News

Cryptocurrency Statistics 2024: Investing In Crypto

Over the last decade, cryptocurrency has gone from an obscure asset to a wildly popular investment before falling significantly amid increasing interest rates. Cryptocurrencies are a form of digital currency secured through cryptography and computer networks. These currencies are not overseen by traditional central institutions, like a government or bank, and transactions are performed while maintaining the semi-anonymity of buyers and sellers.

How cryptocurrencies work can sometimes be complex. Below is an easy-to-follow guide on the most important things to know about digital currencies and new developments in the crypto market.

Learn about cryptocurrency

- Cryptocurrency was born out of the Great Recession, as the concern over central bank powers grew, and users found a way to decentralize money.

- The first cryptocurrency, Bitcoin, was launched in 2009. Its first transaction was used for two Papa John’s pizzas.

- Cryptocurrencies are made possible by a technology called blockchain, which acts as an electronic ledger for anonymous digital transactions.

- Bitcoin began with a value of less than a penny, and at its historical high hit more than $73,000.

- Since its inception, more than 21,000 different cryptocurrencies have evolved and followed in Bitcoin’s footsteps. Ethereum and Tether sit behind Bitcoin in value to round out the top three.

- 26 percent of millennials owned Bitcoin, according to a July 2023 Morning Consult survey, compared to 14 percent of all U.S. adults.

- Global mining for the largest cryptocurrencies is estimated to create between 110 – 170 million metric tons of carbon dioxide emissions per year, according to a White House report.

Types of cryptocurrency

| Equity tokens | Represent equity in the underlying asset, usually the stock of an actual company or equity in a property. Terms are recorded on the blockchain. Very similar to owning traditional stocks, with the main difference being registration on a blockchain versus a database or paper certificate as is the case with traditional stock. Voting rights are also issued with these tokens through the blockchain. | Tesla and PayPal are just two examples of companies that can be bought as regular shares and as tokenized stocks through the blockchain. |

| Utility tokens | Utility tokens are used to raise funds for new cryptocurrency projects. Utility tokens usually serve a specific purpose for their developer, often to raise capital but can also provide access to products or services. Not considered ownership of an asset like an equity token. | Basic Attention Token (BAT) is used for payments in publishing systems.Golem (GNT) offers a way for users to rent computing power systems. |

| Intrinsic tokens | Also called “native” or “built-in” tokens, these tokens are digital forms of currency and have intrinsic value only insofar as the market values them. They do not represent anything, but simply exist as currency. | Bitcoin (BTC) and Ethereum (ETH) are two of the most well-known intrinsic tokens. |

| Asset-backed tokens | Asset-backed tokens are the digital equivalent of IOUs. These tokens are backed by an underlying asset, something physical like gold, paper money, art or gemstones. Users can claim the underlying asset from a specific issuer by sending the token to the issuer. | Any real, physical asset can be tokenized into an asset-backed token. Often, commodities like gold, crude oil and soybeans are used. |

Crypto market rise and fall

- Following the 2008 recession, an individual or group by the name of Satoshi Nakamoto created a white paper to address central bank control of money and the control governments had over citizens’ money.

- In 2009, Bitcoin was created, launching cryptocurrency from academic concept to real-world currency contender.

- Bitcoin was intended to eliminate the control, oversight and fees associated with cash transactions. The legitimacy provided by third-party institutions like banks was supposed to be replaced by cryptographic networks online.

- On Jan. 3, 2009, the first blockchain was launched with the first “block” called the genesis block.

- The first actual transaction with Bitcoin took place on May 22, 2010 when a Florida man negotiated to have two Papa John’s pizzas worth $25 delivered in exchange for 10,000 bitcoins. This established the first actual value of Bitcoin, at 4 bitcoins per penny. Fans have since dubbed this day “Bitcoin Pizza Day.”

- In February 2011, Bitcoin’s price passed the $1 threshold. Roughly 13 years later, Bitcoin hit an all-time high of $73,750 in March 2024.

- Since Bitcoin’s inception, more than 21,000 different cryptocurrencies have been created.

- Bitcoin is the most valuable coin in circulation, with Ethereum and Tether in second and third place, respectively.

- The value of all existing cryptocurrency is around $2.33 trillion, with around $1.2 trillion of that being attributed to Bitcoin (as of May 6, 2024), according to CoinMarketCap.com.

- The global payments revenue is expected to top $3 trillion by 2026, according to a McKinsey report.

- As of May 5, 2024, the size of the Bitcoin blockchain is approximately 570 gigabytes, about 19 percent higher than where it was one year ago.

Cryptocurrency statistics: Investors and demographics

- About 21 percent of American adults have owned cryptocurrency as of 2022, according to NBC News.

- India is ranked at the top of Chainalysis’s global crypto adoption index, as of Sept. 2023, followed by Nigeria and Vietnam, to round out the top three.

- Many high adopters are developing markets, such as Ukraine, Indonesia and the Philippines, according to Chainalysis.

- In the United States, high-income earners are disproportionately represented among crypto investors, with those making $100,000 or more annually comprising 25 percent of crypto owners but only 15 percent of the general public.

- About 70 percent of cryptocurrency owners are men, but they represent only 48 percent of the general population, according to a report by Morning Consult. Women comprise 30 percent of crypto owners but 52 percent of the general population.

- U.S. crypto ownership by ethnicity, in 2021, according to Morning Consult:

| White | 62% | 69% |

| Hispanic | 24% | 16% |

| Black or African American | 8% | 10% |

| Asian | 6% | 5% |

| Gen Z (born 1997-2012) | 13% | 11% |

| Millennials (born 1981-1996) | 57% | 30% |

| Gen X (born 1965-1980) | 20% | 27% |

| Baby Boomers (born 1946-1964) | 10% | 32% |

Cryptocurrency’s environmental impact

Although cryptocurrencies have created a new, alternative method of payment, the production of cryptocurrency has been mired in controversy because of the energy required to produce it.

Bitcoin and other cryptocurrencies are “mined” on decentralized computer networks that act much like a large ledger. This ledger tracks each transaction of cryptocurrency, and computers throughout the network verify and process each transaction through a blockchain database.

Think of it like a long receipt that records every transaction in a cryptocurrency. As transactions are processed and verified, new bitcoins are created, or mined. Mining is the process of adding another entry onto the receipt, or another block to the chain.

This process requires high-powered and sophisticated computers – and a lot of electricity. Bitcoin alone used an estimated 158 terawatt-hours of electricity annualized as of May 2024 – more than Ukraine and Pakistan – according to the Cambridge Bitcoin Electricity Consumption Index.

Bankrate insights

Bitcoin mining consumes so much electricity that it accounts for 0.62 percent of the entire world’s electricity consumption as of May 2024, according to the Cambridge index. Mining for Bitcoin alone is estimated to create 80.1 million metric tons of carbon dioxide emissions per year, comparable to those created by Greece, according to the Cambridge index.

Other key facts show the environmental impact of cryptocurrency:

- If Bitcoin were a country, it would be in the top 40 energy users worldwide, according to Digiconomist.

- One Bitcoin transaction’s carbon footprint is equivalent to more than 762,000 Visa transactions, according to Digiconomist.

- Bitcoin emissions alone could increase average global temperature above 2°C, according to research in the journal Nature Climate Change.

- It is even estimated that Bitcoin mining consumes the same amount of electricity as all the data centers in the world, according to research in the journal Joule.

Crypto taxes and economic statistics

When cryptocurrencies were first created, it was nearly impossible for government tax agencies to track them. The hallmark of blockchain transactions is anonymity, meaning one could not prove the identity of the buyer or the seller.

In 2014, the IRS stated that cryptocurrency was to be treated as property for federal income tax purposes. Although the agency itself has not released official estimates yet, an analysis from Barclays Bank figures that the IRS loses an estimated $50 billion per year from taxes that should be paid on cryptocurrency assets.

Buying and holding cryptocurrency is not considered a taxable event. You can buy and hold the crypto for as long as you want, though you do have to disclose that on your tax return, but once you decide to sell (or realize the gain or loss) you will need to report the amount of profit or loss from the sale.

Is crypto the future of money?

The popularity of cryptocurrency has grown in recent years as access to crypto has become easier. The asset is still incredibly volatile, and in 2022 rising interest rates caused selloffs in Bitcoin, as skittish investors offloaded speculative assets. Bitcoin recovered somewhat in 2023, and reached a new high in March 2024.

The volatility of major cryptocurrencies such as Bitcoin makes them difficult, if not impossible, to use as currencies. Major currencies need to be mostly stable in order to act as a medium of exchange. So the ideas that cryptocurrencies can be both trading vehicles for profit and functional currencies to transact are at odds with each other.

Governments around the world, including the United States, have also started to analyze how to regulate cryptocurrency. On March 9, 2022, U.S. President Joe Biden signed an executive order calling for a broad review of digital assets, including cryptocurrencies. Federal agencies are reviewing digital currencies and assessing the risk they pose to overall financial stability, among other considerations.

Bankrate insights

The difficulties of tax reporting and the controversy surrounding crypto have resulted in the digital asset being entirely banned in more than a dozen countries including Qatar, Saudi Arabia and China. China, which used to account for the majority of the world’s Bitcoin mining, has now outlawed cryptocurrencies altogether as well.

So far, El Salvador and the Central African Republic accept crypto as legal tender, although both countries have had significant problems with its implementation.

Cryptocurrency, although available as a method of payment for some companies scattered throughout the world, has not made the official leap as a widely available currency. Several major companies already accept cryptocurrency as a form of currency or payment, but the list is relatively limited:

- AT&T offers customers a payment option through BitPay.

- Microsoft allows Bitcoin to pay for Xbox store credits.

- Game streaming platform Twitch accepts Bitcoin and Bitcoin Cash as payment.

- AMC theaters allow moviegoers to purchase tickets with Bitcoin and other cryptos.

- The Dallas Mavericks allow the use of Bitcoin for purchasing game tickets and merchandise through the team’s website.

However, many other companies have introduced the ability to pay with cryptocurrency but then rescinded it when customers failed to actually use it.

Cryptocurrency FAQ

-

What happens if you dont report cryptocurrency on taxes?

You can get into serious trouble with the IRS if you don’t declare all your income and pay taxes on it, including stiff financial penalties and potential criminal penalties such as prison time. You may need to respond to a couple items on your annual tax return, depending on your activities.

For all taxpayers, the IRS asks you whether you’ve transacted in cryptocurrency each year on your Form 1040 tax form. So if you’ve bought or sold cryptocurrency during the tax year, you’ll need to declare that on your taxes – or risk lying on your return.

In addition, if you’ve turned a profit on your crypto trades, you’ll need to report that capital gain and pay taxes on it. Alternatively, if you’ve lost money on your trades, you can claim a loss as well as a tax break.

-

How do beginners invest in cryptocurrency?

Cryptocurrency’s volatile nature, the fact that it is not based on a hard asset or cash flow of an underlying entity and the controversy surrounding its climate impact make it a very speculative investment. Even a more established coin like Bitcoin is risky. All cryptocurrencies are fairly new, and it is difficult to compare asset-backed investments like stocks to digital currencies that are backed purely by investor sentiment.

Beginners should only make crypto a small part (less than 5 percent) of a diversified portfolio that includes stocks and other established wealth-building assets. Investors need to understand exactly how cryptocurrency works – and here’s what else you need to know.

-

What is cryptocurrency mining?

Crypto mining is the process of creating new coins on a given blockchain such as Bitcoin’s. Computers operating these decentralized blockchain networks solve complex mathematical problems to try to earn bitcoins. These high-powered computers compete with one another to solve the problems in the hope that they are rewarded with the bitcoins up for grabs.

Mining is extremely energy-intensive and creates significant carbon emissions, among other negatives. Here are further details into how it all works.

-

Where to buy cryptocurrency?

Traders can buy cryptocurrency at many places nowadays, including traditional payment apps such as PayPal and Venmo, investing apps such as Robinhood and Webull, crypto exchanges such as Coinbase as well as a few traditional brokerages such as Interactive Brokers.

If you’re looking to buy crypto, here are some of the top exchanges and apps to consider.

— Georgina Tzanetos wrote a previous version of this story.

News

Brett Token Price Soars 12%; Analyst Expects Further 30% Upside

Brett, the largest meme coin in Blockchain Base, rose more than 12% on Friday, as sentiment in the cryptocurrency and stock sectors improved.

Brett (BRETT) the token rose to $0.133, up 31% from its low this month. Some traders believe the meme coin has more upside potential in the future.

Analyst is bullish on Brett

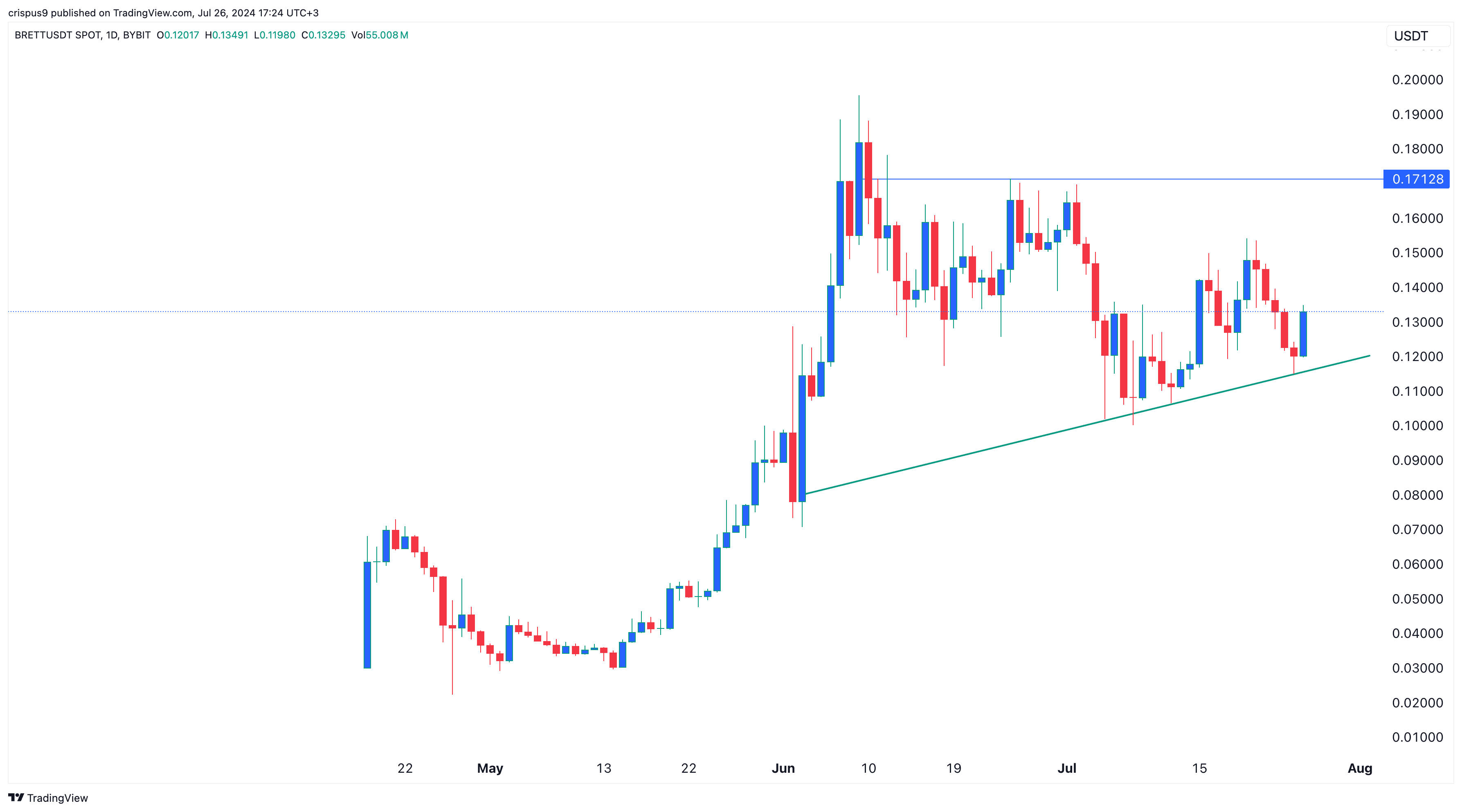

In an X-post, Michael van de Poppe, a trader with over 721,000 followers, said he is optimistic that the token will rise to $0.1712, up 30% from Friday’s trading level.

I’ve been a day trader for a long time and memes are a great way to gain that perspective.

Lots of volume.

And there’s a lot of volatility.When it comes to $BRETTI would look for long positions in this area between $0.125-0.1325 and $0.170 as a clear identification of a potential bull run. photo.twitter.com/hWmSjCZGJa

— Michaël van de Poppe (@CryptoMichNL) July 26, 2024

If he is right, Brett’s market cap will surpass Floki’s (FLOKI), which has a market capitalization of $1.7 billion.

Brett’s bounce came at the start of the Bitcoin 2024 conference today. In a statement at the event, Robert Kennedy, an independent presidential candidate, noted that he is a big supporter of Bitcoin (BTC).

The main protagonist of the event will be Donald Trump, leading in most polls, included in Polymarket. Trump is expected to reiterate his support for cryptocurrencies. Analysts are divided on whether he will announce a Bitcoin reserve at this event.

Blockchain Base is doing well

Brett token also recovered as Base blockchain ecosystems continued to perform well. Launched in 2023 by Coinbase, Base has accumulated over $1.6 billion in DeFi assets, making it the sixth largest chain in the industry. It has surpassed popular networks like Cardano (ADA), Avalanche (AVAILABLE) and Polygon (MATIC).

At the same time, Brett and other altcoins jumped as the U.S. stock market rebounded, signaling that investors have embraced risk-on sentiment. The Dow Jones Industrial Average rose more than 600 points, while the S&P 500 and Nasdaq 100 jumped more than 80 basis points.

Brett Price Chart | Source: Trading View

Technically, Brett formed a morning star pattern, which is a popular reversal sign. In the past, the coin has risen by double digits when it has formed this pattern. For example, it formed on July 12 and then rose by 40%.

On the other hand, this bounce could be a dead cat bounce, where an asset briefly rises and then resumes its downtrend.

News

Top 5 PolitiFi Tokens to Buy Now for MAX Profits

With the US presidential election fast approaching, the cryptocurrency world is buzzing with new trends. In addition to the well-known cartoon-themed meme coins, a new category is making waves: PolitiFi tokens. Did you see that coming?

These politically themed crypto tokens are gaining attention, especially those centered around former President Donald Trump. Today, we explore the 5 trending Trump-themed PolitiFi tokens.

Stock up to benefit later!

1. Trump (Magazine)

Launched about a year ago, the Trump-themed MAGA token has caused quite a stir in the cryptocurrency ecosystem. Inspired by Donald Trump’s slogan “Make America Great Again,” the MAGA token has produced an astonishing 35 million percent return since its inception. Currently trading at $5.65, it has fallen 8.80 percent in the past 24 hours.

Despite this, the token’s trading volume increased by 23.23%, bringing its market cap to $248 million and securing the 220th spot on CoinMarketCap.

Source: Dexscreener

Source: Dexscreener

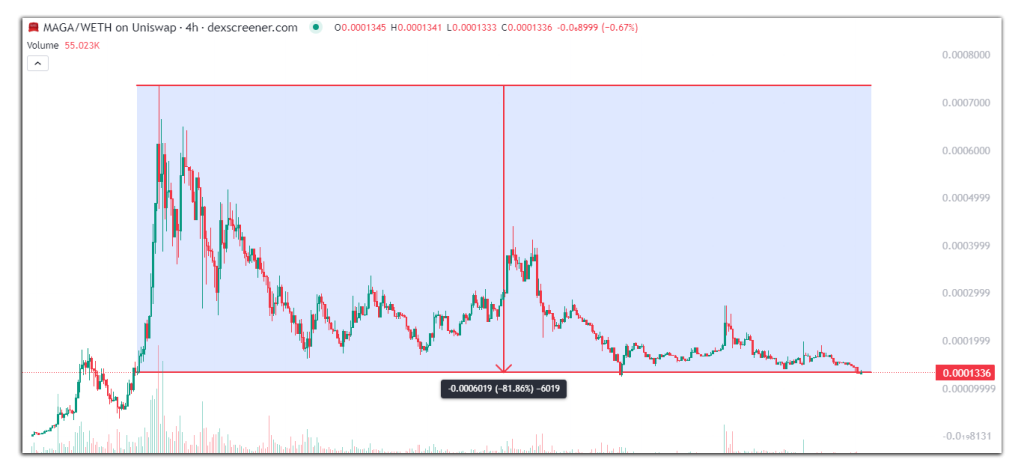

2. MAGA (MAGA)

Another token with the same ticker, MAGA, is also trending in the PolitiFi category. With 390 billion tokens in circulation, this MAGA token has seen a 11.08% price drop over the past 24 hours, but an 81.39% increase in trading volume. Currently trading at $0.0001337, it is ranked 21st on Dexscreener’s trending list and 522nd on CoinMarketCap. Despite being only two months old, it has provided early adopters with a remarkable profit of 313,373.62% at its all-time high of $0.0007354.

Source: Dexscreener

Source: Dexscreener

3. Super Trump Coin (STRUMP)

Super Trump Coin, a meme token depicting Donald Trump as Superman, has a circulating supply of 1.8 billion tokens. Over the past 24 hours, its trading volume has increased by 39.88%. Currently trading at $0.01112, it has dropped by 6.07% over the past 24 hours, but holds a CoinMarketCap rating of 776. From its all-time high of $0.03085, it has dropped by 64.06%. Despite this, its impressive short-term returns have made it a favorite among Trump crypto enthusiasts.

Source: Dexscreener

Source: Dexscreener

4. MAGA Vice President (MVP)

Launched just four months ago, MAGA VP has yet to break into the top 1000 cryptocurrencies on CoinMarketCap, currently ranked 1231st. With a value of $0.128, its trading volume has increased by 21.79% over the past 24 hours, with a market cap of $5.3 million. While it is up 110% at its current price, it is down 83.24% from its all-time high of $0.7706.

Source: Dexscreener

Source: Dexscreener

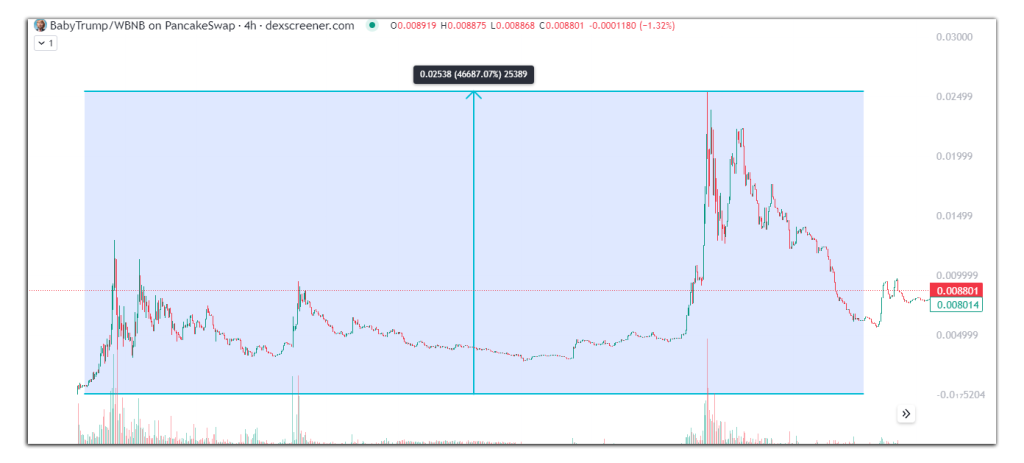

5. Little Trump

One of the most unique Trump-themed tokens is Baby Trump, which depicts Donald Trump as a baby president. With a circulating supply of 406 million tokens, it has a market cap of $3.5 million at a trading price of $0.008616. Although its price has dropped 9.45% in the last 24 hours, its trading volume has increased by 4.29%. At its peak, Baby Trump’s market cap was $11 million.

Notably, Baby Trump is the only token among the five analyzed to be based on the BNB Smart Chain, while the others are based on the Ethereum network.

Source: Dexscreener

Source: Dexscreener

It’s an exciting time for cryptocurrencies

The current political climate in the United States is spawning a new wave of meme tokens themed around various political figures. Among them, Trump-themed PolitiFi tokens are experiencing the most significant surge in popularity. Support for Donald Trump in the crypto community seems to be a driving force behind the success of these tokens.

Do you think Trump-themed PolitiFi tokens are here to stay or just a passing trend? Share your thoughts.

News

Binance Completes Render (RNDR) Token Swap and Rebranding to Render (RENDER)

Lorenzo JengarJul 26, 2024 10:26 AM

Binance has successfully completed the token swap and rebranding of Render (RNDR) to Render (RENDER), opening new trading pairs and enabling deposits and withdrawals.

Binance, a leading cryptocurrency exchange, has successfully completed the token swap and rebranding of Render (RNDR) to Render (RENDER), according to an official announcement from the company. The transition marks a significant milestone for the platform and its users, as deposits and withdrawals for the new RENDER tokens are now open.

New trading pairs and availability

Following the rebranding, Binance has opened spot trading for several new pairs involving RENDER. These pairs include RENDER/BTC, RENDER/USDT, RENDER/FDUSD, RENDER/USDC, RENDER/TRY, RENDER/EUR, and RENDER/BRL. Trading began on July 26, 2024, at 08:00 (UTC). Users engaging in Spot Copy Trading wallets can add these pairs by enabling them in the Personal Pair Preference section of the Spot Copy Trading settings.

Token Distribution and User Instructions

The token exchange was conducted at a ratio of 1 RNDR to 1 RENDER. Users can view the token distribution history via their Binance wallet history. Additionally, there are new RENDER token deposit addresses available for users to obtain.

It is important to note that deposits and withdrawals of the old RNDR tokens are no longer supported. Users are advised to update their wallet addresses and ensure that all transactions involve the new RENDER tokens to avoid any issues.

General information and disclaimers

Binance noted that there may be discrepancies in translated versions of this announcement and that users should refer to the original English version for more accurate information.

For more detailed information, users can refer to the official announcement on Binance website. Source.

As always, Binance reminds users to be cautious with their investment decisions. The platform is not responsible for any losses incurred due to market volatility. Users should consider their own financial situation and consult independent financial advisors if necessary.

Image source: Shutterstock

News

Crypto AI RENDER token soars 15.6% after rebranding. Can it hit $10?

Today, Render Network finalized the migration and upgrade of the cryptographic AI token RENDER. Following the highly anticipated rebranding, the AI token has seen positive price action, rising over 15% in the past day. Investors and market observers have expressed optimism about the rebranded token and believe it could hit $10 soon.

From RNDR to RENDER

Last year, the Render Network Foundation moved from Ethereum (ETH), where it was originally launched, to Solana (SOL). The move followed a community vote that approved two major upgrades to the network.

According to announcementThe move to Solana was “proposed for faster transactions, cheaper fees, and the project’s need to achieve more ambitious goals with more data and on-chain transactions.” The community also voted to rename the token from RNDR to RENDER, which will be finalized in 2024.

This month, the foundation informed users that many cryptocurrency exchanges, including Binance, Kraken, OKX, Crypto.com, and KuCoin, would automatically replace RNDR tokens with the rebranded token at a 1:1 ratio.

Monday, the RNDR The delisting from cryptocurrency exchanges began ahead of the scheduled migration on July 26. Exchanges halted most operations with the token, negatively impacting its performance over the course of the week.

Furthermore, whales apparently contributed impact on the token price. Online reports revealed that some notable holders sold their RNDR following the news, dragging the price from above the $7 support level to below the $6.5 price range.

The token continued to plummet in the following days, falling below the $6 mark, a 17% drop in four days. However, the long-awaited migration and listing of the new RENDER token seems to have kick-started a price recovery.

AI Token Skyrockets 17% After Listing on Binance

The newly renamed cryptocurrency AI Tokens has surged over 17% today after being listed by cryptocurrency exchange Binance. On Friday, the exchange announced that RENDER had been added to Binance Simple Earn, Buy Crypto, and Binance Convert.

Additionally, he revealed that Binance Margin and Futures options will be available today for the AI token. Meanwhile, the Auto-Invest option will be added on Monday, July 29. On that date, cryptocurrency exchange Kraken will also list RENDER and delist RNDR.

Investors and market observers have expressed optimism for the rebranding and listing on Binance. One user X said that as the project enters this new era, “RENDER token with this new chart of lows around $6.5 has the potential to reach unimaginable heights.”

Coinboss Cryptocurrency Analyst consider that the token could “pinball” if it makes a clean break above the $7 resistance level. A successful retest of the target could potentially lead the token to reclaim the $11 mark, further fueling a surge above RNDR’s all-time high (ATH) of $13.53.

Another cryptographic analyst pseudonym you think RENDER may soon hit $10, saying: “Thanks for the fud. See you above $10.” Some users also believe that investors will regret missing the “best buying opportunity.”

Over the past 24 hours, the AI crypto token has seen a remarkable 140% increase in market activity, with a daily trading volume of $83.1 million. At the time of writing, RENDER is trading at $6.89, up 15.6% from the previous day.

RENDER Performance on 3-day chart. Source: RENDERUSDT on Trading View

RENDER Performance on 3-day chart. Source: RENDERUSDT on Trading View

Featured image from Unsplash.com, chart from TradingView.com

-

Videos3 months ago

Videos3 months agoMoney is broke!! The truth about our financial system!

-

News2 months ago

News2 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

Altcoins2 months ago

Altcoins2 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Videos2 months ago

Videos2 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News2 months ago

News2 months agoOver 1 million new tokens launched since April

-

Videos2 months ago

Videos2 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs3 months ago

NFTs3 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

NFTs2 months ago

NFTs2 months agoSolana NFTs jump 30% in 24 hours: what’s behind the increase?

-

Memecoins2 months ago

Memecoins2 months agoSolana Dev hospitalized with third-degree burns while trying to pump Meme Coin

-

Videos3 months ago

Videos3 months agoCryptocurrency Market Update: Where Are We NOW?! What’s next?

-

Memecoins2 months ago

Memecoins2 months agoWhen memecoins reign supreme in the ecosystem!

-

Videos2 months ago

Videos2 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!