News

12 most popular types of cryptocurrency

Ricardo Ceppi/Contributor/Getty Images

Bitcoin gets all the headlines when it comes to cryptocurrencies, but there are literally thousands of other options when it comes to these digital currencies. In fact, cryptocurrencies that are not Bitcoin are generally considered to be “also ran” – what are called “altcoins”, or alternatives to Bitcoin.

While Bitcoin may have been the first major cryptocurrency to hit the market – it debuted in 2009 – several others have become very popular, although not as big as the original.

Here are the largest cryptocurrencies in terms of total dollar value of existing coins, i.e. market capitalization or market capitalization. (Data is from CoinMarketCap.com, as of May 3, 2024.)

The largest cryptocurrencies by market capitalization

1. Bitcoin (BTC)

- Price: $61,524

- Market capitalization: $1.21 trillion

As a harbinger of the cryptocurrency era, Bitcoin it is still the coin that people generally refer to when talking about digital currency. Its mysterious creator, supposedly Satoshi Nakamoto, launched the currency in 2009 and it has been on a roller coaster ride ever since. However, it wasn’t until 2017 that cryptocurrency broke into popular consciousness. In 2024, the SEC approved the trading of ETFs that invest directly in Bitcoin, giving investors an easy way to bet on Bitcoin.

2. Ethereum (ETH)

- Price: $3,069

- Market capitalization: 369 billion dollars

Ethereum – the name of the cryptocurrency platform – is the second name you will most likely recognize in the crypto space. The system allows you to use ether (the currency) to perform a number of functions, but the aspect of the Ethereum smart contract helps make it a popular currency.

3. Tether (USDT)

- Price: $1.00

- Market capitalization: $110 billion

Tether price is pegged at $1 per coin. That’s because that’s what it’s called a stable currency. Stablecoins are tied to the value of a specific asset, in Tether’s case, the US dollar. Tether often serves as a medium when traders move from one cryptocurrency to another. Instead of going back to dollars, they use Tether. However, some people fear that Tether is not securely backed by dollars held in reserve, but instead uses a form of short-term unsecured debt.

4.BNB (BNB)

- Price: $576.31

- Market capitalization: 85 billion dollars

BNB is the cryptocurrency issued by Binance, among the largest cryptocurrency exchanges in the world. Although originally created as a token to pay for discounted trades, Binance Coin can now be used for payments and the purchase of various goods and services.

5. Solana (G)

- Price: $141.48

- Market capitalization: 63 billion dollars

Launched in March 2020, Solana is a newer cryptocurrency and touts its speed in completing transactions and the overall robustness of its “web-scale” platform. The issuance of the currency, called SOL, is limited to 480 million coins.

6. USD Coin (USDC)

- Price: $1.00

- Market capitalization: 33 billion dollars

Like Tether, USD Coin is a stablecoin pegged to the dollar, meaning its value is not expected to fluctuate. The currency’s founders say it is backed by assets that are fully reserved or have an “equivalent fair value,” and that those assets are held in accounts at regulated U.S. institutions.

7. XRP (XRP)

- Price: $0.5256

- Market capitalization: $29 billion

Formerly known as Ripple and created in 2012, XRP offers a way to pay in many different real currencies. Ripple can be useful in cross-border transactions and uses a trust-less mechanism to facilitate payments.

8. Dogecoin (DOGE)

- Price: $0.1385

- Market capitalization: $20 billion

Originally created as a joke following the Bitcoin run-up, Dogemoneta is named after an Internet meme featuring a Shiba Inu dog. Unlike many digital currencies that limit the number of coins in existence, Dogecoin has unlimited issuance. It can be used for payments or sending money.

9. Toncoin (TON)

- Price: $5.49

- Market capitalization: $19 billion

Launched in 2018, Toncoin was developed by Telegram, the encrypted messaging platform. Telegram abandoned the project, which was taken over by the TON Foundation. Toncoin price increased in 2023 after Telegram announced that it would integrate a TON-based wallet into its platform.

10. Cardan (ADA)

- Price: $0.4651

- Market capitalization: $17 billion

Cardan is the cryptocurrency platform behind ada, the name of the currency. Created by the co-founder of Ethereum, Cardano also uses smart contracts, allowing for identity management.

11. Shiba Inu (SHIB)

- Price: $0.00002391

- Market capitalization: $14 billion

Shiba Inu is an Ethereum-based altcoin created anonymously in August 2020 with a Shiba Inu dog as its mascot. Shiba Inu is widely considered an alternative to Dogecoin. Its price peaked in the fall of 2021 after a meteoric rise, but fell by more than 90% before rising again in early 2024.

12. Avalanche (AVAX)

- Price: $35.02

- Market capitalization: $13 billion

Avalanche is a blockchain launched in 2020 and competes with Ethereum as one of the most popular blockchains for smart contracts. AVAX is the native currency of the Avalanche blockchain.

Bottom line

The cryptocurrency market is a Wild West (even if the US government is taking a more active role in overseeing the crypto space), so those speculating on these digital assets should not invest more money than they can afford to lose. Crypto assets have been under downward pressure for much of 2022, and trading has remained volatile in 2023. It is also important to note that individual investors often trade against highly sophisticated traders, making it a difficult experience for beginners. In 2024, the SEC approved several spot Bitcoin ETFs for tradingoffering investors an easy way to bet on Bitcoin’s growth.

Editorial Disclaimer: All investors are advised to conduct their own independent research on investment strategies before making an investment decision. Furthermore, investors are advised that past performance of investment products is no guarantee of future price appreciation.

News

Meme Tokens Surpass Bitcoin in Turkish Trading Activity This Year

The Turkish cryptocurrency market has seen significant growth in recent years. Currently, more than half of the population invests in cryptocurrencies, according to surveys and polls.

This is evident from the fact that the Turkish Lira (TRY) is the fourth most used fiat currency in cryptocurrencies. Several macroeconomic factors are fueling this crypto adoption in the country. Therefore, stablecoins and meme coins have emerged as the favorites of Turkish investors, even surpassing Bitcoin.

Stablecoins and meme coins dominate Turkish trade

According to the latest relationship According to Kaiko, Turkey’s inflationary conditions have significantly increased stablecoin usage in recent years. In 2024, the research firm found that USDT-TRY dominates as the largest trading pair by volume on Binance, reaching over $22 billion, more than five times larger than the next largest pair, PEPE-USDT, which has $4 billion.

Notably, meme tokens have surpassed Bitcoin in terms of trading volume this year, indicating that Turkish traders are also turning to more speculative cryptocurrencies to hedge against currency fluctuations and make profits.

The increased usage of stablecoins is further reflected in the main Bitcoin trading pairs on BTCTurk, which are BTC-USDT and BTC-TRY.

One of the main reasons driving the adoption of cryptocurrencies is Turkey’s fight against double-digit inflation and the currency devaluation for years, with an average inflation rate above 40% over the past five years. In response, the central bank adopted an unorthodox monetary policy, cutting rates until June 2023. However, this worsened the devaluation of the Turkish lira, which lost more than 300% of its value from the end of 2020 to the end of 2023.

Turkey’s decision to normalize its monetary policy after the 2023 elections failed to restore confidence in the TRY, whose value continued to decline in 2024, albeit less rapidly.

Binance Sees Strong Expansion in Türkiye

Amid economic challenges, Binance has strengthened its position as one of the two largest trading platforms for Turkish traders, thanks to deep liquidity and low fees. As part of a large-scale zero-fee campaign, it offered zero fees for BTC-TRY trading between July 2022 and March 2023.

Offering a wide range of TRY-denominated trading pairs and aggressively adding new pairs in recent years have helped Binance maintain its leadership in the country despite the 2022 cryptocurrency bear market. Binance introduced 61 new TRY trading pairs in 2024 alone, bringing the total number to over 200.

Other exchanges, such as Gate.io, KuCoin, and OKX, have jumped into the Turkish crypto ecosystem, but their overall market share remains less than 1%.

News

Top 5 PolitiFi Tokens to Buy Now for MAX Profits

With the US presidential election fast approaching, the cryptocurrency world is buzzing with new trends. In addition to the well-known cartoon-themed meme coins, a new category is making waves: PolitiFi tokens. Did you see that coming?

These politically themed crypto tokens are gaining attention, especially those centered around former President Donald Trump. Today, we explore the 5 trending Trump-themed PolitiFi tokens.

Stock up to benefit later!

1. Trump (Magazine)

Launched about a year ago, the Trump-themed MAGA token has caused quite a stir in the cryptocurrency ecosystem. Inspired by Donald Trump’s slogan “Make America Great Again,” the MAGA token has produced an astonishing 35 million percent return since its inception. Currently trading at $5.65, it has fallen 8.80 percent in the past 24 hours.

Despite this, the token’s trading volume increased by 23.23%, bringing its market cap to $248 million and securing the 220th spot on CoinMarketCap.

Source: Dexscreener

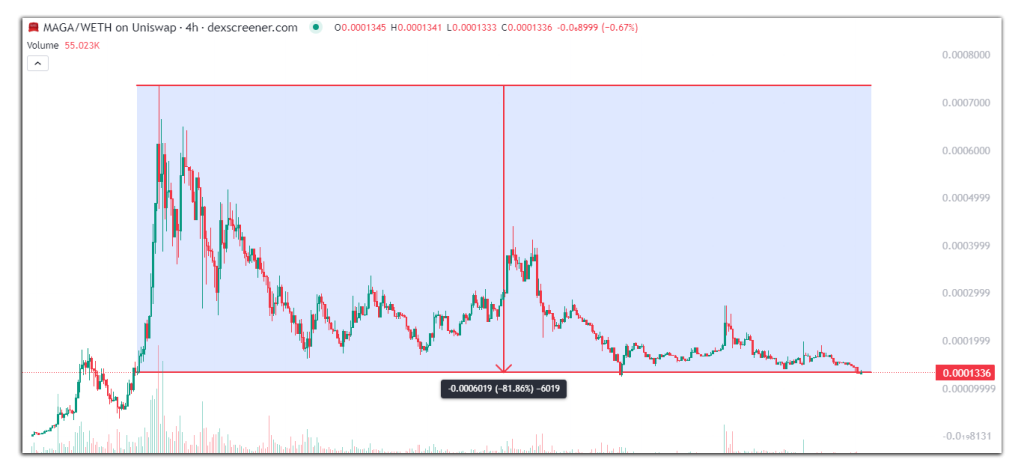

2. MAGA (MAGA)

Another token with the same ticker, MAGA, is also trending in the PolitiFi category. With 390 billion tokens in circulation, this MAGA token has seen a 11.08% price drop over the past 24 hours, but an 81.39% increase in trading volume. Currently trading at $0.0001337, it is ranked 21st on Dexscreener’s trending list and 522nd on CoinMarketCap. Despite being only two months old, it has provided early adopters with a remarkable profit of 313,373.62% at its all-time high of $0.0007354.

Source: Dexscreener

3. Super Trump Coin (STRUMP)

Super Trump Coin, a meme token depicting Donald Trump as Superman, has a circulating supply of 1.8 billion tokens. Over the past 24 hours, its trading volume has increased by 39.88%. Currently trading at $0.01112, it has dropped by 6.07% over the past 24 hours, but holds a CoinMarketCap rating of 776. From its all-time high of $0.03085, it has dropped by 64.06%. Despite this, its impressive short-term returns have made it a favorite among Trump crypto enthusiasts.

Source: Dexscreener

4. MAGA Vice President (MVP)

Launched just four months ago, MAGA VP has yet to break into the top 1000 cryptocurrencies on CoinMarketCap, currently ranked 1231st. With a value of $0.128, its trading volume has increased by 21.79% over the past 24 hours, with a market cap of $5.3 million. While it is up 110% at its current price, it is down 83.24% from its all-time high of $0.7706.

Source: Dexscreener

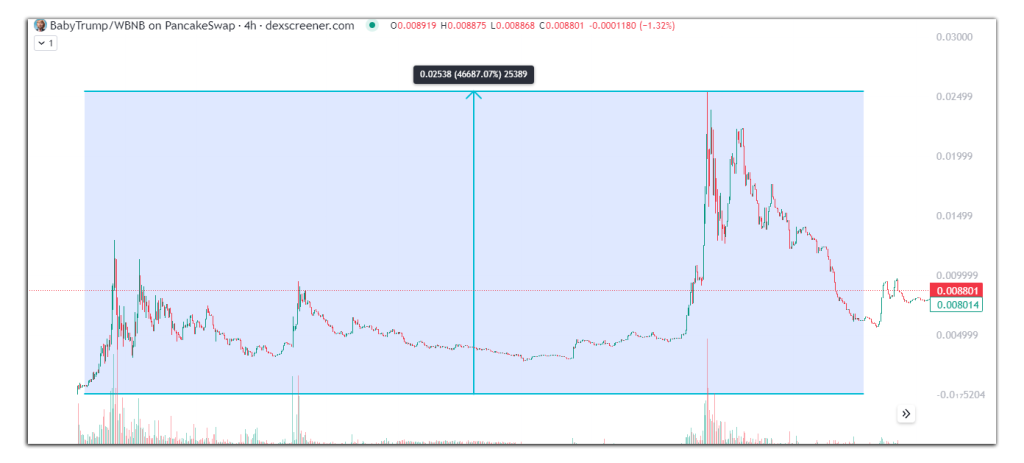

5. Little Trump

One of the most unique Trump-themed tokens is Baby Trump, which depicts Donald Trump as a baby president. With a circulating supply of 406 million tokens, it has a market cap of $3.5 million at a trading price of $0.008616. Although its price has dropped 9.45% in the last 24 hours, its trading volume has increased by 4.29%. At its peak, Baby Trump’s market cap was $11 million.

Notably, Baby Trump is the only token among the five analyzed to be based on the BNB Smart Chain, while the others are based on the Ethereum network.

Source: Dexscreener

It’s an exciting time for cryptocurrencies

The current political climate in the United States is spawning a new wave of meme tokens themed around various political figures. Among them, Trump-themed PolitiFi tokens are experiencing the most significant surge in popularity. Support for Donald Trump in the crypto community seems to be a driving force behind the success of these tokens.

Do you think Trump-themed PolitiFi tokens are here to stay or just a passing trend? Share your thoughts.

News

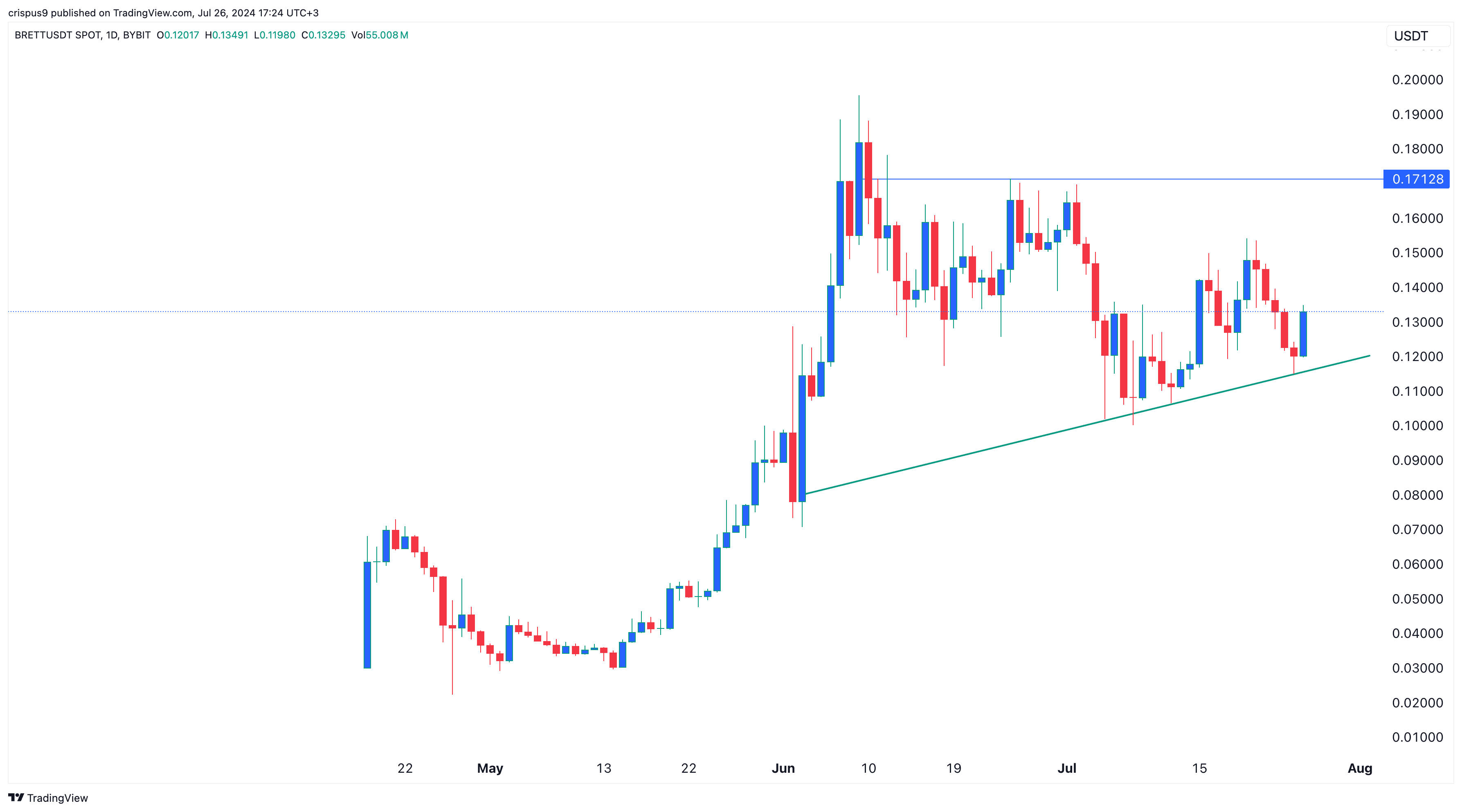

Brett Token Price Soars 12%; Analyst Expects Further 30% Upside

Brett, the largest meme coin in Blockchain Base, rose more than 12% on Friday, as sentiment in the cryptocurrency and stock sectors improved.

Brett (BRETT) the token rose to $0.133, up 31% from its low this month. Some traders believe the meme coin has more upside potential in the future.

Analyst is bullish on Brett

In an X-post, Michael van de Poppe, a trader with over 721,000 followers, said he is optimistic that the token will rise to $0.1712, up 30% from Friday’s trading level.

I’ve been a day trader for a long time and memes are a great way to gain that perspective.

Lots of volume.

And there’s a lot of volatility.When it comes to $BRETTI would look for long positions in this area between $0.125-0.1325 and $0.170 as a clear identification of a potential bull run. photo.twitter.com/hWmSjCZGJa

— Michaël van de Poppe (@CryptoMichNL) July 26, 2024

If he is right, Brett’s market cap will surpass Floki’s (FLOKI), which has a market capitalization of $1.7 billion.

Brett’s bounce came at the start of the Bitcoin 2024 conference today. In a statement at the event, Robert Kennedy, an independent presidential candidate, noted that he is a big supporter of Bitcoin (BTC).

The main protagonist of the event will be Donald Trump, leading in most polls, included in Polymarket. Trump is expected to reiterate his support for cryptocurrencies. Analysts are divided on whether he will announce a Bitcoin reserve at this event.

Blockchain Base is doing well

Brett token also recovered as Base blockchain ecosystems continued to perform well. Launched in 2023 by Coinbase, Base has accumulated over $1.6 billion in DeFi assets, making it the sixth largest chain in the industry. It has surpassed popular networks like Cardano (ADA), Avalanche (AVAILABLE) and Polygon (MATIC).

At the same time, Brett and other altcoins jumped as the U.S. stock market rebounded, signaling that investors have embraced risk-on sentiment. The Dow Jones Industrial Average rose more than 600 points, while the S&P 500 and Nasdaq 100 jumped more than 80 basis points.

Brett Price Chart | Source: Trading View

Technically, Brett formed a morning star pattern, which is a popular reversal sign. In the past, the coin has risen by double digits when it has formed this pattern. For example, it formed on July 12 and then rose by 40%.

On the other hand, this bounce could be a dead cat bounce, where an asset briefly rises and then resumes its downtrend.

News

Top 5 PolitiFi Tokens to Buy Now for MAX Profits

With the US presidential election fast approaching, the cryptocurrency world is buzzing with new trends. In addition to the well-known cartoon-themed meme coins, a new category is making waves: PolitiFi tokens. Did you see that coming?

These politically themed crypto tokens are gaining attention, especially those centered around former President Donald Trump. Today, we explore the 5 trending Trump-themed PolitiFi tokens.

Stock up to benefit later!

1. Trump (Magazine)

Launched about a year ago, the Trump-themed MAGA token has caused quite a stir in the cryptocurrency ecosystem. Inspired by Donald Trump’s slogan “Make America Great Again,” the MAGA token has produced an astonishing 35 million percent return since its inception. Currently trading at $5.65, it has fallen 8.80 percent in the past 24 hours.

Despite this, the token’s trading volume increased by 23.23%, bringing its market cap to $248 million and securing the 220th spot on CoinMarketCap.

Source: Dexscreener

Source: Dexscreener

2. MAGA (MAGA)

Another token with the same ticker, MAGA, is also trending in the PolitiFi category. With 390 billion tokens in circulation, this MAGA token has seen a 11.08% price drop over the past 24 hours, but an 81.39% increase in trading volume. Currently trading at $0.0001337, it is ranked 21st on Dexscreener’s trending list and 522nd on CoinMarketCap. Despite being only two months old, it has provided early adopters with a remarkable profit of 313,373.62% at its all-time high of $0.0007354.

Source: Dexscreener

Source: Dexscreener

3. Super Trump Coin (STRUMP)

Super Trump Coin, a meme token depicting Donald Trump as Superman, has a circulating supply of 1.8 billion tokens. Over the past 24 hours, its trading volume has increased by 39.88%. Currently trading at $0.01112, it has dropped by 6.07% over the past 24 hours, but holds a CoinMarketCap rating of 776. From its all-time high of $0.03085, it has dropped by 64.06%. Despite this, its impressive short-term returns have made it a favorite among Trump crypto enthusiasts.

Source: Dexscreener

Source: Dexscreener

4. MAGA Vice President (MVP)

Launched just four months ago, MAGA VP has yet to break into the top 1000 cryptocurrencies on CoinMarketCap, currently ranked 1231st. With a value of $0.128, its trading volume has increased by 21.79% over the past 24 hours, with a market cap of $5.3 million. While it is up 110% at its current price, it is down 83.24% from its all-time high of $0.7706.

Source: Dexscreener

Source: Dexscreener

5. Little Trump

One of the most unique Trump-themed tokens is Baby Trump, which depicts Donald Trump as a baby president. With a circulating supply of 406 million tokens, it has a market cap of $3.5 million at a trading price of $0.008616. Although its price has dropped 9.45% in the last 24 hours, its trading volume has increased by 4.29%. At its peak, Baby Trump’s market cap was $11 million.

Notably, Baby Trump is the only token among the five analyzed to be based on the BNB Smart Chain, while the others are based on the Ethereum network.

Source: Dexscreener

Source: Dexscreener

It’s an exciting time for cryptocurrencies

The current political climate in the United States is spawning a new wave of meme tokens themed around various political figures. Among them, Trump-themed PolitiFi tokens are experiencing the most significant surge in popularity. Support for Donald Trump in the crypto community seems to be a driving force behind the success of these tokens.

Do you think Trump-themed PolitiFi tokens are here to stay or just a passing trend? Share your thoughts.

-

Videos3 months ago

Videos3 months agoMoney is broke!! The truth about our financial system!

-

News2 months ago

News2 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

Altcoins2 months ago

Altcoins2 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Videos2 months ago

Videos2 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News2 months ago

News2 months agoOver 1 million new tokens launched since April

-

Videos2 months ago

Videos2 months agoRecession soon?? What this means for you and your wallet!!

-

NFTs3 months ago

NFTs3 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

NFTs2 months ago

NFTs2 months agoSolana NFTs jump 30% in 24 hours: what’s behind the increase?

-

Memecoins2 months ago

Memecoins2 months agoSolana Dev hospitalized with third-degree burns while trying to pump Meme Coin

-

Videos3 months ago

Videos3 months agoCryptocurrency Market Update: Where Are We NOW?! What’s next?

-

Memecoins2 months ago

Memecoins2 months agoWhen memecoins reign supreme in the ecosystem!

-

Videos2 months ago

Videos2 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!