NFTs

Disney makes NFTs again in partnership with NBA Top Shot Makers Dapper Labs

Disney, the iconic, century-old brand known almost as much for its pursuit of technical innovation as its ever-expanding catalog of entertainment products, is taking another stab at digital collectible non-fungible tokens (NFTs). This time, it’s through a partnership with Dapper Labs, the Vancouver-based blockchain company with experience building successful consumer-facing Web3 apps, including NBA Top Shot.

And so, on Tuesday, Dapper unveiled a new brand, Disney Pinnacle. It’s an “early access, closed release” mobile app for invited users, opening at 9am (aka waitlist to participate in a testing and feedback phase). An official launch will occur “soon after” on the Apple App Store and will then roll out to web browsers and the Google Play Store, a Dapper spokesperson said in an email.

I spoke with Dapper Labs CEO Roham Gharegozlou and VP of Business Development and Partnerships Ridhima Kahn to get a better sense of what Web3’s next big innovative app could be. Dapper has a history of homeruns, starting with one of the first (if not the first) NFT launches ever, CryptoKitties, which clogged both Ethereum NPR’s “Money for the Planet” covered the news.

Then, in time for the 2020-21 bull market, Dapper launched NBA Top Shot in partnership with the National Basketball Association. Essentially just a platform for people to exchange tokenized snapshots of NBA replays, Top Shots has become one of the innovative apps of the NFT craze. Dapper quickly capitalized on the buzz and launched similar products involving other sports leaguesincluding the NFL.

Disney Pinnacle appears to be following suit. Users will be able to trade digital “pins”, inspired by the popular physical collectible category, featuring Disney-related IP. I haven’t tested the app or seen anything online about the tokens offered, but I was informed that the platform will host intellectual property from Lucasfilm, Pixar and Walt Disney Animation Studios. So imagine Baby Yoda, Woody from “Toy Story” and Snow White as tradable assets.

“Digital collectibles based on perhaps the most popular products of all time… are a path to adoption of [Web3 technology] as well as a way to show people what is possible,” Gharegozlou said in a video call. At a time when NFTs have not seen plenty of recovery like other crypto sectors or assets like bitcoin (BTC)the market needs a moment of rejuvenation.

It’s pretty clear that many of the crypto-native attempts to create valuable IP linked to NFTs have gotten off to a rocky start. Some of the biggest projects, at least in the cartoon “PFP [profile pic] space”, has entirely reneged in your Web3 promises. Rugs were pulled, scripts abandoned and projects with money in the treasury they seem to be struggling.

It’s unclear whether NFTs will be used for ticketing in the mainstream, and big brands are experimenting with cool rewards point tokens — like Starbucks and Reddit (before that ended the project) – have remained distant from the term NFTs, preferring the more evocative: “digital collectible”.

That’s why Dapper’s latest project and first serious attempt to move beyond sports collectibles could be significant. It’s telling from Dapper’s promotional material and conversation with Gharegozlou and Kahn that the term NFT was being avoided while an emphasis was placed on Disney Pinnacle’s mass-market appeal.

Disney has fans, probably billions of them, and superfans. Young and old, there are plenty of people interested in all things Disney, including its theme parks, film portfolio, and merchandise (as seen by the company’s net income of about $1.41 billion in the third quarter of 2023).

Using established brands with built-in, engaged user bases has also worked in the past for Dapper. Top Shots, although trading has slowed significantly since 2021, has accumulated lifetime volumes in excess of $1 billion (Dapp Radar) – not bad for the digital version of trading cards. At its peak, Dapper was valued at US$7.6 billion with the company itself becoming a active investor through NFT and metaverse vertices and launching a value of US$750 million ecosystem background for its custom Flow blockchain.

Additionally, Gharegozlou has experience building consumer startups. As CEO of venture studio Axiom Zen, he built several products, including Apple’s 2015 app of the year called Timeline and some of the first Bitcoin-based games, as well as the first AR/VR platforms like Google Glass and Magic. Leap. Meanwhile, Kahn comes to Dapper from A16Z, where he focused on consumer apps, a spokesperson said.

While some of the magic may be lost when translating physical experiences into digital ones (like holding an Eeyore pin), Disney Pinnacle pins have their advantages as “investments,” Gharegozlou said. This includes the social aspects of collecting in general:

“For collecting and trading badges, the feeling of going to Frontierland and Disneyland and meeting a stranger who shares your fandom for a certain IP or badge style and then making your first trade with them is one of the most exciting. feelings,” Kahn said. (This is an experience she may have had; she has been to Disneyland about 18 times since she started working at Disney.)

But these social experiences are amplified and multiplied by the fact that we are online; in the same way that a message board enhances the types of conversations you’d have with collectors in a comic book store. There are just more chances to meet like-minded fans. Plus, there’s something nonsensical about digital collectibles that sheds light on the fact that collecting anything is often an investment:

“You made a decision, invested the money you earned into purchasing this badge. So it requires a little more investment,” Khan said. Of course, this doesn’t mean that there can’t be an emotional or sentimental reason to buy a digital good, or that people can’t become attached to their digital goods.

Which brings us to the question of the day: are NFTs securities? This was the only time the affable Gharegozlou showed any concern on his face during a video call. He addressed the issue, essentially saying it’s a subtle issue. There are “long-standing laws and precedents that collectibles — whether art, trading cards or anything else — are not securities, and that doesn’t change because they are digital collectibles,” he said.

The company – which has yet to draw the ire of the U.S. Securities and Exchange Commission (SEC), the main U.S. securities watchdog that has lately I’ve been interested in pursuing NFT companies – directed me to an example of “proactive engagement” with a Canadian regulator and a statement from the Chamber of Digital Commerce explaining the differences between “financial” and “commercial” NFTs.

“Dapper Labs does not comment on conversations with regulators,” a spokesperson added in an email. The company recently lost a fairly important motion to dismiss a class action lawsuit filed against Dapper Labs and Gharegozlou in New York, in which the judge singled out the NBA Top Shot Moments in question. probably qualify as “investment contracts”, and therefore could fall under the purview of the SEC.

However, it appears that Dapper Labs is taking steps to prevent unqualified users from accessing the Disney Pinnacle website. For example, at launch, Disney Pinnacles will only be open to users 18 and older, while the URL provided by Dapper appears to be geo-blocking New York state or the US entirely.

I asked about other restrictions around the apps, though I didn’t hear of anything geographic, and I should add that the site wasn’t technically active when I was doing the research for the article, which may affect the findings. However, in Pinnacle’s promotional material it is noted: “Fans in Florida can now collect and trade dynamic pins in real time alongside other fans in California, France, India, Japan and other places around the world,” although I not sure if this means just for the waitlist. (Will update if Dapper returns.)

The regulatory issue just shows the obstacles that bad policies can impose on well-intentioned companies. Dapper’s Kahn called it a “partnership” with Disney, one of the most influential companies in history, which has prior experience in Web3 — mainly through a marketplace called VeVe. These assets are unlikely to be highly financialized or end up with maximum leverage on Blur, although they are as tradable as other NFTs, I believe.

During the call, Gharegozlou and Kahn highlighted how Dapper and Disney tried to keep the average Disney fan in mind while building an “interactive, immersive experience” that non-native crypto fans could use. In other words, the user base is digitally competent Disney fans.

For this purpose, payments can be made via credit cards, ACH [via your bank] and various cryptocurrencies, including bitcoin (BTC) and ether (ETH), “without worrying about extra fees,” Dapper said. The login experience also bypasses the standard Web3 wallet portal with a Web2 option; Gharegozlou said you can sign in “as a Disney fan,” likely meaning using the company’s online credentialing system or an email.

There is no official limit for opening the waitlist today, although the company is trying to keep it manageable. He is looking for “qualitative and quantitative feedback” to improve the app before it officially launches.

Dapper, like the rest of crypto, has taken a hit over the past two years. There was at least three rounds of layoffs since the market started falling in 2022, and I have no idea the state of your portfolio investments. It’s still a sizable company (200 employees, 65% working on code) with a serious pedigree, which has also pioneered serious innovations in cryptographic accessibility and technology running in the background (like account abstraction).

When talking to Gharegozlou and Kahn, it’s also clear that they are consummate professionals who know what to say and what to avoid. Avoid deep technical concerns, because encryption should not be about the technology, but about the experiences it provides. Avoid regulatory issues because at this point there is no benefit in saying anything officially. And don’t talk too much about the app… probably because it’s unfinished.

Everything is fine and well. The company, like its latest app, is a work in progress — and perhaps a model for others.

CORRECTION: Corrects the spelling of Ridhima Kahn’s surname and an incorrectly attributed quote.

NFTs

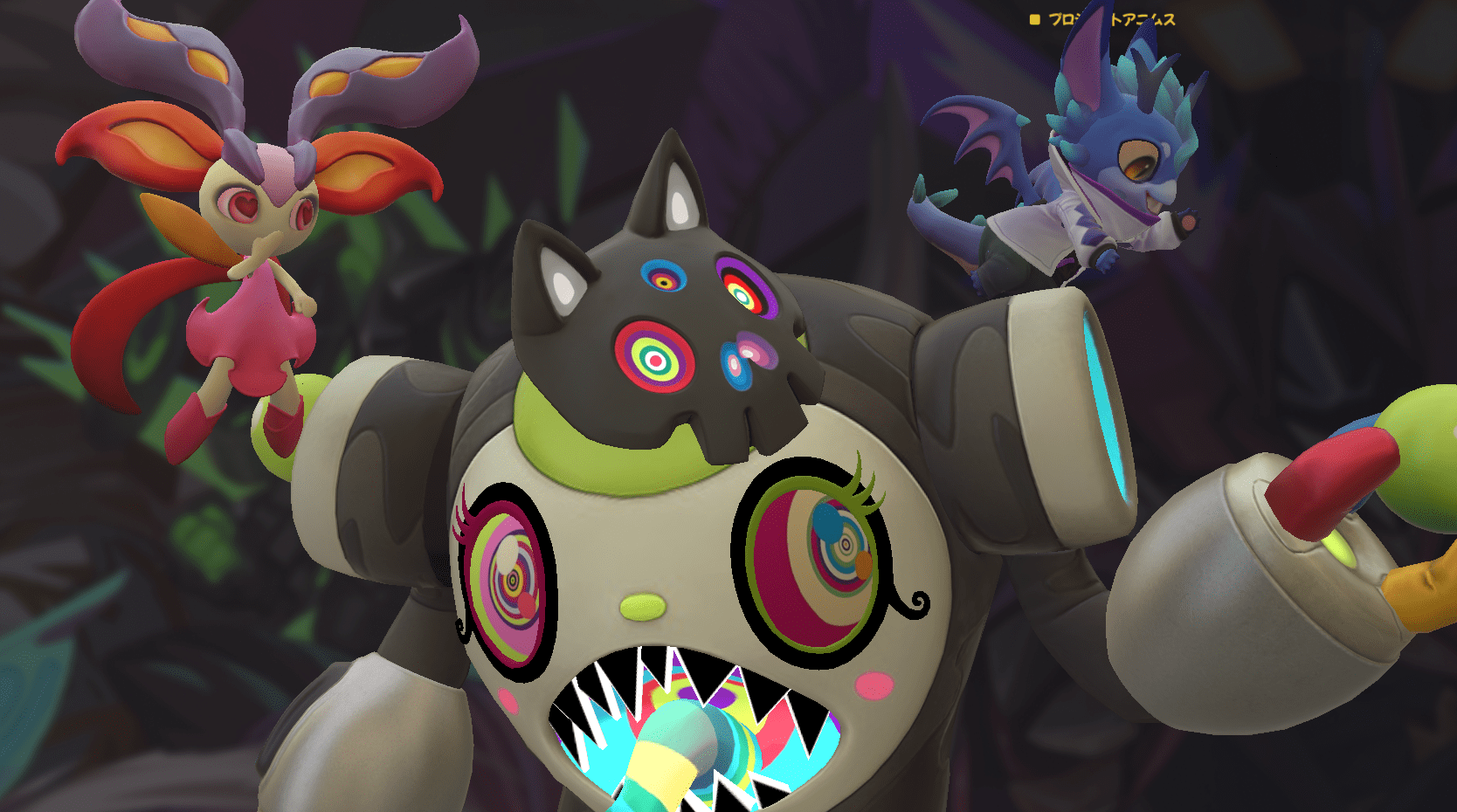

RTFKT Announces Project Animus Reveal, Launches Egg Unboxing Event Amid Mixed Reactions | NFT CULTURE | NFT News | Web3 Culture

RTFKT, the innovative creator-led company renowned for its cutting-edge sneakers and metaverse collectibles, has officially unveiled its highly anticipated collection, Project Animus. This project marks a significant milestone in RTFKT’s journey, introducing a new dimension to its digital universe after a long period of development. However, the initial market response has been disappointing, with the revealed Animi trading at a floor price of 0.05 ETH, significantly lower than the eggs’ floor price of 0.09 ETH.

The Genesis of the Project Animus

Initially introduced in October 2022, Project Animus introduces a unique ecosystem of digital creatures called Animi. These Animi are designed to enhance Clone X’s avatars, offering an immersive and engaging experience for the community. The recent reveal showcased a diverse range of Animi species, each with distinct design traits and elemental attributes, breaking away from traditional trait-based rarity systems.

A New Digital Frontier: The History and Evolution of Project Animus

The Animus Project is RTFKT’s latest intellectual property, promising to revolutionize the NFT space with its unique digital creatures. The journey kicked off on October 8, 2022, with an interactive teaser event called “The Eggsperience.” This livestream event allowed attendees to explore a virtual Animus Research Facility, generating intrigue and excitement among the community.

Renowned artist Takashi Murakami played a significant role in the project, revealing the first Murakami-themed Animus creature, Saisei, on April 30, 2023. This collaboration added a layer of artistic prestige to the project, further elevating its status within the NFT community.

Animus Egg Incubation: A Journey from Egg to Animi

Clone X NFT holders had the opportunity to claim an Animus Egg until March 1, 2024. This was followed by the Animus Egg Hatching event, which ran from May 7 to June 4, 2024. During this period, holders of several RTFKT NFTs, including Clone X, Space Pod, Loot Pod, Exo Pod, and Lux Pod, were able to use a points-based system to increase their chances of hatching rarer Animi. The limited supply of Project Animus Eggs is capped at 20,000, with no public sale planned.

Mixed market reception

Despite the excitement and innovative features, the market reaction to the reveal of Project Animus has been lukewarm. Animi is currently trading at a floor price of 0.05 ETH, significantly lower than the eggs’ floor price of 0.09 ETH. This discrepancy has led to disappointment among some collectors who had high expectations for the project.

What Awaits Us: The Future of Project Animus

Following the reveal, RTFKT plans to release a collection of exclusive Animus Artist Edition characters. Holders of Clone X Artist Edition NFTs are guaranteed to get one of these special editions. The distribution will include 88 Special Edition Animus, with 8 Mythic (Dragon Sakura), 40 Shiny, and 40 Ghost Animus. The odds of receiving a Special Edition Animus are the same for all Eggs hatched, regardless of the points accumulated.

The remaining Animus characters will be distributed among unhatched Eggs, encompassing Special Edition Animus, as well as Cosmic Animus and Murakami Element from Generation 1, Generation 2, and Generation 3.

Conclusion

RTFKT’s Project Animus represents a bold step forward in the NFT space, combining cutting-edge technology with artistic collaboration to create an immersive and innovative digital ecosystem. However, the initial market reception highlights the challenges of living up to high expectations in the ever-evolving NFT landscape. As the project continues to evolve, it promises to deliver unique experiences and opportunities for its community, solidifying RTFKT’s position as a leader in the metaverse and digital collectibles arena.

Summary: RTFKT has unveiled Project Animus, introducing a unique ecosystem of digital creatures called Animi designed to enhance Clone X avatars. Despite the excitement, market response has been mixed, with Animi trading at a lower floor price than eggs. The project kicked off with an interactive event in October 2022, featuring collaborations with artist Takashi Murakami. Following the reveal, RTFKT will release special edition Animus characters. The total supply of Animus Eggs is limited to 20,000, with no public sale planned.

NFTs

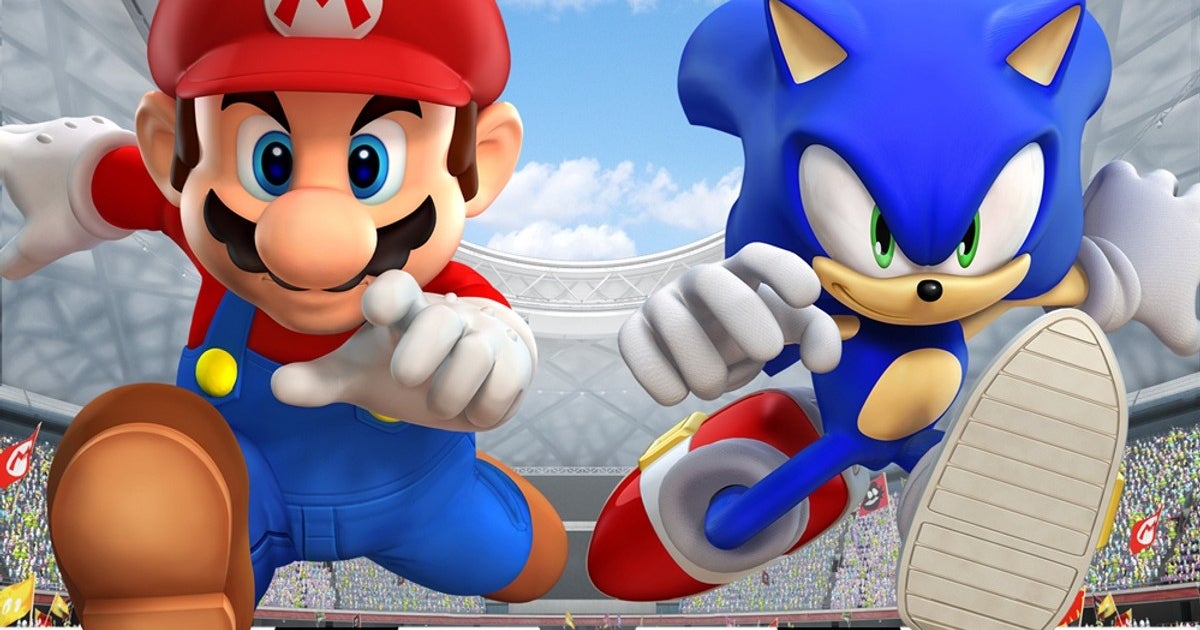

The Olympics have reportedly ditched Mario and Sonic games in favor of mobile and NFTs

The long and historic partnership between Nintendo and Sega to create video games for the Olympics reportedly ended in 2020 as event organizers sought opportunities elsewhere.

Lee Cocker, who served as executive producer on several Mario & Sonic Olympics titles, said Eurogamer the International Olympic Committee let the licensing agreement lapse because it “wanted to look at other partners, NFTs and esports.”

“Basically, the IOC wanted to bring [it] “Turn inward and look for other partners so you can get more money,” Cocker added.

The 2024 Summer Olympics kicked off in Paris last week, but there were no Mario & Sonic games available in time for the event to begin – the first time this has happened since the original release in 2007 to coincide with the 2008 Beijing Summer Olympics.

Over the past two decades, there have been four Mario and Sonic adaptations for the Summer Olympics, as well as two for the Winter Olympics.

This year, instead of a Nintendo/Sega title, the IOC released Olympics Go! Paris 2024, a free-to-play mobile and PC title developed by nWay, which has worked on several Power Rangers games.

Olympics Go! allows players to compete in 12 sports and unlock NFTs from the Paris 2024 digital pin collection.

The original Mario & Sonic at the Olympic Games was announced in March 2007 and marked the first time the two mascots – once archrivals in the console wars of the 1990s – appeared together in a game.

NFTs

DraftKings abruptly shuts down NFT operation, leaving collectors panicking over vast holdings of digital tokens

DraftKings, the daily fantasy sports and sports betting company, abruptly shut down a program called Reignmakers on Tuesday, posting a notice on its website and associated app and sending a mass email to some subset of its user base. Reignmakers, which the company launched in 2021, offered pay-to-play competitions in NFL football, PGA Tour golf and UFC mixed martial arts. The decision to eliminate the entire program, DraftKings says, was not made lightly but was forced “due to recent legal developments.”

DraftKings has yet to specify what “recent legal developments” are troubling its now-dead Reignmakers product. The company was sued in U.S. District Court in 2023 by a Reignmakers player named Justin Dufoe, who accuses the company of dealing in unregistered securities, taking advantage of relatively unsophisticated “retail investors,” and failing to market and support Reignmakers to the degree necessary to return to its users the financial benefits expected. DraftKings filed a motion in September to dismiss Dufoe’s complaint, but that motion was denied on July 2. A scheduling conference was held by the parties on July 29; Reignmakers was permanently shut down on July 30. A DraftKings spokesperson reached by Defector on Wednesday declined to confirm whether Dufoe’s complaint is the “recent legal development” that forced the company’s hand.

Users of the Reignmakers NFL product, who in recent days began murmuring on social channels about a notable lack of DraftKings activity so close to the start of the NFL preseason schedule, were caught off guard and, in some cases, devastated by the news. Members of the DraftKings Discord server, where all Reignmakers-related channels were abruptly shut down and locked following the announcement, flooded a general channel in various states of panic, sharing news, theorizing, lamenting, and, in some cases, openly worrying about whether it would be possible to recoup any decent fraction of the genuinely impressive sums of money they had invested in this DraftKings product.

Reignmakers is nominally a daily fantasy contest—users build lineups of players and then pit those lineups against other users’ lineups for cash prizes—but it’s actually a distributor of nonfungible digital tokens (NFTs), originated and sold by DraftKings, and then frequently resold on a dedicated secondary marketplace also hosted by DraftKings. At the lineup-building level, Reignmakers functions like a card-collecting game, with artificial scarcity driving the prices of the most coveted cards to insane, eye-popping heights. Reignmakers NFTs are tiered and offered in timed drops designed to heighten the sense of scarcity. A user can enter a lower-tier contest using a collection of NFTs that may have cost a few hundred dollars in total (or that were earned by purchasing random packs of NFTs that offer generally low odds of scoring top assets) and throw their lot in with hundreds of casual users competing for relatively unimpressive rewards. Random packs at the lowest tier would have prices as low as a few dollars; mid-tier cards—Star and Elite tiers, I’d guess—could cost a player upwards of $1,000.

But players interested in hunting down the biggest payouts, not just from games but from leaderboard prizes and other assorted prizes, would need to enter higher-tier games, and to enter the higher-tier games, a user’s collection needed to include higher-tier NFTs. DraftKings ensured that these cards were extremely scarce and could only be purchased directly on the marketplace at prices that any reasonable person would consider utterly insane.

For example, the highest-tier Reignmaker contests (called the Reignmakers tier, of course) have in the past been limited to listings with at least two of the highest-tier, rarest NFTs (also the Reignmaker tier) plus three NFTs from the second-highest tier (Legendary). NFTs at these tiers are expensive. Not just expensive in the way that, like, a steak dinner is expensive, but expensive in the way that buying even one of them should trigger a mandatory visit to a gambling addiction counselor, if not sirens and a straitjacket. Back in 2022a Reignmaker-level Ja’Marr Chase NFT from something called the Field Pass Promo Set could be purchased directly from the DraftKings Reignmaker Marketplace for a whopping $32,100.

Reignmakers users purchased NFTs at various levels with the expectation that owning them would convey better odds of winning contests hosted on DraftKings. This was the gamification element of Reignmakers, which emerged several months after DraftKings began trading and minting its NFTs. But as with all NFTs, a very large part of the real appeal for its buyers was the expectation, however insane, that these worthless, virtually worthless, infinitely duplicable digital images would increase in value over time. Now that both the Reignmakers game and the Reignmakers marketplace have been shut down, Reignmakers NFT holders are worried that their investments may have suddenly lost all monetary value. One Discord user described Tuesday as “a bad day to wake up and realize you have $2,000 worth of unopened NFL Rookie Packs”; Another user asked the group if they should expect “a refund” on the $10,000 they’ve already spent on Reignmakers NFTs this year. A pessimistic Reddit user posted tuesday that they would sue DraftKings if they were forced to take a total loss on a Reignmakers NFT collection worth approximately $100,000.

The game (scam?) was built to make numbers like these not only possible, but somewhat easily achievable. A user who intended to compete from a position of strength in multiple overlapping high-profile contests at the same time, and who had been in the blockchain madhouse for a period of years, could easily have spent six figures on Reignmakers NFTs. DraftKings used non-gaming incentives to entice players to spend more and more money, much like casinos give away free suites to players who over-bet on blackjack. Another Reddit user lamented the loss of the additional prizes and ranking bonuses he had hoped to earn in the upcoming NFL season by having a portfolio of NFTs that had reached the highest levels of value and prestige. “I was already loaded up on 2024 creation tokens and rookie debut cards,” said this Reignmakers userwho claimed his portfolio was finally “close to the top 250 overall.”

Dufoe’s complaint says the NFTs minted by DraftKings for Reignmakers qualify as securities, function like securities, and should be regulated as securities. In its motion to dismiss, DraftKings attempted to position its NFTs as game pieces — eye-wateringly expensive, yes, but essentially the same thing as Magic: The Gathering cards or Monopoly hotels. The court, in resolving these arguments, applied what’s known as “the Howey test,” referencing a case from 1946 in which the U.S. Supreme Court established a standard for determining whether a specific instrument qualifies as an investment contract. Judge Dennis J. Casper, in ruling against DraftKings’ motion, concluded that Dufoe could plausibly argue that Reignmakers’ NFT transactions represent “the pooling of assets from multiple investors in such a manner that all share in the profits and risks of the enterprise,” arguing that DraftKings’ absolute control over the game and marketplace effectively binds the financial interests of the company and the buyers, the latter of whom depend on the viability of both for their NFTs to retain any value.

Reignmakers users are different from Monopoly players in at least one crucial way: A person who buys a Monopoly board has no expectation from Hasbro that those little red and green pieces will appreciate in value. It’s a game! No matter what any hysterically conflicted party may say to the contrary, that’s not what NFT collecting is. DraftKings had been selling Reignmakers NFTs for months before they were gamified, and Dufoe, in his complaint, cites public comments made by DraftKings spokespeople that seem to explicitly position Reignmakers NFTs as assets with independent monetary value beyond their utility in Reignmakers contests. Judge Casper, in his ruling on the motion to dismiss, cites a Twitter account associated with a podcast run by DraftKings CEO Matthew Kalish, who in a tweet described NFTs as “the opportunity to invest in startups, artists, operations, and entrepreneurs all at once.” This is probably the kind of thing that NFT peddlers should stop saying. This advice assumes, of course, that NFTs will continue to exist as instruments on the other side of this and other lawsuits.

DraftKings has posted a worryingly sparse FAQ at the bottom of the your ad Tuesday, anticipating but largely failing to address questions from players who see this as yet another in a long line of brutal blockchain rug pulls. In a hilarious reversal of existing Reignmakers policy, Reignmakers users are now allowed by DraftKings to withdraw their Reignmakers NFTs from their DraftKings portfolios and into their personal NFT wallets, where those NFTs will have precisely zero value, to anyone, for the rest of all time. There’s also vague language about Reignmakers users having the option to “relinquish” their NFTs back to DraftKings in exchange for “cash payments,” subject to “certain conditions” and according to an as-yet-unspecified formula that will take into account, among other things, the “size and quality” of a player’s collection.

Reignmakers users are not optimistic. Those who claim to have been victims of other blockchain market crashes are warning their peers on Discord and Reddit to expect payouts that amount to pennies on the dollar; in the absence of any clarifying information, users are unsure whether cashing out their NFTs from Reignmakers to their personal NFT wallets, for reasons that completely pass any and all understanding, would effectively preclude the possibility of delivering these silly digital tokens back to DraftKings. It remains to be seen what exactly DraftKings has in mind with the “certain conditions” attached to the delivery process. There is much that has yet to be resolved. A DraftKings spokesperson contacted by Defector indicated that more time would be needed to answer a list of specific questions and issued a statement noting that it is “in DraftKings’ DNA to innovate and disrupt to provide the best possible gaming experiences for our customers.” The original complaint is embedded below.

Do you know anything about the demise of Reignmakers, either from the consumer side or from the DraftKings side? We’d love to hear from you. Get it in touch!

Recommended

NFTs

There Will Be No More ‘Mario & Sonic’ Olympics Because of NFTs

Nintendo and SEGA have been teaming up with the Olympics for several years now in the popular Mario & sonic in the Olympic Games series, but a new report claims the International Olympic Committee has abandoned the series in favor of new deals in eSports and NFTs.

According to Eurogamer“A veteran behind the series,” Lee Cocker, told the outlet that the IOC chose not to renew its license with SEGA and Nintendo, letting it expire in 2020. “They wanted to look at other partners and NFTs and eSports,” Cocker told Eurogamer. “Basically, the IOC wanted to bring [it] turn inward and look for other partners so they could get more money.”

Mario & Sonic at the Olympic Games is a series that has been running since 2008, with six main games covering the regular and Winter Olympics. In the games, players could control various characters from the Mario and Sonic franchises and compete in Olympic sporting events.

It’s no secret that NFTs are a big part of this year’s Paris 2024 Olympics. Olympics Go! Paris 2024 is a mobile and mobile-connected game your site states that players can “join the excitement of the Paris 2024 Olympic Games with nWay’s officially licensed, commemorative NFT Digital Pins collection honoring Paris 2024!”

As for eSports, Saudi Arabia will host the ESports Olympic Games in 2025. This is part of a partnership with the Saudi National Olympic Committee (NOC) that is expected to last for the next 12 years and is expected to feature regular events.

IOC President Thomas Bach said: “By partnering with the Saudi NOC, we also ensure that Olympic values are respected, in particular with regard to the game titles on the programme, the promotion of gender equality and the engagement with young audiences who are embracing esports.”

In other news, Someone claimed they’re suing Bandai Namco because Elden Ring is too difficult.

-

News11 months ago

News11 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

News11 months ago

News11 months agoOver 1 million new tokens launched since April

-

Altcoins11 months ago

Altcoins11 months agoAltcoin Investments to create millionaires in 2024

-

Memecoins9 months ago

Memecoins9 months agoMemecoins dominate major derivatives in terms of open interest | Flash News Detail

-

News9 months ago

News9 months agoInvest Now: The Hottest New Cryptocurrencies of August 2024 That Could Skyrocket

-

Altcoins9 months ago

Altcoins9 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

NFTs9 months ago

NFTs9 months agoRTFKT Announces Project Animus Reveal, Launches Egg Unboxing Event Amid Mixed Reactions | NFT CULTURE | NFT News | Web3 Culture

-

Altcoins9 months ago

Altcoins9 months agoHot New Altcoin: Memeinator’s Price Upside Potential in July

-

Videos12 months ago

Videos12 months agoMoney is broke!! The truth about our financial system!

-

Memecoins11 months ago

Memecoins11 months agoChatGPT Analytics That Will Work Better in 2024

-

Altcoins11 months ago

Altcoins11 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

News11 months ago

News11 months ago5 Crypto Airdrops After Notcoin to Watch Out for in June 2024