News

Cryptocurrencies Have “Too Many Tokens” and Mergers Are Coming to Consolidate DeFi and Memecoin

Among the tokens that replicate complex financial instruments such as re-hyping in many “a dog in a hat” type projects, there are many tokens in the crypto ecosystem nowadays. Too many, according to some experts, who predict a wave of consolidation in the coming weeks and months.

With more than 13,000 tokens and speaking of $2.5 trillion market cap, the question becomes: why are there so many tokens when usage and adoption of the technology is not even close to where it should be?

According to industry observers, we enter mergers and acquisitions (M&A) that could help clean up sectors such as decentralized finance (DeFi) towards NFT projects and even memecoins.

Similar to the dot-com era of the late 1990s, strong interest from venture capital and the general public during the 2021 bull run has led to capital flowing into too many different crypto projects trying to solve similar problems, creating more tokens than necessary.

“Venture capital and excessive funding cycles during bull markets have led to the creation of a number of projects that often seek to solve similar challenges, just taking a slightly different approach,” said Julian Grigo, head of institutions and fintech at smart wallet infrastructure provider. Safe.

Taking inspiration from traditional industries such as the Internet, semiconductors and healthcare, mergers and acquisitions (M&A) can solve the cryptocurrency problem.

“There are already too many tokens and too many ‘projects’ for insufficient adoption and utility,” said Alex Dreyfus, CEO of the Chiliz network, which previously said it was looking for “some aggressive mergers and acquisitions” this ‘year. “Ultimately, consolidation will be key,” he added.

In fact, there is already a three-way merger that occurred last month as artificial intelligence (AI)-related crypto projects. Recover.aiSingularityNET and Ocean Protocol have said they are merging create a $7.4 billion token this will create an AI collective to fight big tech companies.

But this is just one recent example of large-scale mergers and acquisitions. Why aren’t there more?

The simplest answer might be that the industry is still very young and needs more time to reach a level where mergers can become more frequent. “The crypto M&A market is still in its infancy and, as such, there is often no template or regulation that can make transactions more difficult and complex,” said Safe’s Grigo.

Another challenge unique to cryptocurrencies is the nature of token markets. “Mergers and acquisitions are more difficult in the cryptocurrency sector, because a lot of money is invested in cryptocurrency trading and therefore, unlike traditional finance, where a ‘stock’ could die… cryptocurrencies never die. Everything is always an opportunity for exchange,” Dreyfus said.

One way this can potentially be managed is to conclude deals at the token level rather than the company level, meaning each team “can work on their own initiatives while supporting and growing the same ecosystem. This will create more decentralized ecosystems and have also a very powerful network.” effect,” he added.

But it’s not an easy task to accomplish, according to Shayne Higdon, co-founder and CEO of the HBAR Foundation, part of the Hedera ecosystem. “With cryptocurrencies, where the ethos is open source and decentralized, what are you actually buying or merging? Are you merging operations or just a token? The former is incredibly difficult to do when the business is centralized and will be infinitely more difficult in a future decentralized world,” he said.

“In cryptocurrencies it’s about growing the ecosystem and the resulting network effects. Having a common goal is critical to ensuring that communities vote in favor of the merger. These communities also hope, as a result of a merger, to be able to make more money in the long run,” Higdon said.

Mergers and acquisitions in the cryptocurrency industry may lead to “short-term token appreciation,” but could dilute value in the long run. “Without clear, non-redundant roles and responsibilities for the business, teams and staff, it will be difficult to achieve efficient economies of scale,” she added.

This is not to say that mergers and acquisitions fundamentals can’t work for cryptocurrencies.

The first rule of any M&A would be to ensure synergies between companies or projects and whether the new company can gain an advantage over competitors through the merger. “From an infrastructure perspective, we will increasingly see interoperability play a crucial role in aligning these ambitions and, similarly, I expect to see increased M&A activity between projects that share a common goal,” Grigo said by Safe.

The next step would be to understand tokenomics and the incentives for holders to vote for the deal, similar to how bankers would structure a merger or acquisition offer, whether friendly or hostile. “For projects where founders, investors or teams control the majority of the circulating supply, it is easy to negotiate the deal with a limited number of players,” said Oleg Fomenko, co-founder of the decentralized app Sweat Economy.

“Whereas for sufficiently decentralized projects it is easy to launch a ‘hostile takeover’ by offering tokens to all token holders to accumulate a sufficient amount to influence the governance of the protocol,” Fomenko added.

Other considerations include whether a merger can raise awareness of the project, reach a broader community, create a stronger team to achieve a common goal, Fomenko said, adding that the lack of a central means of providing a potential acquisition constitutes one of the biggest hurdles right now for the Web3 ecosystem. In decentralized systems, all token holders are often not known. There is no proxy agency that can contact the owners to then obtain the vote, as would happen with traditional companies.

In traditional finance, one of the biggest obstacles to closing a deal is regulatory uncertainties. TradFi is littered with high-profile merger and acquisition failures, including tech giant Qualcomm’s more than $40 billion acquisition of NXP Semiconductors, which collapsed after China blocked the deal. Another example was when Canada countered the $39 billion mining giant BHP Billiton hostile takeover of Potash Corp.

According to Sweat Economy’s Fomenko, cryptocurrencies’ relatively immature regulatory landscape could prove to be a distinct advantage for the industry. “Given Web3’s track record, it is likely to have the opposite effect and projects with large treasuries, active teams and communities will take advantage of the current regulatory climate and acquire other businesses before M&A regulation emerges in this field, ” he said.

Conversely, a better regulatory regime could incentivize larger mergers and acquisitions as it may encourage larger financial institutions to intervene as they will have a better idea of how regulators will view a potential deal, according to Safe’s Grigo.

So, if dealmaking takes off in the digital asset space, what should investors be watching?

Naturally, projects that are unable to compete with larger competitors will seek to merge their operations to stay afloat. “The next wave of mergers and acquisitions is likely to occur in sectors where there is a high degree of fragmentation, such as Layer 1 chains that have not cracked the Top 10, DEXs, DeFi protocols, node operators, and perhaps even NFT projects “, said Aki Balogh, co-founder and CEO of DLC.Link

Meanwhile, Safe’s Grigo sees M&A taking place “at all levels”, as he doesn’t see any specific area that is immune to consolidation. He also expects traditional operators to pick up the “most innovative” Web3 projects.

However, projects that are only high quality will be able to raise significant amounts for potential mergers and acquisitions. “The big winners of this trend will likely become companies that have very sophisticated cross-chain analytics capabilities, as well as companies that can provide the holder of the specific token with the message about the potential offering,” according to Sweat’s Fomenko.

He said projects with more liquidity and no active teams could become targets of hostile takeovers. “I predict that this will likely happen in fields where the technologies are largely similar across different players: decentralized exchanges (DEXs), collateralized liquidity providers, and liquid staking protocols. However, any project with a token that is a governance could become a target.”

Fomenko believes this could become a dominant force in the memecoin industry.

“My prediction is that this will peak in the memecoin world, where I foresee the emergence of ‘ShibaPepes’ and ‘FlokiDoges’ in no time.”

News

Brett Token Price Soars 12%; Analyst Expects Further 30% Upside

Brett, the largest meme coin in Blockchain Base, rose more than 12% on Friday, as sentiment in the cryptocurrency and stock sectors improved.

Brett (BRETT) the token rose to $0.133, up 31% from its low this month. Some traders believe the meme coin has more upside potential in the future.

Analyst is bullish on Brett

In an X-post, Michael van de Poppe, a trader with over 721,000 followers, said he is optimistic that the token will rise to $0.1712, up 30% from Friday’s trading level.

I’ve been a day trader for a long time and memes are a great way to gain that perspective.

Lots of volume.

And there’s a lot of volatility.When it comes to $BRETTI would look for long positions in this area between $0.125-0.1325 and $0.170 as a clear identification of a potential bull run. photo.twitter.com/hWmSjCZGJa

— Michaël van de Poppe (@CryptoMichNL) July 26, 2024

If he is right, Brett’s market cap will surpass Floki’s (FLOKI), which has a market capitalization of $1.7 billion.

Brett’s bounce came at the start of the Bitcoin 2024 conference today. In a statement at the event, Robert Kennedy, an independent presidential candidate, noted that he is a big supporter of Bitcoin (BTC).

The main protagonist of the event will be Donald Trump, leading in most polls, included in Polymarket. Trump is expected to reiterate his support for cryptocurrencies. Analysts are divided on whether he will announce a Bitcoin reserve at this event.

Blockchain Base is doing well

Brett token also recovered as Base blockchain ecosystems continued to perform well. Launched in 2023 by Coinbase, Base has accumulated over $1.6 billion in DeFi assets, making it the sixth largest chain in the industry. It has surpassed popular networks like Cardano (ADA), Avalanche (AVAILABLE) and Polygon (MATIC).

At the same time, Brett and other altcoins jumped as the U.S. stock market rebounded, signaling that investors have embraced risk-on sentiment. The Dow Jones Industrial Average rose more than 600 points, while the S&P 500 and Nasdaq 100 jumped more than 80 basis points.

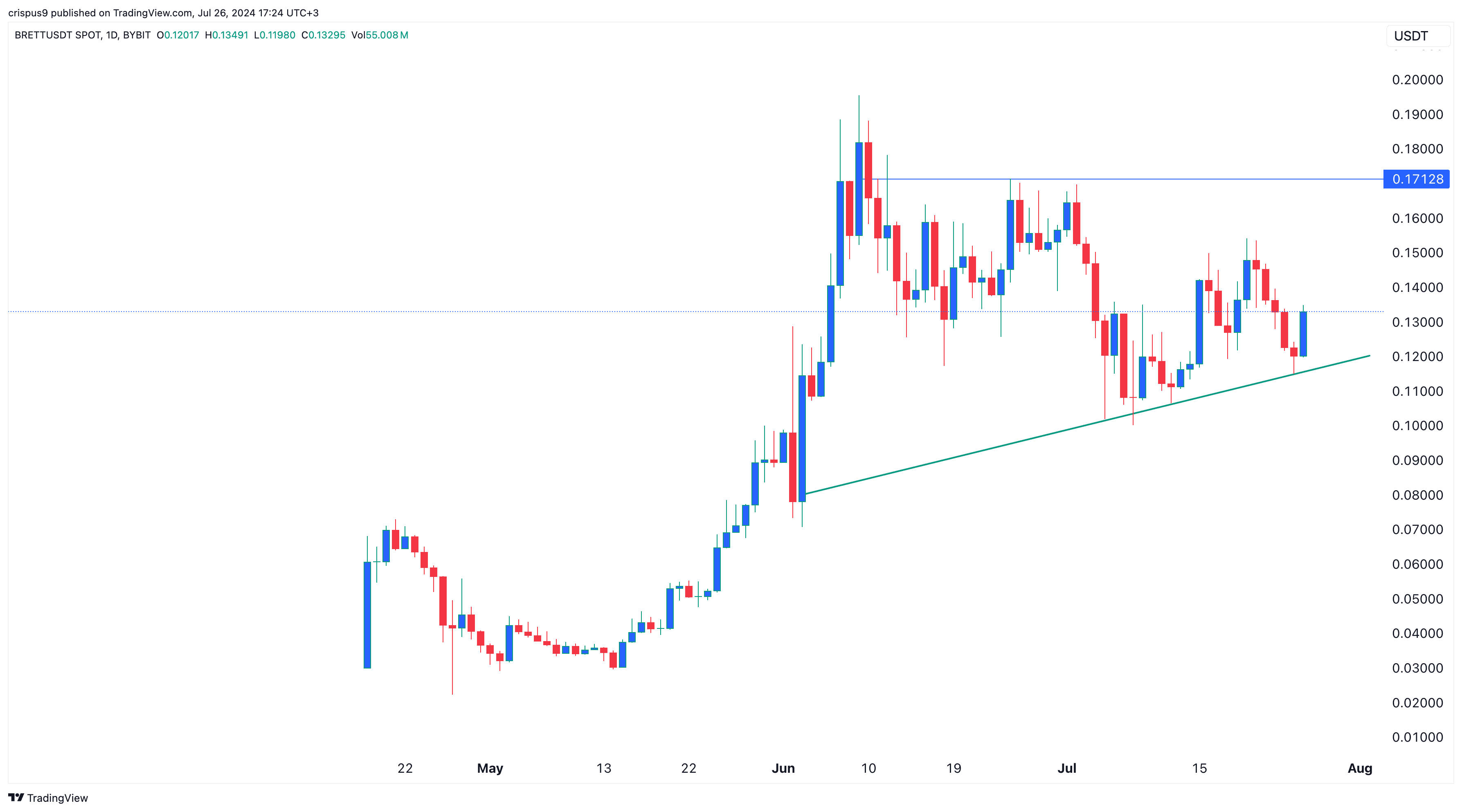

Brett Price Chart | Source: Trading View

Technically, Brett formed a morning star pattern, which is a popular reversal sign. In the past, the coin has risen by double digits when it has formed this pattern. For example, it formed on July 12 and then rose by 40%.

On the other hand, this bounce could be a dead cat bounce, where an asset briefly rises and then resumes its downtrend.

News

Top 5 PolitiFi Tokens to Buy Now for MAX Profits

With the US presidential election fast approaching, the cryptocurrency world is buzzing with new trends. In addition to the well-known cartoon-themed meme coins, a new category is making waves: PolitiFi tokens. Did you see that coming?

These politically themed crypto tokens are gaining attention, especially those centered around former President Donald Trump. Today, we explore the 5 trending Trump-themed PolitiFi tokens.

Stock up to benefit later!

1. Trump (Magazine)

Launched about a year ago, the Trump-themed MAGA token has caused quite a stir in the cryptocurrency ecosystem. Inspired by Donald Trump’s slogan “Make America Great Again,” the MAGA token has produced an astonishing 35 million percent return since its inception. Currently trading at $5.65, it has fallen 8.80 percent in the past 24 hours.

Despite this, the token’s trading volume increased by 23.23%, bringing its market cap to $248 million and securing the 220th spot on CoinMarketCap.

Source: Dexscreener

Source: Dexscreener

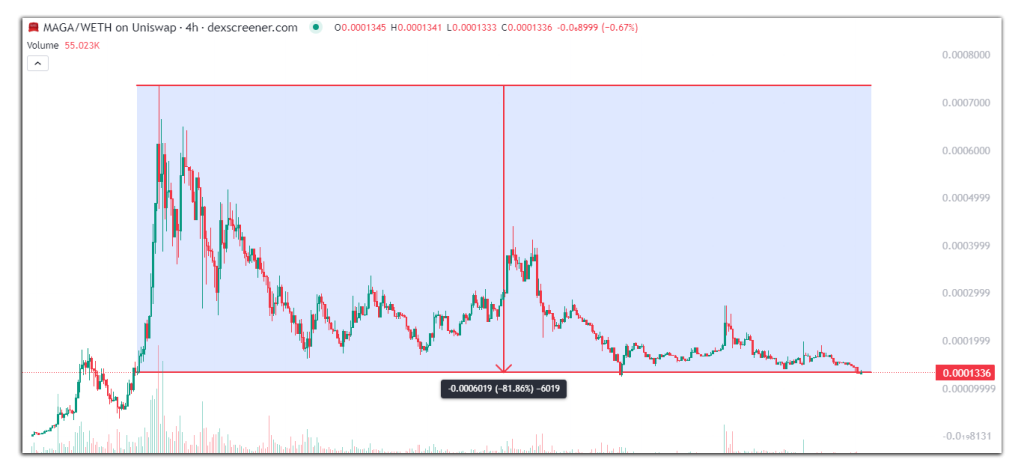

2. MAGA (MAGA)

Another token with the same ticker, MAGA, is also trending in the PolitiFi category. With 390 billion tokens in circulation, this MAGA token has seen a 11.08% price drop over the past 24 hours, but an 81.39% increase in trading volume. Currently trading at $0.0001337, it is ranked 21st on Dexscreener’s trending list and 522nd on CoinMarketCap. Despite being only two months old, it has provided early adopters with a remarkable profit of 313,373.62% at its all-time high of $0.0007354.

Source: Dexscreener

Source: Dexscreener

3. Super Trump Coin (STRUMP)

Super Trump Coin, a meme token depicting Donald Trump as Superman, has a circulating supply of 1.8 billion tokens. Over the past 24 hours, its trading volume has increased by 39.88%. Currently trading at $0.01112, it has dropped by 6.07% over the past 24 hours, but holds a CoinMarketCap rating of 776. From its all-time high of $0.03085, it has dropped by 64.06%. Despite this, its impressive short-term returns have made it a favorite among Trump crypto enthusiasts.

Source: Dexscreener

Source: Dexscreener

4. MAGA Vice President (MVP)

Launched just four months ago, MAGA VP has yet to break into the top 1000 cryptocurrencies on CoinMarketCap, currently ranked 1231st. With a value of $0.128, its trading volume has increased by 21.79% over the past 24 hours, with a market cap of $5.3 million. While it is up 110% at its current price, it is down 83.24% from its all-time high of $0.7706.

Source: Dexscreener

Source: Dexscreener

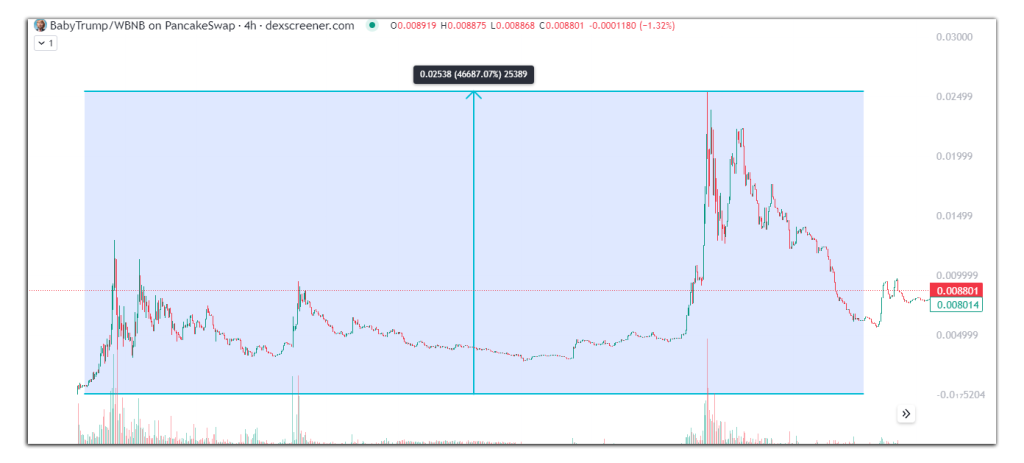

5. Little Trump

One of the most unique Trump-themed tokens is Baby Trump, which depicts Donald Trump as a baby president. With a circulating supply of 406 million tokens, it has a market cap of $3.5 million at a trading price of $0.008616. Although its price has dropped 9.45% in the last 24 hours, its trading volume has increased by 4.29%. At its peak, Baby Trump’s market cap was $11 million.

Notably, Baby Trump is the only token among the five analyzed to be based on the BNB Smart Chain, while the others are based on the Ethereum network.

Source: Dexscreener

Source: Dexscreener

It’s an exciting time for cryptocurrencies

The current political climate in the United States is spawning a new wave of meme tokens themed around various political figures. Among them, Trump-themed PolitiFi tokens are experiencing the most significant surge in popularity. Support for Donald Trump in the crypto community seems to be a driving force behind the success of these tokens.

Do you think Trump-themed PolitiFi tokens are here to stay or just a passing trend? Share your thoughts.

News

Binance Completes Render (RNDR) Token Swap and Rebranding to Render (RENDER)

Lorenzo JengarJul 26, 2024 10:26 AM

Binance has successfully completed the token swap and rebranding of Render (RNDR) to Render (RENDER), opening new trading pairs and enabling deposits and withdrawals.

Binance, a leading cryptocurrency exchange, has successfully completed the token swap and rebranding of Render (RNDR) to Render (RENDER), according to an official announcement from the company. The transition marks a significant milestone for the platform and its users, as deposits and withdrawals for the new RENDER tokens are now open.

New trading pairs and availability

Following the rebranding, Binance has opened spot trading for several new pairs involving RENDER. These pairs include RENDER/BTC, RENDER/USDT, RENDER/FDUSD, RENDER/USDC, RENDER/TRY, RENDER/EUR, and RENDER/BRL. Trading began on July 26, 2024, at 08:00 (UTC). Users engaging in Spot Copy Trading wallets can add these pairs by enabling them in the Personal Pair Preference section of the Spot Copy Trading settings.

Token Distribution and User Instructions

The token exchange was conducted at a ratio of 1 RNDR to 1 RENDER. Users can view the token distribution history via their Binance wallet history. Additionally, there are new RENDER token deposit addresses available for users to obtain.

It is important to note that deposits and withdrawals of the old RNDR tokens are no longer supported. Users are advised to update their wallet addresses and ensure that all transactions involve the new RENDER tokens to avoid any issues.

General information and disclaimers

Binance noted that there may be discrepancies in translated versions of this announcement and that users should refer to the original English version for more accurate information.

For more detailed information, users can refer to the official announcement on Binance website. Source.

As always, Binance reminds users to be cautious with their investment decisions. The platform is not responsible for any losses incurred due to market volatility. Users should consider their own financial situation and consult independent financial advisors if necessary.

Image source: Shutterstock

News

Crypto AI RENDER token soars 15.6% after rebranding. Can it hit $10?

Today, Render Network finalized the migration and upgrade of the cryptographic AI token RENDER. Following the highly anticipated rebranding, the AI token has seen positive price action, rising over 15% in the past day. Investors and market observers have expressed optimism about the rebranded token and believe it could hit $10 soon.

From RNDR to RENDER

Last year, the Render Network Foundation moved from Ethereum (ETH), where it was originally launched, to Solana (SOL). The move followed a community vote that approved two major upgrades to the network.

According to announcementThe move to Solana was “proposed for faster transactions, cheaper fees, and the project’s need to achieve more ambitious goals with more data and on-chain transactions.” The community also voted to rename the token from RNDR to RENDER, which will be finalized in 2024.

This month, the foundation informed users that many cryptocurrency exchanges, including Binance, Kraken, OKX, Crypto.com, and KuCoin, would automatically replace RNDR tokens with the rebranded token at a 1:1 ratio.

Monday, the RNDR The delisting from cryptocurrency exchanges began ahead of the scheduled migration on July 26. Exchanges halted most operations with the token, negatively impacting its performance over the course of the week.

Furthermore, whales apparently contributed impact on the token price. Online reports revealed that some notable holders sold their RNDR following the news, dragging the price from above the $7 support level to below the $6.5 price range.

The token continued to plummet in the following days, falling below the $6 mark, a 17% drop in four days. However, the long-awaited migration and listing of the new RENDER token seems to have kick-started a price recovery.

AI Token Skyrockets 17% After Listing on Binance

The newly renamed cryptocurrency AI Tokens has surged over 17% today after being listed by cryptocurrency exchange Binance. On Friday, the exchange announced that RENDER had been added to Binance Simple Earn, Buy Crypto, and Binance Convert.

Additionally, he revealed that Binance Margin and Futures options will be available today for the AI token. Meanwhile, the Auto-Invest option will be added on Monday, July 29. On that date, cryptocurrency exchange Kraken will also list RENDER and delist RNDR.

Investors and market observers have expressed optimism for the rebranding and listing on Binance. One user X said that as the project enters this new era, “RENDER token with this new chart of lows around $6.5 has the potential to reach unimaginable heights.”

Coinboss Cryptocurrency Analyst consider that the token could “pinball” if it makes a clean break above the $7 resistance level. A successful retest of the target could potentially lead the token to reclaim the $11 mark, further fueling a surge above RNDR’s all-time high (ATH) of $13.53.

Another cryptographic analyst pseudonym you think RENDER may soon hit $10, saying: “Thanks for the fud. See you above $10.” Some users also believe that investors will regret missing the “best buying opportunity.”

Over the past 24 hours, the AI crypto token has seen a remarkable 140% increase in market activity, with a daily trading volume of $83.1 million. At the time of writing, RENDER is trading at $6.89, up 15.6% from the previous day.

RENDER Performance on 3-day chart. Source: RENDERUSDT on Trading View

RENDER Performance on 3-day chart. Source: RENDERUSDT on Trading View

Featured image from Unsplash.com, chart from TradingView.com

-

Videos3 months ago

Videos3 months agoMoney is broke!! The truth about our financial system!

-

News2 months ago

News2 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

Altcoins2 months ago

Altcoins2 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Videos2 months ago

Videos2 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News2 months ago

News2 months agoOver 1 million new tokens launched since April

-

Videos2 months ago

Videos2 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs3 months ago

NFTs3 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

NFTs2 months ago

NFTs2 months agoSolana NFTs jump 30% in 24 hours: what’s behind the increase?

-

Memecoins2 months ago

Memecoins2 months agoSolana Dev hospitalized with third-degree burns while trying to pump Meme Coin

-

Videos3 months ago

Videos3 months agoCryptocurrency Market Update: Where Are We NOW?! What’s next?

-

Memecoins2 months ago

Memecoins2 months agoWhen memecoins reign supreme in the ecosystem!

-

Videos2 months ago

Videos2 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!