News

When Law Firms Go Bad: The Battle Over Contingency Fee Valuations and Crypto Tokens | Farrell Fritz, PC

As both a professional and a close follower of New York business divorce jurisprudence, I have seen a recent increase in litigation centered on the dissolution of professional services firms and cryptocurrency businesses. Perhaps the cryptocurrency business part is a natural consequence of the recent rapid expansion of the industry. As far as professional services firms go, your guess is as good as mine.

Whatever the cause of this trend, these disputes pose some of the most challenging and difficult appraisal questions for lawyers and the appraisal experts they rely on. How to evaluate an owner’s interest in a professional services firm depends on the nature of the firm’s fee structure. And the more complex the firm’s fee structure – imagine a law firm with contingent fees and co-counsel assignments in potentially massive, but also extremely uncertain verdicts – the more complicated the valuation. And the legal world is just starting to grapple with a basic understanding of blockchain technology, not to mention the complex valuation issues that different cryptocurrency assets can raise.

Based on these complications, a law firm with high contingency fee cases that accepts payments in cryptocurrency tokens could be one of the most difficult companies to value: a final exam in a crash course in litigation from a business valuation expert, for so to speak. For some lawyers and experts, the results are in: Freedman Normand Friedland LLP v. Cyrulnik, 21-CV-1746 (JGK) (SDNY May 15, 2024).

Roche Freedman and Cyrulnik

This controversy begins with three former Boies Schiller lawyers: Roche, Freedman and Cyrulnik. In the summer of 2019, Roche and Freedman left Boies Schiller and founded Roche Freedman LLP (the “Company”). Almost immediately they began to aggressively recruit Cyrulnik, who was senior to them at Boies Schiller. The firm’s recruiting pitch to Cyrulnik promised him a significant stake in his high-stakes contingency fee litigation.

Cyrulnik ultimately agreed to join the Firm, and in connection with Cyrulnik’s addition, the Firm’s six partners entered into a Memorandum of Understanding outlining the Firm’s partnership and compensation structure. Regarding equity capital, the MOU assigned Cyrulnik 27% of the Company’s capital (the largest share) and a fixed allocation of 25% of certain cryptocurrency tokens that the Company had obtained as payment for services. Regarding compensation, the MOU outlined how partners would be compensated for both hourly rate and contingency rate cases.

The memorandum of understanding also specified that a “founding member” – including Cyrulnik – could not be removed except for “cause” and by a vote of two-thirds of the Company’s equity partners. If removed for cause, the removed partner was entitled to the compensation earned under the MOU’s compensation structure, but was required to return his or her assets to the remaining partners.

The disputed removal

In January 2021, according to Cyrulnik, the remaining members of the firm orchestrated a plan to oust him as a partner in order to exclude him from the firm’s profits, particularly from crypto tokens, which had substantially increased in value. They called a secret meeting and, two days later, informed Cyrulnik that he had been removed for cause. The firm’s “suit” resembles the complaints of a law associate; Cyrulnik was accused of exercising “unilateral control” over staff and creating “unsustainable environments for employees.”

The parties were in court in February. The firm filed suit first, seeking among other things a declaratory judgment confirming the validity of Cyrulnik’s removal. Cyrulnik responded by claiming, among other things, the violation of the MOU, the dissolution of the Company and the acquisition at fair value of its 27% equity interest.

Judge Koeltl believes a trial on cause and evaluation is necessary

Both sides vigorously (and quickly) realized and filed dueling summary judgment motions. From order of 24 November 2023, Judge Koeltl granted in part and denied in part each of these motions for summary judgment. A great read that covers all sorts of fascinating issues regarding the enforceability of the MOU and the interaction between the MOU and Florida partnership law, the summary judgment decision narrowed the claims, but ultimately found questions of facts concerning (i) whether Cyrulnik was validly removed for cause and, regardless of the answer to such question, (ii) the amount owed to Cyrulnik under the MOU as compensation or payment for his participation.

The second issue starts a process on some important evaluation questions:

First, assuming Cyrulnik is entitled to payment for his 27% stake in the business, what is the value of that interest? The issue becomes especially complicated because at the time of Cyrulnik’s ouster, the firm’s greatest “asset” was his contingent fee representation in several mass securities cases, which, if successful, would result in substantial payouts for the company.

Second, what is the value of the cryptocurrency “tokens” held by the Company at the time of Cyrulnik’s ouster? The matter was complicated by the fact that crypto tokens were not freely traded and many had not yet been vested in the Company under the terms of the crypto-paying customer agreement.

Evaluation testimony offered by Cyrulnik

To evaluate the Firm’s contingency fee workload, Cyrulnik offered the advice of a credentialed valuation expert. That expert developed a methodology loosely based on BVR’s ten steps to evaluate law firm emergency casesin which he calculated the value of contingency cases in a few simple steps:

- Multiply the estimated probable damages by the estimated probability of a successful outcome to arrive at the probability-adjusted gross premium;

- Consider the probability-adjusted gross premium and applicable retention/co-advisor agreements to achieve the achievable recovery for the business;

- Subtract the amounts owed to any litigation financiers from the recoverable amount to the company to reach the net recoverable amount to the company;

- Adjust the enterprise’s Net Achievable Recovery for overhead and apply the MOU compensation structure to the enterprise’s Adjusted Net Achievable Recovery.

To evaluate the company’s crypto tokens, Cyrulnik offered expert testimony from cryptocurrency veteran Vikram Kapoor. He valued the Company’s acquired tokens at their highest interim value during a reasonable period following Cyrulnik’s discovery that Roche and Freedman had not remitted Cyrulnik’s share. And Kapoor’s assessment of unmatured tokens adequately considered the risk that such tokens may not mature.

The company’s exclusion proposals

The company moved to exclude Cyrulnik’s valuation experts.

Regarding the contingency fee workload, the study focused on Cyrulnik’s expert input into its multi-step process. The expert was not a lawyer, nor did he have any experience in assessing disputes. AS, supported the Societyhow could Cyrulnik’s expert purport to calculate the “estimated probable damages”, the “estimated probability of a positive outcome”, or any other input to his formula.

As for crypto tokens, supported the Society that Cyrulnik’s expert’s valuation of the acquired tokens should be ruled out because it was basic arithmetic: multiplying the price of the token on a given date by the quantity of tokens held by the Company. With respect to unvested tokens, the Company argued that Cyrulnik’s expert should be excluded because “courts have repeatedly found that damages from unvested options are ‘impermissibly speculative.'”

The decision

From Opinion and order of 15 May 2024, Judge Koeltl granted the firm’s request to prevent the evaluation of contingent cases by Cyrulnik’s expert. The Court found that the expert did not have the experience and legal capacity to calculate the necessary inputs to his methodology:

The Jenkins test is highly specific to individual disputes and depends on an analysis of the likely damages in each case and the likelihood of success, but Jenkins provides no basis for its purported experience in determining the accuracy of these assumptions. Instead, Jenkins’ assumptions and the inputs he relies on boil down to his “ipse dixit” for which he offers no support.

The Court was particularly critical of the fact that the expert relied on pleadings and, in one case, newspaper articles, to arrive at his input:

Regarding the Tether case, Jenkins estimated that the damages amounted to $850,000,000, but this was based on newspaper reports with no indication of the reliability of such reports and estimated that the chances of recovery were 50%. Jenkins did not have the experience to make such an assessment. .”

In the same order, the Court denied the company’s motion to disqualify Cyrulnik’s crypto valuation expert. The Court found that the expert’s valuation of the acquired tokens was not “basic arithmetic”, since the expert’s testimony was necessary to explain some assumptions about “why it was appropriate to use the high and low price of the tokens in each valuation date, rather than the average of the opening and closing prices on the relevant dates.”

With respect to the unvested tokens, the Court found that Cyrulnik’s interest in the unvested tokens is not analogous to that of an employee with unvested stock options. Rather, the tokens constituted specific consideration for the MOU and such consideration was not too speculative to value. In any case, the Court stated, the tokens were indeed awarded to the Company and therefore can be properly assessed as amounts owed to Cyrulnik.

Then, in a relatively tidy decision, Judge Koeltl sheds valuable light on valuation standards for two of the trickiest (and trending) assets: contingency fee disputes and cryptocurrency tokens.

An evaluation process takes place

Judge Koeltl’s decision also sets the contours of what will be a very interesting trial later this summer. I will watch it for a few reasons.

First, to see how agility Cyrulnik manages to maintain the line between fact and expert testimony. Excluding its case evaluation expert, you can bet that Cyrulink will offer testimony, as one of the lead case lawyers, on the Firm’s contingency fee cases. Can Cyrulnik’s testimony replace the expert opinions that were denied to him?

Second, to see the Court absorb, credit, and discredit the opinions of competing experts regarding the value of crypto tokens. Cryptocurrency valuation litigation is still in its infancy, and this process is poised to resolve several questions of first impression.

[View source.]

News

Top 5 Crypto Pre-Sales for August 2024

Have you heard about cryptocurrencies in 2011? Was Bitcoin so popular back then? Well, yes, some forward-thinking people saw its potential early and invested in BTC back then. Investors were skeptical about this new financial element; however, many took the risk and invested what they could risk in the cryptocurrency market.

Going through the list of top presales, we have identified and studied five of the main candidates that can change the game on the trading charts. These new opportunities promise the best returns and a great chance to buy tokens at affordable prices. While 5thScape is at the top of our recommendation, projects like DarkLume and Artemis Coin are pioneers in their respective categories.

Top 5 Crypto Pre-Sales to Add to Your Watchlist in 2024

Below we present the top five cryptocurrency pre-sales that you should consider adding to your investment watchlist.

- 5th Landscape (5SCAPE) – King of digital VR gaming with AR/VR elements

- Dark light (DLUME) – Virtual Metaverse for Social Exploration

- SpacePay (SPY) – Versatile Financial Payment Gateway for Seamless Transactions

- EarthMeta (EMT) – Replicating our planet on a virtual platform

- Artemis Coin (ARTMS) – NFT Marketplace for Digital Real Estate Investment

In-Depth Review: The Best Crypto Pre-Sales of 2024

Now, let’s take a closer look at these pre-sale events and how they can help investors make significant profits this year.

5th Landscape (5SCAPE)

The 5thScape project combines emerging technology using the fundamentals of virtual and augmented reality on the Ethereum platform using its native currency as 5SCAPE. Users of the token experience increased security and interactive gameplay in the digital space.

Here are the potential reasons why investors are admiring the 5thScape ecosystem:

Immersive Gameplay: With over five game titles, the platform is ready to amaze the audience with games ranging from archery, sports, battle and high-speed racing.

Innovative VR Content: 5thScape’s progress in the crypto-gaming space will contribute to the development of educational resources and other VR content on the website.

Motion Control Gadgets: This project is working hard to introduce VR devices such as headsets and gaming chairs with precise controls and high-resolution soundscapes to achieve the best immersive feeling while exploring the ecosystem.

Practical utility: 5SCAPE tokens stimulate participation in various activities and convert the ecosystem into economic value for investors.

Staking Opportunities: Acquiring 5SCAPE tokens after listing on exchanges can generate higher earnings

Free Giveaways and Prizes: The distribution of free coins and VR subscriptions attract investors.

Visit 5thScape for more details>>

Dark Light (DLUME)

We just saw how 5thScape captures investors with its AR/VR digital landscape. DarkLume works on similar VR principles but has a completely new VR metaverse. Its presale is about to hit the $1 million mark and simultaneously increase fund inflows.

What are the specifics that allow DarkLume to lead the metaverse industry?

Native currency: The project has DLUME as a digital currency that can be used for in-game purchases or upgrades. These utility tokens also give their holders the right to vote on the development and expansion of the project.

Benefits of staking: Investors who want to hold and earn from this currency expect to multiply their funds after the stock market listing.

Exploratory Metaverse: Once you enter this world, there is no turning back. There are so many opportunities to find recreational activities and relieve stress. Walking through lush landscapes and stargazing at night can be a memorable experience. If you are a party animal, DarkLume’s virtual discos and clubs will win you over.

Visit DarkLume for more details>>

Payment for space (SPY)

Traditional financial setups face many challenges in daily transactions and are also expensive. To solve these concerns, Maxwell Bunting founded SpacePay by combining cryptocurrency payments and blockchain technology. The London-based startup makes online shopping and payments more seamless by integrating its network with existing card terminals, allowing users to make payments in any digital currency. Merchants can choose to receive payments in conventional currency without having to pay exorbitantly.

SpacePay has designed a user-friendly and convenient interface that supports over 325 crypto wallets. SPY, the native token of this platform, serves to enable all transactions within its ecosystem. Tokens can also be used to generate passive income through staking and additional community rewards.

EarthMeta (EMT)

EarthMeta is a virtual metaverse created to replicate our planet, Earth. It is listed as one of the best crypto pre-sales of 2024, with a focus on creating new NFT platforms and virtual assets in premium cities. The startup encourages users to own and govern virtual landscapes.

Cities are then further broken down into smaller assets such as landmarks, buildings, monuments, parks, schools, and more. NFTs can now be bought and sold in the project’s marketplace. Governors are eligible to earn 1% fees per transaction within their city. EMT token holders can also generate more at once with custom API integrations and participation in DAO activities.

Artemis (ARTMS)

Today we have covered a number of financial projects that you can consider along with 5thScape, the most promising VR coins of the decade. Artemis (ARTMS) is a financial platform that allows investors to transact and trade using its digital asset, ARTMS. Users can also lend, borrow, stake, save, and generate rewards from yield farming.

The project is about to enter Phase 4 of development which will see the launch of the Artemis Crypto System. This system is customized to facilitate a large number of secure and transparent crypto transactions. Cryptocurrency enthusiasts and professional entities can buy and sell products such as smartphones, bicycles and internet services using crypto payments. Early investors have great advantages until the project is available at a discounted price in the pre-sale.

Read this before investing in the next cryptocurrency market

Experienced investors know the factors to consider before investing in this dynamic market. Here are some points that beginners should remember before securing a position in the cryptocurrency universe.

- It is essential to verify the project details and the founders.

- Read and understand the whitepaper for all the technical information about the ICO, the roadmap and the mission of the project.

- The project roadmap will provide greater clarity on milestones and results achieved.

- Review the fundamentals of the new technologies involved in the development of the platform.

- Before investing in any cryptocurrency, carefully evaluate the benefits and risks to avoid losses and build a profitable portfolio.

Conclusion

5thScape ICO Offers Tokens at Deeply Discounted Prices. Once the presale is over, the token price will skyrocket 434% from the first round and promise 600x returns to early investors. Who wouldn’t want to be part of an innovative and growing VR ecosystem? Check your details, review all the documents and start investing in 5thScape now.

Time flies, and so does the $100,000 prize.

News

Best Upcoming Cryptocurrencies for Long-Term Profits: Turn $100 Into $1000 With These Picks

Have you ever wondered how much return Bitcoin has given to investors who bought this gold cryptocurrency a decade ago? In 2014, Bitcoin reached its significant milestone of $1,000 in the first month. Currently, it is trading at around $64k, which is an astonishing 6300% increase in the span of 10 years. No stock, no ETF could ever give you such monumental returns. This simply proves that the cryptocurrency market turns your dreams of investment returns into reality.

While the established giants are not giving so much returns now, the ball is in the court of upcoming cryptocurrencies that are based on the development of projects to provide up to 1000x returns in the near future. In this article, we will explore 5 upcoming cryptocurrencies for long-term earnings that can turn your $100 into $1000 – the only key is strategic investing with a lot of patience!

Best Upcoming Cryptocurrencies For Long Term Profits

Below we list the top 5 cryptocurrencies for long-term gains, which are set to give you returns of up to 1000 times in the coming times.

- 5th Landscape (5LANDSCAPE)

- Dark light (DISGUST)

- BlockDAG (BDAG)

- eTukTuk (TUK)

- WienerAI (WAI)

Take a deeper look at the background of these 5 upcoming cryptocurrencies for long-term gains and see why they could be viable options for your cryptocurrency portfolio.

1. 5° Landscape (5SCAPE)

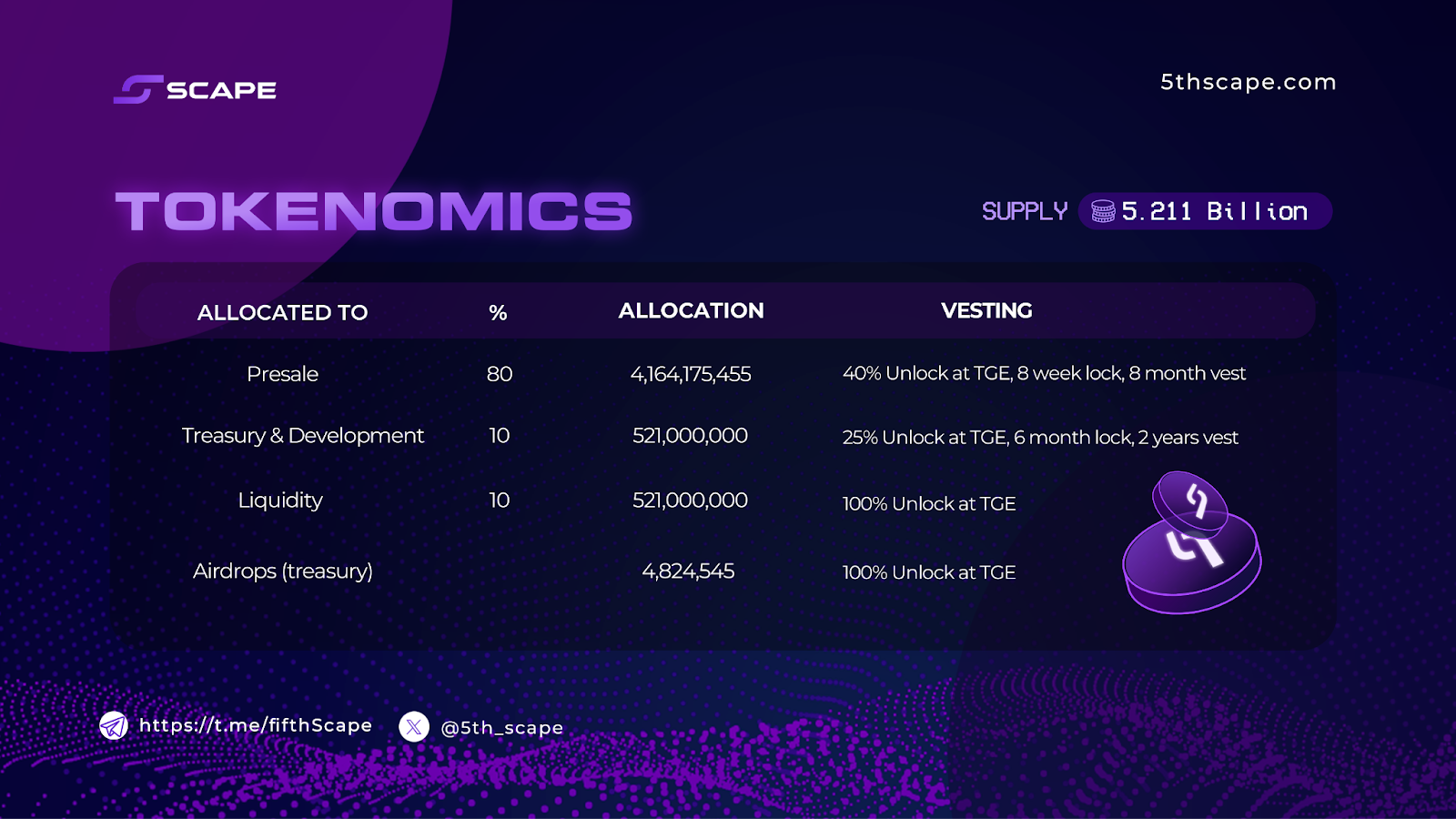

5thScape is changing the face of entertainment by merging augmented and virtual reality with blockchain technology, offering a VR content ecosystem unlike any other destination on the internet. Its native token, 5SCAPE, is the cornerstone of this innovative ecosystem. With a limited supply of 5.21 billion tokens, 5SCAPE offers early investors a unique opportunity to participate in the growth of a potentially transformative platform.

Combining the immersive experiences of VR technology with a cryptocurrency that has a real-world use case, 5thScape presents a compelling investment proposition. The project’s focus on providing unparalleled user experiences, coupled with its potential to generate substantial returns, makes 5SCAPE an ideal new cryptocurrency to have in your portfolio for long-term gains.

Click here to invest in 5thScape today >>

2. DarkLume (DLUME)

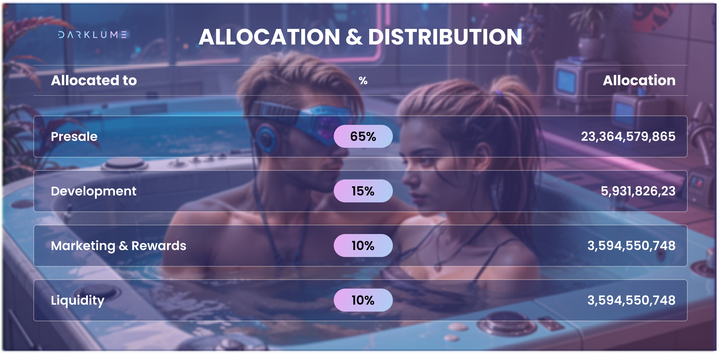

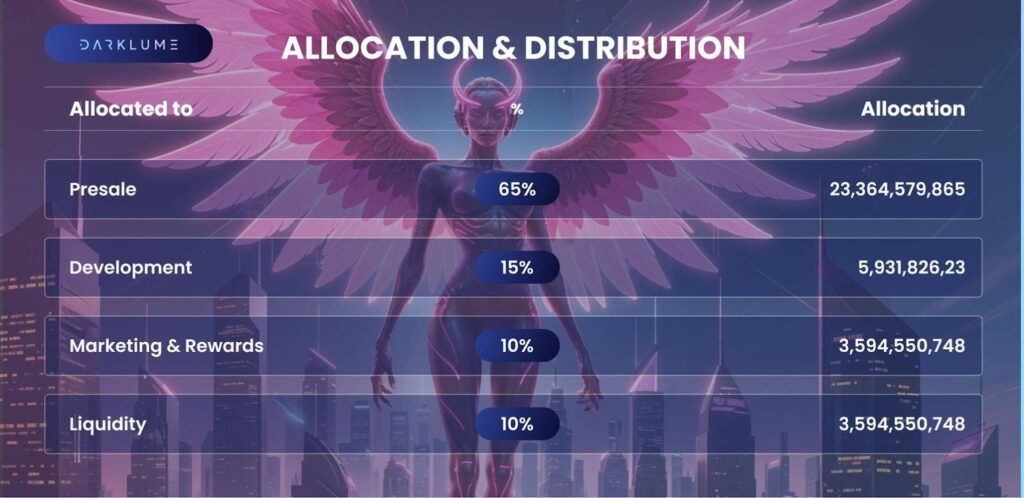

DarkLume is a meticulously crafted metaverse where users can experience a lavish digital lifestyle. At its core is the DLUME token, the currency that powers this virtual economy. By owning DLUME, users gain access to exclusive experiences, from owning virtual properties to attending high-society events and hosting virtual celebrations with their friends.

The metaverse is divided into virtual countries, each with its own citizenship requirements. To become a citizen, users must possess a specific amount of DLUME. Maintaining citizenship involves paying taxes in DLUME and creating a sense of community and responsibility among users.

Unlike other metaverse platforms that are limited to digital interactions only, DarkLume offers a wide range of activities, from leisure and entertainment to social interactions and exciting experiences. The platform’s focus on luxury ensures that every aspect of the metaverse is designed to exceed expectations. As DarkLume continues to grow, its DLUME token is expected to be in high demand. The metaverse concept is supported by renowned names such as Mark Zuckerberg and Satya Nadella. As it is the future of immersive socialization, the DLUME token is expected to appreciate in value over time.

Explore DarkLume’s website to learn more

3. BlockDAG (BDAG)

BlockDAG is an innovative blockchain platform that uses a Directed Acyclic Graph (DAG) structure together with blockchain technology to offer fast transaction speeds, lower fees, and better scalability.

Unlike traditional blockchains that process transactions sequentially, BlockDAG processes them in parallel, which allows it to handle a much higher transaction volume. This approach makes BlockDAG an ideal platform for applications that require high throughput and low latency, such as DeFi, gaming, and IoT. Its presale has been a great success so far, and BlockDAG’s adaptability may be an optimistic sign for early investors in the BDAG token.

4. eTukTuk (TUK)

eTukTuk is a new leading crypto project that combines sustainable transportation with blockchain technology. Its main goal is to electrify the famous “tuk-tuk” industry, reducing carbon emissions that cause environmental damage while creating a thriving ecosystem. Its TUK token powers the entire platform.

One of the most notable features of eTukTuk is its Play-to-Earn (P2E) gameplay. Players can earn TUK tokens by completing challenges and missions in the game. This gamified approach not only makes the platform engaging but also incentivizes user participation in building the eTukTuk ecosystem. The primary utility of the TUK token is as a mode of payment for tuk-tuk drivers who use EV charging stations for their vehicles installed across Sri Lanka. The project will soon expand to other countries.

Overall, the value proposition of the TUK crypto token is strengthened by its utility within the platform. It can be used to purchase electric tuk-tuks, charge them at the network’s charging stations, and access various platform services. As eTukTuk adoption grows, demand for TUK tokens is expected to increase, potentially resulting in significant appreciation in the token’s value.

5. WienerAI (WAI)

WienerAI is a new blockchain-based platform that uses next-generation artificial intelligence (AI) technology to transform the cryptocurrency trading space. Its flagship product is an AI trading bot (with a sausage-themed mascot) designed to analyze market trends, identify potential opportunities, and execute trades with zero errors. With the power of AI, WienerAI provides users with a market edge in the complex and dynamic world of investing.

The platform’s native WAI token is a digital asset that underpins the entire ecosystem. Token holders can enjoy various benefits, including discounted trading fees, priority access to new features, and even a share of the platform’s profits. As WienerAI gains traction and its AI trading bot proves successful, the continued flow of demand for the WAI token will fuel its price.

Final Thoughts: Best Cryptocurrencies for Long-Term Profits

Each cryptocurrency project explored in this article brings a unique and innovative perspective to the blockchain industry. From the immersive worlds of 5thScape and DarkLume to the efficiency gains of BlockDAG and the sustainability focus of eTukTuk, not to mention WienerAI’s AI-powered trading bot with a new approach to investing, these projects are pushing the boundaries of what’s possible with blockchain technology.

While all of these projects are promising, 5thScape and DarkLume stand out as particularly interesting investment opportunities. The combination of 5thScape’s robust VR ecosystem tokenomics and unique AR/VR offeringstogether with the fantasy world of the DarkLume metaversehas the potential to appeal to a wide range of investors who may be entertainment lovers, not just cryptocurrency enthusiasts. Given their current presale stages, acquiring 5SCAPE and DLUME tokens at these early-bird prices could prove to be a strategic move for those seeking substantial returns.

This is a sponsored article. The opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on the information presented in this article.

News

Avalanche Predicts ‘Most Bullish Unlock’ in Broader Market $1 Billion in Token Release

Token Unlocks data shows that several crypto projects:AvalancheWormhole, Aptos, SandboxArbitrum, Optimism and others are set to unlock around $1 billion worth of tokens in August.

Approximately $260 million will be allocated in the first three days of the month.

Crypto projects often schedule token unlocks to control the asset supply and prevent market oversaturation. This gradual release helps avoid significant sell-offs by early investors or team members who hold large amounts of crypto assets.

Wormhole and Avalanche to Release Over $400 Million in Tokens

The biggest news this month will be Wormhole and Avalanche.

On August 3rd, Hole in the walla cross-chain messaging protocol, will release 600 million tokens worth $151.67 million, or 33.33% of its circulating supply.

Avalanche will follow on August 20, unlocking 9.54 million AVAX tokens worth approximately $251 million, or 2.42% of its circulating supply.

The Token Unlocks dashboard shows that 4.5 million AVAX, worth $118.53 million, will go to the Avalanche team, 2.25 million AVAX, worth $59.27 million, will go to strategic partners, and the remainder will go to the Foundation and as an airdrop.

Farid Rached, former head of ecosystem growth at Avalanche, underlined that this planned unlock would be the most bullish in its history because “it is the last big step for the team and public/private investors.”

Other important unlocks

Sui, a layer 1 network, will unlock 64 million tokens worth $50 million, or 2.56% of its circulating supply, on August 1.

Similarly, decentralized exchange dYdX will issue 8.33 million tokens worth nearly $11 million, or 3.65% of its circulating supply. These tokens will be distributed to investors, founders, staff, and future employees.

Aptos will unlock 11.31 million APT tokens worth $74.64 million on August 12. These will be allocated to the Aptos community, top contributors, the foundation, and investors, with top contributors receiving the largest share: 3.96 million APT worth $26 million.

On August 14, Sandbox will release 205.6 million SAND tokens worth $66.75 million. This issuance will be split between the team, advisors, and a corporate reserve.

Finally, Ethereum’s layer 2 networks Referee AND Optimism will collectively unlock over $110 million worth of tokens by August 16 and 31, respectively.

Mentioned in this article

Latest Alpha Market Report

News

Big Tech Beats Bitcoin (BTC) as Trump’s Trade Cancellation Weakens Token

Bitcoin has failed to join the cross-asset rally fueled by dovish comments from the Federal Reserve, as the tight US election race casts doubt on Donald Trump’s ability to implement his pro-cryptocurrency agenda.

The digital asset slipped 2.4% on Wednesday, tracking a Fed-fueled surge in an index of the Magnificent Seven large-cap tech stocks by one of the widest margins in 2024. The token fell further on Thursday, changing hands at $63,750 by 6:10 a.m. in London.

-

News11 months ago

News11 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

News11 months ago

News11 months agoOver 1 million new tokens launched since April

-

Altcoins11 months ago

Altcoins11 months agoAltcoin Investments to create millionaires in 2024

-

Memecoins9 months ago

Memecoins9 months agoMemecoins dominate major derivatives in terms of open interest | Flash News Detail

-

News9 months ago

News9 months agoInvest Now: The Hottest New Cryptocurrencies of August 2024 That Could Skyrocket

-

Altcoins9 months ago

Altcoins9 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

NFTs9 months ago

NFTs9 months agoRTFKT Announces Project Animus Reveal, Launches Egg Unboxing Event Amid Mixed Reactions | NFT CULTURE | NFT News | Web3 Culture

-

Altcoins9 months ago

Altcoins9 months agoHot New Altcoin: Memeinator’s Price Upside Potential in July

-

Videos12 months ago

Videos12 months agoMoney is broke!! The truth about our financial system!

-

Memecoins11 months ago

Memecoins11 months agoChatGPT Analytics That Will Work Better in 2024

-

Altcoins11 months ago

Altcoins11 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

News11 months ago

News11 months ago5 Crypto Airdrops After Notcoin to Watch Out for in June 2024