Altcoins

Ethereum ETFs Will Lead “All Altcoins on Wall Street”

The cryptocurrency industry seems excited and hopeful following the Securities and Exchange Commission’s (SEC) final approval of Ethereum spot exchange-traded funds (ETFs). As investors await the official launch of the investment product, many have been discussing the implications of the debut.

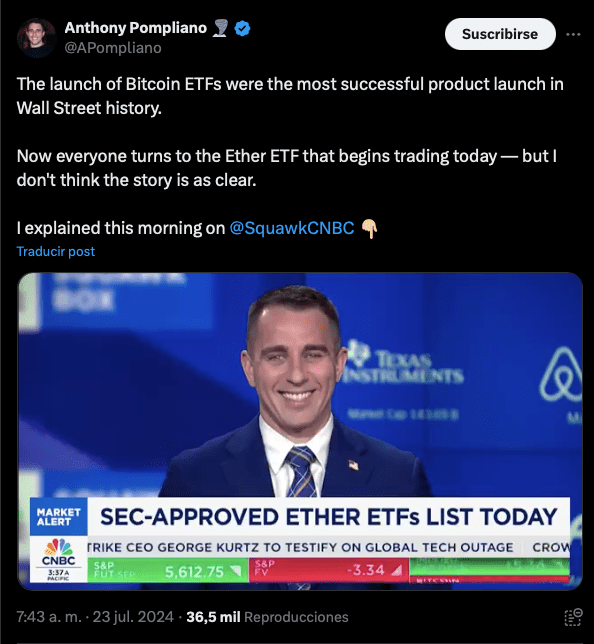

American entrepreneur Anthony Pompliano recently joined CNBC’s Squawk Box to discuss the highly anticipated launch and its potential impact on the market. Pompliano says the ETH ETF story isn’t “as clear-cut” as Bitcoin ETFs, but it will lead to broader adoption in the crypto industry.

Will Ethereum ETFs be comparable to Bitcoin ETFs?

On Tuesday, Anthony Pompliano, CEO of Professional Capital Management, discussed the latest milestone for the crypto industry. During the CNBC interview, the American entrepreneur shared his thoughts on the approval and the launch of Ethereum spot ETFs.

Anthony Pompliano joins CNBC's Squawk Box. Source: Anthony Pompliano on X

Pompliano said that Bitcoin (BTC) ETFs have had a huge impact on the industry and its adoption, calling it “a historic event, probably the best ETF launch in history.” He noted that BTC-based investment products continue to see substantial inflows.

“One of the interesting statistics is that the BlackRock Bitcoin ETF has seen more inflows than QQQ since the beginning of the year,” Pompliano said, noting that just yesterday, BTC products had almost $500 million in admissions.

These numbers raise the question of whether the launch of the second crypto-related ETF will be as big as the first. BTC bulls believe that it won’t be comparable to the BTC ETF numbers because “people aren’t talking about it as much. The media attention, the hype and all that stuff isn’t really there.”

Pompliano believes that the reason for the lack of media and public attention is that the story of ETH “is not as clear” as that of BTC. explain that the story “is clear with Bitcoin, it’s digital gold,” while people discuss Ethereum as a “technology platform” with “much more competition.”

All Altcoins “Will Come to Wall Street”

Despite this “unclear” speech, the American businessman pointed out that companies like Bitwise were offering their ETH-based product as a form of diversification. Pompliano believes that this speech could benefit the Ethereum-based investment product because it could attract people who do not want just one ETF based on the cryptocurrency, but several.

The CEO said that the revenues of the newly launched products will not be “as large” as those Bitcoin “We have to see what the flows look like because the story is not as clear. You won’t have access to staking, so the cash flow that people love about Ethereum is not available to these ETF holders,” he said.

However, Pompliano believes that the approval of ETH ETFs will have a larger impact on the crypto industry. For him, the “interesting” takeaway from today’s launch is “less related to Ethereum and more related to the rest of the market.”

He believes that today’s debut will bring all altcoins to Wall Street, although it could take some time and more regulatory clarity before “these things come to Wall Street.” Pompliano added that the launch of the ETH ETFs has potentially opened the door for the adoption of cryptocurrencies from “simply Bitcoin” to the industry.

So what went from zero to a “Will it be Bitcoin or not?” is now going to become a crypto industry. And the reason why it becomes interesting is because people who have this portfolio model or this portfolio approach are going to start applying it to all of crypto.

Ultimately, Pompliano predicted that Ethereum ETFs will see good inflow numbers and that the price of ETH will increase, “but it won’t be to the extent that people are hoping for because of these other pressures.”

Ethereum is trading at $3,499 in the weekly chart. Source: ETHUSDT on TradingView

Featured image from Unsplash.com, chart from TradingView.com