ADA’s recovery potential. Cardano’s recent upgrades and continued development have been positively received by the market, contributing to its attractiveness.

Chain link

Current price: $13.55

Whale activity: Chainlink recently integrated its Cross-Chain Interoperability Protocol (CCIP) with TrueFi on the Ethereum and Arbitrum blockchain platforms. TrueFi, backed by Coinbase and Chainlink, provides transparent and real-time financial data, improving the decentralized finance (DeFi) ecosystem. This integration could drive increased adoption and usage of Chainlink, making it a popular choice among whales.

Altcoins

Ethereum (ETH) ETF Fails to Spark Altcoin Season, Market Rebounds Above $1 Trillion

The rebound in altcoin market cap to $1 trillion slightly changes the positive dynamics for the much-anticipated altcoin season in Q3 2024.

Bulls took control of today’s session, pushing the total cryptocurrency market cap to $2.39 trillion, up 4% in 24 hours at press time. Total trading volume stands at $82.2 billion, up 4.4% in 24 hours, at the time of writing.

The Ethereum ETF was supposed to be the flagship of the altcoin season, but the response so far suggests nothing in its favor.

Altcoin market cap is moving in a flag pattern, a steady rise above $1.56T could trigger the altcoin rally and lead to the altcoin season with favorable market conditions.

Ethereum ETF Potential Stabilizes

The Ethereum ETF got off to a strong start with $1 billion in trading volume on its first day with massive inflows and outflows. This activity attracted a lot of money to Ethereum but failed to circulate among other altcoins.

With the launch of Ethereum, market sentiments were poised to trigger the altcoin season, but the cooling volume of the ETH ETF and the distributed interest in the BTC ETF could not muster enough power.

While the price of Ethereum (ETH) is yet to react, experts predict that the price will see a massive surge between $4,000 and $7,000. At the time of writing, ETH is trading at $3,271 with a 24-hour growth of 3.08%.

Altcoin Season Indicator Kills All Hopes.

The required demand for the altcoin season has not been met by the cryptocurrency markets and this can be seen in the Altseason Season Index indicator which is below the threshold of 25.

A push above 75 will mark the start of altcoin season.

Source Blockchain Center

Furthermore, analyzing the performance of the top 50 assets in 90 days shows that only 11 of them have outperformed BTC.

To kick off the official altcoin season, at least 75% of assets must outperform Bitcoin.

An increase in inflows and the return of investors in September and October could potentially trigger the altcoin season we have all been waiting for.

Altcoins

Why Altcoins Like Toncoin and Pepe Stumbled This Week

Crypto consumers around the world got excited about the launch of Ethereum spot ETFs! In fact, that wasn’t the case.

Many crypto watchers expected this week to be as hot as the summer season for cryptocurrencies and tokens. After all, the man who could be our next vice president is a well-known crypto advocate (and former venture capitalist), and a new financial instrument tied to a prominent cryptocurrency has debuted.

But somehow the stars didn’t align, and for the most part, the altcoin market crashed. Both utility and meme cryptocurrencies fell during the period, according to data compiled by S&P Global Markets Insights. Yourcoin (TONNE 0.78%), for example, fell by almost 8% over the week, while Peas (POINT 1.62%) and Shiba Inu (SHIB 3.42%) did not do much better, with losses around 7%. Grandpa (PEPE 2.99%) fell by 6%.

Are Hopes for a Cryptocurrency Ally Fading?

That high-profile crypto fan is, needless to say, Republican vice presidential nominee JD Vance. News of his rise to the bottom half of that party’s ticket has crypto fans excited; if Vance and running mate Donald Trump win, the cryptocurrency industry could have a pretty powerful advocate firmly ensconced in the White House for several crucial years.

The excitement faded with Joe Biden’s announcement that he would not seek reelection. Vice President Kamala Harris confidently stepped up to the plate, and at least initially seemed to have a strong sense of purpose and savvy for the vice presidential job. At the same time, doubts seemed to be growing about Vance’s suitability as a No. 2 candidate. This naturally made crypto enthusiasts less enthusiastic about the upcoming election.

This should have been at least somewhat mitigated by the kick-off of Ethereum place exchange traded funds (ETFs). After all, when Bitcoin ETFs were launched earlier this year and sparked a surge in interest in the leading cryptocurrency. This made perfect sense, as a crypto spot ETF is an elegant way for an investor to put money into such assets without having to own them directly.

Of course, few people expected such a craze for Ethereum ETFs. These instruments are no longer a novelty, and Ethereum does not have quite the fame and fascination of its big brother. Still, like Bitcoin ETFs, the Ethereum variant offers the market a quick and easy entry into the currency. And Ethereum is a more versatile instrument than Bitcoin and has more potential, in my opinion, so it is quite surprising that the new ETFs have not been more successful.

Perhaps it’s “crypto ETF fatigue,” or perhaps many investors are only interested in these instruments if they have “Bitcoin” in their title.

Signs of life at the end of the week

That being said, heading into Friday afternoon, there seemed to be something of a rebound in Cryptoland. Bitcoin recovered from the bottom and many altcoins also gained (like Ethereum, which by early evening was up 3%). This may be the start of a new bull run now that the market is recovering from the Harris Effect and the damp squib of the Ethereum ETF launch.

Next week is sure to be an interesting one in the cryptocurrency market; watch this space for more.

Eric Volkman has positions in Bitcoin and Ethereum. The Motley Fool has positions in and recommends Bitcoin and Ethereum. The Motley Fool recommends TON. The Motley Fool has a disclosure policy.

Altcoins

Cryptocurrency Investment Strategies to Maximize Gains During This Altcoin Season

After reaching the peak of the year in March, Bitcoin Bitcoin peaks again at $73,000; market analysts worry about the potential for an explosive altcoin season. Here’s how experts suggest you position your portfolio for this long-awaited “Banana Zone.”

Bee’s Strategy for Beginners

A crypto analyst, Bee shares his knowledge for newcomers with limited capital. He started his journey on the Aptos testnet, earning $30,000 from an APT airdrop in just four months. For those starting out with no funds, Bee recommends getting involved in active testnets like Berachain and Babylon Chain for similar opportunities.

Airdrop Farming and Meme Coins on Mainnet

After his initial success, Bee moved to mainnet airdrop farming, using over 100 accounts to farm the Arbitrum airdrop, which netted him $180,000. He advises investors with at least $1,000 to look into projects on networks like Base Network, Zora, and Hyperlane. Bee has also capitalized on the rise of meme coins, making a $10,000 investment in Pepe (PEPE) at over $160,000 at its peak.

He continues to trade meme coins, recently turning a $3,000 investment in POPCAT tokens into $60,000.

Structured Plans for Altcoin Season

YouTuber “No BS Crypto” offers a structured approach to altcoin season. He emphasizes setting clear goals, adopting a risk-averse mindset, diligently tracking trades, diversifying investments into promising crypto narratives, developing a defined exit strategy, and using disciplined dollar-cost averaging.

Hidden treasures backed by venture capitalists

Interestingly, fellow YouTuber Miles Deutscher suggests looking at VC-backed altcoins that have recently underperformed but are poised to recover. He believes that these tokens, like LayerZero (ZRO), zkSync (ZK), Ethena (ENA), StarkNet and Aethir (ATH) offer solid short-term trading opportunities due to their strong use cases and support despite recent price declines.

Each expert offers a different perspective on maximizing gains during altcoin season, so consider these strategies based on your investment goals and risk tolerance.

Read also : Cat-themed meme coins should be bought amid market recovery

The potential for massive gains is undeniable, but so is the risk. Approach “altcoin season” with caution and a well-thought-out plan.

-

Videos3 months ago

Videos3 months agoMoney is broke!! The truth about our financial system!

-

News2 months ago

News2 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

Altcoins2 months ago

Altcoins2 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Videos2 months ago

Videos2 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News2 months ago

News2 months agoOver 1 million new tokens launched since April

-

Videos2 months ago

Videos2 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs3 months ago

NFTs3 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

NFTs2 months ago

NFTs2 months agoSolana NFTs jump 30% in 24 hours: what’s behind the increase?

-

Memecoins2 months ago

Memecoins2 months agoSolana Dev hospitalized with third-degree burns while trying to pump Meme Coin

-

Videos3 months ago

Videos3 months agoCryptocurrency Market Update: Where Are We NOW?! What’s next?

-

Memecoins2 months ago

Memecoins2 months agoWhen memecoins reign supreme in the ecosystem!

-

Videos2 months ago

Videos2 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!