Altcoins

BNB wants to cross $600, but why the altcoin may fall to $550 instead

- A bullish invalidation could send BNB down to $561.

- Funding rate and sentiment were negative, suggesting a bearish bias.

Binance [BNB] could attempt to exit according to the 4 hour chart. But AMBCrypto’s analysis revealed that this effort could be in vain.

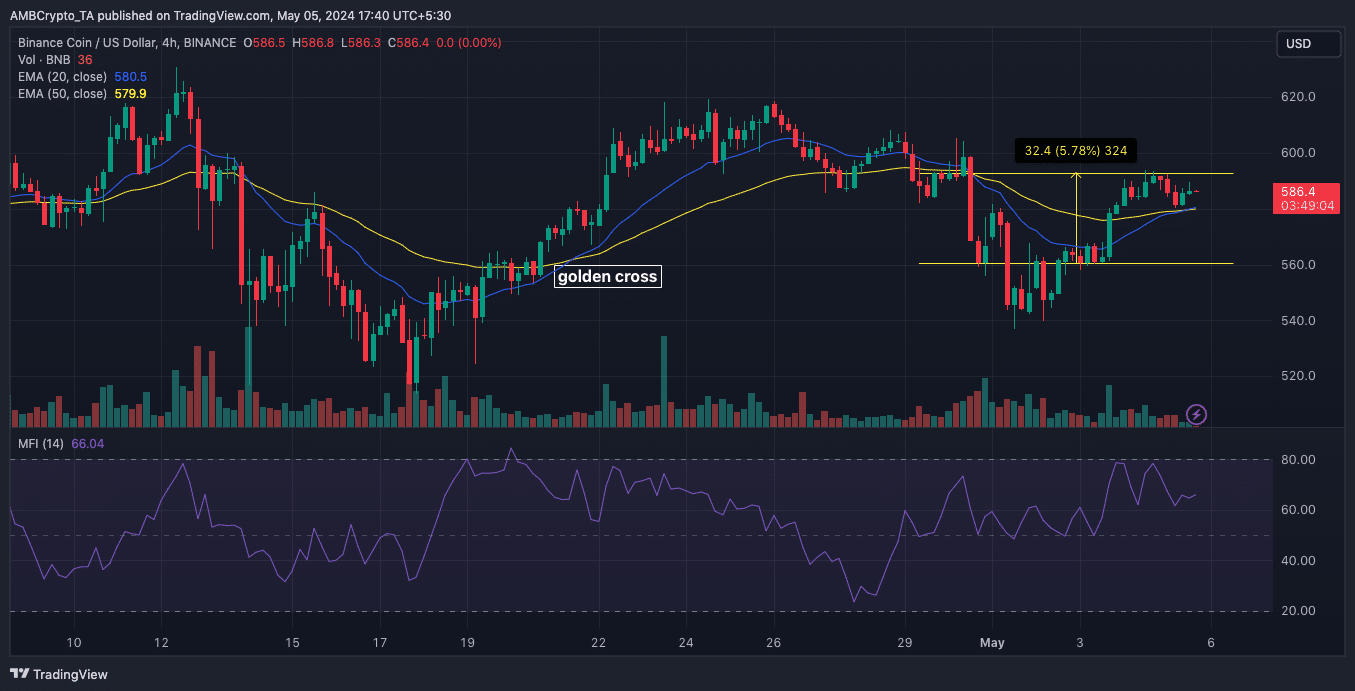

One of the reasons for this prediction is the exponential moving average (EMA). This indicator measures the direction of the trend over a certain period of time.

At press time, BNB changed hands at $586. But the 20 EMA (blue) and the 50 EMA (yellow) were in the same place. The EMA positions indicated the hesitation of the bulls and bears to direct the price action.

Therefore, BNB could trade in a tight range unless a crossover occurs.

The golden cross has disappeared: the next death cross?

If the 20 EMA rises above the 50 EMA, the price could extend around $593. But that seemed unlikely, as BNB’s next target could be $561, which is where the last gold cross occurred.

For those unfamiliar, the golden cross is the terminology used to describe a situation where the 20 EMA rises above the 50 EMA. If the 50 EMA rises above, it is called a famine cross.

Source: TradingView

In addition to the indicator above, another which suggested a decline was the Money Flow Index (MFI).

This indicator uses price and volume data to show whether a cryptocurrency is under buying pressure or not.

At press time, the MFI had fallen to 66.04, indicating that BNB buying volume had declined. If the reading continues to decline, the bearish thesis could be validated.

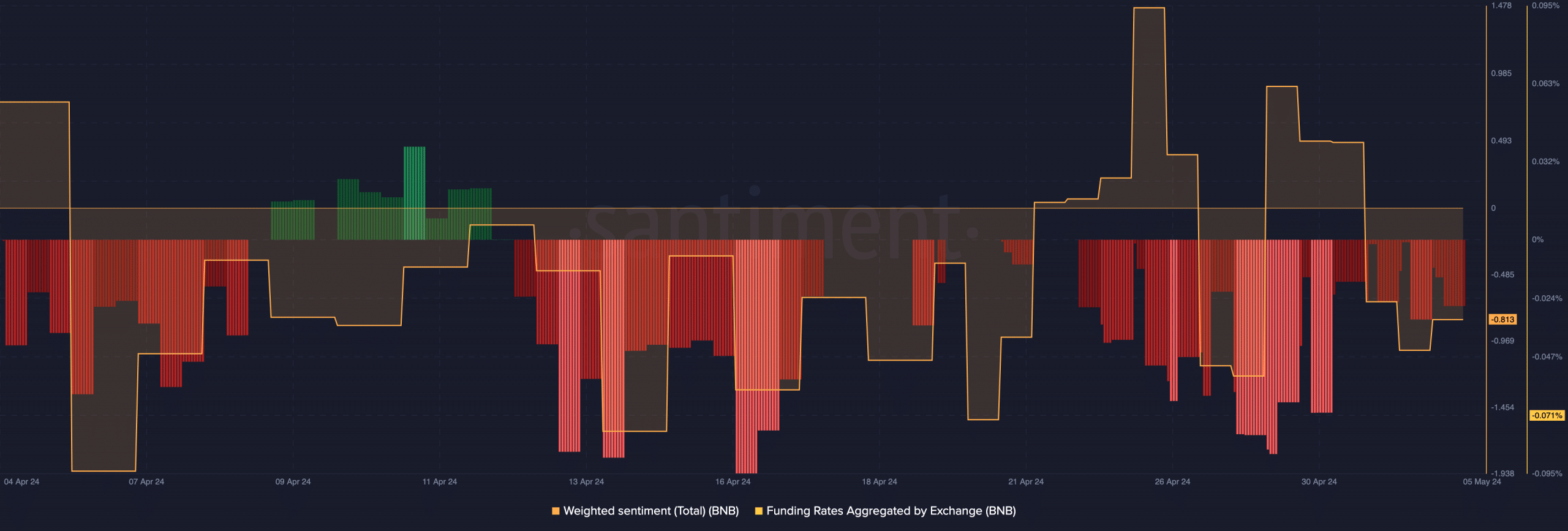

However, this AMBCrypto analysis was not the only one to share this view. A review of on-chain data revealed that a large portion of the market expects the price of BNB to fall.

Bears double their bet

This was clear from the balanced feeling, which was negative at the time of going to press. This negative value shows that most comments about BNB on social platforms were bearish.

As long as that stays the same, it might be difficult for the price to climb. On the other hand, if remarks on BNB start to turn bullish, the trend could change.

Furthermore, an examination of the funding rate showed that it was at the extreme end of the negative zone. The funding rate means more traders have turned to short positions.

Source: Santiment

If the financing was positive, this would have implied that traders bullish on the part. Additionally, financing also impacts the price. At press time, BNB price declined while funding was negative.

Is your wallet green? Check the BNB Profit Calculator

The reasonable conclusion here is that fraudulent sellers are aggressive and get rewards for their positions.

In a case like this, BNB could dampen a bullish move, and a possible decline could be the next step unless spot buyers save the day.

Altcoins

Best Altcoins for the Next Bull Cycle: Santiment’s Recommendations

As Bitcoin (BTC) approached the $67,000 mark on Friday, the altcoin market, led by Ethereum (ETH)has shown strong bullish signals. Many altcoins are reaching the peak of a multi-week consolidation phase that began earlier this year. On-chain data also indicates that institutional investors have been actively buying crypto assets, preparing for the next phase of the bull market.

Additionally, several altcoins have recently retested the bullish breakout of the overall downtrend. With Bitcoin dominance set to decline, focusing on the altcoin market could be a smart move to maximize returns.

Expert advice: What should you pay attention to?

According to market intelligence platform Santiment, investors should keep an eye on the average trading returns of different assets.

After critically analyzing market data, Santiment believes that Shiba Inu (SHIB), Uniswap (UNI), Polygon (MATIC), Chainlink (LINK), Cardano (ADA), and Ripple-backed XRP are the best large-cap altcoins to buy now to maximize profits in the future.

Meanwhile, Santiment pointed out that Toncoin (TONNE), Bitcoin, Ethereum (ETH), and Dogecoin (DOGE) present a higher risk to maximize profits in the planned alternative season.

Market Outlook: Volatility Ahead?

With the Federal Open Market Committee (FOMC) expected to deliver its policy statements next week, increased volatility in the cryptocurrency market is likely. Furthermore, historical data suggests that August could bring a bearish trend for the sector.

Despite this, the cryptocurrency market is expected to turn bullish again in the fourth quarter, driven by the US elections and anticipated interest rate cuts.

Read also : Kennedy Jr. Proposes $615 Billion Bitcoin Investment After Election Victory

Invest smart. The future of cryptocurrencies is bright.

Altcoins

Analyst Says Ethereum-Based Altcoin “Looks Strong As Hell,” Outlines Path Ahead For Bitcoin And Solana

A widely followed crypto analyst and trader believes a memecoin is headed for the next leg higher.

Pseudonymous crypto trader Altcoin Sherpa tell his 216,400 followers on the social media platform X that Pepe (PEPE) market fundamentals appear solid.

“PEPE: I never got a chance to add $0.00001111, but I’m still in it. He seems pretty strong. I’m still a big fan of memes in general.”

Source: Altcoin Sherpa/X

Pepe is trading at $0.00001128 at the time of writing, down 8% in the last 24 hours.

Then the analyst said Ethereum (ETH) rival of Solana (GROUND) has greater upside potential due to network activity.

“SOL: Go long on Solana. Why? Because SOL memes continue to take off and everyone is denominated in Solana. Being in the trenches of crap money really helps you understand this stuff better. I expect a pullback soon, but this would be the bottom to buy in my opinion.”

Source: Altcoin Sherpa/X

Looking at the analyst’s chart, he suggests that SOL could eventually reach $205.

Solana is trading at $166 at the time of writing, down 6.7% in the past 24 hours.

Finally, the analyst said that Bitcoin (Bitcoin) appears to be in an uptrend but could retest the $63,000 level.

“BTC: Price still looks pretty strong to me. If you really want a dip to get in, look for $63,000 around the 200 four-hour exponential moving average (EMA). For now, things should continue in my opinion.”

Source: Altcoin Sherpa/X

At the time of writing, Bitcoin is trading at $64,596, down nearly 2% in the past 24 hours.

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated image: DALLE3

Altcoins

XRP, ADA, and Other Altcoins to Accumulate Ahead of Trump’s Nashville Speech

Bitcoin has recovered most of its losses from the week as traders eagerly await former U.S. President Donald Trump’s appearance at the Bitcoin 2024 conference in Nashville, Tennessee. Interestingly, Bitcoin gained over 1% today as Trump appears to have changed his stance on digital currencies this election cycle.

Analysts Buzz About Altcoins said that this week, crypto whales have been quietly accumulating several altcoins, showing confidence in their short-term potential despite recent performance declines. Here are the top altcoins:

Arbitration:

Current price: $0.72

Whale activity:Despite its significant decline since the start of the year, Arbitrum has seen an 87% increase in net inflow from large holders over the past week. This suggests that whales believe in the token’s long-term potential. Arbitrum, a Layer 2 scaling solution for Ethereum, aims to improve transaction speeds and reduce costs on the Ethereum network. The recent accumulation of whales could indicate confidence in its technology and future adoption.

XRP:

Current price: $0.59

Whale activity:According to Santiment, the number of addresses holding between 100 million and 1 billion XRP tokens has increased since July 23. This shows that the supply has increased from 38% to 40%, which is a sign of growing confidence among large holders. XRP has benefited from recent legal victories and market sentiment, making it an attractive option for whales.

Cardan:

Current price: $0.41

Whale activity:Cardano saw a staggering 10,878% increase in large holder inflows in a single day, surpassing the 5 billion mark. This indicates a significant level of confidence among whales in ADA’s recovery potential. Cardano’s recent upgrades and continued development have been positively received by the market, contributing to its attractiveness.

Chain link

Current price: $13.55

Whale activity: Chainlink recently integrated its Cross-Chain Interoperability Protocol (CCIP) with TrueFi on the Ethereum and Arbitrum blockchain platforms. TrueFi, backed by Coinbase and Chainlink, provides transparent and real-time financial data, improving the decentralized finance (DeFi) ecosystem. This integration could drive increased adoption and usage of Chainlink, making it a popular choice among whales.

Altcoins

Ethereum (ETH) ETF Fails to Spark Altcoin Season, Market Rebounds Above $1 Trillion

The rebound in altcoin market cap to $1 trillion slightly changes the positive dynamics for the much-anticipated altcoin season in Q3 2024.

Bulls took control of today’s session, pushing the total cryptocurrency market cap to $2.39 trillion, up 4% in 24 hours at press time. Total trading volume stands at $82.2 billion, up 4.4% in 24 hours, at the time of writing.

The Ethereum ETF was supposed to be the flagship of the altcoin season, but the response so far suggests nothing in its favor.

Altcoin market cap is moving in a flag pattern, a steady rise above $1.56T could trigger the altcoin rally and lead to the altcoin season with favorable market conditions.

Ethereum ETF Potential Stabilizes

The Ethereum ETF got off to a strong start with $1 billion in trading volume on its first day with massive inflows and outflows. This activity attracted a lot of money to Ethereum but failed to circulate among other altcoins.

With the launch of Ethereum, market sentiments were poised to trigger the altcoin season, but the cooling volume of the ETH ETF and the distributed interest in the BTC ETF could not muster enough power.

While the price of Ethereum (ETH) is yet to react, experts predict that the price will see a massive surge between $4,000 and $7,000. At the time of writing, ETH is trading at $3,271 with a 24-hour growth of 3.08%.

Altcoin Season Indicator Kills All Hopes.

The required demand for the altcoin season has not been met by the cryptocurrency markets and this can be seen in the Altseason Season Index indicator which is below the threshold of 25.

A push above 75 will mark the start of altcoin season.

Source Blockchain Center

Furthermore, analyzing the performance of the top 50 assets in 90 days shows that only 11 of them have outperformed BTC.

To kick off the official altcoin season, at least 75% of assets must outperform Bitcoin.

An increase in inflows and the return of investors in September and October could potentially trigger the altcoin season we have all been waiting for.

-

Videos3 months ago

Videos3 months agoMoney is broke!! The truth about our financial system!

-

News2 months ago

News2 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

Altcoins2 months ago

Altcoins2 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Videos2 months ago

Videos2 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News2 months ago

News2 months agoOver 1 million new tokens launched since April

-

Videos2 months ago

Videos2 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs3 months ago

NFTs3 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

NFTs2 months ago

NFTs2 months agoSolana NFTs jump 30% in 24 hours: what’s behind the increase?

-

Memecoins2 months ago

Memecoins2 months agoSolana Dev hospitalized with third-degree burns while trying to pump Meme Coin

-

Videos3 months ago

Videos3 months agoCryptocurrency Market Update: Where Are We NOW?! What’s next?

-

Memecoins2 months ago

Memecoins2 months agoWhen memecoins reign supreme in the ecosystem!

-

Videos2 months ago

Videos2 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!