Altcoins

If the SEC approves ether ETFs, will it approve altcoin ETFs?

As the likelihood of the Securities and Exchange Commission (SEC) approving a spot ether ETF suddenly increases, altcoin investors are speculating on a possible wave of approvals for additional coins.

Indeed, this very morning, WisdomTree won approval from the UK’s Financial Conduct Authority to list its 100% physically backed Ethereum ETP on the London Stock Exchange as early as May 28 – although the products will not be available for retail investment.

The bullish momentum in ether, which is up 29% this week alone, could spill over to other crypto assets.

On Monday, Bloomberg ETF analysts James Seyffart and Eric Balchunas said the likelihood of the SEC approving an ether spot ETF had jumped from 25% to 75% on comments reported by the agency to at least an exchange and an ETF applicant regarding their 19b-4 exchange rule change request.

The Wall Street Journal confirmed the news while CoinDesk also quoted three people close to the case. Around the same time and without citing the 19b-4 news, David Han of Coinbase Institutional wrote a note adjusting upwards its outlook for a spot ether ETF.

Barrons claims SEC employees told the exchanges “that it is tend to approve of themaccording to people familiar with the matter.

As early as tomorrow, the SEC could approve a so-called 19b-4 filing which, alongside a related S-1 filing whose deadline is a few weeks away, could lead to a possible listing of a spot ether ETF by the investment manager VanEck.

Other ETF sponsors have also filed 19b-4 filings with the SEC for a spot ether ETF, including Fidelity, 21Shares, Invesco/Galaxy and Franklin Templeton. VanEck asked for the earliest response date: tomorrow.

UPDATE: This is happening. We have at least 5 potential #Ethereum ETF issuers that have submitted their amended 19b-4s within the last 25 minutes.

Fidelity, VanEck, Invesco/Galaxy, Ark/21Shares and Franklin all submitted via CBOE. pic.twitter.com/pHGt8iRWi8–James Seyffart (@JSeyff) May 21, 2024

Will a spot ether ETF lead to other altcoin ETFs?

Granted, ether is just one of many altcoins traded on U.S. exchanges through trusts. There are more than a dozen publicly traded trusts in the United States holding alternative crypto assets: Litecoin (LTC), Chain link (LINK), Basic Attention Token (BAT), Bitcoin Cash (BCH), Decentralized country (MANA), Ethereum Classic (ETC), Filecoin (SON), Peas (POINT), Horizon (ZEN), Stellar lumens (XLM), Livepeer (LPT), Zcash (ZEC), and Solana (GROUND).

So if the SEC approves a spot ether ETF, could it also approve ETFs for additional altcoins?

The logic of altcoin proponents – arguing that non-ether spot altcoin ETFs could gain SEC approval shortly after a spot ether ETF – generally follows a simple argument: if the SEC allowed Grayscale to convert its Bitcoin trust into an ETF, why would commissioners deny trusted sponsors of other crypto assets from converting to ETFs?

For obvious reasons, this argument could fail if the SEC claims that the crypto asset is an unregistered security. However, the SEC has not classified all crypto assets held in US public trusts as securities.

Interestingly, many crypto trusts traded on OTC Markets, a US exchange, expressly hold Unregistered Securities Designated by the SECincluding GROUND, MANAAnd SON. More and more crypto assets are rumor be unregistered securities designated by the SEC: ZEN, XLM and ZEN.

Nevertheless, certain trusts trading in U.S. OTC markets do not hold SEC-designated unregistered securitiessuch as POINT Or ETC trust. Perhaps if the SEC were to approve a spot ether ETF, commissioners could approve spot ETFs based on such potentially non-security crypto assets.

It should be noted that just because the SEC has not classified a crypto asset as an unregistered security, does not mean it is not. Congress did not direct the SEC to proactively classify all assets. Instead, the SEC simply chooses to accept or reject the requests it receives, or take enforcement action against illegal behavior on a case-by-case basis, because it has the time, money, personnel and resources.

The silence of the commissioners does not indicate a non-designation.

Of course, there is a counterargument to this logic. Unlike altcoins like DOT or ETC, only Bitcoin and Ethereum have futures contracts listed on the Chicago Mercantile Exchange (CME). This significantly sized CME market for ether alone could be an important reason to only approve a spot ether ETF and no other altcoins.

Spot Ether ETF: Is this no longer an obvious rejection from the SEC?

According to reports from sources at Bloomberg, Barron’s and the Wall Street Journal, the SEC’s Trading and Markets Division has requested changes to the joint Form 19b-4 from an exchange and a sponsor – likely VanEck. This is a bullish sign for possible spot ETF approval because, in the opinion of market observers, the SEC is generally silent or disinterested in 19b-4 filings if it intends to make them. dismiss.

Because the SEC is requesting a new application, the reasoning is as follows: his interest is probably a positive development.

Update: @JSeyff and I’m increasing our odds of Ether ETF spot approval to 75% (from 25%), hearing talk this afternoon that the SEC may do a 180 on this issue (a growing issue). more political), so now everyone is scrambling (like us, everyone assumed they would be refused). See… https://t.co/gcxgYHz3om

– Eric Balchunas (@EricBalchunas) May 20, 2024

A Bloomberg ETF analyst thinks ether is likely to get spot ETF approval from the SEC.

Many have viewed the SEC’s stance toward an ether spot ETF as decidedly negative. Joe Lubin’s ConsenSys even sued the SEC, claiming that the commissioners had secretly classified ether as an unregistered security.

Therefore, if the SEC is indeed considering possible approval of a spot ETF for Ethereum, it would be a marked change in tone.

Learn more: ConsenSys says SEC has designated ETH as a security but won’t say where

Amidst all these media reports, the price of ether increased by 29% in the last seven days — outperforming Bitcoin’s 12% rally by another 17%.

Form 19b-4 requests information from applicants necessary for the public to understand why the SEC should amend its Section 19(b)(1) rules pursuant to the Securities Exchange Act of 1934. In this case, the exchange and a sponsor of ETFs must explain why the SEC should allow the use of ether as the sole asset of a spot ETF.

Do you have any advice? Send us an email or ProtonMail. For more informed news, follow us on X, Instagram, Blue skyAnd Google Newsor subscribe to our Youtube channel.

Altcoins

Altcoins with huge potential Bonk and Mpeppe (MPEPE)

The cryptocurrency market is full of potential, and two altcoins that have recently caught the attention of investors are Bonk (BONK) and Mpeppe (MPEPE)Both of these tokens offer unique features and promising growth prospects that set them apart in the crowded altcoin space. In this article, we will explore what makes Bonk (BONK) and Mpeppe (MPEPE) attractive investment opportunities and how they could shape the future of the cryptocurrency market.

Bonk (BONK): The viral sensation

Bonk (BONK) burst onto the scene with a playful and viral take on cryptocurrency. Here’s a closer look at what’s made Bonk (BONK) a sure bet in the altcoin space.

The Viral Marketing Strategy

Bonk (BONK) Bonk has harnessed the power of internet memes and viral marketing to quickly gain popularity. Its branding, which features a humorous and engaging mascot, has resonated with the crypto community and beyond. By harnessing the viral nature of meme culture, Bonk (BONK) has quickly established a strong presence and captured the imagination of a wide audience.

Merging meme culture and blockchain innovation

Mpeppe (MPEPE) is emerging as a new and exciting player in the altcoin market. With its unique blend of features and innovative approach, Mpeppe (MPEPE) is attracting the attention of investors and cryptocurrency enthusiasts.

Mpeppe (MPEPE) combines the fun and relatable aspects of meme culture with advanced blockchain technology. Inspired by football and blockchain innovation, Mpeppe (MPEPE) offers a distinctive brand identity that appeals to a wide audience. This fusion of entertainment and technology sets Mpeppe (MPEPE) apart from other altcoins and offers an attractive investment opportunity.

Community impact

The strength of each cryptocurrency’s community will play a vital role in its future trajectory. Bonk (BONK) and Mpeppe (MPEPE) Cryptocurrencies build strong, engaged communities, but how they foster and grow those communities will determine their long-term success. Active, supportive communities can generate lasting interest and value, making them essential to the future of every cryptocurrency.

Conclusion: Invest in Bonk and Mpeppe

Bonk (BONK) and Mpeppe (MPEPE) represent exciting opportunities in the altcoin market. While Bonk (BONK) has established itself through its viral marketing and strong community support, Mpeppe (MPEPE) offers a unique blend of meme culture and advanced blockchain features. Both coins have the potential to make a significant impact in the cryptocurrency space.

For investors looking to explore high-potential altcoins, keeping an eye on Bonk (BONK) and Mpeppe (MPEPE) offers interesting opportunities. As the market evolves, these tokens could play a significant role in the future of cryptocurrencies, making them attractive options for those looking for growth and innovation in the altcoin space.

For more information on the Mpeppe presale (MPEPE):

Visit Mpeppe (MPEPE)

Join us and become a member of the community:

Altcoins

Top 6 Altcoins Expected to EXPLODE Before 2025: Buy Now!

As we approach 2025, the cryptocurrency market is poised for a major shift. According to Austin, an analyst at Altcoin Daily, potential policy changes could trigger a major surge in altcoins. A potential change in the Federal Reserve’s policy rate in September could lead to substantial growth in the cryptocurrency market, benefiting Ethereum, Solana, and several promising new altcoins.

Here’s a look at some altcoins priced between $1 and $2 that could offer good returns during the current market downturn. Dive right in.

Top 6 Altcoins to Watch

Aethir: The Decentralized GPU Marketplace

Aethir is becoming a key player in decentralized cloud infrastructure for gaming and AI. With over $36 million in annual revenue, Aethir is meeting the growing demand for GPU computing from large tech companies like Google and Microsoft. By utilizing underutilized GPUs, Aethir is making a significant impact in the tech world. Current Price: $0.07176.

Ondo: The Best Bet in the RWA Sector

Ondo is transforming the way financial assets are tokenized with its real asset protocols. The ONDO token, used for Ondo DAO and Flux Finance, offers a 5.3% annual dividend in USDY. Despite a recent 35% price drop, ONDO’s price action suggests a potential breakout. With less selling pressure and an increase in off-exchange holdings, the outlook appears positive. Current price: $0.9251.

Lukso: Blockchain for Creators and Social Networks

Lukso is creating a unique blockchain focused on connecting creators, brands, and users. As an alternative to Ethereum, Lukso offers universal profiles and gasless transactions, making blockchain technology more accessible. With a strong vision and strong leadership, Lukso is poised for wider adoption. Current Price: $1.71.

AIT Protocol: Decentralized AI Data Annotation

The AIT protocol addresses the need for decentralization of work in AI data annotation. It connects human trainers with AI model owners through a decentralized marketplace, thereby improving AI models. Its growing adoption in Asia and strategic investments suggest that it could be a major disruptor in the AI space. Current price: $0.1169.

Foxy (Linea): A meme piece with level 2 potential

Foxy, a cryptocurrency associated with Linea’s Ethereum layer 2 scaling, has received support from ConsenSys. It stands out in Ethereum layer 2 due to its MetaMask integration and fast transactions. With Linea’s growing adoption and low transaction costs, Foxy is well-positioned for growth. Current price: $0.01116.

Off-grid: Emerging Altcoin in Video Gaming

Finally, Off The Grid, developed by Godzilla, is generating excitement in the crypto gaming sector. Although it has not yet launched, it has received positive feedback from industry experts, suggesting strong potential. Other infrastructure projects like Immutable and games such as Xers and Star Heroes are also worth considering for those interested in crypto gaming.

Who’s excited about the potential altcoin rally?

Altcoins

Bitcoin Dominance Hits 3-Year High: Is Altcoin Season Coming?

As Bitcoin dominance hits a three-year high of 56%, analysts are predicting the potential start of an altcoin season. Although Bitcoin’s current valuation has fallen below $63,600, the high dominance level suggests a significant shift in the market.

Experts point out that Bitcoin dominance is a key factor in predicting altcoin trends. If Bitcoin holds its price while its dominance declines, it could signal a flow of investment into altcoins. This triggers what many call an “altcoin season.”

Conversely, if Bitcoin price and dominance fall simultaneously, it usually indicates a broader market correction rather than an altcoin boom.

What Factors Suggest an Imminent Altcoin Season?

Markus Thielen of 10X Research noted that Bitcoin Price Tends to Stabilize in August. Therefore, a stable Bitcoin price, coupled with declining dominance, may create the ideal conditions for altcoins to thrive.

Learn more: Bitcoin Dominance Chart: What Is It and Why Does It Matter?

Bitcoin Domination. Source: TradingView

In addition, Ki Young Ju, founder of the chain analysis CryptoQuant platform has highlighted increasing activities by crypto whales that appear to be preparing for an altcoin rally.

“Limit buy order volume for altcoins, excluding Bitcoin and Ethereum, is increasing, indicating that strong buy walls are being put in place” said.

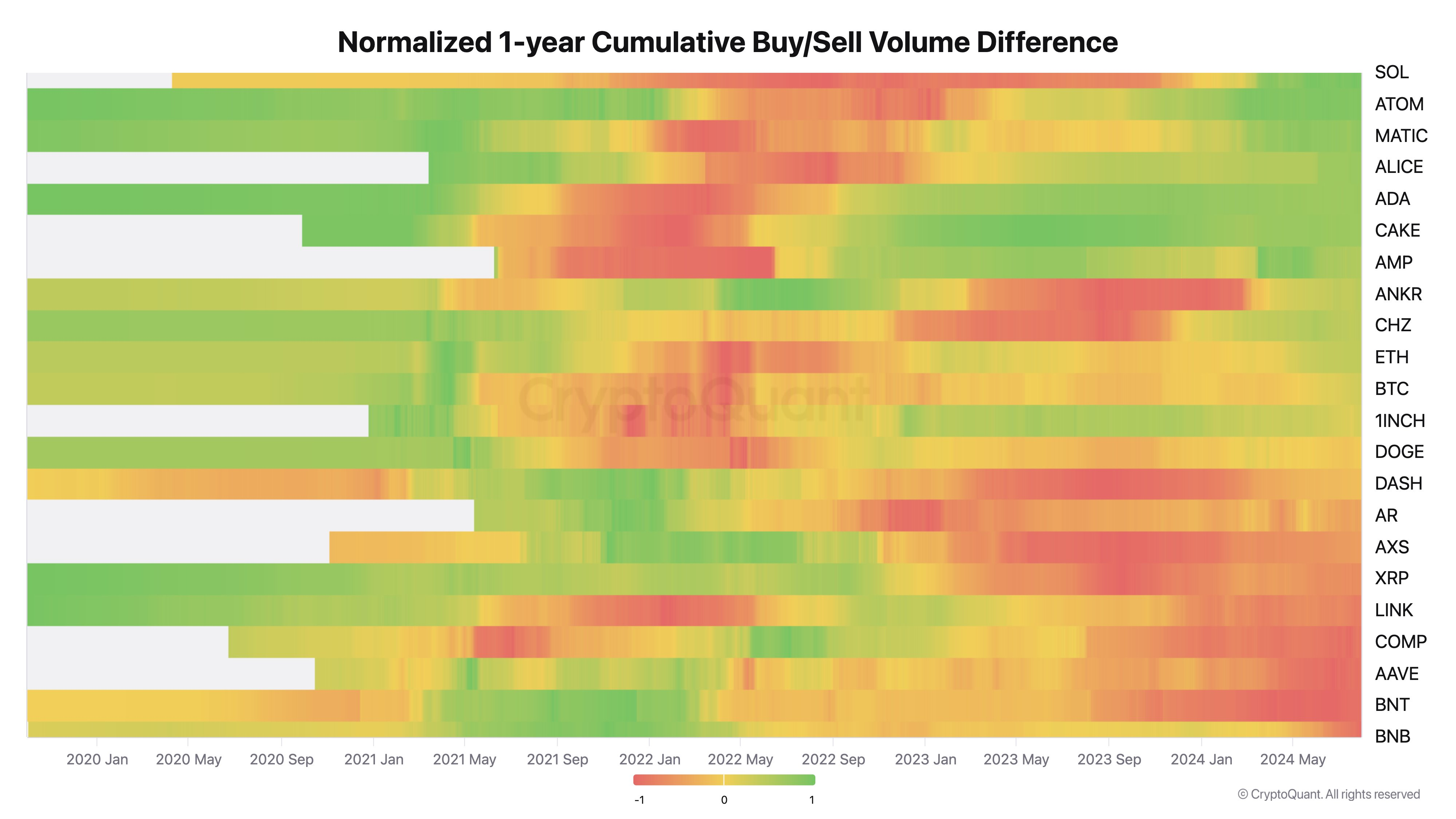

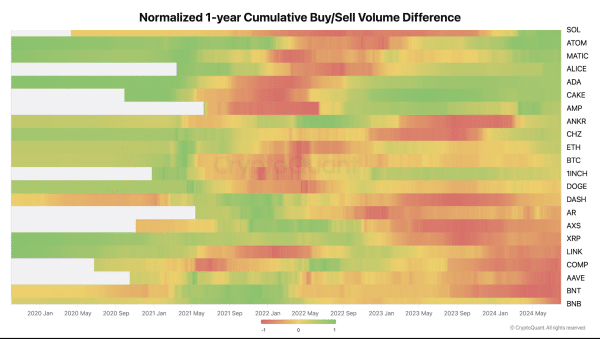

Ju explained that limit orders, which are preferred by institutions for large trades to minimize price impact, create “quote volume.” His analysis, which includes a graph of the 1-year normalized cumulative buy/sell volume difference, indicates that altcoins like Solana (SOL)Cosmos (ATOM) and Polygon (MATIC) experience significant accumulation activities.

“The indicator is calculated by taking the cumulative sum of the difference between the buy and sell quote volumes, using a one-year rolling window. If there is an upward trend, it means the buy volume of the quotes is increasing, indicating stronger buy walls,” Ju explained.

Normalized cumulative difference over 1 year between purchase and sale volumes. Source: CryptoQuant

Normalized cumulative difference over 1 year between purchase and sale volumes. Source: CryptoQuant

This bullish sentiment is reflected in the trends following recent developments in crypto financial products. Crypto Vikings, a renowned analyst, suggests that current market conditions are conducive to altcoin season.

“Many alts are down 60-80% in the last couple of months, and many of them have already bottomed and are in a good buy zone. Bitcoin Domination is also facing major resistance relative to where the massive altcoin season began each cycle,” Crypto Vikings declared.

Sentiment is increasingly optimistic, as many believe that the disillusionment that follows periods of prolonged economic downturn opens the way to profitable investments.

Another trader, Mags, noted that altcoins are only up 58% after breaking a 525-day accumulation. Therefore, he predicts a possible continuation of the altcoin rally after a reaccumulation consolidation.

“Permanent bears will tell you that altcoins are done and in a distribution phase. But if you look at the chart, altcoins are only up 58% since they broke out after 525 days of accumulation. Do you really think a breakout after 525 days of consolidation will end after only a 58% move?” wrote on X (Twitter).

Learn more: 11 Cryptos to Add to Your Portfolio Before Altcoin Season

On the other hand, Brian Quinlivan, senior analyst at Santiment, told BeInCrypto that there is a lack of enthusiasm for the altcoin season due to the recent price drops.

“As far as mentions of altcoin season go, we’re not really seeing any significant enthusiasm from traders about it. Traders have at least been a little bit more vocal since we started seeing prices drop over the last three days,” Quinlivan told BeInCrypto.

Disclaimer

In accordance with the Trust Project This price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and conditions, Privacy PolicyAnd Disclaimer have been updated.

Altcoins

On-chain data confirms whales are preparing for altcoin surge with increased buy orders

Ki Young Ju, CEO of analytics platform CryptoQuant, believes whales are preparing for an upcoming surge in altcoins.

In a recent revelation about X, Ju underlines that the volume of limit buy orders for altcoins, excluding Bitcoin and Ethereum, is increasing. This pattern suggests the formation of substantial buy walls, highlighting significant buying pressure from large-scale investors.

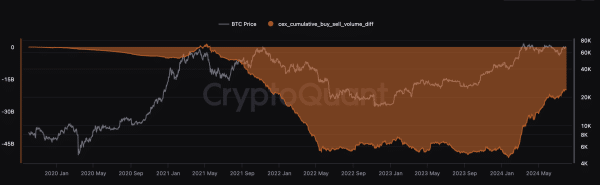

Ju’s chart identifies two main phases in limit order volume for altcoins: the limit sell phase and the limit buy phase. The limit sell phase saw a notable increase in cumulative sell orders in 2022, demonstrating strong selling pressure from whales and other market participants. This phase coincided with a period of falling altcoin prices due to unfavorable market conditions.

Then, the limit buying phase began, marked by a significant increase in cumulative buy orders. This indicates a period of strategic accumulation where whales establish substantial buy walls.

According to Ju, the increase in buying volume suggests confidence in the future conditions of the altcoin market. This buying pressure creates strong support levels, indicating that whales are preparing for a positive change in the market.

Buying pressure on specific altcoins

Ju also provided a heatmap of the 1-year normalized cumulative buy/sell volume difference for various altcoins, showing the buying and selling pressure over time. Solana (SOL) has seen alternating strong buying and selling phases, with recent activity showing increased buying interest. Cosmos (ATOM) and Polygon (MATIC) have also shown increased buying pressure despite mixed activity trends.

Cardano (ADA) and PancakeSwap (CAKE) have shown balanced buying and selling phases, with recent trends proving increased buying pressure. Coins like AMP and ANKR have also demonstrated increased buying activity. The heatmap reveals that most altcoins are seeing increased buying pressure as whales and large investors accumulate altcoins in anticipation of a rally.

Meanwhile, coins experiencing selling pressure, as indicated by the predominantly red areas on the heatmap, include DOGE, DASH, AXS, XRP, COMP, and AAVE, BNT.

Bitcoin whales are also buying

It is important to note that while whales are accumulating altcoins, Bitcoin whales are also active. Crypto Basic note an increase in buyer activity on Binance, which aligns with an increase in the buy/sell ratio of takers and whale movements. Analyst Ali Martinez highlighted the ratio fluctuations from below 0.8 to above 1.7 between July 27 and 31. Ratios above 1.0 indicate aggressive buying, often preceding price rallies.

From July 27 to July 28, the ratio remained mostly above 1.0, corresponding to the rise in Bitcoin price from around $66,500 to over $67,000. A spike to around 1.5 led to a sharp increase in price to around $68,500. However, on July 30 and 31, the ratio fell below 1.0 several times, corresponding to a drop in price to around $66,000, before a final spike to 1.7 indicated another slight increase in price.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

-

News11 months ago

News11 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

News11 months ago

News11 months agoOver 1 million new tokens launched since April

-

Memecoins9 months ago

Memecoins9 months agoMemecoins dominate major derivatives in terms of open interest | Flash News Detail

-

Altcoins11 months ago

Altcoins11 months agoAltcoin Investments to create millionaires in 2024

-

News9 months ago

News9 months agoInvest Now: The Hottest New Cryptocurrencies of August 2024 That Could Skyrocket

-

Altcoins9 months ago

Altcoins9 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

NFTs9 months ago

NFTs9 months agoRTFKT Announces Project Animus Reveal, Launches Egg Unboxing Event Amid Mixed Reactions | NFT CULTURE | NFT News | Web3 Culture

-

Altcoins9 months ago

Altcoins9 months agoHot New Altcoin: Memeinator’s Price Upside Potential in July

-

Videos12 months ago

Videos12 months agoMoney is broke!! The truth about our financial system!

-

Memecoins11 months ago

Memecoins11 months agoChatGPT Analytics That Will Work Better in 2024

-

Altcoins11 months ago

Altcoins11 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

News10 months ago

News10 months ago5 Crypto Airdrops After Notcoin to Watch Out for in June 2024