Altcoins

10 Best Altcoin Exchanges for Crypto Investors in 2024

Last updated:

May 7, 2024 04:58 EDT

| 23 min read

Leading altcoin exchanges support hundreds of cryptocurrencies, making them ideal for creating diversified portfolios. This usually includes a blend of small and large-cap projects from various cryptocurrency niches.

Read on to discover the best altcoin exchange for traders in 2024. We review 10 popular cryptocurrency exchanges, which are ranked by supported altcoins, trading fees, reputation, payment methods, and more.

Top Altcoin Exchanges Compared

Summarized below are the 10 best altcoin exchange platforms to consider today:

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| eToro | 110 | 1% | Yes | 2007 |

| MEXC | 2,500 | 0.10% | Yes | 2018 |

| Gate.io | 1,700 | 0.10% | Yes | 2013 |

| OKX | 330 | 0.10% | Yes | 2017 |

| Bybit | 610 | 0.10% | Yes | 2018 |

| Binance | 410 | 0.10% | Yes | 2017 |

| Coinbase | 248 | 1.49% | Yes | 2012 |

| Margex | 35 | 0.06% | Yes | 2020 |

| Kraken | 200 | 0.25% | Yes | 2013 |

| PrimeXBT | 35 | 0.20% | Yes | 2018 |

Best Altcoin Exchanges Reviewed

Let’s take a closer look at the altcoin trading exchanges listed above. Our reviews cover everything investors need to know when making an informed decision.

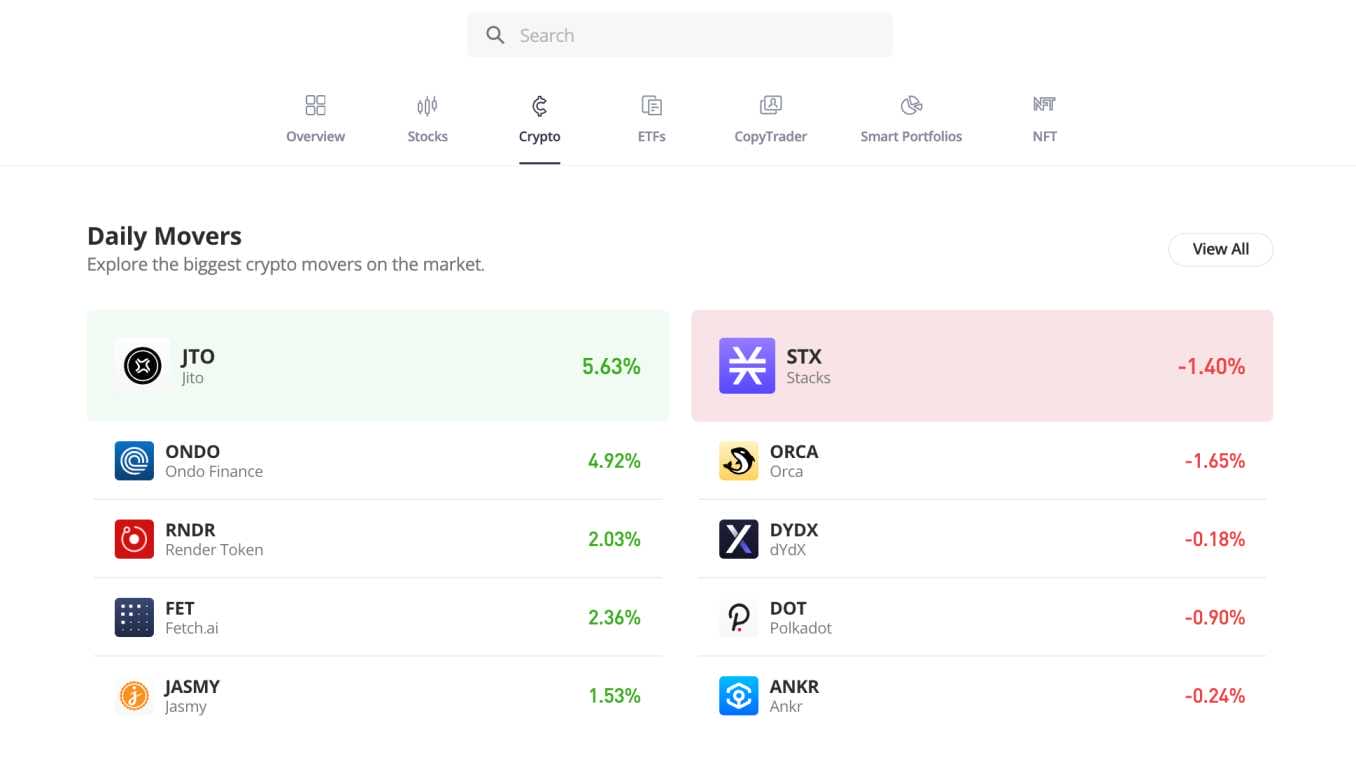

1. eToro – The Overall Best Altcoin Exchange for Safety, Plus Copy Trading Tools

eToro is the overall best altcoin exchange — especially for first-time investors. As a regulated exchange, eToro accepts a variety of convenient payment methods. This includes Visa, MasterCard, PayPal, Skrill, ACH, and bank wires. The minimum deposit requirement starts from $10. No deposit fees are charged on USD payments.

However, eToro charges an FX fee on other currencies, starting from 1.5%. eToro supports 110 cryptocurrencies, including some of the best altcoins. This covers large caps like Ethereum, BNB, Dogecoin, Cardano, Solana, and XRP. Lower-cap tokens include Axie Infinity, Ondo Finance, Flare, Aave, and SushiSwap.The minimum trade size is just $10 per altcoin.

This makes eToro a good option for diversifying on a budget. eToro also offers copy trading tools. There are thousands of investors to choose from, and the minimum capital requirement is $200. There are also smart portfolios, which are pre-built and professionally managed by the eToro team. eToro is licensed by multiple bodies, including the FCA and CySEC

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| eToro | 110 | 1% | Yes | 2007 |

Pros

- The overall best place to buy altcoins

- A safe and regulated platform with multiple licenses

- USD deposits are fee-free

- Supports 110 altcoin markets

- A great option for copy trading

- Offers a native app for iOS and Android

Cons

- Altcoin trading fees of 1% per slide

- High deposit fees on non-USD payments

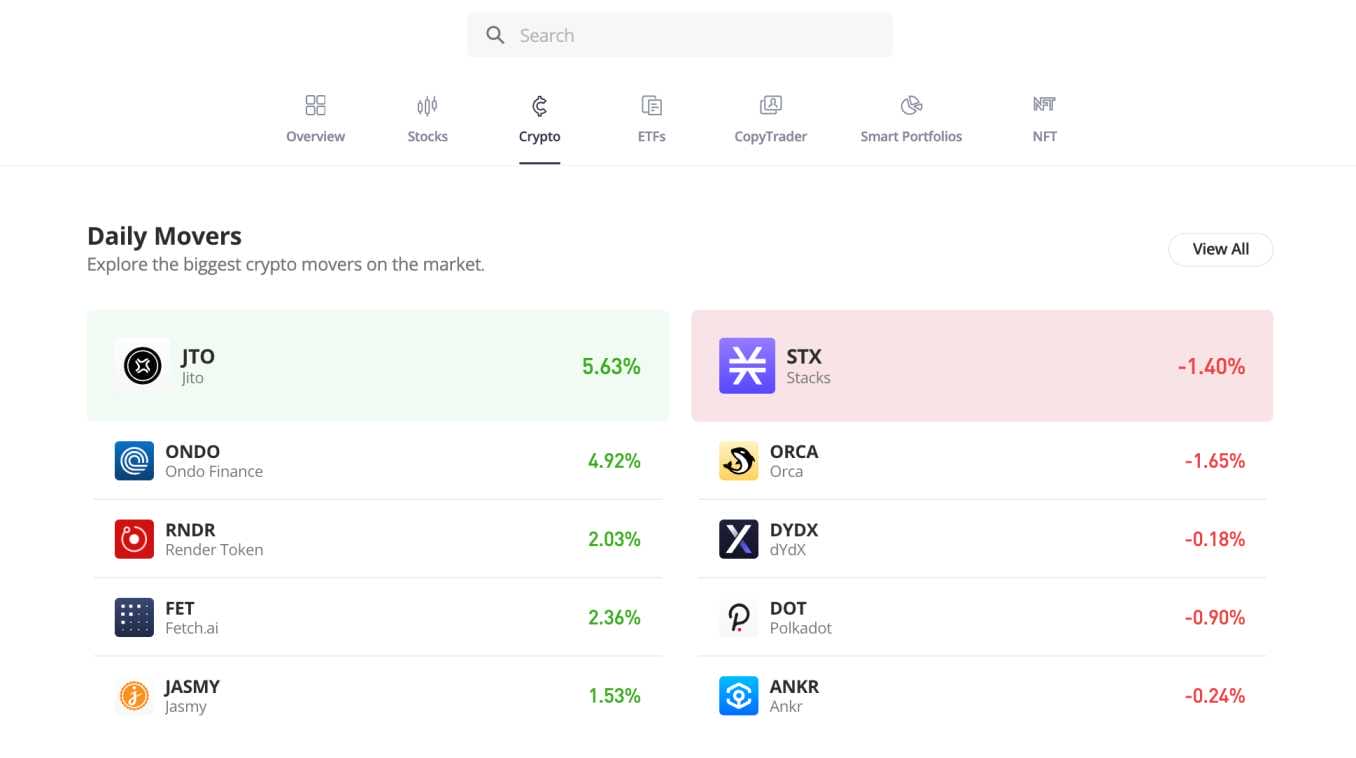

2. MEXC – Low-Fee Altcoin Exchange Supporting More Than 2,500 Altcoins

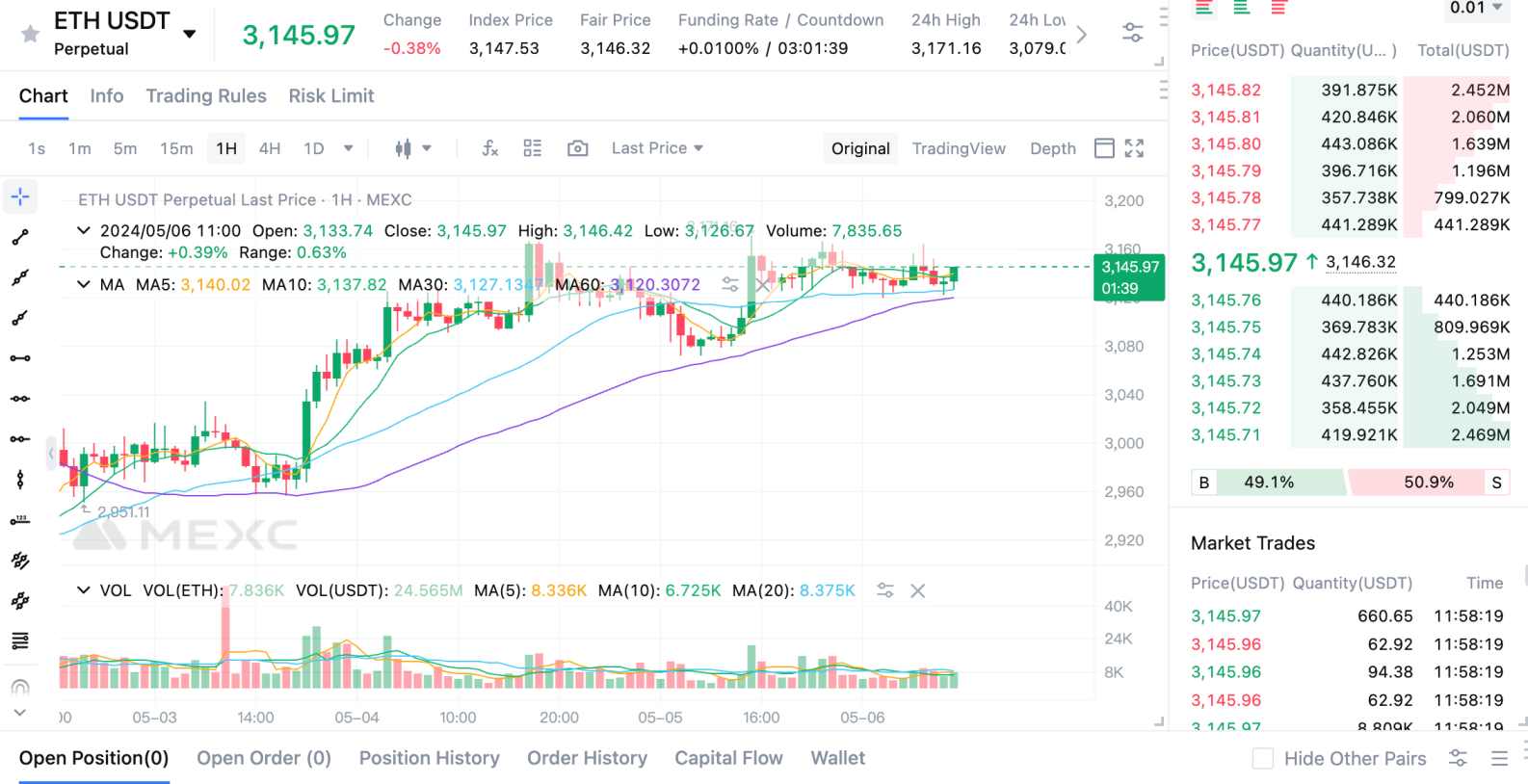

One of the largest selections of altcoin markets can be found on the MEXC exchange. This popular altcoin platform supports over 2,500 cryptocurrencies, including market leaders like Ethereum, Solana, and Cardano. Traders will also find plenty of micro-cap altcoins, making MEXC one of the best options for finding the next 1,000x crypto.

MEXC offers advanced charting tools, including technical indicators and TradingView integration. It also offers in-depth order books and risk management tools like stop-losses and take-profits. While most traders opt for the spot trading markets, MEXC also supports cryptocurrency derivatives.

These are ideal for short-selling altcoins or trading with leverage. Large-cap altcoins come with leverage of up to 200x. We also like MEXC’s fee structure. It charges just 0.1% when trading the spot markets and 0.01% on leveraged futures. Debit/credit card payments are processed by fiat gateway partners. Other payment methods are available in the peer-to-peer department.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| MEXC | 2,500 | 0.1% | Yes | 2018 |

Pros

- Lists more than 2,500 altcoins

- Low trading fees of just 0.1% per slide

- Premium trading volumes and liquidity

- Supports desktop trading and a native mobile app

- Altcoin leverage of up to 200x

Cons

- US clients are not accepted

- The instant buy feature only supports six altcoins

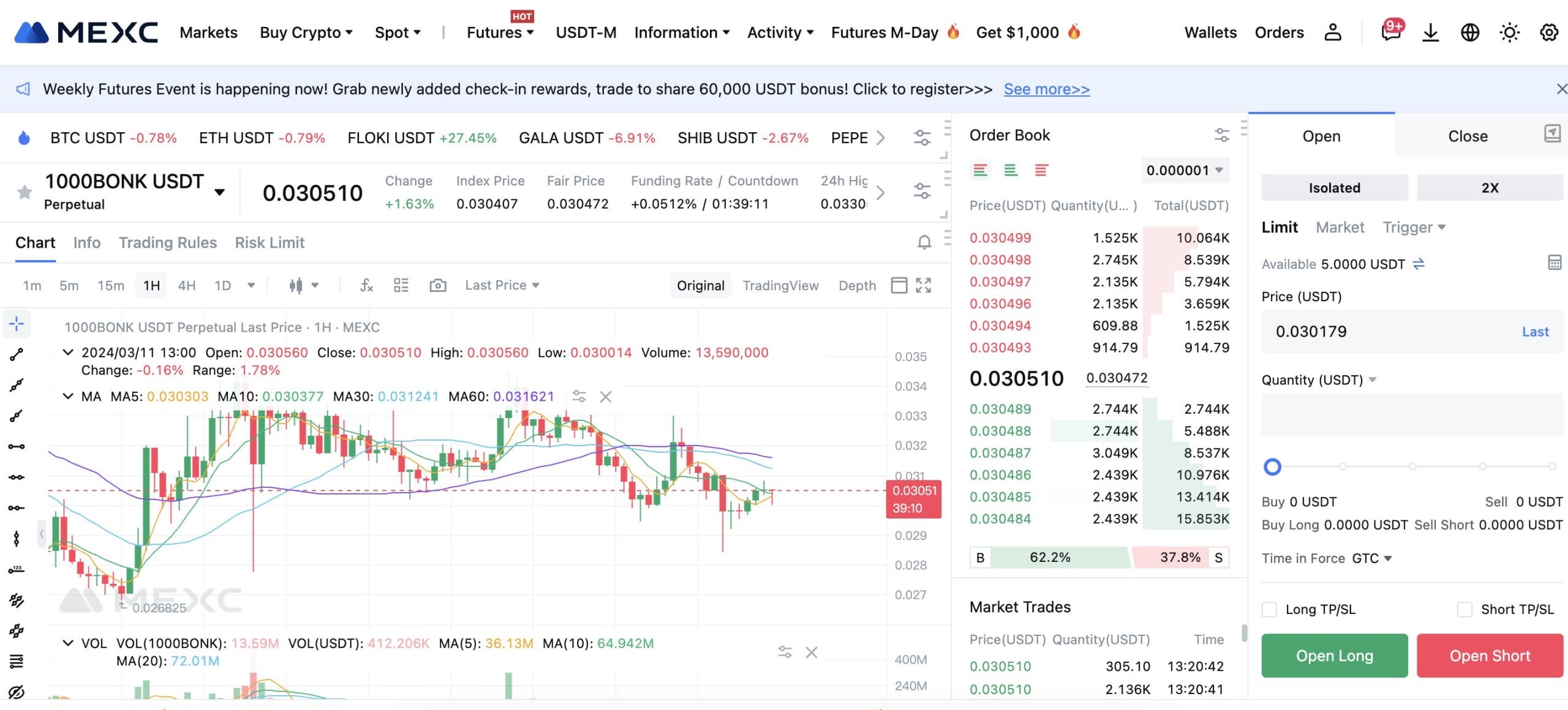

3. Gate.io – Huge Range of Supported Altcoins With Competitive Earning Rates

Next is Gate.io, which supports more than 1,700 altcoins. This covers a huge range of micro, small, and large-cap markets. Not only is Gate.io ideal for diversification but also for earning competitive interest rates. For example, Bitcoin, Ethereum, and Tether deposits are currently earning 6%, 7%, and 11.5% respectively.

Even higher APYs are available when depositing lower-cap altcoins. For instance, you’ll get 16.65% on Sui and 42% on Frontier. Lock-up terms and deposit limits vary depending on the altcoin. Like many crypto exchanges, Gate.io supports spot trading and derivative markets. The latter includes perpetual and delivery futures settled in USDT or the underlying altcoin.

Gate.io also supports copy trading tools, automated bots, and structured loans. Beginners are also catered for; Gate.io offers a simplified conversion tool. This enables users to swap cryptocurrencies without visiting the trading dashboard. What’s more, users can instantly buy altcoins with debit/credit cards and e-wallets.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| Gate.io | 1,700 | 0.1% | Yes | 2013 |

Pros

- Choose from over 1,700 altcoin markets

- Attracts substantial 24-hour trading volumes

- Ideal for beginners and experienced pros alike

- Leveraged markets include delivery and perpetual futures

- Instantly buy altcoins with fiat money

Cons

- Simplified conversion tool comes with higher fees

- $60,000 minimum to reduce spot trading commissions

4. OKX – Trade Over 330 Altcoins at Commissions of Just 0.1% Per Slide

Next on this list of altcoin exchanges is OKX. This is a great option for trading altcoins with low commissions. The highest commission charged is just 0.1% per slide. This means you’ll pay $1 for every $1,000 traded. OKX also offers reduced commissions when 30-day volumes hit certain milestones.

The commission also drops when holding OKB tokens, which are native to the OKX exchange. In terms of markets, OKX supports over 330 altcoins. This includes some of the best meme coins, such as Pepe, Bonk, Shiba Inu, and Dogecoin. OKX also supports derivative markets, including perpetual and delivery futures, as well as margin accounts and options.

Derivatives come with leverage of up to 100x and they support long and short trading. OKX accepts fiat money payments, although fees are built into the exchange rate. The minimum deposit requirement is $30. OKX also offers a peer-to-peer altcoin trading platform, which increases the number of supported crypto assets and payment types.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| OKX | 330 | 0.1% | Yes | 2017 |

Pros

- Supports over 330 altcoins

- Trading commissions start from just 0.1% per slide

- One of the best crypto leverage trading platforms

- Supports spot trading, futures, margin accounts, and options

- Advanced trading dashboard with technical indicators

Cons

- Minimum debit/credit card deposit of $30

- Fiat deposit fees are built into the exchange rate

5. Bybit – A Great Option for Buying and Selling Newly Launched Cryptocurrencies

Another popular altcoin exchange to consider is Bybit. It supports over 610 altcoins, including some of the best new cryptocurrencies to buy. This means you can often find the next altcoin gems before they explode. Moreover, Bybit supports a wide range of trading instruments. For instance, beginners will prefer the spot trading markets.

This enables traders to buy and sell altcoins without leverage. More experienced traders might prefer its derivatives section. This includes perpetual futures with leverage of up to 125x. Bybit also supports options markets, but only two altcoins are available: Ethereum and Solana. Although Bybit offers manual charting tools, it also supports automated trading features.

This includes thousands of fully automated bots. Simply select the preferred strategy and the bot will trade altcoins on your behalf. Bybit is also one of the best crypto exchanges for low trading fees. Spot trading and derivative commissions start from 0.1% and 0.02%, respectively. Bybit supports fiat money deposits via third-party gateways.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| Bybit | 610 | 0.1% | Yes | 2018 |

Pros

- More than 610 altcoins are listed

- Spot trading fees start from 0.1% per slide

- Also offers perpetual futures and options

- Supports some of the best crypto trading bots

- No KYC process when signing up

Cons

- Lack of regulation from tier-one bodies

- Doesn’t accept traders from the US

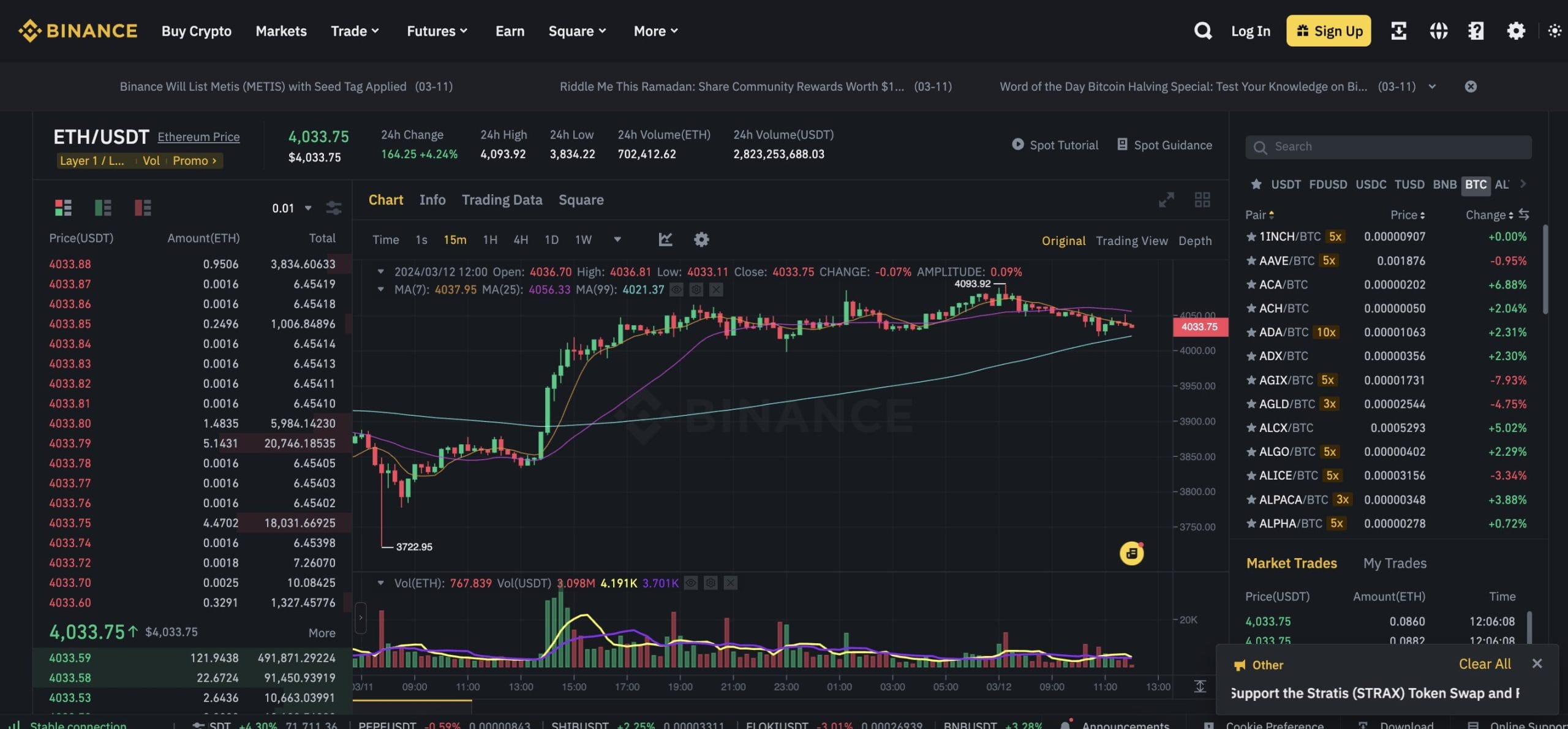

6. Binance – Top-Rated Exchange for Day Trading, Offers Premium Liquidity and Low Fees

We found that Binance is the best altcoin exchange for day traders. For a start, Binance offers significantly more liquidity than its market peers. More than $11 billion worth of spot trading positions were executed in the prior 24 hours. This often exceeds $100 billion during peak market cycles. In addition, Binance offers advanced charting features that are ideal for day trading strategies.

This includes more than 100 technical indicators, such as moving averages and the RSI, not to mention custom drawing tools and fully customizable charting screens. Binance also offers competitive trading commissions. Spot trading fees start from 0.1% per slide. Reduced commissions are available when holding BNB or meeting minimum 30-day volumes.

In terms of markets, Binance supports over 410 altcoins. This translates to over 1,600 trading pairs. Binance is another great option for trading cryptocurrency derivatives, including perpetual futures and options. While fiat money deposits are accepted, some currencies are no longer supported. Deposit fees vary depending on the trader’s location.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| Binance | 410 | 0.1% | Yes | 2017 |

Pros

- The best crypto exchange for day traders

- Offers the largest 24-hour volumes in the market

- Buy and sell altcoins from just 0.1% per slide

- Supports more than 100 technical indicators

- Choose between spot trading and derivative instruments

Cons

- Fiat deposits aren’t supported in all countries

- Facing increased pressures from global regulators

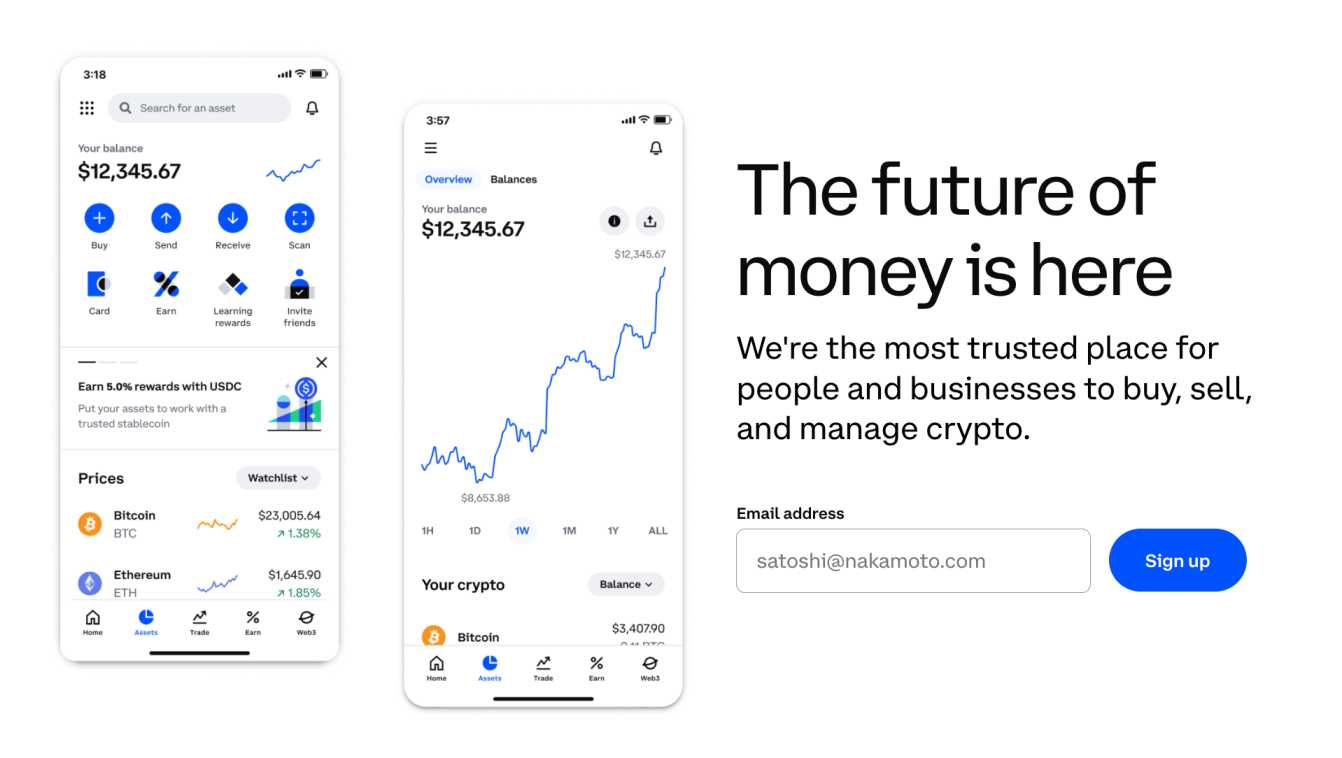

7. Coinbase – Popular Altcoin Platform for Beginners Seeking a User-Friendly Experience

Beginners might find that Coinbase is the best crypto exchange for altcoins. It offers a user-friendly platform that doesn’t require prior trading experience. Users can buy their preferred altcoins instantly with various payment methods, including Visa, MasterCard, and PayPal. Coinbase charges almost 4% when using the instant buy tool.

Bank transfers are also accepted, including ACH and UK Faster Payments. This deposit option is fee-free, although you’ll still need to pay commissions when completing an altcoin trade. This starts at 1.49% on positions over $200. A simple workaround is to switch over to Coinbase Advanced, which reduces the commission to 0.5%.

Coinbase lists nearly 250 altcoin markets. This includes everything from Ethereum and XRP to Cardano, Solana, and Dogecoin. Trades can be executed on the Coinbase website or mobile app. Coinbase is also a great option for earning passive rewards on altcoin investments. Some altcoins come with staking APYs of over 10% without lock-up requirements.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| Coinbase | 248 | 1.49% | Yes | 2012 |

Pros

- One of the best altcoin exchanges for beginners

- Launched in 2012 and heavily regulated

- Accepts US clients

- Supports debit/credit cards, PayPal, and bank transfers

- Almost 250 altcoin markets are supported

Cons

- Standard altcoin trading commissions of 1.49%

- The KYC process often requires multiple attempts

8. Margex – KYC-Free Derivatives Platform With 100x Leverage and 0.06% Commissions

Experienced traders will find that Margex is one of the best altcoin exchanges. It offers cost-effective perpetual futures on 35 altcoin markets. All perpetual instruments support long and short trading with high leverage limits. Ethereum and BNB can be traded with 100x leverage, while limits are reduced to 50x or 25x on other altcoins.

Margex offers competitive trading fees; market takers pay 0.06% per slide. However, there are no commission reductions when trading larger amounts. We found that Margex uses more than a dozen liquidity providers, ensuring that spreads are minimized around the clock. What’s more, Margex offers an innovative staking feature.

Users can stake their preferred altcoins to earn competitive rewards while still using the funds to trade perpetuals. APYs of up to 5% are currently available. Margex also offers copy trading features, which is great for investing in altcoins passively. Accepted deposit methods include debit/credit cards and SEPA.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| Margex | 35 | 0.06% | Yes | 2020 |

Pros

- A great option for trading perpetual futures

- Offers leverage of between 25x and 100x

- Staking balances can be used for trading

- Commissions of just 0.06% per slide

- Partnered with over a dozen liquidity providers

Cons

- Spot trading platform is still being developed

- Supports just 35 altcoin markets

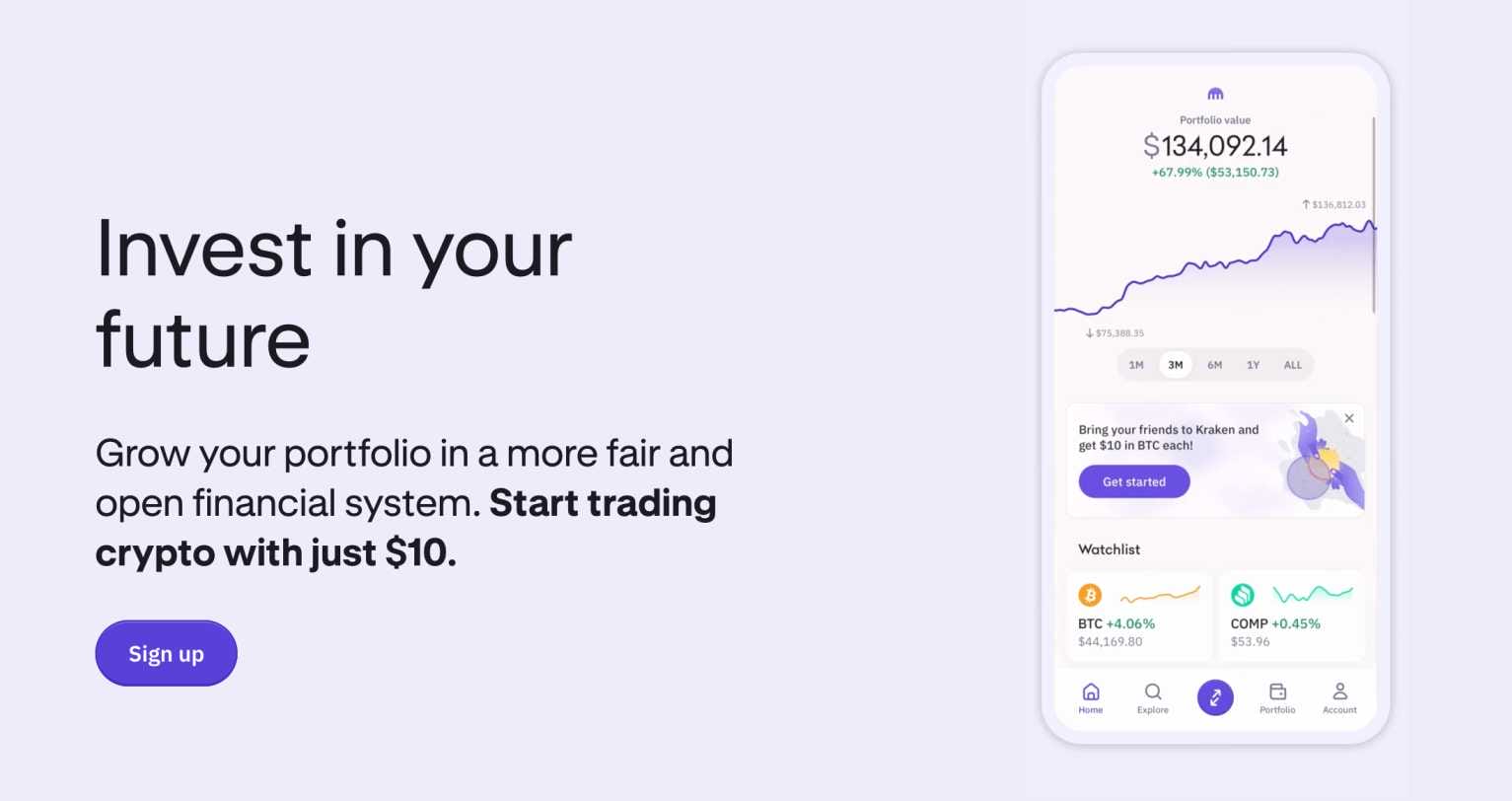

9. Kraken – US-Friendly Altcoin Exchange Supporting Over 200 Cryptocurrencies

Kraken is a US-friendly crypto exchange that launched in 2013. It supports over 200 cryptocurrencies, including Solana, Filecoin, Dogecoin, Polkadot, Dash, and Waves. The minimum investment requirement is a budget-friendly $10. What’s more, Kraken offers a ‘recurring buy’ feature that’s ideal for dollar-cost averaging.

For example, an altcoin investor could buy $50 worth of Litecoin every Monday and $50 worth of Bitcoin Cash every Friday. In terms of deposit methods, Kraken supports cost-effective bank transfers. Multiple banking networks are supported, including SEPA and ACH. Debit/credit cards are also accepted, meaning you can buy altcoins instantly.

However, Visa and MasterCard payments cost 3.75% + €0.25. Although Kraken is ideal for beginners, it also offers an advanced trading dashboard. This supports charting tools, technical indicators, and perpetual futures. Kraken also offers staking rewards and an NFT marketplace. Kraken recently launched a decentralized altcoin wallet, which comes as a mobile app.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| Kraken | 200 | 0.25% | Yes | 2013 |

Pros

- US-friendly exchange with solid regulation

- Supports over 200 popular altcoins

- Suitable for all experience levels

- Offers a recurring buy feature for long-term investors

- Recently launched a decentralized wallet app

Cons

- Higher commissions than most altcoin exchanges

- Debit/credit card fees are high

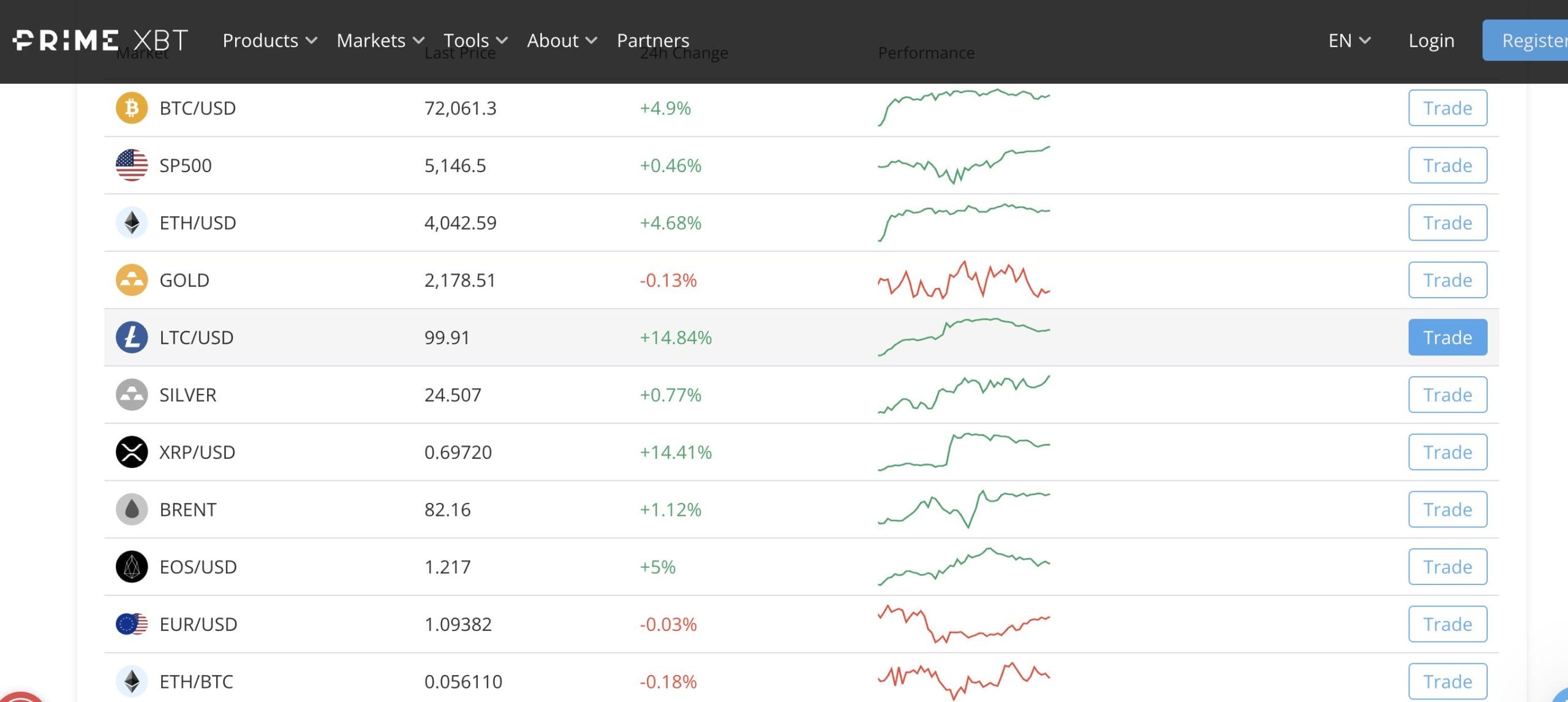

10. PrimeXBT – Seamlessly Access Leveraged Altcoin Markets on a Mobile App

PrimeXBT is one of the best altcoin exchanges when trading on a mobile app. Its native app for iOS and Android supports perpetual futures with leverage of up to 100x. 35 altcoin markets are listed, including Polkadot, Solana, Litecoin, Ethereum, and Cardano. Perpetuals come in two forms: isolated and cross-margin.

PrimeXBT boasts premium liquidity and market-leading spreads. The PrimeXBT charting dashboard has been optimized for smartphone usage, ensuring traders can analyze the markets while on the move. Tools include advanced order types, a customizable workspace, and over 50 technical indicators.

When it comes to fees, altcoin trading commissions cost 0.2% per slide. The minimum trade requirement is 0.001 BTC or the altcoin equivalent. In addition to altcoins, PrimeXBT also supports other financial markets, including energies, precious metals, indices, and forex. However, these markets are offered as contracts-for-differences (CFDs), which aren’t available in all regions.

| Exchange Name | Number of Altcoins Listed | Trading Fee % | Fiat Deposits? | Year Opened |

| PrimeXBT | 35 | 0.2% | Yes | 2018 |

Pros

- A great option for trading altcoins on a mobile app

- Charting tools have been optimized for smartphones

- Trusted by over 1 million users

- Specializes in leveraged perpetual futures

- Also supports commodities, forex, and other financial markets

Cons

- Limited range of altcoins when compared to other exchanges

- Doesn’t accept US traders

What is an Altcoin Exchange?

Altcoin exchanges allow users to buy and sell altcoins — any cryptocurrency other than Bitcoin. Some altcoin exchanges are aimed at long-term buyers who want to invest with fiat money. This means users can buy altcoins instantly with a debit/credit card or e-wallet. After that, the investor can withdraw their altcoins to a private wallet.

Alternatively, some altcoin exchanges are more suitable for active traders. These platforms offer advanced trading tools ideal for short-term strategies, such as comprehensive charts, drawing tools, and technical indicators. Some altcoin exchanges also support derivative products like futures and options.

This enables users to go long or short on altcoins with leverage. In all cases, altcoin exchanges make money from trading commissions. This averages 0.1% per slide, meaning a $1 commission is paid for every $1,000 traded. Ultimately, altcoin exchanges provide access to a wide range of cryptocurrencies, making them suitable for diversification strategies.

How to Choose The Best Altcoin Exchange

There are more than 760 altcoin exchanges listed on CoinMarketCap. This makes choosing the best altcoin exchange a time-consuming task. We’ll now explain the most important factors to consider when selecting a suitable platform.

Highest Number of Altcoins Listed

The first metric to explore is the number of altcoins listed. Some exchanges support thousands of altcoins, while others list several dozen. Choosing an exchange with a large number of markets enables investors to build a well-balanced altcoin portfolio. For example, MEXC and Gate.io list more than 2,500 and 1,700 altcoins, respectively.

This covers a huge range of new cryptocurrencies with small valuations, making them ideal for growth investors. However, PrimeXBT and Margex list just 35 altcoins. These are established, large-cap altcoins like Ethereum, Solana, and BNB. This means investors won’t have access to up-and-coming projects with a higher growth potential.

Lowest Altcoin Trading Fees

Trading fees will vary widely between altcoin exchanges. Investors should prioritize exchanges with the most competitive commissions. This is the fee paid whenever a buy or sell order is executed. As such, commissions eat away at your potential altcoin profits. Exchanges with the lowest commissions are MEXC, Gate.io, OKX, Bybit, and Binance.

These platforms charge just 0.1% per slide. Moreover, reduced trading commissions are available when 30-day volumes increase. Some altcoin exchanges offer discounts when holding their native token. For example, MEXC and Binance are backed by MK Token and BNB, respectively.

Those looking to trade leveraged products, such as perpetual futures, should also explore financing fees. Leverage is a loan taken from the altcoin exchange, so interest is applied to the position size. Some altcoin exchanges charge financing fees daily, while others implement them every few hours.

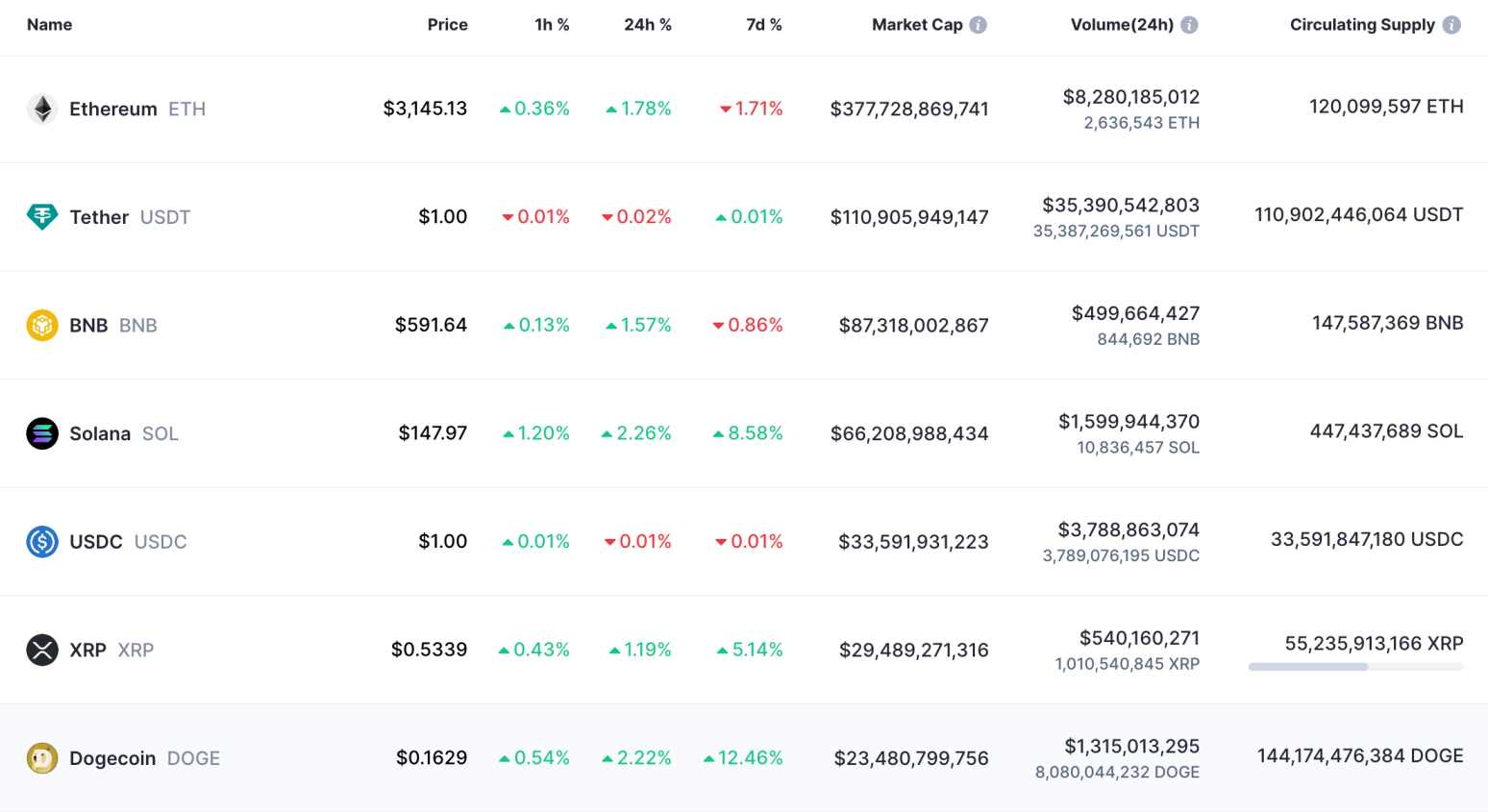

Highest Trading Pair Liquidity

Investors should also explore liquidity when choosing the best exchange for altcoins. Put simply, exchanges with high liquidity ensure smooth trading conditions. This means buy and sell orders are matched promptly without vastly impacting prices. All of the altcoin exchanges discussed today offer sufficient liquidity.

However, this isn’t always the case when using less-established platforms. For example, consider a recently launched altcoin exchange that has limited trading volumes. If there isn’t enough liquidity in a particular market, an altcoin trader won’t be able to sell their tokens at a suitable price.

This means the trader might need to accept a sub-par price to force their sell orders through. CoinMarketCap is a good option when analyzing liquidity levels. It gives a liquidity score from 0 to 100 for over 760 altcoin exchanges. Binance ranks the best with a score of 859. After that, Kraken and Coinbase have a liquidity score of 732 and 708, respectively.

What Happens if There Isn’t Enough Liquidity to Sell My Altcoins?

- If you’re using an altcoin exchange without sufficient liquidity, cashing out a profitable position can be problematic.

- Just remember — another market participant must accept your sell order.

- Reducing the sell order price is one option, as this can motivate buyers to enter the market.

- However, if there aren’t any buyers at all — your sell order will remain pending.

- In this instance, you could be forced to transfer the altcoins to an exchange with more liquidity.

- This will increase the chances of finding a suitable buyer.

Support for Preferred Deposit Method

One of the biggest barriers for new altcoin investors is getting funds into an exchange. This means that new market entrants need to deposit fiat money, such as dollars or euros. Fortunately, the best altcoin exchanges accept a wide range of convenient payment methods. Fees will vary widely depending on the payment type and currency.

For example, eToro is the best option for instant deposits with US dollars. No fees are charged when using Visa, MasterCard, PayPal, Skill, or any other supported method. However, eToro is expensive when using other currencies; FX fees start from 1.5% of the deposit amount.

Coinbase is an expensive option when using instant payment methods — fees cost almost 4%. However, Coinbase is ideal when depositing funds from a bank account. No fees are charged on local banking methods like ACH and Faster Payments. What’s more, bank payments typically arrive in under five minutes.

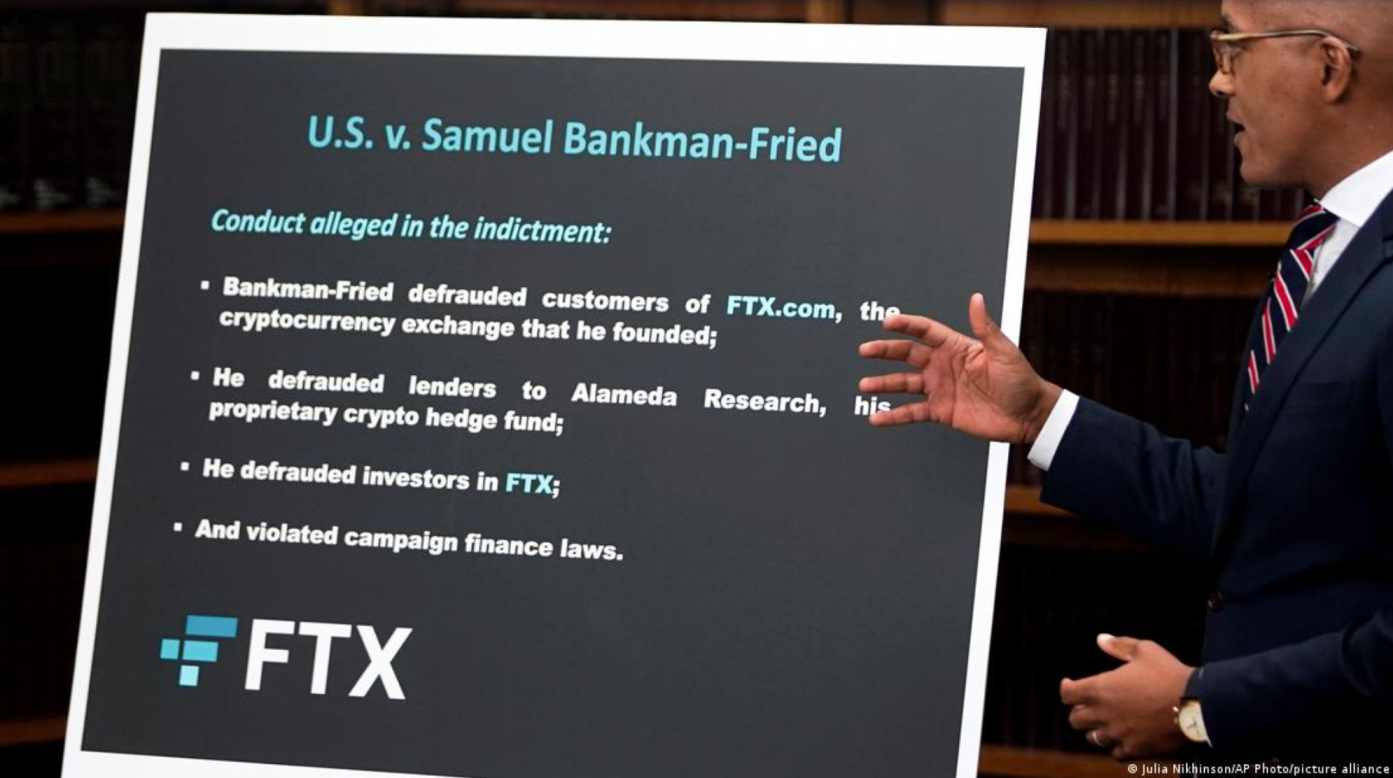

Trustworthiness and Security

Many altcoin exchanges have experienced hacks — sometimes resulting in hundreds of millions of dollars worth of stolen coins. In other cases, altcoin exchanges have collapsed because of internal fraud. FTX is the most notable example, with customers losing over $8 billion. With this in mind, trust and security should be prioritized when selecting the best altcoin exchange.

There are several aspects to consider. First, explore when the exchange was launched; more established platforms are preferred. Next, assess whether the altcoin exchange is regulated. eToro and Coinbase are the market leaders here; both are approved by FINRA and the SEC. eToro is also licensed by the FCA (UK) and CySEC (Europe).

Another security check is ‘proof of reserves’, which became mainstream after the FTX collapse. Put simply, crypto exchanges should be audited by a reputable body and showcase their cryptocurrency reserves. Reserves should not only cover customer deposits but also be held in liquid coins, such as Bitcoin and Tether.

Account security features are also important. For example, eToro and Binance have made two-factor authentication mandatory. This means users must enter a unique code every time they log in. The code is sent via SMS or through the Google Authenticator app. Other security features to look for include IP/device whitelisting and anti-phishing safeguards.

Should I Keep my Altcoins in an Exchange?

- Regardless of whether the cryptocurrency exchange is regulated and what security features it offers, the best option is to withdraw your altcoins to a self-custody wallet.

- In doing so, you’re removing your altcoins from counterpart risks — such as hacks, scams, and fraud.

- The altcoins you buy can be kept in a private wallet until you’re ready to sell.

- You can then transfer the altcoins to the same exchange, sell them for fiat currency, and cash out to a bank account.

Understanding Fees on Altcoin Exchanges

Similar to online stock brokers, altcoin exchanges implement an assortment of charges. Understanding fees for the services you wish to use is crucial. Let’s take a much closer look at the fees charged when using an altcoin exchange.

Spot Trading Commissions

The most common fee is the spot trading commission. This is the fee you pay when buying and selling altcoins. It’s typically charged as a percentage of the overall trade size. As mentioned, the best altcoin exchanges charge commissions of just 0.1% per slide.

- So, suppose you purchase $500 worth of Ethereum.

- At 0.1%, you’ve paid a buy commission of $0.50.

- A few weeks later, your Ethereum position has increased to $900. You decide to sell, so again, pay a 0.1% commission.

- This means you’ve paid a sales commission of $0.90.

Many altcoin exchanges use a maker/taker model, which can be confusing for beginners.

- Market ‘makers’ get the lowest commissions, as they provide liquidity to the exchange

- Market ‘takers’ pay a slightly higher commission, as they use the liquidity that’s already available

What’s more, altcoin exchanges typically use staggered commission structures, which can benefit high volume traders. This means commissions decline as monthly trading volumes increase. For example, Binance reduces the commission from 0.1% to 0.06% when trading over $20 million within 30 days.

Derivative Trading Commissions

Derivative products attract different fees from the spot trading markets. You’ll notice that derivative commissions are usually lower. However, this is based on the total leveraged amount.

For example, suppose the altcoin exchange charges 0.01% when trading perpetual futures. You risk $1,000 with 20x leverage, amplifying the trade size to $20,000. At 0.01%, you pay a $2 commission (0.01% x $20,000).

Financing Fees

Derivative trading attracts an additional fee to the commission — financing. This is the interest charged on leveraged positions. Some altcoin exchanges charge a financing fee every few hours.

For example, at Kraken, it’s every four hours. Other exchanges charge financing fees once per day. Therefore, you’ll need to know the interest rate charged and how often it’s implemented.

Payment Fees

Altcoin exchanges can also charge payment fees when making a fiat deposit. This can vary depending on the currency and payment type.

Withdrawal Fees

Withdrawing altcoins from an exchange will also attract fees. We prefer exchanges that mirror the actual network charge in real time. For example, suppose the Ethereum network currently charges GAS fees of 0.0013 ETH (about $4). The exchange should also charge 0.0013 ETH, meaning it doesn’t add a markup.

However, many altcoin exchanges have flat withdrawal fees, regardless of the current network charge. This will almost always end up costing you more. Just make sure the exchange doesn’t charge a percentage fee on withdrawals; this can make large payments unviable.

Conclusion – What is the Best Altcoin Exchange?

We’ve revealed the best altcoin exchanges in the market. eToro is our top pick. It is a regulated platform that supports 110 altcoins and offers a user-friendly interface for both beginners and advanced traders.

Investors can deposit funds instantly with a variety of payment methods, including Visa, MasterCard, and PayPal. eToro also offers a secure altcoin wallet, not to mention copy trading tools and smart portfolios.

FAQs

Which exchange is best for altcoins?

eToro is the best altcoin exchange for long-term investors, with the platform supporting fiat payments and a secure crypto wallet. MEXC is the better option for day traders seeking advanced charting tools and leveraged products.

Which exchange has the most altcoins?

MEXC has one of the largest altcoin collections; more than 2,500 cryptocurrencies are supported.

Is it safe to hold coins on exchanges?

Holding coins on exchanges introduces counterparty risks, meaning you’re trusting a third party to keep your funds safe. The safest option is to withdraw the coins to a private, self-custody wallet.

References

- Top cryptocurrency spot exchanges (CoinMarketCap)

- Elon Musk continues to tweet about altcoins like baby dogecoin—but investors should tread very carefully (CNBC)

- Phishing attacks: defending your organisation (NCSC)

- Bankman-Fried sentenced to 25 years for multi-billion dollar FTX fraud (Reuters)

About the Author

Kane Pepi is a financial, gambling and cryptocurrency writer with over 2,000 published works, including on platforms like InsideBitcoins and Motley Fool. He specializes in cryptocurrency guides, exchange and wallet reviews, and covers new crypto projects for Cryptonews.com. His expertise includes asset valuation, portfolio management, and financial crime prevention. Pepi holds a Bachelor’s in Finance, a Master’s in Financial Crime, and is pursuing a Doctorate in money laundering in crypto and blockchain. Connect with Kane on LinkedIn.

Altcoins

Altcoins with huge potential Bonk and Mpeppe (MPEPE)

The cryptocurrency market is full of potential, and two altcoins that have recently caught the attention of investors are Bonk (BONK) and Mpeppe (MPEPE)Both of these tokens offer unique features and promising growth prospects that set them apart in the crowded altcoin space. In this article, we will explore what makes Bonk (BONK) and Mpeppe (MPEPE) attractive investment opportunities and how they could shape the future of the cryptocurrency market.

Bonk (BONK): The viral sensation

Bonk (BONK) burst onto the scene with a playful and viral take on cryptocurrency. Here’s a closer look at what’s made Bonk (BONK) a sure bet in the altcoin space.

The Viral Marketing Strategy

Bonk (BONK) Bonk has harnessed the power of internet memes and viral marketing to quickly gain popularity. Its branding, which features a humorous and engaging mascot, has resonated with the crypto community and beyond. By harnessing the viral nature of meme culture, Bonk (BONK) has quickly established a strong presence and captured the imagination of a wide audience.

Merging meme culture and blockchain innovation

Mpeppe (MPEPE) is emerging as a new and exciting player in the altcoin market. With its unique blend of features and innovative approach, Mpeppe (MPEPE) is attracting the attention of investors and cryptocurrency enthusiasts.

Mpeppe (MPEPE) combines the fun and relatable aspects of meme culture with advanced blockchain technology. Inspired by football and blockchain innovation, Mpeppe (MPEPE) offers a distinctive brand identity that appeals to a wide audience. This fusion of entertainment and technology sets Mpeppe (MPEPE) apart from other altcoins and offers an attractive investment opportunity.

Community impact

The strength of each cryptocurrency’s community will play a vital role in its future trajectory. Bonk (BONK) and Mpeppe (MPEPE) Cryptocurrencies build strong, engaged communities, but how they foster and grow those communities will determine their long-term success. Active, supportive communities can generate lasting interest and value, making them essential to the future of every cryptocurrency.

Conclusion: Invest in Bonk and Mpeppe

Bonk (BONK) and Mpeppe (MPEPE) represent exciting opportunities in the altcoin market. While Bonk (BONK) has established itself through its viral marketing and strong community support, Mpeppe (MPEPE) offers a unique blend of meme culture and advanced blockchain features. Both coins have the potential to make a significant impact in the cryptocurrency space.

For investors looking to explore high-potential altcoins, keeping an eye on Bonk (BONK) and Mpeppe (MPEPE) offers interesting opportunities. As the market evolves, these tokens could play a significant role in the future of cryptocurrencies, making them attractive options for those looking for growth and innovation in the altcoin space.

For more information on the Mpeppe presale (MPEPE):

Visit Mpeppe (MPEPE)

Join us and become a member of the community:

Altcoins

Top 6 Altcoins Expected to EXPLODE Before 2025: Buy Now!

As we approach 2025, the cryptocurrency market is poised for a major shift. According to Austin, an analyst at Altcoin Daily, potential policy changes could trigger a major surge in altcoins. A potential change in the Federal Reserve’s policy rate in September could lead to substantial growth in the cryptocurrency market, benefiting Ethereum, Solana, and several promising new altcoins.

Here’s a look at some altcoins priced between $1 and $2 that could offer good returns during the current market downturn. Dive right in.

Top 6 Altcoins to Watch

Aethir: The Decentralized GPU Marketplace

Aethir is becoming a key player in decentralized cloud infrastructure for gaming and AI. With over $36 million in annual revenue, Aethir is meeting the growing demand for GPU computing from large tech companies like Google and Microsoft. By utilizing underutilized GPUs, Aethir is making a significant impact in the tech world. Current Price: $0.07176.

Ondo: The Best Bet in the RWA Sector

Ondo is transforming the way financial assets are tokenized with its real asset protocols. The ONDO token, used for Ondo DAO and Flux Finance, offers a 5.3% annual dividend in USDY. Despite a recent 35% price drop, ONDO’s price action suggests a potential breakout. With less selling pressure and an increase in off-exchange holdings, the outlook appears positive. Current price: $0.9251.

Lukso: Blockchain for Creators and Social Networks

Lukso is creating a unique blockchain focused on connecting creators, brands, and users. As an alternative to Ethereum, Lukso offers universal profiles and gasless transactions, making blockchain technology more accessible. With a strong vision and strong leadership, Lukso is poised for wider adoption. Current Price: $1.71.

AIT Protocol: Decentralized AI Data Annotation

The AIT protocol addresses the need for decentralization of work in AI data annotation. It connects human trainers with AI model owners through a decentralized marketplace, thereby improving AI models. Its growing adoption in Asia and strategic investments suggest that it could be a major disruptor in the AI space. Current price: $0.1169.

Foxy (Linea): A meme piece with level 2 potential

Foxy, a cryptocurrency associated with Linea’s Ethereum layer 2 scaling, has received support from ConsenSys. It stands out in Ethereum layer 2 due to its MetaMask integration and fast transactions. With Linea’s growing adoption and low transaction costs, Foxy is well-positioned for growth. Current price: $0.01116.

Off-grid: Emerging Altcoin in Video Gaming

Finally, Off The Grid, developed by Godzilla, is generating excitement in the crypto gaming sector. Although it has not yet launched, it has received positive feedback from industry experts, suggesting strong potential. Other infrastructure projects like Immutable and games such as Xers and Star Heroes are also worth considering for those interested in crypto gaming.

Who’s excited about the potential altcoin rally?

Altcoins

Bitcoin Dominance Hits 3-Year High: Is Altcoin Season Coming?

As Bitcoin dominance hits a three-year high of 56%, analysts are predicting the potential start of an altcoin season. Although Bitcoin’s current valuation has fallen below $63,600, the high dominance level suggests a significant shift in the market.

Experts point out that Bitcoin dominance is a key factor in predicting altcoin trends. If Bitcoin holds its price while its dominance declines, it could signal a flow of investment into altcoins. This triggers what many call an “altcoin season.”

Conversely, if Bitcoin price and dominance fall simultaneously, it usually indicates a broader market correction rather than an altcoin boom.

What Factors Suggest an Imminent Altcoin Season?

Markus Thielen of 10X Research noted that Bitcoin Price Tends to Stabilize in August. Therefore, a stable Bitcoin price, coupled with declining dominance, may create the ideal conditions for altcoins to thrive.

Learn more: Bitcoin Dominance Chart: What Is It and Why Does It Matter?

Bitcoin Domination. Source: TradingView

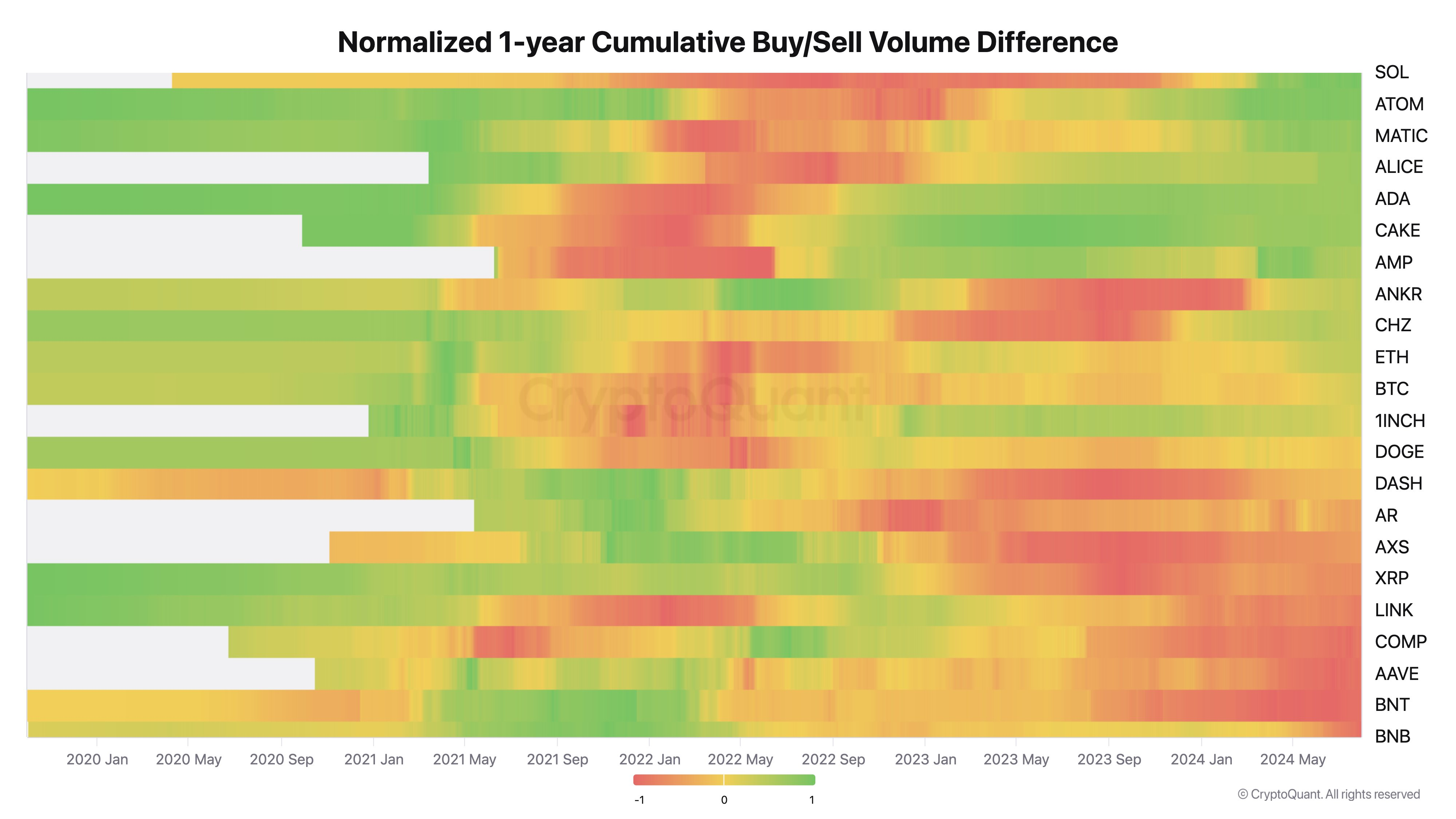

In addition, Ki Young Ju, founder of the chain analysis CryptoQuant platform has highlighted increasing activities by crypto whales that appear to be preparing for an altcoin rally.

“Limit buy order volume for altcoins, excluding Bitcoin and Ethereum, is increasing, indicating that strong buy walls are being put in place” said.

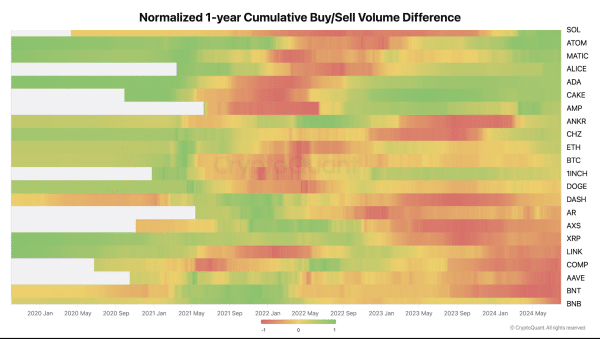

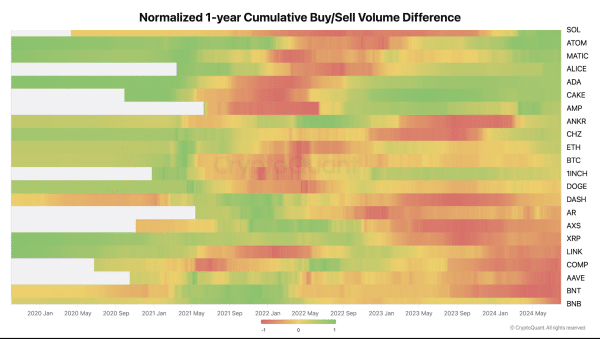

Ju explained that limit orders, which are preferred by institutions for large trades to minimize price impact, create “quote volume.” His analysis, which includes a graph of the 1-year normalized cumulative buy/sell volume difference, indicates that altcoins like Solana (SOL)Cosmos (ATOM) and Polygon (MATIC) experience significant accumulation activities.

“The indicator is calculated by taking the cumulative sum of the difference between the buy and sell quote volumes, using a one-year rolling window. If there is an upward trend, it means the buy volume of the quotes is increasing, indicating stronger buy walls,” Ju explained.

Normalized cumulative difference over 1 year between purchase and sale volumes. Source: CryptoQuant

Normalized cumulative difference over 1 year between purchase and sale volumes. Source: CryptoQuant

This bullish sentiment is reflected in the trends following recent developments in crypto financial products. Crypto Vikings, a renowned analyst, suggests that current market conditions are conducive to altcoin season.

“Many alts are down 60-80% in the last couple of months, and many of them have already bottomed and are in a good buy zone. Bitcoin Domination is also facing major resistance relative to where the massive altcoin season began each cycle,” Crypto Vikings declared.

Sentiment is increasingly optimistic, as many believe that the disillusionment that follows periods of prolonged economic downturn opens the way to profitable investments.

Another trader, Mags, noted that altcoins are only up 58% after breaking a 525-day accumulation. Therefore, he predicts a possible continuation of the altcoin rally after a reaccumulation consolidation.

“Permanent bears will tell you that altcoins are done and in a distribution phase. But if you look at the chart, altcoins are only up 58% since they broke out after 525 days of accumulation. Do you really think a breakout after 525 days of consolidation will end after only a 58% move?” wrote on X (Twitter).

Learn more: 11 Cryptos to Add to Your Portfolio Before Altcoin Season

On the other hand, Brian Quinlivan, senior analyst at Santiment, told BeInCrypto that there is a lack of enthusiasm for the altcoin season due to the recent price drops.

“As far as mentions of altcoin season go, we’re not really seeing any significant enthusiasm from traders about it. Traders have at least been a little bit more vocal since we started seeing prices drop over the last three days,” Quinlivan told BeInCrypto.

Disclaimer

In accordance with the Trust Project This price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAnd Disclaimer have been updated.

Altcoins

On-chain data confirms whales are preparing for altcoin surge with increased buy orders

Ki Young Ju, CEO of analytics platform CryptoQuant, believes whales are preparing for an upcoming surge in altcoins.

In a recent revelation about X, Ju underlines that the volume of limit buy orders for altcoins, excluding Bitcoin and Ethereum, is increasing. This pattern suggests the formation of substantial buy walls, highlighting significant buying pressure from large-scale investors.

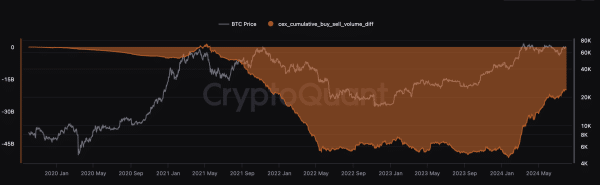

Ju’s chart identifies two main phases in limit order volume for altcoins: the limit sell phase and the limit buy phase. The limit sell phase saw a notable increase in cumulative sell orders in 2022, demonstrating strong selling pressure from whales and other market participants. This phase coincided with a period of falling altcoin prices due to unfavorable market conditions.

Then, the limit buying phase began, marked by a significant increase in cumulative buy orders. This indicates a period of strategic accumulation where whales establish substantial buy walls.

According to Ju, the increase in buying volume suggests confidence in the future conditions of the altcoin market. This buying pressure creates strong support levels, indicating that whales are preparing for a positive change in the market.

Buying pressure on specific altcoins

Ju also provided a heatmap of the 1-year normalized cumulative buy/sell volume difference for various altcoins, showing the buying and selling pressure over time. Solana (SOL) has seen alternating strong buying and selling phases, with recent activity showing increased buying interest. Cosmos (ATOM) and Polygon (MATIC) have also shown increased buying pressure despite mixed activity trends.

Cardano (ADA) and PancakeSwap (CAKE) have shown balanced buying and selling phases, with recent trends proving increased buying pressure. Coins like AMP and ANKR have also demonstrated increased buying activity. The heatmap reveals that most altcoins are seeing increased buying pressure as whales and large investors accumulate altcoins in anticipation of a rally.

Meanwhile, coins experiencing selling pressure, as indicated by the predominantly red areas on the heatmap, include DOGE, DASH, AXS, XRP, COMP, and AAVE, BNT.

Bitcoin whales are also buying

It is important to note that while whales are accumulating altcoins, Bitcoin whales are also active. Crypto Basic note an increase in buyer activity on Binance, which aligns with an increase in the buy/sell ratio of takers and whale movements. Analyst Ali Martinez highlighted the ratio fluctuations from below 0.8 to above 1.7 between July 27 and 31. Ratios above 1.0 indicate aggressive buying, often preceding price rallies.

From July 27 to July 28, the ratio remained mostly above 1.0, corresponding to the rise in Bitcoin price from around $66,500 to over $67,000. A spike to around 1.5 led to a sharp increase in price to around $68,500. However, on July 30 and 31, the ratio fell below 1.0 several times, corresponding to a drop in price to around $66,000, before a final spike to 1.7 indicated another slight increase in price.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

-

News12 months ago

News12 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

News11 months ago

News11 months agoOver 1 million new tokens launched since April

-

Altcoins11 months ago

Altcoins11 months agoAltcoin Investments to create millionaires in 2024

-

Memecoins9 months ago

Memecoins9 months agoMemecoins dominate major derivatives in terms of open interest | Flash News Detail

-

News9 months ago

News9 months agoInvest Now: The Hottest New Cryptocurrencies of August 2024 That Could Skyrocket

-

Altcoins9 months ago

Altcoins9 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

NFTs9 months ago

NFTs9 months agoRTFKT Announces Project Animus Reveal, Launches Egg Unboxing Event Amid Mixed Reactions | NFT CULTURE | NFT News | Web3 Culture

-

Altcoins9 months ago

Altcoins9 months agoHot New Altcoin: Memeinator’s Price Upside Potential in July

-

Videos12 months ago

Videos12 months agoMoney is broke!! The truth about our financial system!

-

Memecoins11 months ago

Memecoins11 months agoChatGPT Analytics That Will Work Better in 2024

-

Altcoins11 months ago

Altcoins11 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

News11 months ago

News11 months ago5 Crypto Airdrops After Notcoin to Watch Out for in June 2024