NFTs

Esqueça BoredApes e CryptoPunks, os NFTs estão de volta às empresas

Há dois anos, os tokens não fungíveis estavam em alta, à medida que aficionados e especuladores de arte empurravam imagens baseadas em blockchain para US$ 27 bilhões em valor. Agora que o mercado quebrou, uma versão muito menos ambiciosa dos NFTs está encontrando um lar bem-vindo nos departamentos de marketing da América corporativa.

Por Maria Gracia Santillana LinaresEquipe da Forbes

Na primeira semana de outubro, a negociação de tokens não fungíveis (NFT) caiu para seu nível semanal mais baixo desde 2020, de acordo com dados do TheBlock, com apenas US$ 50 milhões em colecionáveis digitais negociados em mercados secundários. Foi um mês sombrio para os NFTs, cujo volume de negócios despencou de um recorde de US$ 3,2 bilhões por semana em 2022, à medida que os preços caíram para frações de seus máximos do boom criptográfico.

A atividade morna ocorreu duas semanas antes da Nike planejar vender mais de 30.000 pares de seus populares tênis Dunks em uma coleção ligada a NFTs, com um toque cada vez mais popular que permitiu que compradores não-blockchain entrassem em ação. Ao contrário de praticamente todos os esforços anteriores, os compradores podiam pagar com cartão de crédito em vez de usar criptomoeda, adquirindo um par de Dunks de tamanho personalizado em uma das três combinações de cores: branco e azul, preto e roxo e preto e vermelho.

Apelar aos seus tradicionais compradores jovens deu certo para a Nike, com a venda rendendo US$ 7 milhões, ou uma média de cerca de US$ 230 por par, e cada proprietário do Dunk teria uma versão digital do tênis na blockchain Ethereum. É um modelo de lançamento que provou ser uma manobra de marketing útil – em agosto de 2022, a Nike ofereceu uma coleção de roupas de lazer de 10 peças por meio de sua linha CloneX NFT. A empresa de Beaverton, Oregon, famosa por seu longo relacionamento com Michael Jordan, vende roupas relacionadas ao NFT desde dezembro de 2022, quando lançou a coleção de tênis CryptoKicks iRL com cadarço automático. Peças daquela oferta inaugural que foram vendidas por cerca de US$ 900 agora pode render até US$ 3.000 em sites de revenda de tênis como EstoqueX.

A coleção Dunk Genesis “foi um grande sucesso”, diz Steven Vasilev, cofundador do estúdio NFT RTFKT (pronuncia-se “Artifact”), que foi comprado pela Nike em dezembro de 2021. “Mesmo que o mercado ainda esteja em baixa, nossos produtos são ainda trazendo novas pessoas.

Os tokens não fungíveis são criados, comprados e vendidos em blockchains, como criptomoedas como bitcoin e éter. Mas embora os tokens de cada moeda sejam iguais, cada NFT é único e pode ser usado para recompensar os usuários com várias vantagens ou ser vinculado a objetos no mundo real. Eles também podem ser negociados em vários mercados secundários como o OpenSea.

O cenário do NFT mudou drasticamente nos dois anos desde que os tokens se tornaram parte da arte e da cultura pop convencionais. Há pouco mais de um ano, CryptoPunks, uma coleção de milhares de fotos pixeladas de cabeças e os símios de desenhos animados do Bored Ape Yacht Club, conquistaram preços multimilionários em leilão. Agora, os mais caros raramente são negociados por mais de US$ 100.000. NFTs vendidos por mais de US$ 10 milhões desapareceram no ano passado e empresas nascidas de coleções de NFT, como Rektguy e Yuga Labs, fornecedora de Bored Apes, estão lutando para desviar seus modelos de negócios de pagamentos de royalties gerado pelas vendas secundárias. O mercado geral encolheu para US$ 9,5 bilhões em receita no ano passado, de US$ 26,7 bilhões em 2022, de acordo com CriptoSlam. Emergindo do rescaldo da mania dos NFT estão grandes empresas que estão adotando os tokens como um dispositivo de marketing de ponta, ajudando-os a se aproximar dos clientes existentes e atrair novos.

Para onde NFTs

As vendas de tokens não fungíveis atingiram o pico em 2022, quando as imagens digitais inscritas em blockchains estavam no centro da cultura pop. Dois anos depois, as vendas estão definhando.

“Onde a Nike atende atletas, nós atendemos criadores”, diz Vasilev, que é membro da Forbes 2023 30 Menos de 30 Varejo e Comércio Eletrônico lista. “Não gostamos da palavra NFT”, acrescenta, “acreditamos que é muito técnico e confunde muitos clientes. Por isso, preferimos chamá-los de ‘colecionáveis digitais’.”

Sempresas mais próximas como A Nike está na vanguarda da segunda vinda dos NFTs, mas não está sozinha.

Embora ainda esteja muito longe de obter receitas ou lucros significativos, a América Corporativa está encontrando maneiras úteis de empregar os tokens exclusivos baseados em blockchain em seus arsenais de marketing.

Algumas empresas como a Nike estão incorporando NFTs em seus produtos, trazendo imagens virtuais para a realidade física. A gigante dos cartões de crédito Mastercard, por exemplo, fez parceria com o crypto neobank Hi para permitir que os usuários de NFT exibissem seus próprios NFTs nos cartões plásticos de suas carteiras.

“Os designs dos cartões e os cartões que você usa para pagamento refletem quem você é”, diz Christian Rau, chefe das operações de criptografia e fintech da Mastercard na Europa quando a parceria foi lançada em outubro de 2022. A arte digital em um cartão de crédito “basicamente permite que os consumidores exibir uma manifestação física de um NFT com o qual eles realmente se importam.”

Além da marca física, outros incluíram elementos blockchain nas estratégias de marketing existentes. A Coca-Cola adicionou NFTs à sua campanha publicitária global Masterpiece em junho, na qual as icônicas garrafas vermelhas e pretas da empresa foram distribuídas por versões animadas de obras de arte conhecidas como “The Scream” de Edvard Munch e “Bedroom in” de Vincent Van Gogh. Arles.” Em agosto, a empresa lançou uma série de obras de arte digitais no blockchain Base da Coinbase que colocavam combinações de pinturas famosas e obras contemporâneas em suas garrafas de refrigerante em uma série de imagens digitais vinculadas a NFTs. Coca-Cola’s derrubar arrecadou US$ 543.000 com a venda de 80.000 tokens.

A tática virtual explora os mercados existentes de superfãs da Coca-Cola e colecionadores de embalagens vintage, alguns dos quais estão dispostos a gastar até US$ 4.000 em leilão para as garrafas mais raras. Os NFTs da Coca-Cola, em comparação, permitiram aos colecionadores a chance de comprar US$ 25 em éter para coletar na época da venda de agosto de 2023.

Existem também empresas que estão usando NFTs para dar nova vida aos seus programas de fidelidade. A Starbucks, por exemplo, lançou uma versão de teste de seu programa de fidelidade Odyssey em dezembro de 2022, dando a um grupo seleto de usuários acesso a jogos online e missões que geram recompensas NFT. Os tokens oferecem aos titulares programas exclusivos, incluindo bônus de estrelas Starbucks (pontos de fidelidade da empresa), acesso a bebidas especiais, aulas on-line de preparação de coquetéis e férias.

As recompensas já estão chegando para os membros existentes do Odyssey. Os 20 maiores detentores de pontos em janeiro de 2024 serão convidados a fazer uma viagem com todas as despesas pagas à Costa Rica, onde a Starbucks possui sua única fazenda de café, de acordo com uma postagem no X do executivo da Odyssey Steve Kaczynski.

A Lufthansa da Alemanha adotou uma abordagem semelhante em relação à fidelidade, entregando NFTs comemorativos para determinadas viagens ou destinos aos usuários da plataforma Uptrip da companhia aérea, agindo como selos digitais para as carteiras digitais dos passageiros. O serviço cria NFTs no blockchain Polygon que podem ser resgatado para WiFi gratuito durante o voo, acesso a salas VIP de aeroportos e milhas aéreas.

Tecnicamente, este tipo de programa de fidelidade não precisa depender da tecnologia blockchain para funcionar, mas usá-la poderia tornar o processo mais barato, além de dar aos clientes da Lufthansa a impressão de que a empresa adota a tecnologia mais recente. “As empresas podem ter muitas ferramentas de um programa de fidelidade sem precisar construir tanta infraestrutura”, diz Paul Brody, líder global de blockchain da consultoria Ernst & Young.

Como o objetivo desses itens colecionáveis é, em grande parte, manter os usuários fiéis à empresa emissora, a negociação é desencorajada, então você não verá muitos desses NFTs acumulando volume em mercados como OpenSea e Blur.

Ainda assim, diz Brody, “pode acabar sendo uma ótima publicidade… Sua carteira blockchain vai se tornar um pouco como sua estante de troféus pública”.

O maior obstáculo que as empresas podem enfrentar no marketing – e na expansão de seus mercados – usando NFTs pode vir da natureza dos ativos criptográficos. Obter NFTs geralmente inclui adicionar extensões de navegador, obter uma carteira criptografada, criar senhas longas e fazer transações em moedas digitais como o éter, o que pode ser assustador para os não iniciados.

Essa é parte da razão pela qual Vasilev, da Nike, evita o termo NFT. É também por isso que a RTFKT adicionou uma opção para comprar primeiro o tênis físico (sem o NFT) usando opções tradicionais de pagamento com cartão de crédito em vez de criptografia. Fazer isso no lançamento do Dunk Genesis trouxe novos clientes, diz Vasilev, já que 93% dos compradores que compraram os tênis físicos antes dos NFTs eram clientes pela primeira vez dos produtos RTFKT. “Achamos que esta é uma excelente maneira de integrar novas pessoas”, acrescenta.

Sempresas mais próximas podem representam o casamento perfeito entre a tecnologia NFT e o marketing de marca, especialmente porque as principais marcas já cultivam jovens compradores por meio de um mercado ativo de colecionáveis. Seguindo a Nike, Adidas e Puma estão lançando suas próprias coleções compatíveis com blockchain.

A gigante alemã de roupas esportivas Adidas adotou uma abordagem combinada física e digital para o uso de NFTs. Em agosto, a empresa fez parceria com a marca japonesa de streetwear BAPE para lançar uma edição limitada de 100 pares de tênis brancos virtuais que poderiam ser usados para comprar o equivalente físico. Em parceria com a MoonPay, plataforma de pagamento criptografado, os usuários dão lances nos 100 itens por 72 horas, antes de retirar seu par digital. Cada NFT era negociável, mas também poderia ser trocado por tênis Forum Low 84 da Adidas em um padrão de cor Triple White exclusivo para titulares dispostos a queimar ou destruir o NFT. O lance mais alto por um único par de tênis foi de quase US$ 4 mil, de acordo com Eterscan.

A maior parte dos NFT da Adidas explorações permaneceram dentro das paredes virtuais do metaverso, liberando produtos em plataformas de jogos e participando de Semana de Moda do Metaverso em 2023.

A Puma adaptou estratégias utilizadas por ambos os seus rivais. Depois de experimentar tênis feitos sob encomenda para versões físicas de uma coleção NFT lançada no início de 2022, ela se concentrou na primeira venda de tokens que poderiam ser trocados por uma versão de edições limitadas de um tênis de corrida existente chamado Fast-RB. Por enquanto, porém, ela está se concentrando no uso do Puma Pass, um token que dá aos usuários acesso antecipado a mais coleções NFT e em wearables digitais para serem usados em plataformas de jogos.

“Apenas criar uma coleção de fotos de perfil ou um programa de fidelidade já é uma tarefa fácil”, diz Ivan Dashkov, chefe de tecnologias emergentes da Puma, que vê a criatividade como a chave para o sucesso do blockchain. “Você realmente precisa pensar em maneiras novas e inovadoras de usar [blockchain] tecnologia para alcançar, para interagir com seu cliente.

O uso de NFTs como ferramenta de marketing ainda está engatinhando. Quase nenhum programa de marketing corporativo existente tomou medidas para implementar programas NFT permanentes, diz Brody.

A ênfase está na experimentação e no uso do consumidor e, à medida que a negociação em mercados outrora escaldantes como o OpenSea continua a definhar, ninguém está falando sobre o mercado secundário para NFTs.

Diz Brody: “Estamos caminhando para um futuro que será cada vez mais NFTs como lembranças e troféus públicos, e não como ativos financeiros transferíveis”.

MAIS DA FORBES

ForbesComo Vivek Ramaswamy ficou mais rico enquanto injetava milhões em uma campanha presidencial fracassadaBy ByteDance, proprietário da ForbesTikTok, lançou silenciosamente 4 aplicativos generativos de IA desenvolvidos pelo GPTBy da OpenAI ForbesSundown: Apesar de não pagar US$ 300 milhões em empréstimos, esta empresa solar residencial ainda vale US$ 630 milhões – por enquanto ForbesComo uma empresa de chips em dificuldades se beneficiou das ambições de IA dos investidores do Oriente MédioBy ForbesO bilionário da concessionária de automóveis que ninguém conheceBy

NFTs

RTFKT Announces Project Animus Reveal, Launches Egg Unboxing Event Amid Mixed Reactions | NFT CULTURE | NFT News | Web3 Culture

RTFKT, the innovative creator-led company renowned for its cutting-edge sneakers and metaverse collectibles, has officially unveiled its highly anticipated collection, Project Animus. This project marks a significant milestone in RTFKT’s journey, introducing a new dimension to its digital universe after a long period of development. However, the initial market response has been disappointing, with the revealed Animi trading at a floor price of 0.05 ETH, significantly lower than the eggs’ floor price of 0.09 ETH.

The Genesis of the Project Animus

Initially introduced in October 2022, Project Animus introduces a unique ecosystem of digital creatures called Animi. These Animi are designed to enhance Clone X’s avatars, offering an immersive and engaging experience for the community. The recent reveal showcased a diverse range of Animi species, each with distinct design traits and elemental attributes, breaking away from traditional trait-based rarity systems.

A New Digital Frontier: The History and Evolution of Project Animus

The Animus Project is RTFKT’s latest intellectual property, promising to revolutionize the NFT space with its unique digital creatures. The journey kicked off on October 8, 2022, with an interactive teaser event called “The Eggsperience.” This livestream event allowed attendees to explore a virtual Animus Research Facility, generating intrigue and excitement among the community.

Renowned artist Takashi Murakami played a significant role in the project, revealing the first Murakami-themed Animus creature, Saisei, on April 30, 2023. This collaboration added a layer of artistic prestige to the project, further elevating its status within the NFT community.

Animus Egg Incubation: A Journey from Egg to Animi

Clone X NFT holders had the opportunity to claim an Animus Egg until March 1, 2024. This was followed by the Animus Egg Hatching event, which ran from May 7 to June 4, 2024. During this period, holders of several RTFKT NFTs, including Clone X, Space Pod, Loot Pod, Exo Pod, and Lux Pod, were able to use a points-based system to increase their chances of hatching rarer Animi. The limited supply of Project Animus Eggs is capped at 20,000, with no public sale planned.

Mixed market reception

Despite the excitement and innovative features, the market reaction to the reveal of Project Animus has been lukewarm. Animi is currently trading at a floor price of 0.05 ETH, significantly lower than the eggs’ floor price of 0.09 ETH. This discrepancy has led to disappointment among some collectors who had high expectations for the project.

What Awaits Us: The Future of Project Animus

Following the reveal, RTFKT plans to release a collection of exclusive Animus Artist Edition characters. Holders of Clone X Artist Edition NFTs are guaranteed to get one of these special editions. The distribution will include 88 Special Edition Animus, with 8 Mythic (Dragon Sakura), 40 Shiny, and 40 Ghost Animus. The odds of receiving a Special Edition Animus are the same for all Eggs hatched, regardless of the points accumulated.

The remaining Animus characters will be distributed among unhatched Eggs, encompassing Special Edition Animus, as well as Cosmic Animus and Murakami Element from Generation 1, Generation 2, and Generation 3.

Conclusion

RTFKT’s Project Animus represents a bold step forward in the NFT space, combining cutting-edge technology with artistic collaboration to create an immersive and innovative digital ecosystem. However, the initial market reception highlights the challenges of living up to high expectations in the ever-evolving NFT landscape. As the project continues to evolve, it promises to deliver unique experiences and opportunities for its community, solidifying RTFKT’s position as a leader in the metaverse and digital collectibles arena.

Summary: RTFKT has unveiled Project Animus, introducing a unique ecosystem of digital creatures called Animi designed to enhance Clone X avatars. Despite the excitement, market response has been mixed, with Animi trading at a lower floor price than eggs. The project kicked off with an interactive event in October 2022, featuring collaborations with artist Takashi Murakami. Following the reveal, RTFKT will release special edition Animus characters. The total supply of Animus Eggs is limited to 20,000, with no public sale planned.

NFTs

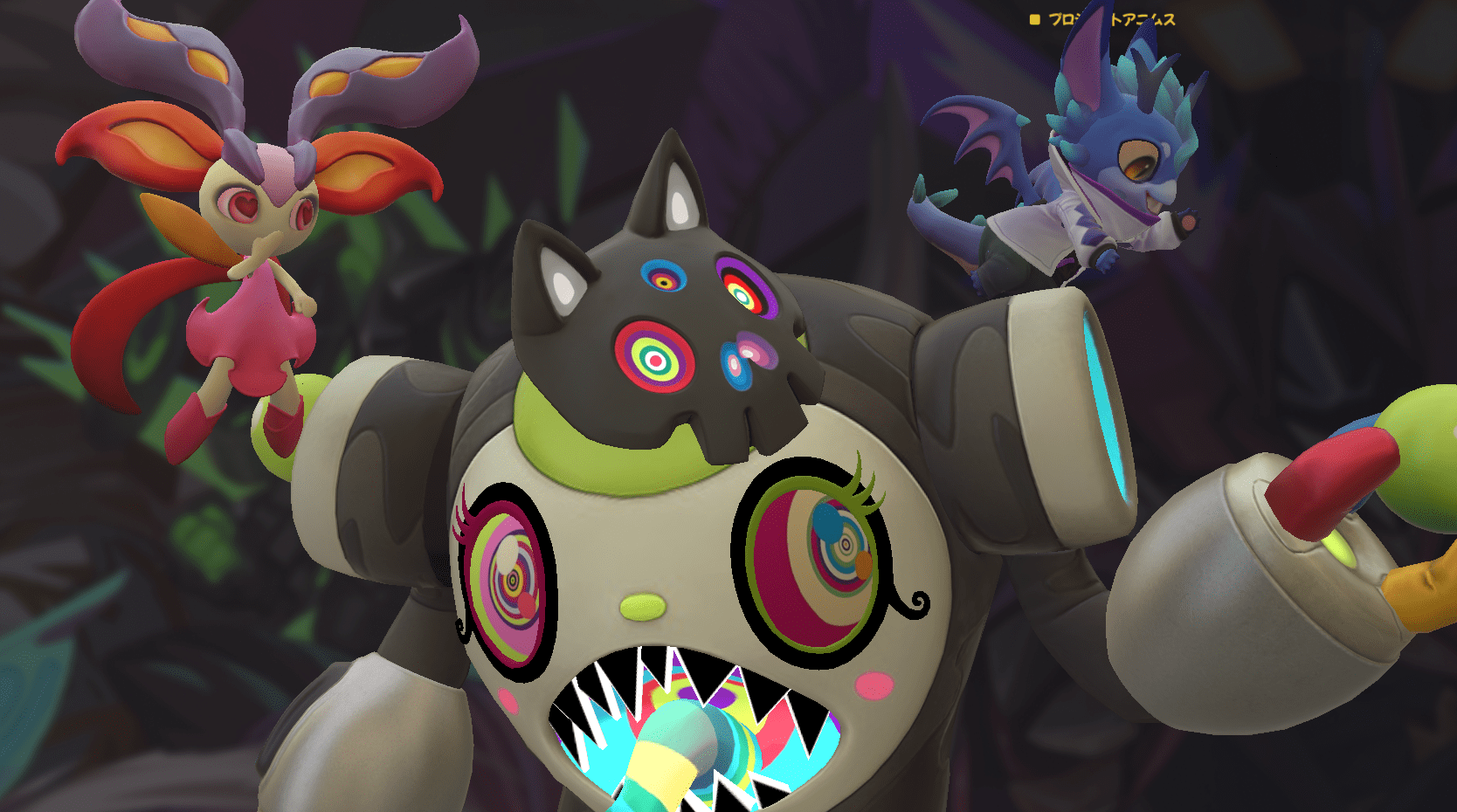

The Olympics have reportedly ditched Mario and Sonic games in favor of mobile and NFTs

The long and historic partnership between Nintendo and Sega to create video games for the Olympics reportedly ended in 2020 as event organizers sought opportunities elsewhere.

Lee Cocker, who served as executive producer on several Mario & Sonic Olympics titles, said Eurogamer the International Olympic Committee let the licensing agreement lapse because it “wanted to look at other partners, NFTs and esports.”

“Basically, the IOC wanted to bring [it] “Turn inward and look for other partners so you can get more money,” Cocker added.

The 2024 Summer Olympics kicked off in Paris last week, but there were no Mario & Sonic games available in time for the event to begin – the first time this has happened since the original release in 2007 to coincide with the 2008 Beijing Summer Olympics.

Over the past two decades, there have been four Mario and Sonic adaptations for the Summer Olympics, as well as two for the Winter Olympics.

This year, instead of a Nintendo/Sega title, the IOC released Olympics Go! Paris 2024, a free-to-play mobile and PC title developed by nWay, which has worked on several Power Rangers games.

Olympics Go! allows players to compete in 12 sports and unlock NFTs from the Paris 2024 digital pin collection.

The original Mario & Sonic at the Olympic Games was announced in March 2007 and marked the first time the two mascots – once archrivals in the console wars of the 1990s – appeared together in a game.

NFTs

DraftKings abruptly shuts down NFT operation, leaving collectors panicking over vast holdings of digital tokens

DraftKings, the daily fantasy sports and sports betting company, abruptly shut down a program called Reignmakers on Tuesday, posting a notice on its website and associated app and sending a mass email to some subset of its user base. Reignmakers, which the company launched in 2021, offered pay-to-play competitions in NFL football, PGA Tour golf and UFC mixed martial arts. The decision to eliminate the entire program, DraftKings says, was not made lightly but was forced “due to recent legal developments.”

DraftKings has yet to specify what “recent legal developments” are troubling its now-dead Reignmakers product. The company was sued in U.S. District Court in 2023 by a Reignmakers player named Justin Dufoe, who accuses the company of dealing in unregistered securities, taking advantage of relatively unsophisticated “retail investors,” and failing to market and support Reignmakers to the degree necessary to return to its users the financial benefits expected. DraftKings filed a motion in September to dismiss Dufoe’s complaint, but that motion was denied on July 2. A scheduling conference was held by the parties on July 29; Reignmakers was permanently shut down on July 30. A DraftKings spokesperson reached by Defector on Wednesday declined to confirm whether Dufoe’s complaint is the “recent legal development” that forced the company’s hand.

Users of the Reignmakers NFL product, who in recent days began murmuring on social channels about a notable lack of DraftKings activity so close to the start of the NFL preseason schedule, were caught off guard and, in some cases, devastated by the news. Members of the DraftKings Discord server, where all Reignmakers-related channels were abruptly shut down and locked following the announcement, flooded a general channel in various states of panic, sharing news, theorizing, lamenting, and, in some cases, openly worrying about whether it would be possible to recoup any decent fraction of the genuinely impressive sums of money they had invested in this DraftKings product.

Reignmakers is nominally a daily fantasy contest—users build lineups of players and then pit those lineups against other users’ lineups for cash prizes—but it’s actually a distributor of nonfungible digital tokens (NFTs), originated and sold by DraftKings, and then frequently resold on a dedicated secondary marketplace also hosted by DraftKings. At the lineup-building level, Reignmakers functions like a card-collecting game, with artificial scarcity driving the prices of the most coveted cards to insane, eye-popping heights. Reignmakers NFTs are tiered and offered in timed drops designed to heighten the sense of scarcity. A user can enter a lower-tier contest using a collection of NFTs that may have cost a few hundred dollars in total (or that were earned by purchasing random packs of NFTs that offer generally low odds of scoring top assets) and throw their lot in with hundreds of casual users competing for relatively unimpressive rewards. Random packs at the lowest tier would have prices as low as a few dollars; mid-tier cards—Star and Elite tiers, I’d guess—could cost a player upwards of $1,000.

But players interested in hunting down the biggest payouts, not just from games but from leaderboard prizes and other assorted prizes, would need to enter higher-tier games, and to enter the higher-tier games, a user’s collection needed to include higher-tier NFTs. DraftKings ensured that these cards were extremely scarce and could only be purchased directly on the marketplace at prices that any reasonable person would consider utterly insane.

For example, the highest-tier Reignmaker contests (called the Reignmakers tier, of course) have in the past been limited to listings with at least two of the highest-tier, rarest NFTs (also the Reignmaker tier) plus three NFTs from the second-highest tier (Legendary). NFTs at these tiers are expensive. Not just expensive in the way that, like, a steak dinner is expensive, but expensive in the way that buying even one of them should trigger a mandatory visit to a gambling addiction counselor, if not sirens and a straitjacket. Back in 2022a Reignmaker-level Ja’Marr Chase NFT from something called the Field Pass Promo Set could be purchased directly from the DraftKings Reignmaker Marketplace for a whopping $32,100.

Reignmakers users purchased NFTs at various levels with the expectation that owning them would convey better odds of winning contests hosted on DraftKings. This was the gamification element of Reignmakers, which emerged several months after DraftKings began trading and minting its NFTs. But as with all NFTs, a very large part of the real appeal for its buyers was the expectation, however insane, that these worthless, virtually worthless, infinitely duplicable digital images would increase in value over time. Now that both the Reignmakers game and the Reignmakers marketplace have been shut down, Reignmakers NFT holders are worried that their investments may have suddenly lost all monetary value. One Discord user described Tuesday as “a bad day to wake up and realize you have $2,000 worth of unopened NFL Rookie Packs”; Another user asked the group if they should expect “a refund” on the $10,000 they’ve already spent on Reignmakers NFTs this year. A pessimistic Reddit user posted tuesday that they would sue DraftKings if they were forced to take a total loss on a Reignmakers NFT collection worth approximately $100,000.

The game (scam?) was built to make numbers like these not only possible, but somewhat easily achievable. A user who intended to compete from a position of strength in multiple overlapping high-profile contests at the same time, and who had been in the blockchain madhouse for a period of years, could easily have spent six figures on Reignmakers NFTs. DraftKings used non-gaming incentives to entice players to spend more and more money, much like casinos give away free suites to players who over-bet on blackjack. Another Reddit user lamented the loss of the additional prizes and ranking bonuses he had hoped to earn in the upcoming NFL season by having a portfolio of NFTs that had reached the highest levels of value and prestige. “I was already loaded up on 2024 creation tokens and rookie debut cards,” said this Reignmakers userwho claimed his portfolio was finally “close to the top 250 overall.”

Dufoe’s complaint says the NFTs minted by DraftKings for Reignmakers qualify as securities, function like securities, and should be regulated as securities. In its motion to dismiss, DraftKings attempted to position its NFTs as game pieces — eye-wateringly expensive, yes, but essentially the same thing as Magic: The Gathering cards or Monopoly hotels. The court, in resolving these arguments, applied what’s known as “the Howey test,” referencing a case from 1946 in which the U.S. Supreme Court established a standard for determining whether a specific instrument qualifies as an investment contract. Judge Dennis J. Casper, in ruling against DraftKings’ motion, concluded that Dufoe could plausibly argue that Reignmakers’ NFT transactions represent “the pooling of assets from multiple investors in such a manner that all share in the profits and risks of the enterprise,” arguing that DraftKings’ absolute control over the game and marketplace effectively binds the financial interests of the company and the buyers, the latter of whom depend on the viability of both for their NFTs to retain any value.

Reignmakers users are different from Monopoly players in at least one crucial way: A person who buys a Monopoly board has no expectation from Hasbro that those little red and green pieces will appreciate in value. It’s a game! No matter what any hysterically conflicted party may say to the contrary, that’s not what NFT collecting is. DraftKings had been selling Reignmakers NFTs for months before they were gamified, and Dufoe, in his complaint, cites public comments made by DraftKings spokespeople that seem to explicitly position Reignmakers NFTs as assets with independent monetary value beyond their utility in Reignmakers contests. Judge Casper, in his ruling on the motion to dismiss, cites a Twitter account associated with a podcast run by DraftKings CEO Matthew Kalish, who in a tweet described NFTs as “the opportunity to invest in startups, artists, operations, and entrepreneurs all at once.” This is probably the kind of thing that NFT peddlers should stop saying. This advice assumes, of course, that NFTs will continue to exist as instruments on the other side of this and other lawsuits.

DraftKings has posted a worryingly sparse FAQ at the bottom of the your ad Tuesday, anticipating but largely failing to address questions from players who see this as yet another in a long line of brutal blockchain rug pulls. In a hilarious reversal of existing Reignmakers policy, Reignmakers users are now allowed by DraftKings to withdraw their Reignmakers NFTs from their DraftKings portfolios and into their personal NFT wallets, where those NFTs will have precisely zero value, to anyone, for the rest of all time. There’s also vague language about Reignmakers users having the option to “relinquish” their NFTs back to DraftKings in exchange for “cash payments,” subject to “certain conditions” and according to an as-yet-unspecified formula that will take into account, among other things, the “size and quality” of a player’s collection.

Reignmakers users are not optimistic. Those who claim to have been victims of other blockchain market crashes are warning their peers on Discord and Reddit to expect payouts that amount to pennies on the dollar; in the absence of any clarifying information, users are unsure whether cashing out their NFTs from Reignmakers to their personal NFT wallets, for reasons that completely pass any and all understanding, would effectively preclude the possibility of delivering these silly digital tokens back to DraftKings. It remains to be seen what exactly DraftKings has in mind with the “certain conditions” attached to the delivery process. There is much that has yet to be resolved. A DraftKings spokesperson contacted by Defector indicated that more time would be needed to answer a list of specific questions and issued a statement noting that it is “in DraftKings’ DNA to innovate and disrupt to provide the best possible gaming experiences for our customers.” The original complaint is embedded below.

Do you know anything about the demise of Reignmakers, either from the consumer side or from the DraftKings side? We’d love to hear from you. Get it in touch!

Recommended

NFTs

There Will Be No More ‘Mario & Sonic’ Olympics Because of NFTs

Nintendo and SEGA have been teaming up with the Olympics for several years now in the popular Mario & sonic in the Olympic Games series, but a new report claims the International Olympic Committee has abandoned the series in favor of new deals in eSports and NFTs.

According to Eurogamer“A veteran behind the series,” Lee Cocker, told the outlet that the IOC chose not to renew its license with SEGA and Nintendo, letting it expire in 2020. “They wanted to look at other partners and NFTs and eSports,” Cocker told Eurogamer. “Basically, the IOC wanted to bring [it] turn inward and look for other partners so they could get more money.”

Mario & Sonic at the Olympic Games is a series that has been running since 2008, with six main games covering the regular and Winter Olympics. In the games, players could control various characters from the Mario and Sonic franchises and compete in Olympic sporting events.

It’s no secret that NFTs are a big part of this year’s Paris 2024 Olympics. Olympics Go! Paris 2024 is a mobile and mobile-connected game your site states that players can “join the excitement of the Paris 2024 Olympic Games with nWay’s officially licensed, commemorative NFT Digital Pins collection honoring Paris 2024!”

As for eSports, Saudi Arabia will host the ESports Olympic Games in 2025. This is part of a partnership with the Saudi National Olympic Committee (NOC) that is expected to last for the next 12 years and is expected to feature regular events.

IOC President Thomas Bach said: “By partnering with the Saudi NOC, we also ensure that Olympic values are respected, in particular with regard to the game titles on the programme, the promotion of gender equality and the engagement with young audiences who are embracing esports.”

In other news, Someone claimed they’re suing Bandai Namco because Elden Ring is too difficult.

-

News12 months ago

News12 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

News12 months ago

News12 months agoOver 1 million new tokens launched since April

-

Memecoins9 months ago

Memecoins9 months agoMemecoins dominate major derivatives in terms of open interest | Flash News Detail

-

Altcoins11 months ago

Altcoins11 months agoAltcoin Investments to create millionaires in 2024

-

News9 months ago

News9 months agoInvest Now: The Hottest New Cryptocurrencies of August 2024 That Could Skyrocket

-

Altcoins9 months ago

Altcoins9 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

NFTs9 months ago

NFTs9 months agoRTFKT Announces Project Animus Reveal, Launches Egg Unboxing Event Amid Mixed Reactions | NFT CULTURE | NFT News | Web3 Culture

-

Altcoins9 months ago

Altcoins9 months agoHot New Altcoin: Memeinator’s Price Upside Potential in July

-

Videos12 months ago

Videos12 months agoMoney is broke!! The truth about our financial system!

-

Memecoins11 months ago

Memecoins11 months agoChatGPT Analytics That Will Work Better in 2024

-

Altcoins12 months ago

Altcoins12 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

News11 months ago

News11 months ago5 Crypto Airdrops After Notcoin to Watch Out for in June 2024