Altcoins

Why the altcoin market is declining after the token is unlocked

Altcoins are facing an early crypto winter, mainly due to significant token unlocks in 2024.

According to Bloomberg, the first investors of the project seek to quickly sell the tokens received, wishing to guarantee profits in the short term. At the same time, they do not want to keep unlocked altcoins on their balance sheets, for future growth.

The data of Unlocked Tokens The platform, which tracks 138 projects, says 120 are expected to release tokens in 2024. Analysts estimate the total market value of this volume of assets at $58 billion.

Edward Chin, co-founder of investment firm Parataxis Capital, believes that the massive selloffs of these assets are putting intense pressure on the altcoin market. At the same time, brokers often have to offer potential buyers tokens from early investors at a discount of up to 40%.

“The market is weird right now, in that many of the infrastructure projects that investors funded during the bear market are now getting to launch their tokens, but there aren’t a ton of regular buyers of those tokens at high prices.”

Lex Sokolin, co-founder of Generative Ventures

How does unlocking affect tokens?

The timing and extent of token unlocking can have a significant impact on market dynamics. Unlocking multiple tokens at once may reduce interest in purchasing and temporarily lower token prices.

Token unlock events can cause market fluctuations as investors react to the new token supply. Investors can adjust their positions based on the unlock schedule and the expected impact on token prices, resulting in price variations.

Which tokens crashed after unlocking?

For example, the token of the dYdX project, DYDX, fell 61% in the last three months. At the time of writing, the asset’s price is $1.4 and its market capitalization is $838 million.

Source: CoinMarketCap

A similar situation is observed in the Pyth network (PYTH) and Avalanche (AVAX) projects. During the same period, their tokens fell by 55% and 66% respectively.

The three listed projects were released in May 2024. The general volatility of the market is making the situation worse with altcoins. Of the 90+ largest crypto assets by market capitalization, only 12 have posted positive returns since mid-March 2024.

According to statistics, about 80 projects show negative dynamics in this indicator. At the same time, the price of 23 assets fell by more than 50%.

Crypto winter in the altcoin market

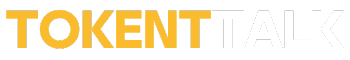

10xSearch Analysts note that the top 115 altcoins have seen their prices drop more than 50% since their 2024 peaks. This correction is mostly similar to declines seen in previous market cycles in 2017 and 2021. Without an influx of new funds and a restoration of liquidity, the fall in altcoin prices could continue.

Source: 10xSearch

Source: 10xSearch

“Today, altcoins are in a brutal bear market. In 2024, 73% of these 115 coins peaked in March. We were right to call for Bitcoin to outperform everything else, notably Ethereum, but at the beginning of March the situation changed.

10xSearch

While altcoins are falling, the two flagship cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), have shown relative resilience. They are down 11% and 13% respectively from their peaks this year.

“Surviving the altcoin bear market depends on one crucial factor: effective risk management. Token unlocking and unfavorable crypto liquidity indicators are the main catalysts for this altcoin crash.

10xSearch

In May, analysts warned of a potential decline in altcoin prices due to the release of a large volume of tokens. Nearly $2 billion in unlocked tokens are expected to enter the market before July, which could lead to a cryptocurrency sell-off and a drop in prices.

According to experts, this situation is due to the action of venture capital funds. In the first quarter of 2022, these funds invested $13 billion in altcoins. Under pressure from investors wishing to return their funds, venture capital funds are forced to sell their tokens. The situation is aggravated by growing investor interest in artificial intelligence (AI).

Should traders wait for altcoin season?

The sharing of Bitcoin the total capitalization of the entire crypto market, the volume of which is $2.4 trillion, is 54.6%. The so-called Bitcoin Dominance Index indicates the market cycle and investor sentiment, with smaller cryptocurrencies generally outperforming Bitcoin and Ethereum in terms of growth rate.

Source: TradingView

Source: TradingView

Typically, the share of the leading digital currency in the total capitalization of the entire crypto market increases during cyclical industry downturns. During a bullish period in the market, when many altcoins are growing faster than Bitcoin, Bitcoin declines. So, the first cryptocurrency dominance index indicates the market cycle and investor sentiment.

Swissblock Analysts called the conditions for starting the altcoin season. Experts believe that traders should monitor the ETH/BTC price ratio, which is the price of Ethereum in Bitcoin equivalent. The growth of the ETH/BTC pair is traditionally seen as a harbinger of an influx of capital into alternatives.

Additionally, technical analyst Titan of Crypto also expressed confidence in the upcoming alt season in April.

According to him, the altcoin market is poised for significant growth. The analyst pointed out that the phase after the BTC halving usually becomes a turning point for them. Technical charts suggest that altcoins will soon take center stage, foreshadowing a potentially lucrative alt-season.

Disclosure: This article does not constitute investment advice. The content and materials presented on this page are provided for educational purposes only.

Altcoins

Altcoins with huge potential Bonk and Mpeppe (MPEPE)

The cryptocurrency market is full of potential, and two altcoins that have recently caught the attention of investors are Bonk (BONK) and Mpeppe (MPEPE)Both of these tokens offer unique features and promising growth prospects that set them apart in the crowded altcoin space. In this article, we will explore what makes Bonk (BONK) and Mpeppe (MPEPE) attractive investment opportunities and how they could shape the future of the cryptocurrency market.

Bonk (BONK): The viral sensation

Bonk (BONK) burst onto the scene with a playful and viral take on cryptocurrency. Here’s a closer look at what’s made Bonk (BONK) a sure bet in the altcoin space.

The Viral Marketing Strategy

Bonk (BONK) Bonk has harnessed the power of internet memes and viral marketing to quickly gain popularity. Its branding, which features a humorous and engaging mascot, has resonated with the crypto community and beyond. By harnessing the viral nature of meme culture, Bonk (BONK) has quickly established a strong presence and captured the imagination of a wide audience.

Merging meme culture and blockchain innovation

Mpeppe (MPEPE) is emerging as a new and exciting player in the altcoin market. With its unique blend of features and innovative approach, Mpeppe (MPEPE) is attracting the attention of investors and cryptocurrency enthusiasts.

Mpeppe (MPEPE) combines the fun and relatable aspects of meme culture with advanced blockchain technology. Inspired by football and blockchain innovation, Mpeppe (MPEPE) offers a distinctive brand identity that appeals to a wide audience. This fusion of entertainment and technology sets Mpeppe (MPEPE) apart from other altcoins and offers an attractive investment opportunity.

Community impact

The strength of each cryptocurrency’s community will play a vital role in its future trajectory. Bonk (BONK) and Mpeppe (MPEPE) Cryptocurrencies build strong, engaged communities, but how they foster and grow those communities will determine their long-term success. Active, supportive communities can generate lasting interest and value, making them essential to the future of every cryptocurrency.

Conclusion: Invest in Bonk and Mpeppe

Bonk (BONK) and Mpeppe (MPEPE) represent exciting opportunities in the altcoin market. While Bonk (BONK) has established itself through its viral marketing and strong community support, Mpeppe (MPEPE) offers a unique blend of meme culture and advanced blockchain features. Both coins have the potential to make a significant impact in the cryptocurrency space.

For investors looking to explore high-potential altcoins, keeping an eye on Bonk (BONK) and Mpeppe (MPEPE) offers interesting opportunities. As the market evolves, these tokens could play a significant role in the future of cryptocurrencies, making them attractive options for those looking for growth and innovation in the altcoin space.

For more information on the Mpeppe presale (MPEPE):

Visit Mpeppe (MPEPE)

Join us and become a member of the community:

Altcoins

Top 6 Altcoins Expected to EXPLODE Before 2025: Buy Now!

As we approach 2025, the cryptocurrency market is poised for a major shift. According to Austin, an analyst at Altcoin Daily, potential policy changes could trigger a major surge in altcoins. A potential change in the Federal Reserve’s policy rate in September could lead to substantial growth in the cryptocurrency market, benefiting Ethereum, Solana, and several promising new altcoins.

Here’s a look at some altcoins priced between $1 and $2 that could offer good returns during the current market downturn. Dive right in.

Top 6 Altcoins to Watch

Aethir: The Decentralized GPU Marketplace

Aethir is becoming a key player in decentralized cloud infrastructure for gaming and AI. With over $36 million in annual revenue, Aethir is meeting the growing demand for GPU computing from large tech companies like Google and Microsoft. By utilizing underutilized GPUs, Aethir is making a significant impact in the tech world. Current Price: $0.07176.

Ondo: The Best Bet in the RWA Sector

Ondo is transforming the way financial assets are tokenized with its real asset protocols. The ONDO token, used for Ondo DAO and Flux Finance, offers a 5.3% annual dividend in USDY. Despite a recent 35% price drop, ONDO’s price action suggests a potential breakout. With less selling pressure and an increase in off-exchange holdings, the outlook appears positive. Current price: $0.9251.

Lukso: Blockchain for Creators and Social Networks

Lukso is creating a unique blockchain focused on connecting creators, brands, and users. As an alternative to Ethereum, Lukso offers universal profiles and gasless transactions, making blockchain technology more accessible. With a strong vision and strong leadership, Lukso is poised for wider adoption. Current Price: $1.71.

AIT Protocol: Decentralized AI Data Annotation

The AIT protocol addresses the need for decentralization of work in AI data annotation. It connects human trainers with AI model owners through a decentralized marketplace, thereby improving AI models. Its growing adoption in Asia and strategic investments suggest that it could be a major disruptor in the AI space. Current price: $0.1169.

Foxy (Linea): A meme piece with level 2 potential

Foxy, a cryptocurrency associated with Linea’s Ethereum layer 2 scaling, has received support from ConsenSys. It stands out in Ethereum layer 2 due to its MetaMask integration and fast transactions. With Linea’s growing adoption and low transaction costs, Foxy is well-positioned for growth. Current price: $0.01116.

Off-grid: Emerging Altcoin in Video Gaming

Finally, Off The Grid, developed by Godzilla, is generating excitement in the crypto gaming sector. Although it has not yet launched, it has received positive feedback from industry experts, suggesting strong potential. Other infrastructure projects like Immutable and games such as Xers and Star Heroes are also worth considering for those interested in crypto gaming.

Who’s excited about the potential altcoin rally?

Altcoins

Bitcoin Dominance Hits 3-Year High: Is Altcoin Season Coming?

As Bitcoin dominance hits a three-year high of 56%, analysts are predicting the potential start of an altcoin season. Although Bitcoin’s current valuation has fallen below $63,600, the high dominance level suggests a significant shift in the market.

Experts point out that Bitcoin dominance is a key factor in predicting altcoin trends. If Bitcoin holds its price while its dominance declines, it could signal a flow of investment into altcoins. This triggers what many call an “altcoin season.”

Conversely, if Bitcoin price and dominance fall simultaneously, it usually indicates a broader market correction rather than an altcoin boom.

What Factors Suggest an Imminent Altcoin Season?

Markus Thielen of 10X Research noted that Bitcoin Price Tends to Stabilize in August. Therefore, a stable Bitcoin price, coupled with declining dominance, may create the ideal conditions for altcoins to thrive.

Learn more: Bitcoin Dominance Chart: What Is It and Why Does It Matter?

Bitcoin Domination. Source: TradingView

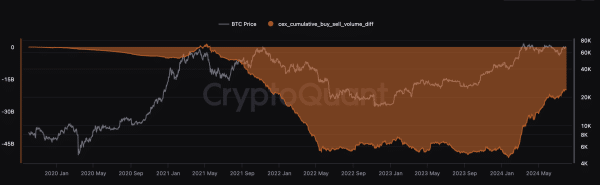

In addition, Ki Young Ju, founder of the chain analysis CryptoQuant platform has highlighted increasing activities by crypto whales that appear to be preparing for an altcoin rally.

“Limit buy order volume for altcoins, excluding Bitcoin and Ethereum, is increasing, indicating that strong buy walls are being put in place” said.

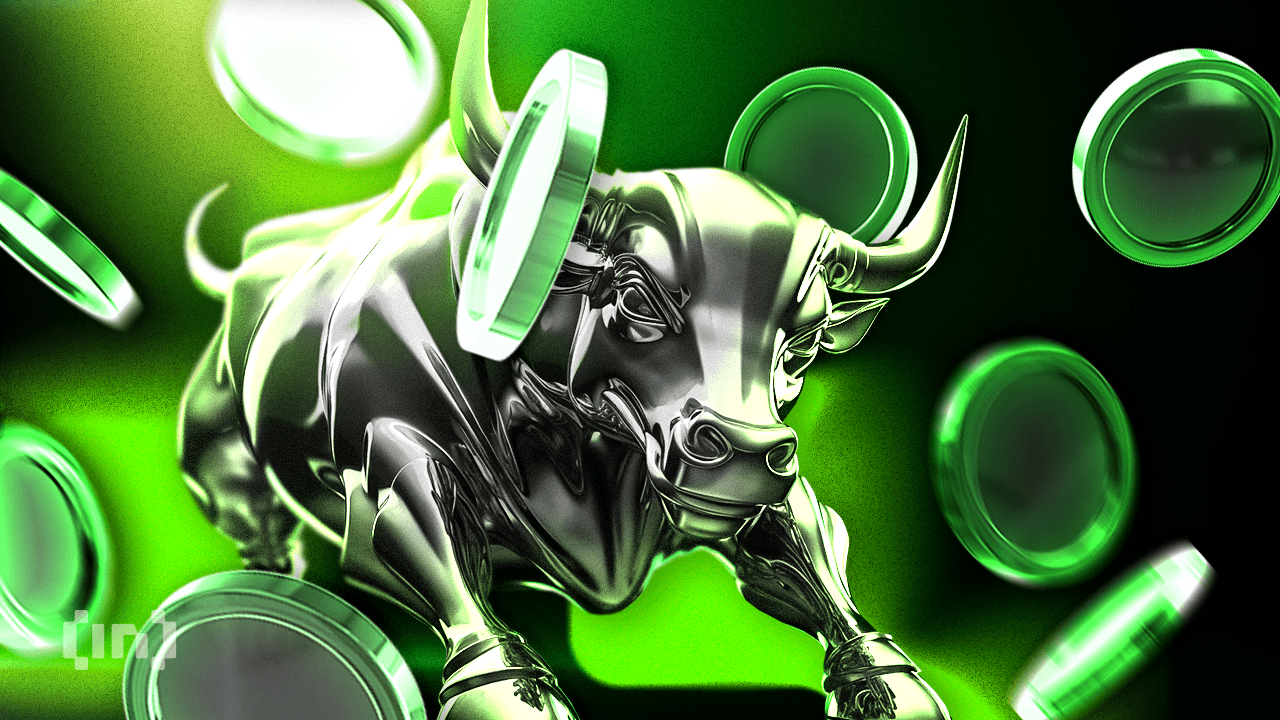

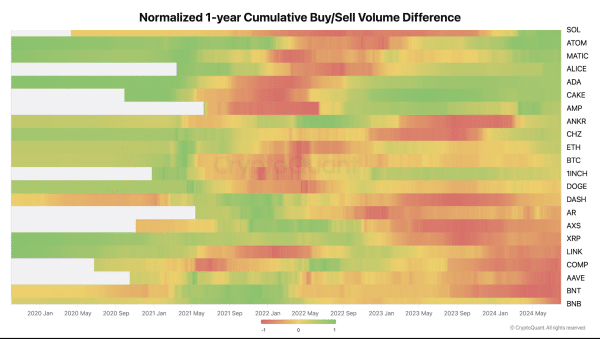

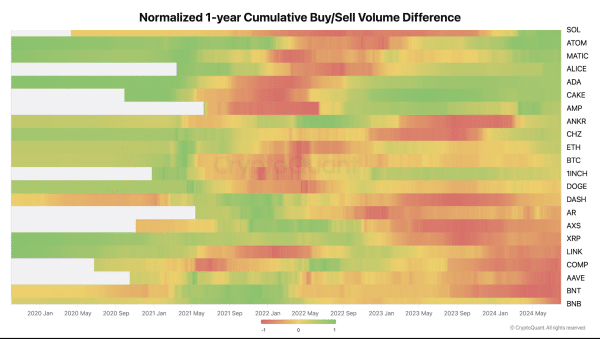

Ju explained that limit orders, which are preferred by institutions for large trades to minimize price impact, create “quote volume.” His analysis, which includes a graph of the 1-year normalized cumulative buy/sell volume difference, indicates that altcoins like Solana (SOL)Cosmos (ATOM) and Polygon (MATIC) experience significant accumulation activities.

“The indicator is calculated by taking the cumulative sum of the difference between the buy and sell quote volumes, using a one-year rolling window. If there is an upward trend, it means the buy volume of the quotes is increasing, indicating stronger buy walls,” Ju explained.

Normalized cumulative difference over 1 year between purchase and sale volumes. Source: CryptoQuant

Normalized cumulative difference over 1 year between purchase and sale volumes. Source: CryptoQuant

This bullish sentiment is reflected in the trends following recent developments in crypto financial products. Crypto Vikings, a renowned analyst, suggests that current market conditions are conducive to altcoin season.

“Many alts are down 60-80% in the last couple of months, and many of them have already bottomed and are in a good buy zone. Bitcoin Domination is also facing major resistance relative to where the massive altcoin season began each cycle,” Crypto Vikings declared.

Sentiment is increasingly optimistic, as many believe that the disillusionment that follows periods of prolonged economic downturn opens the way to profitable investments.

Another trader, Mags, noted that altcoins are only up 58% after breaking a 525-day accumulation. Therefore, he predicts a possible continuation of the altcoin rally after a reaccumulation consolidation.

“Permanent bears will tell you that altcoins are done and in a distribution phase. But if you look at the chart, altcoins are only up 58% since they broke out after 525 days of accumulation. Do you really think a breakout after 525 days of consolidation will end after only a 58% move?” wrote on X (Twitter).

Learn more: 11 Cryptos to Add to Your Portfolio Before Altcoin Season

On the other hand, Brian Quinlivan, senior analyst at Santiment, told BeInCrypto that there is a lack of enthusiasm for the altcoin season due to the recent price drops.

“As far as mentions of altcoin season go, we’re not really seeing any significant enthusiasm from traders about it. Traders have at least been a little bit more vocal since we started seeing prices drop over the last three days,” Quinlivan told BeInCrypto.

Disclaimer

In accordance with the Trust Project This price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAnd Disclaimer have been updated.

Altcoins

On-chain data confirms whales are preparing for altcoin surge with increased buy orders

Ki Young Ju, CEO of analytics platform CryptoQuant, believes whales are preparing for an upcoming surge in altcoins.

In a recent revelation about X, Ju underlines that the volume of limit buy orders for altcoins, excluding Bitcoin and Ethereum, is increasing. This pattern suggests the formation of substantial buy walls, highlighting significant buying pressure from large-scale investors.

Ju’s chart identifies two main phases in limit order volume for altcoins: the limit sell phase and the limit buy phase. The limit sell phase saw a notable increase in cumulative sell orders in 2022, demonstrating strong selling pressure from whales and other market participants. This phase coincided with a period of falling altcoin prices due to unfavorable market conditions.

Then, the limit buying phase began, marked by a significant increase in cumulative buy orders. This indicates a period of strategic accumulation where whales establish substantial buy walls.

According to Ju, the increase in buying volume suggests confidence in the future conditions of the altcoin market. This buying pressure creates strong support levels, indicating that whales are preparing for a positive change in the market.

Buying pressure on specific altcoins

Ju also provided a heatmap of the 1-year normalized cumulative buy/sell volume difference for various altcoins, showing the buying and selling pressure over time. Solana (SOL) has seen alternating strong buying and selling phases, with recent activity showing increased buying interest. Cosmos (ATOM) and Polygon (MATIC) have also shown increased buying pressure despite mixed activity trends.

Cardano (ADA) and PancakeSwap (CAKE) have shown balanced buying and selling phases, with recent trends proving increased buying pressure. Coins like AMP and ANKR have also demonstrated increased buying activity. The heatmap reveals that most altcoins are seeing increased buying pressure as whales and large investors accumulate altcoins in anticipation of a rally.

Meanwhile, coins experiencing selling pressure, as indicated by the predominantly red areas on the heatmap, include DOGE, DASH, AXS, XRP, COMP, and AAVE, BNT.

Bitcoin whales are also buying

It is important to note that while whales are accumulating altcoins, Bitcoin whales are also active. Crypto Basic note an increase in buyer activity on Binance, which aligns with an increase in the buy/sell ratio of takers and whale movements. Analyst Ali Martinez highlighted the ratio fluctuations from below 0.8 to above 1.7 between July 27 and 31. Ratios above 1.0 indicate aggressive buying, often preceding price rallies.

From July 27 to July 28, the ratio remained mostly above 1.0, corresponding to the rise in Bitcoin price from around $66,500 to over $67,000. A spike to around 1.5 led to a sharp increase in price to around $68,500. However, on July 30 and 31, the ratio fell below 1.0 several times, corresponding to a drop in price to around $66,000, before a final spike to 1.7 indicated another slight increase in price.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

-

News7 months ago

News7 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

News7 months ago

News7 months agoOver 1 million new tokens launched since April

-

Videos8 months ago

Videos8 months agoMoney is broke!! The truth about our financial system!

-

Altcoins7 months ago

Altcoins7 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Memecoins7 months ago

Memecoins7 months agoChatGPT Analytics That Will Work Better in 2024

-

Altcoins7 months ago

Altcoins7 months agoAltcoin Investments to create millionaires in 2024

-

NFTs8 months ago

NFTs8 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

Videos7 months ago

Videos7 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News5 months ago

News5 months agoInvest Now: The Hottest New Cryptocurrencies of August 2024 That Could Skyrocket

-

Memecoins5 months ago

Memecoins5 months agoMemecoins dominate major derivatives in terms of open interest | Flash News Detail

-

Altcoins5 months ago

Altcoins5 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

NFTs5 months ago

NFTs5 months agoRTFKT Announces Project Animus Reveal, Launches Egg Unboxing Event Amid Mixed Reactions | NFT CULTURE | NFT News | Web3 Culture