News

7 Best Crypto Projects on Blast Network in 2024

Last updated:

April 29, 2024 05:59 EDT

| 11 min read

Blast is one of the latest blockchain projects offering layer 2 solutions for Ethereum. It’s largely focused on passive ETH staking rewards, although the network also serves other use cases. With just over $1.5 billion in total value locked, Blast offers growth investors a first-mover advantage.

In this guide, we explore the 7 best Blast network projects for 2024. Read on to discover undervalued gems before the Blast narrative explodes.

The Top Crypto Projects on Blast Network

Here are 7 Blast network projects to consider investing in today:

- Renzo Restaked ETH (EZETH) – Large-cap Blast project offering decentralized re-staking tools and instant liquidity

- USDB (USDB) – Earn high staking yields of up to 15% without volatility and price speculation

- Juice Finance (JUICE) – Decentralized finance platform offering 300% purchasing power to Blast network users

- PacMoon (PAC) – Community-centric token helping to increase use cases within the Blast ecosystem

- Blast Pepe (BEPE) – One of the first meme coins on the Blast network, FDMC of just $20 million

- Zaibot (ZAI) – Zone artificial intelligence meets crypto with revenue sharing and token tracking

- SwapBlast Finance Token (SBF) – Up-and-coming decentralized exchange for trading Blast network tokens

A Closer Look at the Top Blast Ecosystem Tokens

We’ll now explain how the leading Blast network crypto coins work. Read on to choose the most suitable Blast projects for your portfolio.

1. Renzo Restaked ETH (EZETH) – Large-Cap Blast Project Offering Decentralized Re-Staking Tools

The first Blast network project to consider is Renzo. It specializes in ETH re-staking in collaboration with the EigenLayer ecosystem. EigenLayer is a decentralized finance initiative that simplifies the staking process. The ETH re-staking concept takes crypto staking strategies to the next level.

After staking ETH on the Renzo platform users receive an equivalent number of EZETH tokens. This means users have access to liquidity while earning passive ETH rewards. The Renzo staking protocol is backed by ETH. As such, the value of EZETH is pegged to ETH 1:1. Therefore, the upside potential of EZETH aligns with Etheruem’s performance.

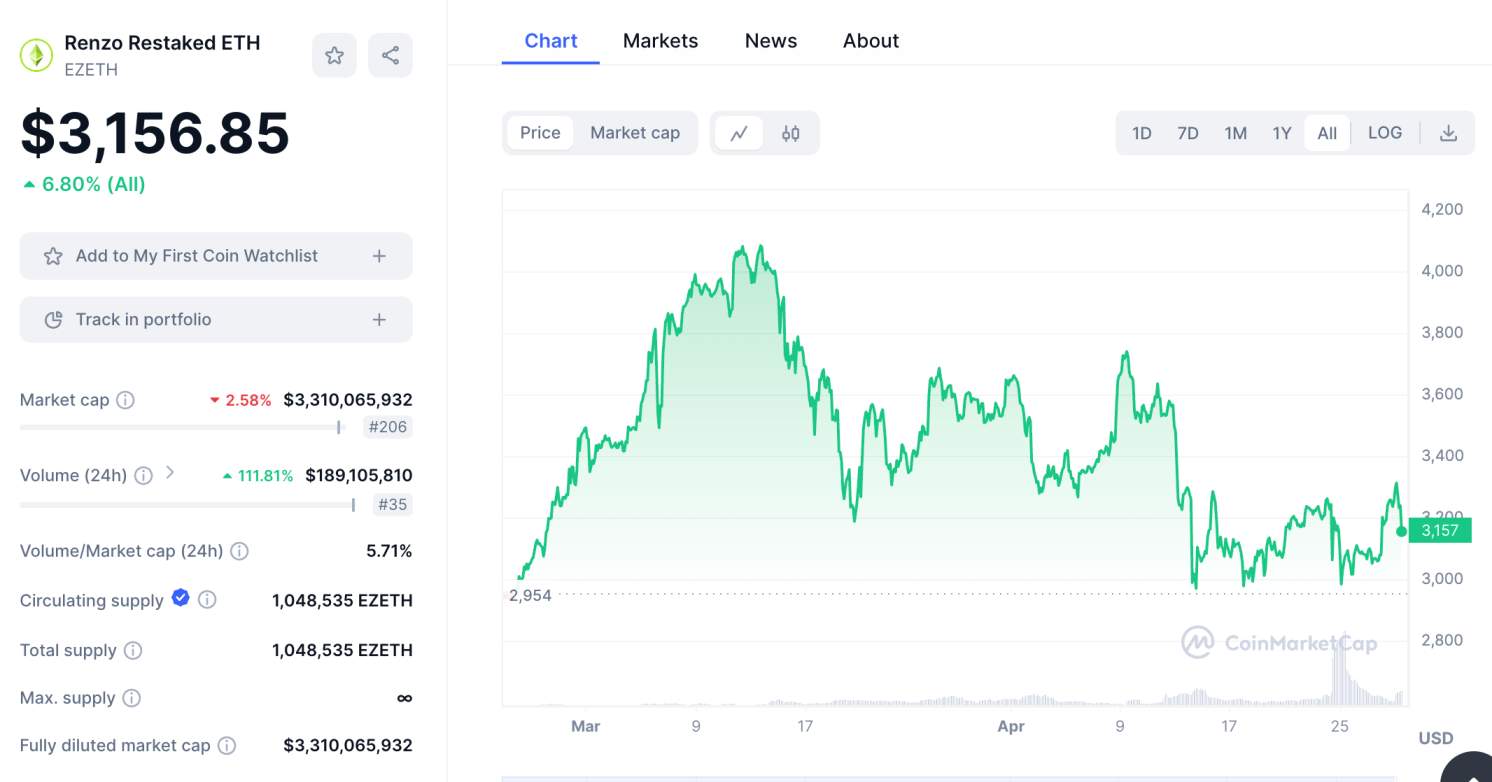

However, opting for EZETH can yield a higher return on investment when factoring in staking rewards. This is because Renzo offers more competitive APYs than the Ethereum network. The APY can increase further when putting the EZETH liquidity to good use. Renzo Restaked ETH has a market capitalization of over $3 billion, making it one of the largest on the Blast network.

2. USDB (USDB) – Earn High Staking Yields of up to 15% Without Volatility and Price Speculation

Next on this list of cryptocurrencies on the Blast network is USDB. This is an algorithmic stablecoin, so there’s no potential for price appreciation. Equally – assuming USDB retains its peg to the US dollar, holders can avoid volatility and price speculation. This means the benefit of buying USDB is the huge yield on offer.

Blast recently increased the staking APY to 15%. This competitive yield is offered in digital T-Bills on the MakerDAO network. It comes with an auto-rebalancing tool to ensure the 1:1 peg is maintained. However, just remember that Terra USD also leveraged algorithmic principles – the stablecoin is now worth a small fraction of a dollar.

Therefore, USDB isn’t risk-free, especially when considering the 15% yield available. In terms of valuation, USDB has a market capitalization of just under $330 million. This will increase as new holders enter the market. Trading volumes are relatively small, with just $43 million worth of USDB changing hands in the last 24 hours.

3. Juice Finance (JUICE) – Decentralized Finance Platform Offering 300% Leverage to Blast Network Users

Juice Finance is also one of the best projects on the Blast network. This is an up-and-coming decentralized finance platform for the Blast ecosystem. It specializes in decentralized ‘Point Farming’. In simple terms, this concept enables users to increase their purchasing power. First, users must deposit ETH into the Juice Finance platform.

The user receives up to 300% of the deposited amount in USDB. The USDB can be used on other crypto ventures within the Blast framework. However, the specific USDB received depends on how many Blast ‘Points’ are earned. Points are accumulated by contributing to the Blast ecosystem. For example, by buying and selling tokens, providing liquidity, or making wallet transfers.

JUICE is one of the newest Blast tokens, having launched in late March 2024. It currently trades 43% below its initial listing price of $0.1588. JUICE is listed on decentralized exchanges like Thruster and MonoSwap. It’s also available on HTX and Gate.io. Juice Finance has a fully diluted market capitalization of $90 million, meaning the upside potential is huge.

4. PacMoon (PAC) – Community-Centric Token Helping to Increase Use Cases Within the Blast Ecosystem

PacMoon is next on this list of Blast network tokens. It claims to be the ‘community coin’ of Blast, although the network hasn’t officially endorsed the project. Nonetheless, PacMoon aims to increase use cases within the broader Blast ecosystem. It’s currently inviting developers to its platform; those contributing are incentivized with PAC tokens.

The PacMoon community – including casual holders, can also take part in the incentive model. For example, those liking PacMoon tweets will receive points. PacMoon states that points can be redeemed for PAC tokens at a later date. In terms of price performance, PacMoon was launched on April 15th, 2024 at $0.07655.

It currently trades 8% below its initial price. That said, PAC tokens have increased by over 30% in the prior 24 hours. This shows that momentum is strong. PacMoon has a market capitalization of almost $19 million. However, just 27% of the total supply is circulating. This translates to a fully diluted valuation of about $70 million.

5. Blast Pepe (BEPE) – One of the First Meme Coins on the Blast Network, FDMC of Just $20 Million

One of the best meme coins on the Blast network is Blast Pepe. Launched in March 2024, it’s one of the original meme projects to adopt the Blast standard. The total supply is 100 billion BEPE; 100% has been issued to the circulating supply. What’s more, Blast Pepe claims to have burned its liquidity pool.

This vastly reduces the risks of being rug-pulled. While Blast Pepe has no use cases or utility, the project will be launching B404 NFTs in the near future. This is the NFT standard for the Blast network. All that said, Blast Pepe is a high-risk investment. It has a market capitalization of under $690,000.

This means BEPE tokens witness huge volatility levels. There’s also a lack of sufficient liquidity in the market. In terms of performance, Blast Pepe is trading 30% below its initial listing price. Since hitting an all-time high of $0.00008047, Blast Pepe has declined by 90%. Based on current prices, Blast Pepe has a market capitalization of just $20 million.

6. Zaibot (ZAI) – Zone Artificial Intelligence Meets Crypto With Revenue Sharing and Token Tracking

Zaibot claims to be the “Vanguard of AI Bots”. This Blast network project is leveraging zone artificial intelligence to help its community stay ahead of the crypto markets. It offers various tools to help maximize gains – including an AI-backed token tracker. This reveals the best micro-cap crypto tokens to invest in before they explode.

Zaibot also offers a ‘Trending Boost’ feature. This raises ETH from the Zaibot community, which is then used to boost pre-agreed tokens on pricing channels. For instance, CoinMarketCap, DexScreener, or Bird Eye – depending on how much is raised. Zaibot also offers a revenue-sharing program. Those contributing to the Zaibot ecosystem receive tokenized rewards.

There’s also a referral program with additional earning opportunities. Zaibot’s native token, ZAI, was launched in March 2024. It currently trades with a nano-cap valuation of $1.2 million. However, this increases to almost $25 million when factoring in the fully diluted supply. ZAI trades almost 60% below all-time highs.

7. SwapBlast Finance Token (SBF) – Up-and-Coming Decentralized Exchange for Trading Blast Network Tokens

SwapBlast Finance Token is an up-and-coming exchange for trading Blast ecosystem tokens. While it aims to become one of the best decentralized exchanges, SwapBlast has a long way to go. Currently, the exchange has just over $487,000 in total value locked. Trading volumes in the prior 24 hours were just under $25,000.

Nonetheless, the broader Blast narrative is still nascent, so SwapBlast Finance Token is still worth considering. In addition to decentralized token swaps, SwapBlast also offers yield services. This includes liquidity provision, with rewards earned in SBF tokens. The exchange also supports staking tools, market analytics, and a decentralized lottery game.

SwapBlast Finance Token isn’t currently listed on CoinMarketCap, so SBF pricing data is taken from CoinGecko. SBF tokens have a fully diluted valuation of just over $192,000. What’s more, the total supply is just 4 million SBF. Even so, SwapBlast Finance Token is up 23% since launching in March 2024.

What is the Blast Layer-2 Network?

At its core, Blast is a layer 2 network for the Ethereum blockchain. Similar to Base, Arbitrum, Polygon, and Optimism, Blast helps the Ethereum ecosystem increase efficiency levels, including greater scalability. For instance, while Ethereum has completed its merge to proof-of-stake, it still processes under 30 transactions per second.

Moreover, high fees continue to hinder the Ethereum experience. As such, the Ethereum ecosystem is turning to layer 2 networks like Blast. In doing so, fees are reduced, and transaction throughput is increased. This ensures that ERC-20 projects operate viable business models. Otherwise, each smart contract movement further contributes to network overload.

In addition, the Blast network claims to be the only layer 2 project offering native yields on ETH and stablecoins. The latter includes APYs of up to 15% on USDB, an algorithmic stablecoin pegged to the US dollar. Blast also offers re-staking services via Renzo Restaked ETH, providing real-time liquidity to investors.

However, in its current form, Blast is one of the smallest layer 2 networks. According to CoinGecko data, the total value locked of all Blast projects is just $1.5 billion. In contrast, more than $55 billion is locked on the Ethereum network. Moreover, very few projects have opted to build on Blast. That said, Blast’s mainnet only went live in February 2024 – so it’s still brand new.

Why Invest in Blast Network Crypto Projects?

Blast network coins operate in a growing yet nascent marketplace. There is no knowing whether the Blast ecosystem will take off, especially considering how much competition there is in the layer 2 space. That said, the Blast mainnet is less than two months old, so investors can secure a first-mover advantage at rock-bottom prices.

Let’s take a closer look at the investment thesis.

Layer 2 Networks are the Short-to-Medium Term Solution for Ethereum

In its current form, the Ethereum network is expensive – especially when deploying smart contract movements. It’s also unable to scale, meaning it can’t handle the required transaction throughput. While the long-term plan is to handle more than 100,000 transactions per second at near-zero fees, Ethereum is a long way away from these objectives.

As such, the solution – at least in the short-to-medium term, is layer 2 networks. They enable Ethereum smart contracts to initially process transactions off-chain. This reduces the network overload and vastly reduces fees. As a prominent layer 2 solution, Blast will be competing for a slice of the market.

This means Blast has real-world utility; it offers value to ERC-20 projects processing transactions through its network. However, competition in the layer 2 marketplace is fierce. As mentioned, some of the leading contenders are Polygon, Arbitrum, and Optimism.

Coinbase has also entered the market with the Base network. You can read more about the best Base chain meme coins here. Ultimately, only time will tell how Ethereum-based projects take to Blast. It must offer faster, cheaper, and more scalable transactions than other market players.

The Blast Mainnet Only Launched in February 2024

Blast is the newest layer 2 solution in the market. As mentioned, the mainnet launch only took place in February 2024. This means investing in Blast network crypto coins today offers a first-mover advantage. This could lead to substantial growth if and when the network takes off,

The same concept was seen with other layer 2 networks. For example, some of the most recognized tokens on the Base network are Brett, Toshi, and Mochi. These tokens were some of the first to launch when Base went live in mid-2023. Early backers are now looking at significant growth. Therefore, buying Blast network tokens early could offer a similar outcome.

Most Crypto Coins on Blast Network are Micro-Caps

Very few tokens have been built on the Blast network. The majority of existing market entrants are micro-cap projects. This means investors can target a sizable upside. For instance, we mentioned that Juice Finance is one of the first decentralized finance platforms in the Blast ecosystem. Even so, it has a fully diluted market capitalization of just $90 million.

Similarly, SwapBlast Finance Token – which offers decentralized swapping services for Blast tokens, has a fully diluted valuation of just $192,000. These minute valuations offer a realistic chance of finding the next 1000x crypto. Conversely, the risks are also sky-high, so ensure your Blast portfolio is well diversified.

Conclusion

In summary, Blast is one of the newest layer 2 solutions for Ethereum; the mainnet launched as recently as February 2024. This means the Blast ecosystem is brand-new, allowing investors to secure an early advantage.

However, Blast is competing with established layer 2’s like Arbitrum and Polygon. This means Blast network tokens operate in an already crowded space. Diversification is the best approach should you want to invest in this marketplace.

FAQs

What is Blast in crypto?

Blast is a layer 2 network for the Ethereum ecosystem, allowing ERC-20 smart contracts to reduce fees and increase scalability. Similar to other layer 2’s, Blast enables third-party projects to build on its network.

What are the best crypto projects on the Blast network?

Some of the best projects on the Blast network include Renzo Restaked ETH, USDB, Juice Finance, and PacMoon. Speculative traders might also consider Blast Pepe, Zaibot, and SwapBlast Finance Token.

References

- About Blast: Documentation (Blast)

- Blast Blockchain (CoinGecko)

- Top Blast Ecosystem Tokens by Market Capitalization (CoinMarketCap)

- TerraUSD Collapse Will ‘Probably be the End’ of Most Algorithmic Stablecoins, Crypto Exec says (CNBC)

- Ether Prices Spike on Hopes of an ETF — But the SEC Signals That’s Less Clear Cut Than Bitcoin (CNBC)

About the Author

Kane Pepi is a financial, gambling and cryptocurrency writer with over 2,000 published works, including on platforms like InsideBitcoins and Motley Fool. He specializes in cryptocurrency guides, exchange and wallet reviews, and covers new crypto projects for Cryptonews.com. His expertise includes asset valuation, portfolio management, and financial crime prevention. Pepi holds a Bachelor’s in Finance, a Master’s in Financial Crime, and is pursuing a Doctorate in money laundering in crypto and blockchain. Connect with Kane on LinkedIn.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.