Altcoins

10 Best Altcoin Exchanges for Crypto Investors in 2024

Last updated:

May 7, 2024 04:58 EDT

| 23 min read

Leading altcoin exchanges support hundreds of cryptocurrencies, making them ideal for creating diversified portfolios. This usually includes a blend of small and large-cap projects from various cryptocurrency niches.

Read on to discover the best altcoin exchange for traders in 2024. We review 10 popular cryptocurrency exchanges, which are ranked by supported altcoins, trading fees, reputation, payment methods, and more.

Top Altcoin Exchanges Compared

Summarized below are the 10 best altcoin exchange platforms to consider today:

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| eToro | 110 | 1% | Yes | 2007 |

| MEXC | 2,500 | 0.10% | Yes | 2018 |

| Gate.io | 1,700 | 0.10% | Yes | 2013 |

| OKX | 330 | 0.10% | Yes | 2017 |

| Bybit | 610 | 0.10% | Yes | 2018 |

| Binance | 410 | 0.10% | Yes | 2017 |

| Coinbase | 248 | 1.49% | Yes | 2012 |

| Margex | 35 | 0.06% | Yes | 2020 |

| Kraken | 200 | 0.25% | Yes | 2013 |

| PrimeXBT | 35 | 0.20% | Yes | 2018 |

Best Altcoin Exchanges Reviewed

Let’s take a closer look at the altcoin trading exchanges listed above. Our reviews cover everything investors need to know when making an informed decision.

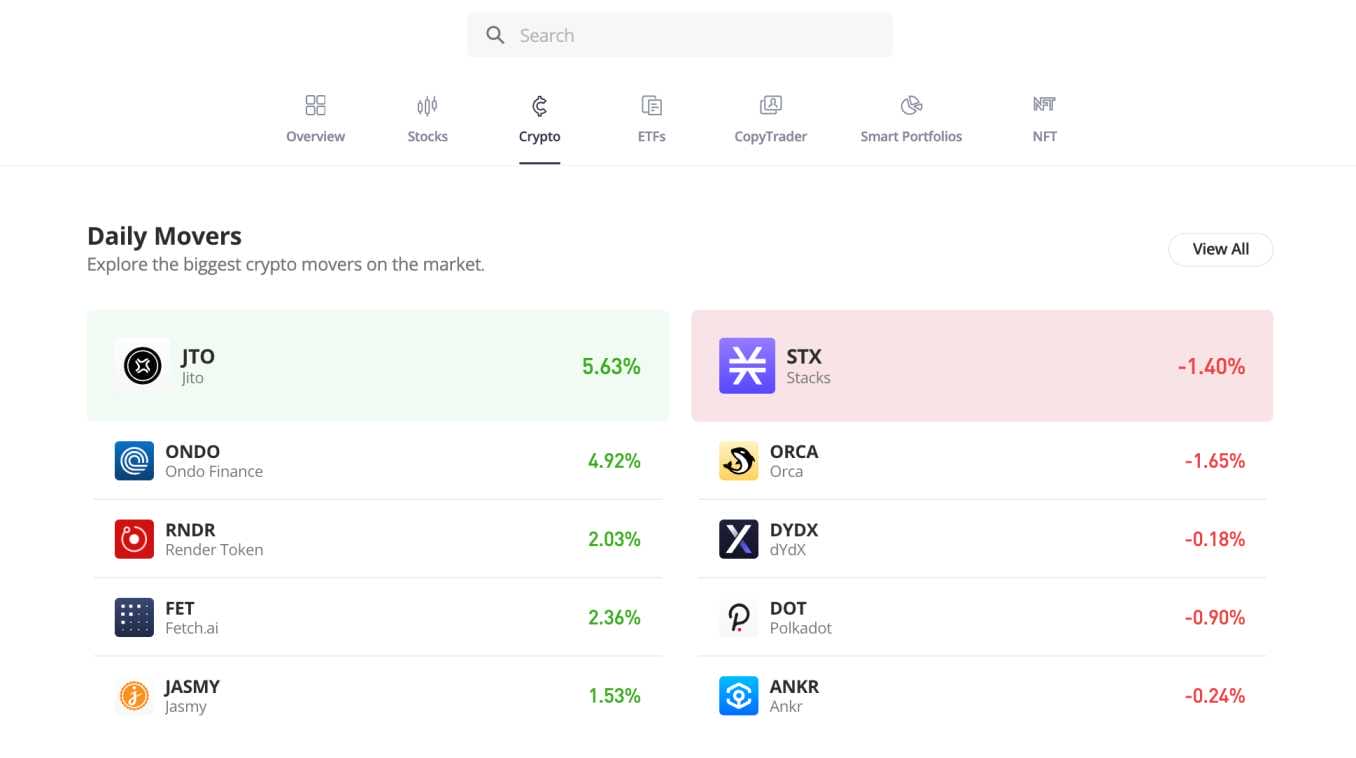

1. eToro – The Overall Best Altcoin Exchange for Safety, Plus Copy Trading Tools

eToro is the overall best altcoin exchange — especially for first-time investors. As a regulated exchange, eToro accepts a variety of convenient payment methods. This includes Visa, MasterCard, PayPal, Skrill, ACH, and bank wires. The minimum deposit requirement starts from $10. No deposit fees are charged on USD payments.

However, eToro charges an FX fee on other currencies, starting from 1.5%. eToro supports 110 cryptocurrencies, including some of the best altcoins. This covers large caps like Ethereum, BNB, Dogecoin, Cardano, Solana, and XRP. Lower-cap tokens include Axie Infinity, Ondo Finance, Flare, Aave, and SushiSwap.The minimum trade size is just $10 per altcoin.

This makes eToro a good option for diversifying on a budget. eToro also offers copy trading tools. There are thousands of investors to choose from, and the minimum capital requirement is $200. There are also smart portfolios, which are pre-built and professionally managed by the eToro team. eToro is licensed by multiple bodies, including the FCA and CySEC

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| eToro | 110 | 1% | Yes | 2007 |

Pros

- The overall best place to buy altcoins

- A safe and regulated platform with multiple licenses

- USD deposits are fee-free

- Supports 110 altcoin markets

- A great option for copy trading

- Offers a native app for iOS and Android

Cons

- Altcoin trading fees of 1% per slide

- High deposit fees on non-USD payments

2. MEXC – Low-Fee Altcoin Exchange Supporting More Than 2,500 Altcoins

One of the largest selections of altcoin markets can be found on the MEXC exchange. This popular altcoin platform supports over 2,500 cryptocurrencies, including market leaders like Ethereum, Solana, and Cardano. Traders will also find plenty of micro-cap altcoins, making MEXC one of the best options for finding the next 1,000x crypto.

MEXC offers advanced charting tools, including technical indicators and TradingView integration. It also offers in-depth order books and risk management tools like stop-losses and take-profits. While most traders opt for the spot trading markets, MEXC also supports cryptocurrency derivatives.

These are ideal for short-selling altcoins or trading with leverage. Large-cap altcoins come with leverage of up to 200x. We also like MEXC’s fee structure. It charges just 0.1% when trading the spot markets and 0.01% on leveraged futures. Debit/credit card payments are processed by fiat gateway partners. Other payment methods are available in the peer-to-peer department.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| MEXC | 2,500 | 0.1% | Yes | 2018 |

Pros

- Lists more than 2,500 altcoins

- Low trading fees of just 0.1% per slide

- Premium trading volumes and liquidity

- Supports desktop trading and a native mobile app

- Altcoin leverage of up to 200x

Cons

- US clients are not accepted

- The instant buy feature only supports six altcoins

3. Gate.io – Huge Range of Supported Altcoins With Competitive Earning Rates

Next is Gate.io, which supports more than 1,700 altcoins. This covers a huge range of micro, small, and large-cap markets. Not only is Gate.io ideal for diversification but also for earning competitive interest rates. For example, Bitcoin, Ethereum, and Tether deposits are currently earning 6%, 7%, and 11.5% respectively.

Even higher APYs are available when depositing lower-cap altcoins. For instance, you’ll get 16.65% on Sui and 42% on Frontier. Lock-up terms and deposit limits vary depending on the altcoin. Like many crypto exchanges, Gate.io supports spot trading and derivative markets. The latter includes perpetual and delivery futures settled in USDT or the underlying altcoin.

Gate.io also supports copy trading tools, automated bots, and structured loans. Beginners are also catered for; Gate.io offers a simplified conversion tool. This enables users to swap cryptocurrencies without visiting the trading dashboard. What’s more, users can instantly buy altcoins with debit/credit cards and e-wallets.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| Gate.io | 1,700 | 0.1% | Yes | 2013 |

Pros

- Choose from over 1,700 altcoin markets

- Attracts substantial 24-hour trading volumes

- Ideal for beginners and experienced pros alike

- Leveraged markets include delivery and perpetual futures

- Instantly buy altcoins with fiat money

Cons

- Simplified conversion tool comes with higher fees

- $60,000 minimum to reduce spot trading commissions

4. OKX – Trade Over 330 Altcoins at Commissions of Just 0.1% Per Slide

Next on this list of altcoin exchanges is OKX. This is a great option for trading altcoins with low commissions. The highest commission charged is just 0.1% per slide. This means you’ll pay $1 for every $1,000 traded. OKX also offers reduced commissions when 30-day volumes hit certain milestones.

The commission also drops when holding OKB tokens, which are native to the OKX exchange. In terms of markets, OKX supports over 330 altcoins. This includes some of the best meme coins, such as Pepe, Bonk, Shiba Inu, and Dogecoin. OKX also supports derivative markets, including perpetual and delivery futures, as well as margin accounts and options.

Derivatives come with leverage of up to 100x and they support long and short trading. OKX accepts fiat money payments, although fees are built into the exchange rate. The minimum deposit requirement is $30. OKX also offers a peer-to-peer altcoin trading platform, which increases the number of supported crypto assets and payment types.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| OKX | 330 | 0.1% | Yes | 2017 |

Pros

- Supports over 330 altcoins

- Trading commissions start from just 0.1% per slide

- One of the best crypto leverage trading platforms

- Supports spot trading, futures, margin accounts, and options

- Advanced trading dashboard with technical indicators

Cons

- Minimum debit/credit card deposit of $30

- Fiat deposit fees are built into the exchange rate

5. Bybit – A Great Option for Buying and Selling Newly Launched Cryptocurrencies

Another popular altcoin exchange to consider is Bybit. It supports over 610 altcoins, including some of the best new cryptocurrencies to buy. This means you can often find the next altcoin gems before they explode. Moreover, Bybit supports a wide range of trading instruments. For instance, beginners will prefer the spot trading markets.

This enables traders to buy and sell altcoins without leverage. More experienced traders might prefer its derivatives section. This includes perpetual futures with leverage of up to 125x. Bybit also supports options markets, but only two altcoins are available: Ethereum and Solana. Although Bybit offers manual charting tools, it also supports automated trading features.

This includes thousands of fully automated bots. Simply select the preferred strategy and the bot will trade altcoins on your behalf. Bybit is also one of the best crypto exchanges for low trading fees. Spot trading and derivative commissions start from 0.1% and 0.02%, respectively. Bybit supports fiat money deposits via third-party gateways.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| Bybit | 610 | 0.1% | Yes | 2018 |

Pros

- More than 610 altcoins are listed

- Spot trading fees start from 0.1% per slide

- Also offers perpetual futures and options

- Supports some of the best crypto trading bots

- No KYC process when signing up

Cons

- Lack of regulation from tier-one bodies

- Doesn’t accept traders from the US

6. Binance – Top-Rated Exchange for Day Trading, Offers Premium Liquidity and Low Fees

We found that Binance is the best altcoin exchange for day traders. For a start, Binance offers significantly more liquidity than its market peers. More than $11 billion worth of spot trading positions were executed in the prior 24 hours. This often exceeds $100 billion during peak market cycles. In addition, Binance offers advanced charting features that are ideal for day trading strategies.

This includes more than 100 technical indicators, such as moving averages and the RSI, not to mention custom drawing tools and fully customizable charting screens. Binance also offers competitive trading commissions. Spot trading fees start from 0.1% per slide. Reduced commissions are available when holding BNB or meeting minimum 30-day volumes.

In terms of markets, Binance supports over 410 altcoins. This translates to over 1,600 trading pairs. Binance is another great option for trading cryptocurrency derivatives, including perpetual futures and options. While fiat money deposits are accepted, some currencies are no longer supported. Deposit fees vary depending on the trader’s location.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| Binance | 410 | 0.1% | Yes | 2017 |

Pros

- The best crypto exchange for day traders

- Offers the largest 24-hour volumes in the market

- Buy and sell altcoins from just 0.1% per slide

- Supports more than 100 technical indicators

- Choose between spot trading and derivative instruments

Cons

- Fiat deposits aren’t supported in all countries

- Facing increased pressures from global regulators

7. Coinbase – Popular Altcoin Platform for Beginners Seeking a User-Friendly Experience

Beginners might find that Coinbase is the best crypto exchange for altcoins. It offers a user-friendly platform that doesn’t require prior trading experience. Users can buy their preferred altcoins instantly with various payment methods, including Visa, MasterCard, and PayPal. Coinbase charges almost 4% when using the instant buy tool.

Bank transfers are also accepted, including ACH and UK Faster Payments. This deposit option is fee-free, although you’ll still need to pay commissions when completing an altcoin trade. This starts at 1.49% on positions over $200. A simple workaround is to switch over to Coinbase Advanced, which reduces the commission to 0.5%.

Coinbase lists nearly 250 altcoin markets. This includes everything from Ethereum and XRP to Cardano, Solana, and Dogecoin. Trades can be executed on the Coinbase website or mobile app. Coinbase is also a great option for earning passive rewards on altcoin investments. Some altcoins come with staking APYs of over 10% without lock-up requirements.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| Coinbase | 248 | 1.49% | Yes | 2012 |

Pros

- One of the best altcoin exchanges for beginners

- Launched in 2012 and heavily regulated

- Accepts US clients

- Supports debit/credit cards, PayPal, and bank transfers

- Almost 250 altcoin markets are supported

Cons

- Standard altcoin trading commissions of 1.49%

- The KYC process often requires multiple attempts

8. Margex – KYC-Free Derivatives Platform With 100x Leverage and 0.06% Commissions

Experienced traders will find that Margex is one of the best altcoin exchanges. It offers cost-effective perpetual futures on 35 altcoin markets. All perpetual instruments support long and short trading with high leverage limits. Ethereum and BNB can be traded with 100x leverage, while limits are reduced to 50x or 25x on other altcoins.

Margex offers competitive trading fees; market takers pay 0.06% per slide. However, there are no commission reductions when trading larger amounts. We found that Margex uses more than a dozen liquidity providers, ensuring that spreads are minimized around the clock. What’s more, Margex offers an innovative staking feature.

Users can stake their preferred altcoins to earn competitive rewards while still using the funds to trade perpetuals. APYs of up to 5% are currently available. Margex also offers copy trading features, which is great for investing in altcoins passively. Accepted deposit methods include debit/credit cards and SEPA.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| Margex | 35 | 0.06% | Yes | 2020 |

Pros

- A great option for trading perpetual futures

- Offers leverage of between 25x and 100x

- Staking balances can be used for trading

- Commissions of just 0.06% per slide

- Partnered with over a dozen liquidity providers

Cons

- Spot trading platform is still being developed

- Supports just 35 altcoin markets

9. Kraken – US-Friendly Altcoin Exchange Supporting Over 200 Cryptocurrencies

Kraken is a US-friendly crypto exchange that launched in 2013. It supports over 200 cryptocurrencies, including Solana, Filecoin, Dogecoin, Polkadot, Dash, and Waves. The minimum investment requirement is a budget-friendly $10. What’s more, Kraken offers a ‘recurring buy’ feature that’s ideal for dollar-cost averaging.

For example, an altcoin investor could buy $50 worth of Litecoin every Monday and $50 worth of Bitcoin Cash every Friday. In terms of deposit methods, Kraken supports cost-effective bank transfers. Multiple banking networks are supported, including SEPA and ACH. Debit/credit cards are also accepted, meaning you can buy altcoins instantly.

However, Visa and MasterCard payments cost 3.75% + €0.25. Although Kraken is ideal for beginners, it also offers an advanced trading dashboard. This supports charting tools, technical indicators, and perpetual futures. Kraken also offers staking rewards and an NFT marketplace. Kraken recently launched a decentralized altcoin wallet, which comes as a mobile app.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| Kraken | 200 | 0.25% | Yes | 2013 |

Pros

- US-friendly exchange with solid regulation

- Supports over 200 popular altcoins

- Suitable for all experience levels

- Offers a recurring buy feature for long-term investors

- Recently launched a decentralized wallet app

Cons

- Higher commissions than most altcoin exchanges

- Debit/credit card fees are high

10. PrimeXBT – Seamlessly Access Leveraged Altcoin Markets on a Mobile App

PrimeXBT is one of the best altcoin exchanges when trading on a mobile app. Its native app for iOS and Android supports perpetual futures with leverage of up to 100x. 35 altcoin markets are listed, including Polkadot, Solana, Litecoin, Ethereum, and Cardano. Perpetuals come in two forms: isolated and cross-margin.

PrimeXBT boasts premium liquidity and market-leading spreads. The PrimeXBT charting dashboard has been optimized for smartphone usage, ensuring traders can analyze the markets while on the move. Tools include advanced order types, a customizable workspace, and over 50 technical indicators.

When it comes to fees, altcoin trading commissions cost 0.2% per slide. The minimum trade requirement is 0.001 BTC or the altcoin equivalent. In addition to altcoins, PrimeXBT also supports other financial markets, including energies, precious metals, indices, and forex. However, these markets are offered as contracts-for-differences (CFDs), which aren’t available in all regions.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| PrimeXBT | 35 | 0.2% | Yes | 2018 |

Pros

- A great option for trading altcoins on a mobile app

- Charting tools have been optimized for smartphones

- Trusted by over 1 million users

- Specializes in leveraged perpetual futures

- Also supports commodities, forex, and other financial markets

Cons

- Limited range of altcoins when compared to other exchanges

- Doesn’t accept US traders

What is an Altcoin Exchange?

Altcoin exchanges allow users to buy and sell altcoins — any cryptocurrency other than Bitcoin. Some altcoin exchanges are aimed at long-term buyers who want to invest with fiat money. This means users can buy altcoins instantly with a debit/credit card or e-wallet. After that, the investor can withdraw their altcoins to a private wallet.

Alternatively, some altcoin exchanges are more suitable for active traders. These platforms offer advanced trading tools ideal for short-term strategies, such as comprehensive charts, drawing tools, and technical indicators. Some altcoin exchanges also support derivative products like futures and options.

This enables users to go long or short on altcoins with leverage. In all cases, altcoin exchanges make money from trading commissions. This averages 0.1% per slide, meaning a $1 commission is paid for every $1,000 traded. Ultimately, altcoin exchanges provide access to a wide range of cryptocurrencies, making them suitable for diversification strategies.

How to Choose The Best Altcoin Exchange

There are more than 760 altcoin exchanges listed on CoinMarketCap. This makes choosing the best altcoin exchange a time-consuming task. We’ll now explain the most important factors to consider when selecting a suitable platform.

Highest Number of Altcoins Listed

The first metric to explore is the number of altcoins listed. Some exchanges support thousands of altcoins, while others list several dozen. Choosing an exchange with a large number of markets enables investors to build a well-balanced altcoin portfolio. For example, MEXC and Gate.io list more than 2,500 and 1,700 altcoins, respectively.

This covers a huge range of new cryptocurrencies with small valuations, making them ideal for growth investors. However, PrimeXBT and Margex list just 35 altcoins. These are established, large-cap altcoins like Ethereum, Solana, and BNB. This means investors won’t have access to up-and-coming projects with a higher growth potential.

Lowest Altcoin Trading Fees

Trading fees will vary widely between altcoin exchanges. Investors should prioritize exchanges with the most competitive commissions. This is the fee paid whenever a buy or sell order is executed. As such, commissions eat away at your potential altcoin profits. Exchanges with the lowest commissions are MEXC, Gate.io, OKX, Bybit, and Binance.

These platforms charge just 0.1% per slide. Moreover, reduced trading commissions are available when 30-day volumes increase. Some altcoin exchanges offer discounts when holding their native token. For example, MEXC and Binance are backed by MK Token and BNB, respectively.

Those looking to trade leveraged products, such as perpetual futures, should also explore financing fees. Leverage is a loan taken from the altcoin exchange, so interest is applied to the position size. Some altcoin exchanges charge financing fees daily, while others implement them every few hours.

Highest Trading Pair Liquidity

Investors should also explore liquidity when choosing the best exchange for altcoins. Put simply, exchanges with high liquidity ensure smooth trading conditions. This means buy and sell orders are matched promptly without vastly impacting prices. All of the altcoin exchanges discussed today offer sufficient liquidity.

However, this isn’t always the case when using less-established platforms. For example, consider a recently launched altcoin exchange that has limited trading volumes. If there isn’t enough liquidity in a particular market, an altcoin trader won’t be able to sell their tokens at a suitable price.

This means the trader might need to accept a sub-par price to force their sell orders through. CoinMarketCap is a good option when analyzing liquidity levels. It gives a liquidity score from 0 to 100 for over 760 altcoin exchanges. Binance ranks the best with a score of 859. After that, Kraken and Coinbase have a liquidity score of 732 and 708, respectively.

What Happens if There Isn’t Enough Liquidity to Sell My Altcoins?

- If you’re using an altcoin exchange without sufficient liquidity, cashing out a profitable position can be problematic.

- Just remember — another market participant must accept your sell order.

- Reducing the sell order price is one option, as this can motivate buyers to enter the market.

- However, if there aren’t any buyers at all — your sell order will remain pending.

- In this instance, you could be forced to transfer the altcoins to an exchange with more liquidity.

- This will increase the chances of finding a suitable buyer.

Support for Preferred Deposit Method

One of the biggest barriers for new altcoin investors is getting funds into an exchange. This means that new market entrants need to deposit fiat money, such as dollars or euros. Fortunately, the best altcoin exchanges accept a wide range of convenient payment methods. Fees will vary widely depending on the payment type and currency.

For example, eToro is the best option for instant deposits with US dollars. No fees are charged when using Visa, MasterCard, PayPal, Skill, or any other supported method. However, eToro is expensive when using other currencies; FX fees start from 1.5% of the deposit amount.

Coinbase is an expensive option when using instant payment methods — fees cost almost 4%. However, Coinbase is ideal when depositing funds from a bank account. No fees are charged on local banking methods like ACH and Faster Payments. What’s more, bank payments typically arrive in under five minutes.

Trustworthiness and Security

Many altcoin exchanges have experienced hacks — sometimes resulting in hundreds of millions of dollars worth of stolen coins. In other cases, altcoin exchanges have collapsed because of internal fraud. FTX is the most notable example, with customers losing over $8 billion. With this in mind, trust and security should be prioritized when selecting the best altcoin exchange.

There are several aspects to consider. First, explore when the exchange was launched; more established platforms are preferred. Next, assess whether the altcoin exchange is regulated. eToro and Coinbase are the market leaders here; both are approved by FINRA and the SEC. eToro is also licensed by the FCA (UK) and CySEC (Europe).

Another security check is ‘proof of reserves’, which became mainstream after the FTX collapse. Put simply, crypto exchanges should be audited by a reputable body and showcase their cryptocurrency reserves. Reserves should not only cover customer deposits but also be held in liquid coins, such as Bitcoin and Tether.

Account security features are also important. For example, eToro and Binance have made two-factor authentication mandatory. This means users must enter a unique code every time they log in. The code is sent via SMS or through the Google Authenticator app. Other security features to look for include IP/device whitelisting and anti-phishing safeguards.

Should I Keep my Altcoins in an Exchange?

- Regardless of whether the cryptocurrency exchange is regulated and what security features it offers, the best option is to withdraw your altcoins to a self-custody wallet.

- In doing so, you’re removing your altcoins from counterpart risks — such as hacks, scams, and fraud.

- The altcoins you buy can be kept in a private wallet until you’re ready to sell.

- You can then transfer the altcoins to the same exchange, sell them for fiat currency, and cash out to a bank account.

Understanding Fees on Altcoin Exchanges

Similar to online stock brokers, altcoin exchanges implement an assortment of charges. Understanding fees for the services you wish to use is crucial. Let’s take a much closer look at the fees charged when using an altcoin exchange.

Spot Trading Commissions

The most common fee is the spot trading commission. This is the fee you pay when buying and selling altcoins. It’s typically charged as a percentage of the overall trade size. As mentioned, the best altcoin exchanges charge commissions of just 0.1% per slide.

- So, suppose you purchase $500 worth of Ethereum.

- At 0.1%, you’ve paid a buy commission of $0.50.

- A few weeks later, your Ethereum position has increased to $900. You decide to sell, so again, pay a 0.1% commission.

- This means you’ve paid a sales commission of $0.90.

Many altcoin exchanges use a maker/taker model, which can be confusing for beginners.

- Market ‘makers’ get the lowest commissions, as they provide liquidity to the exchange

- Market ‘takers’ pay a slightly higher commission, as they use the liquidity that’s already available

What’s more, altcoin exchanges typically use staggered commission structures, which can benefit high volume traders. This means commissions decline as monthly trading volumes increase. For example, Binance reduces the commission from 0.1% to 0.06% when trading over $20 million within 30 days.

Derivative Trading Commissions

Derivative products attract different fees from the spot trading markets. You’ll notice that derivative commissions are usually lower. However, this is based on the total leveraged amount.

For example, suppose the altcoin exchange charges 0.01% when trading perpetual futures. You risk $1,000 with 20x leverage, amplifying the trade size to $20,000. At 0.01%, you pay a $2 commission (0.01% x $20,000).

Financing Fees

Derivative trading attracts an additional fee to the commission — financing. This is the interest charged on leveraged positions. Some altcoin exchanges charge a financing fee every few hours.

For example, at Kraken, it’s every four hours. Other exchanges charge financing fees once per day. Therefore, you’ll need to know the interest rate charged and how often it’s implemented.

Payment Fees

Altcoin exchanges can also charge payment fees when making a fiat deposit. This can vary depending on the currency and payment type.

Withdrawal Fees

Withdrawing altcoins from an exchange will also attract fees. We prefer exchanges that mirror the actual network charge in real time. For example, suppose the Ethereum network currently charges GAS fees of 0.0013 ETH (about $4). The exchange should also charge 0.0013 ETH, meaning it doesn’t add a markup.

However, many altcoin exchanges have flat withdrawal fees, regardless of the current network charge. This will almost always end up costing you more. Just make sure the exchange doesn’t charge a percentage fee on withdrawals; this can make large payments unviable.

Conclusion – What is the Best Altcoin Exchange?

We’ve revealed the best altcoin exchanges in the market. eToro is our top pick. It is a regulated platform that supports 110 altcoins and offers a user-friendly interface for both beginners and advanced traders.

Investors can deposit funds instantly with a variety of payment methods, including Visa, MasterCard, and PayPal. eToro also offers a secure altcoin wallet, not to mention copy trading tools and smart portfolios.

FAQs

Which exchange is best for altcoins?

eToro is the best altcoin exchange for long-term investors, with the platform supporting fiat payments and a secure crypto wallet. MEXC is the better option for day traders seeking advanced charting tools and leveraged products.

Which exchange has the most altcoins?

MEXC has one of the largest altcoin collections; more than 2,500 cryptocurrencies are supported.

Is it safe to hold coins on exchanges?

Holding coins on exchanges introduces counterparty risks, meaning you’re trusting a third party to keep your funds safe. The safest option is to withdraw the coins to a private, self-custody wallet.

References

- Top cryptocurrency spot exchanges (CoinMarketCap)

- Elon Musk continues to tweet about altcoins like baby dogecoin—but investors should tread very carefully (CNBC)

- Phishing attacks: defending your organisation (NCSC)

- Bankman-Fried sentenced to 25 years for multi-billion dollar FTX fraud (Reuters)

About the Author

Kane Pepi is a financial, gambling and cryptocurrency writer with over 2,000 published works, including on platforms like InsideBitcoins and Motley Fool. He specializes in cryptocurrency guides, exchange and wallet reviews, and covers new crypto projects for Cryptonews.com. His expertise includes asset valuation, portfolio management, and financial crime prevention. Pepi holds a Bachelor’s in Finance, a Master’s in Financial Crime, and is pursuing a Doctorate in money laundering in crypto and blockchain. Connect with Kane on LinkedIn.