News

Cryptocurrency Basics: Pros, Cons and How It Works

In this article we cover:

What is cryptocurrency?

Cryptocurrency (or “crypto”) is a digital currency, such as Bitcoin, that is used as an alternative payment method or speculative investment. Cryptocurrencies get their name from the cryptographic techniques that let people spend them securely without the need for a central government or bank.

-

Bitcoin was initially developed primarily to be a form of payment that isn’t controlled or distributed by a central bank. While financial institutions have traditionally been necessary to verify that a payment has been processed successfully, Bitcoin accomplishes this securely, without that central authority.

-

Ethereum uses the same underlying technology as Bitcoin, but instead of strictly peer-to-peer payments, the cryptocurrency is used to pay for transactions on the Ethereum network. This network, built on the Ethereum blockchain, enables entire financial ecosystems to operate without a central authority. To visualize this, think insurance without the insurance company, or real estate titling without the title company.

-

Scores of altcoins (broadly defined as any cryptocurrency other than Bitcoin) arose to capitalize on the various — and at times promising — use cases for blockchain technology.

Advertisement

| NerdWallet rating

NerdWallet’s ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. 4.9 /5 |

NerdWallet rating

NerdWallet’s ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. 5.0 /5 |

NerdWallet rating

NerdWallet’s ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. 4.1 /5 |

|

Fees $0 per online equity trade |

||

|

Promotion None no promotion available at this time |

Promotion None no promotion available at this time |

Promotion Get up to $700 when you open and fund a J.P. Morgan Self-Directed Investing account with qualifying new money. |

Why do people invest in cryptocurrencies?

People invest in cryptocurrencies for the same reason anyone invests in anything. They hope its value will rise, netting them a profit.

If demand for Bitcoin grows, for example, the interplay of supply and demand could push up its value.

If people began using Bitcoin for payments on a huge scale, demand for Bitcoin would go up, and in turn, its price in dollars would increase. So, if you’d purchased one Bitcoin before that increase in demand, you could theoretically sell that one Bitcoin for more U.S. dollars than you bought it for, making a profit.

The same principles apply to Ethereum. “Ether” is the cryptocurrency of the Ethereum blockchain, where developers can build financial apps without the need for a third-party financial institution. Developers must use Ether to build and run applications on Ethereum, so theoretically, the more that is built on the Ethereum blockchain, the higher the demand for Ether.

However, it’s important to note that to some, cryptocurrencies aren’t investments at all. Bitcoin enthusiasts, for example, hail it as a much-improved monetary system over our current one and would prefer we spend and accept it as everyday payment. One common refrain — “one Bitcoin is one Bitcoin” — underscores the view that Bitcoin shouldn’t be measured in USD, but rather by the value it brings as a new monetary system.

Why is Bitcoin still popular?

Since its inception, Bitcoin has been regularly derided as dead, worthless or a scam, in part because its price is prone to meteoric rises and dramatic falls. When Bitcoin’s price rose to $60,000 in 2021 before collapsing to around $17,000 in 2022, many experts and investors said it wouldn’t recover from this burst.

But it did, hitting a series of record highs in early 2024. Those surges in price could be partially be attributed to approval by the SEC of spot Bitcoin ETFs in Jan. 2024. This gave some of the largest asset managers in the world (think Fidelity and BlackRock) a way to offer their clients exposure to Bitcoin, making it easier for those clients to hold Bitcoin in accounts such as IRAs and taxable brokerage accounts.

But Bitcoin’s 2024 price rise is also due to other factors. Every four years, something known as “Bitcoin halving” occurs. The most recent halving occurred in April 2024, cutting the mining reward from 6.25 to 3.125. The anticipation of fewer Bitcoins entering the market drives up the price.

What’s more, the surge in interest rates in 2022 that pummeled growth stocks may have had a similar influence on Bitcoin; investors tend to prefer security over volatility during times of uncertainty. But as talk of interest rate cuts in 2024 circulates, some investors may have more appetite for risky assets like Bitcoin, leading them to get back in now.

And lastly, there are still Bitcoin enthusiasts who preach that looking at Bitcoin through the lens of fiat currencies like the U.S. dollar or Great British pound is missing the point entirely, and that its true value lies in being a new monetary system.

But, if there’s anything about Bitcoin that appears to be predictable, it’s that it will continue to be volatile. In the relative short-term, both camps are likely right: Bitcoin will rise and Bitcoin will fall. But at the moment, it appears the Bitcoin bulls are winning out.

How does cryptocurrency work?

Cryptocurrencies are supported by a technology known as blockchain, which maintains a tamper-resistant record of transactions and keeps track of who owns what. The use of blockchains addressed a problem faced by previous efforts to create purely digital currencies: preventing people from making copies of their holdings and attempting to spend it twice[0].

Individual units of cryptocurrencies can be referred to as coins or tokens, depending on how they are used. Some are intended to be units of exchange for goods and services, others are stores of value, and some can be used to participate in specific software programs such as games and financial products.

How are cryptocurrencies created?

One common way cryptocurrencies are created is through a process known as mining, which is used by Bitcoin. Bitcoin mining can be an energy-intensive process in which computers solve complex puzzles in order to verify the authenticity of transactions on the network. As a reward, the owners of those computers can receive newly created cryptocurrency. Other cryptocurrencies use different methods to create and distribute tokens, and many have a significantly lighter environmental impact.

For most people, the easiest way to get cryptocurrency is to buy it, either from an exchange or another user.

Why are there so many kinds of cryptocurrency?

It’s important to remember that Bitcoin is different from cryptocurrency in general. While Bitcoin is the first and most valuable cryptocurrency, the market is large.

There are more than two million different cryptocurrencies in existence, according to CoinMarketCap.com, a market research website[0]. And while some cryptocurrencies have total market valuations in the hundreds of billions of dollars, others are obscure and essentially worthless.

If you’re thinking about getting into cryptocurrency, it can be helpful to start with one that is commonly traded and relatively well-established in the market. These coins typically have the largest market capitalizations.

Thoughtfully selecting your cryptocurrency, however, is no guarantee of success in such a volatile space. Sometimes, an issue in the deeply interconnected crypto industry can spill out and have broad implications on asset values.

For instance, in November of 2022 the market took a major hit as the cryptocurrency exchange FTX struggled to deal with liquidity issues amid a spike in withdrawals. As the fallout spread, cryptocurrencies both large and small saw their values plummet.

Are cryptocurrencies financial securities, like stocks?

Whether or not cryptocurrency is a security is a bit of a gray area right now. To back up a little, generally, a “security” in finance is anything that represents a value and can be traded. Stocks are securities because they represent ownership in a public company. Bonds are securities because they represent a debt owed to the bondholder. And both of these securities can be traded on public markets.

Regulators are increasingly starting to signal cryptocurrencies should be regulated similarly to other securities, such as stocks and bonds. But this take is receiving pushback; scholars, legal firms and some of the biggest players in the crypto industry have argued against this, claiming the rules that apply to stocks and bonds, for example, don’t apply as broadly to cryptocurrencies.

The Securities and Exchange Commission has set its sights on the sector generally. The agency has raised concerns about activities including crypto staking, and well as the operations of some large crypto companies.

Whether the SEC will treat cryptocurrencies, or specific types of cryptocurrencies, as securities will be at the forefront of crypto regulation, and could have major implications for the asset class in the near future.

Pros and cons of cryptocurrency

Cryptocurrency inspires passionate opinions across the spectrum of investors. Here are a few reasons that some people believe it is a transformational technology, while others worry it’s a fad.

Cryptocurrency pros

-

Some supporters like the fact that cryptocurrency removes central banks from managing the money supply since over time these banks tend to reduce the value of money via inflation.

-

In communities that have been underserved by the traditional financial system, some people see cryptocurrencies as a promising foothold. Pew Research Center data from 2021 found that Asian, Black and Hispanic people “are more likely than White adults to say they have ever invested in, traded or used a cryptocurrency[0].”

-

Other advocates like the blockchain technology behind cryptocurrencies, because it’s a decentralized processing and recording system and can be more secure than traditional payment systems.

-

Some cryptocurrencies offer their owners the opportunity to earn passive income through a process called staking. Crypto staking involves using your cryptocurrencies to help verify transactions on a blockchain protocol. Though staking has its risks, it can allow you to grow your crypto holdings without buying more.

Cryptocurrency cons

-

Many cryptocurrency projects are untested, and blockchain technology in general has yet to gain wide adoption. If the underlying idea behind cryptocurrency does not reach its potential, long-term investors may never see the returns they hoped for.

-

For shorter-term crypto investors, there are other risks. Its prices tend to change rapidly, and while that means that many people have made money quickly by buying in at the right time, many others have lost money by doing so just before a crypto crash.

-

Those wild shifts in value may also cut against the basic ideas behind the projects that cryptocurrencies were created to support. For example, people may be less likely to use Bitcoin as a payment system if they are not sure what it will be worth the next day.

-

The environmental impact of Bitcoin and other projects that use similar mining protocols is significant. A comparison by the University of Cambridge, for instance, said worldwide Bitcoin mining consumes more than twice as much power as all U.S. residential lighting[0]. Some cryptocurrencies use different technology that demands less energy.

-

Governments around the world have not yet fully reckoned with how to handle cryptocurrency, so regulatory changes and crackdowns have the potential to affect the market in unpredictable ways.

Track your finances all in one place

Get started by signing up and linking an account.

Cryptocurrency legal and tax issues

There’s no question that cryptocurrencies are legal in the U.S., though China has essentially banned their use, and ultimately whether they’re legal depends on each individual country.

The question of whether cryptocurrencies are legally allowed, however, is only one part of the legal question. Other things to consider include how crypto is taxed and what you can buy with cryptocurrency.

-

Legal tender: You might call them cryptocurrencies, but they differ from traditional currencies in one important way: there’s no requirement in most places that they be accepted as “legal tender.” The U.S. dollar, by contrast, must be accepted for “all debts, public and private.” Countries around the world are taking various approaches to cryptocurrency. For now, in the U.S., what you can buy with cryptocurrency depends on the preferences of the seller.

-

Crypto taxes: Again, the term “currency” is a bit of a red herring when it comes to taxes in the U.S. Cryptocurrencies are taxed as property, rather than currency. That means that when you sell them, you’ll pay tax on the capital gains, or the difference between the price of the purchase and sale. And if you’re given crypto as payment — or as a reward for an activity such as mining — you’ll be taxed on the value at the time you received them.

Your decision: Is cryptocurrency a good investment?

Cryptocurrency is a relatively risky investment, no matter which way you slice it. Generally speaking, high-risk investments should make up a small part of your overall portfolio — one common guideline is no more than 10%. You may want to look first to shore up your retirement savings, pay off debt or invest in less-volatile funds made up of stocks and bonds.

There are other ways to manage risk within your crypto portfolio, such as by diversifying the range of cryptocurrencies that you buy. Crypto assets may rise and fall at different rates, and over different time periods, so by investing in several different products you can insulate yourself — to some degree — from losses in one of your holdings.

Perhaps the most important thing when investing in anything is to do your homework. This is particularly important when it comes to cryptocurrencies, which are often linked to a specific technological product that is being developed or rolled out. When you buy a stock, it is linked to a company that is subject to well-defined financial reporting requirements, which can give you a sense of its prospects.

Cryptocurrencies, on the other hand, are more loosely regulated in the U.S., so discerning which projects are viable can be even more challenging. If you have a financial advisor who is familiar with cryptocurrency, it may be worth asking for input.

For beginning investors, it can also be worthwhile to examine how widely a cryptocurrency is being used. Most reputable crypto projects have publicly available metrics showing data such as how many transactions are being carried out on their platforms. If use of a cryptocurrency is growing, that may be a sign that it is establishing itself in the market. Cryptocurrencies also generally make “white papers” available to explain how they’ll work and how they intend to distribute tokens.

If you’re looking to invest in less established crypto products, here are some additional questions to consider:

-

Who’s heading the project? An identifiable and well-known leader is a positive sign.

-

Are there other major investors who are investing in it? It’s a good sign if other well-known investors want a piece of the currency.

-

Will you own a portion in the company or just currency or tokens? This distinction is important. Being a part owner means you get to participate in its earnings (you’re an owner), while buying tokens simply means you’re entitled to use them, like chips in a casino.

-

Is the currency already developed, or is the company looking to raise money to develop it? The further along the product, the less risky it is.

It can take a lot of work to comb through a prospectus; the more detail it has, the better your chances it’s legitimate. But even legitimacy doesn’t mean the currency will succeed. That’s an entirely separate question, and that requires a lot of market savvy. Be sure to consider how to protect yourself from fraudsters who see cryptocurrencies as an opportunity to bilk investors.

Frequently asked questions

How does a blockchain work?

Most cryptocurrencies are based on blockchain technology, a networking protocol through which computers can work together to keep a shared, tamper-proof record of transactions. The challenge in a blockchain network is in making sure that all participants can agree on the correct copy of the historical ledger. Without a recognized way to validate transactions, it would be difficult for people to trust that their holdings are secure. There are several ways of reaching “consensus” on a blockchain network, but the two that are most widely used are known as “proof of work” and “proof of stake.”

What does proof of work mean?

Proof of work is one way of incentivizing users to help maintain an accurate historical record of who owns what on a blockchain network. Bitcoin uses proof of work, which makes this method an important part of the crypto conversation. Blockchains rely on users to collate and submit blocks of recent transactions for inclusion in the ledger, and Bitcoin’s protocol rewards them for doing so successfully. This process is known as mining.

There is stiff competition for these rewards, so many users try to submit blocks, but only one can be selected for each new block of transactions. To decide who gets the reward, Bitcoin requires users to solve a difficult puzzle, which uses a huge amount of energy and computing power. The completion of this puzzle is the “work” in proof of work.

For lucky miners, the Bitcoin rewards are more than enough to offset the costs involved. But the huge upfront cost is also a way to discourage dishonest players. If you win the right to create a block, it might not be worth the risk of tampering with the records and having your submission thrown out — forfeiting the reward. In this instance, spending the money on energy costs in an attempt to tamper with the historical record would have resulted in significant loss.

Ultimately, the goal of proof of work is to make it more rewarding to play by the rules than to try to break them.

Proof of stake is another way of achieving consensus about the accuracy of the historical record of transactions on a blockchain. It eschews mining in favor of a process known as staking, in which people put some of their own cryptocurrency holdings at stake to vouch for the accuracy of their work in validating new transactions. Some of the cryptocurrencies that use proof of stake include Cardano, Solana and Ethereum (which is in the process of converting from proof of work).

Proof of stake systems have some similarities to proof of work protocols, in that they rely on users to collect and submit new transactions. But they have a different way of incentivizing honest behavior among those who participate in that process. Essentially, people who propose new blocks of information to be added to the record must put some cryptocurrency at stake. In many cases, your chances of landing a new block (and the associated rewards) go up as you put more at stake. People who submit inaccurate data can lose some of the money they’ve put at risk.

How do you mine cryptocurrency?

Mining cryptocurrency is generally only possible for a proof-of-stake cryptocurrency such as Bitcoin. And before you get too far, it is worth noting that the barriers to entry can be high and the probability of success relatively low without major investment.

While early Bitcoin users were able to mine the cryptocurrency using regular computers, the task has gotten more difficult as the network has grown. Now, most miners use special computers whose sole job is to run the complex calculations involved in mining all day every day. And even one of these computers isn’t going to guarantee you success. Many miners use entire warehouses full of mining equipment in their quest to collect rewards.

If you don’t have the resources to compete with the heavy hitters, one option is joining a mining pool, where users share rewards. This reduces the size of the reward you’d get for a successful block, but increases the chance that you could at least get some return on your investment.

How do you pull your money out of crypto?

Just like with buying cryptocurrencies, there are several options for converting your crypto holdings into cash. While decentralized exchanges and peer-to-peer transactions may be right for some investors, many choose to use centralized services to offload their holdings.

With a centralized exchange, the process is basically the reverse of buying. But one advantage if you own crypto is that you probably already have everything set up. Here are the steps:

-

Connect the wallet that holds the cryptocurrencies that you want to sell, and make sure the exchange you’ve chosen supports both that wallet and the asset in question.

-

Move your cryptocurrency onto the exchange.

-

Sell your cryptocurrency.

-

Transfer the proceeds back to your bank account.

Every exchange will handle such transactions differently, so you’ll want to look up the fees and processes for your specific provider. Also, remember that you may be creating crypto tax liability when you sell your digital assets.

How does a blockchain work?

Most cryptocurrencies are based on

blockchain technology

, a networking protocol through which computers can work together to keep a shared, tamper-proof record of transactions. The challenge in a blockchain network is in making sure that all participants can agree on the correct copy of the historical ledger. Without a recognized way to validate transactions, it would be difficult for people to trust that their holdings are secure. There are several ways of reaching “consensus” on a blockchain network, but the two that are most widely used are known as “proof of work” and “proof of stake.”

What does proof of work mean?

Proof of work

is one way of incentivizing users to help maintain an accurate historical record of who owns what on a blockchain network. Bitcoin uses proof of work, which makes this method an important part of the crypto conversation. Blockchains rely on users to collate and submit blocks of recent transactions for inclusion in the ledger, and Bitcoin’s protocol rewards them for doing so successfully. This process is known as mining.

There is stiff competition for these rewards, so many users try to submit blocks, but only one can be selected for each new block of transactions. To decide who gets the reward, Bitcoin requires users to solve a difficult puzzle, which uses a huge amount of energy and computing power. The completion of this puzzle is the “work” in proof of work.

For lucky miners, the Bitcoin rewards are more than enough to offset the costs involved. But the huge upfront cost is also a way to discourage dishonest players. If you win the right to create a block, it might not be worth the risk of tampering with the records and having your submission thrown out — forfeiting the reward. In this instance, spending the money on energy costs in an attempt to tamper with the historical record would have resulted in significant loss.

Ultimately, the goal of proof of work is to make it more rewarding to play by the rules than to try to break them.

» Learn more:

How does Bitcoin work?

What is proof of stake?

Proof of stake

is another way of achieving consensus about the accuracy of the historical record of transactions on a blockchain. It eschews mining in favor of a process known as staking, in which people put some of their own cryptocurrency holdings at stake to vouch for the accuracy of their work in validating new transactions. Some of the cryptocurrencies that use proof of stake include Cardano, Solana and Ethereum (which is in the process of converting from proof of work).

Proof of stake systems have some similarities to proof of work protocols, in that they rely on users to collect and submit new transactions. But they have a different way of incentivizing honest behavior among those who participate in that process. Essentially, people who propose new blocks of information to be added to the record must put some cryptocurrency at stake. In many cases, your chances of landing a new block (and the associated rewards) go up as you put more at stake. People who submit inaccurate data can lose some of the money they’ve put at risk.

How do you mine cryptocurrency?

Mining cryptocurrency is generally only possible for a proof-of-stake cryptocurrency such as Bitcoin. And before you get too far, it is worth noting that the barriers to entry can be high and the probability of success relatively low without major investment.

While early Bitcoin users were able to mine the cryptocurrency using regular computers, the task has gotten more difficult as the network has grown. Now, most miners use special computers whose sole job is to run the complex calculations involved in mining all day every day. And even one of these computers isn’t going to guarantee you success. Many miners use entire warehouses full of mining equipment in their quest to collect rewards.

If you don’t have the resources to compete with the heavy hitters, one option is joining a mining pool, where users share rewards. This reduces the size of the reward you’d get for a successful block, but increases the chance that you could at least get some return on your investment.

How do you pull your money out of crypto?

Just like with buying cryptocurrencies, there are several options for converting your crypto holdings into cash. While decentralized exchanges and peer-to-peer transactions may be right for some investors, many choose to use centralized services to offload their holdings.

With a centralized exchange, the process is basically the reverse of buying. But one advantage if you own crypto is that you probably already have everything set up. Here are the steps:

-

Connect the wallet that holds the cryptocurrencies that you want to sell, and make sure the exchange you’ve chosen supports both that wallet and the asset in question.

-

Move your cryptocurrency onto the exchange.

-

Sell your cryptocurrency.

-

Transfer the proceeds back to your bank account.

Every exchange will handle such transactions differently, so you’ll want to look up the fees and processes for your specific provider. Also, remember that you may be creating

crypto tax

liability when you sell your digital assets.

News

Top 5 Crypto Pre-Sales for August 2024

Have you heard about cryptocurrencies in 2011? Was Bitcoin so popular back then? Well, yes, some forward-thinking people saw its potential early and invested in BTC back then. Investors were skeptical about this new financial element; however, many took the risk and invested what they could risk in the cryptocurrency market.

Going through the list of top presales, we have identified and studied five of the main candidates that can change the game on the trading charts. These new opportunities promise the best returns and a great chance to buy tokens at affordable prices. While 5thScape is at the top of our recommendation, projects like DarkLume and Artemis Coin are pioneers in their respective categories.

Top 5 Crypto Pre-Sales to Add to Your Watchlist in 2024

Below we present the top five cryptocurrency pre-sales that you should consider adding to your investment watchlist.

- 5th Landscape (5SCAPE) – King of digital VR gaming with AR/VR elements

- Dark light (DLUME) – Virtual Metaverse for Social Exploration

- SpacePay (SPY) – Versatile Financial Payment Gateway for Seamless Transactions

- EarthMeta (EMT) – Replicating our planet on a virtual platform

- Artemis Coin (ARTMS) – NFT Marketplace for Digital Real Estate Investment

In-Depth Review: The Best Crypto Pre-Sales of 2024

Now, let’s take a closer look at these pre-sale events and how they can help investors make significant profits this year.

5th Landscape (5SCAPE)

The 5thScape project combines emerging technology using the fundamentals of virtual and augmented reality on the Ethereum platform using its native currency as 5SCAPE. Users of the token experience increased security and interactive gameplay in the digital space.

Here are the potential reasons why investors are admiring the 5thScape ecosystem:

Immersive Gameplay: With over five game titles, the platform is ready to amaze the audience with games ranging from archery, sports, battle and high-speed racing.

Innovative VR Content: 5thScape’s progress in the crypto-gaming space will contribute to the development of educational resources and other VR content on the website.

Motion Control Gadgets: This project is working hard to introduce VR devices such as headsets and gaming chairs with precise controls and high-resolution soundscapes to achieve the best immersive feeling while exploring the ecosystem.

Practical utility: 5SCAPE tokens stimulate participation in various activities and convert the ecosystem into economic value for investors.

Staking Opportunities: Acquiring 5SCAPE tokens after listing on exchanges can generate higher earnings

Free Giveaways and Prizes: The distribution of free coins and VR subscriptions attract investors.

Visit 5thScape for more details>>

Dark Light (DLUME)

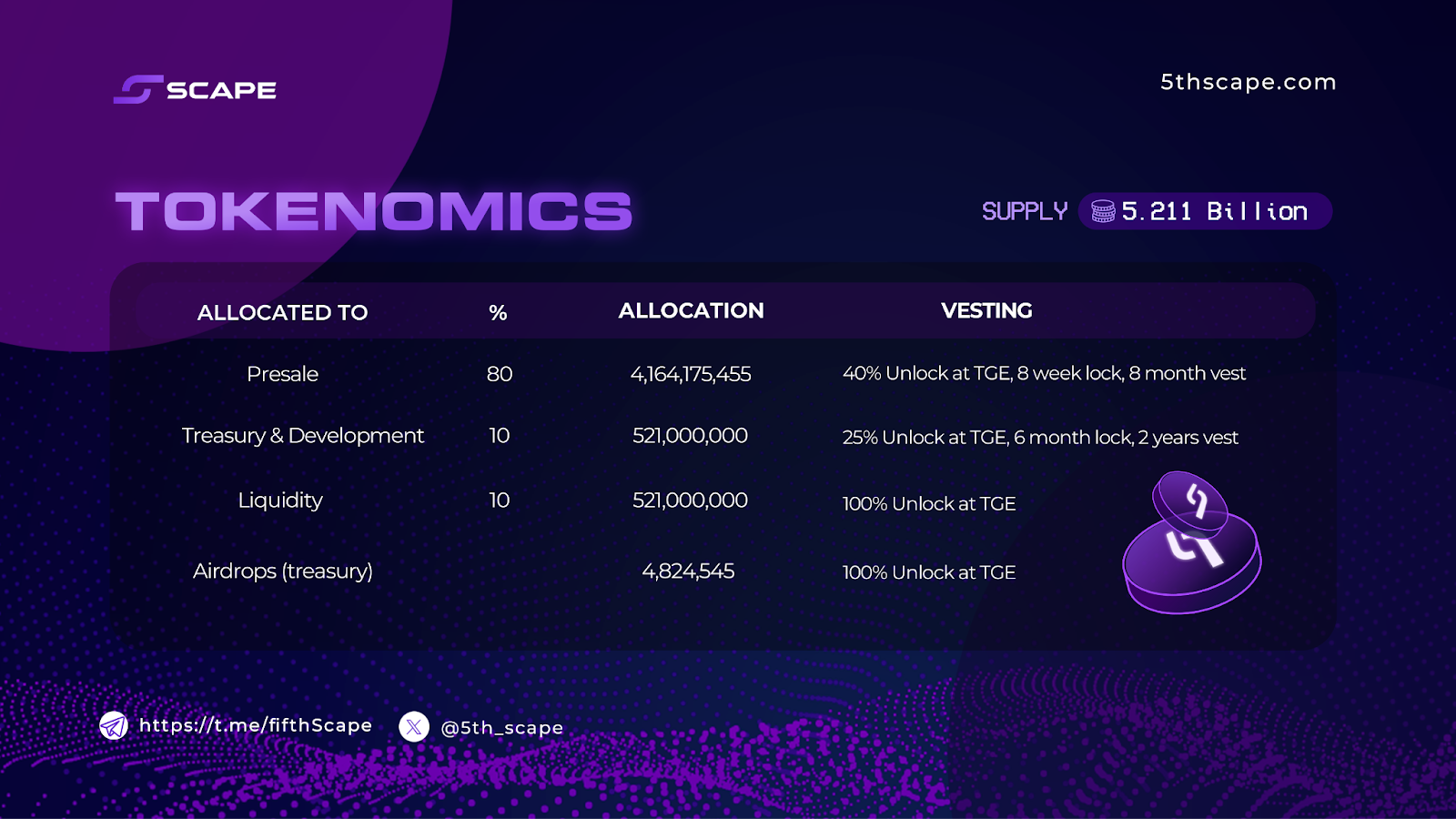

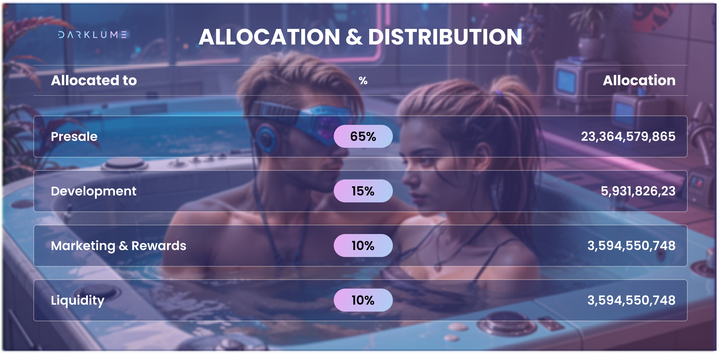

We just saw how 5thScape captures investors with its AR/VR digital landscape. DarkLume works on similar VR principles but has a completely new VR metaverse. Its presale is about to hit the $1 million mark and simultaneously increase fund inflows.

What are the specifics that allow DarkLume to lead the metaverse industry?

Native currency: The project has DLUME as a digital currency that can be used for in-game purchases or upgrades. These utility tokens also give their holders the right to vote on the development and expansion of the project.

Benefits of staking: Investors who want to hold and earn from this currency expect to multiply their funds after the stock market listing.

Exploratory Metaverse: Once you enter this world, there is no turning back. There are so many opportunities to find recreational activities and relieve stress. Walking through lush landscapes and stargazing at night can be a memorable experience. If you are a party animal, DarkLume’s virtual discos and clubs will win you over.

Visit DarkLume for more details>>

Payment for space (SPY)

Traditional financial setups face many challenges in daily transactions and are also expensive. To solve these concerns, Maxwell Bunting founded SpacePay by combining cryptocurrency payments and blockchain technology. The London-based startup makes online shopping and payments more seamless by integrating its network with existing card terminals, allowing users to make payments in any digital currency. Merchants can choose to receive payments in conventional currency without having to pay exorbitantly.

SpacePay has designed a user-friendly and convenient interface that supports over 325 crypto wallets. SPY, the native token of this platform, serves to enable all transactions within its ecosystem. Tokens can also be used to generate passive income through staking and additional community rewards.

EarthMeta (EMT)

EarthMeta is a virtual metaverse created to replicate our planet, Earth. It is listed as one of the best crypto pre-sales of 2024, with a focus on creating new NFT platforms and virtual assets in premium cities. The startup encourages users to own and govern virtual landscapes.

Cities are then further broken down into smaller assets such as landmarks, buildings, monuments, parks, schools, and more. NFTs can now be bought and sold in the project’s marketplace. Governors are eligible to earn 1% fees per transaction within their city. EMT token holders can also generate more at once with custom API integrations and participation in DAO activities.

Artemis (ARTMS)

Today we have covered a number of financial projects that you can consider along with 5thScape, the most promising VR coins of the decade. Artemis (ARTMS) is a financial platform that allows investors to transact and trade using its digital asset, ARTMS. Users can also lend, borrow, stake, save, and generate rewards from yield farming.

The project is about to enter Phase 4 of development which will see the launch of the Artemis Crypto System. This system is customized to facilitate a large number of secure and transparent crypto transactions. Cryptocurrency enthusiasts and professional entities can buy and sell products such as smartphones, bicycles and internet services using crypto payments. Early investors have great advantages until the project is available at a discounted price in the pre-sale.

Read this before investing in the next cryptocurrency market

Experienced investors know the factors to consider before investing in this dynamic market. Here are some points that beginners should remember before securing a position in the cryptocurrency universe.

- It is essential to verify the project details and the founders.

- Read and understand the whitepaper for all the technical information about the ICO, the roadmap and the mission of the project.

- The project roadmap will provide greater clarity on milestones and results achieved.

- Review the fundamentals of the new technologies involved in the development of the platform.

- Before investing in any cryptocurrency, carefully evaluate the benefits and risks to avoid losses and build a profitable portfolio.

Conclusion

5thScape ICO Offers Tokens at Deeply Discounted Prices. Once the presale is over, the token price will skyrocket 434% from the first round and promise 600x returns to early investors. Who wouldn’t want to be part of an innovative and growing VR ecosystem? Check your details, review all the documents and start investing in 5thScape now.

Time flies, and so does the $100,000 prize.

News

Best Upcoming Cryptocurrencies for Long-Term Profits: Turn $100 Into $1000 With These Picks

Have you ever wondered how much return Bitcoin has given to investors who bought this gold cryptocurrency a decade ago? In 2014, Bitcoin reached its significant milestone of $1,000 in the first month. Currently, it is trading at around $64k, which is an astonishing 6300% increase in the span of 10 years. No stock, no ETF could ever give you such monumental returns. This simply proves that the cryptocurrency market turns your dreams of investment returns into reality.

While the established giants are not giving so much returns now, the ball is in the court of upcoming cryptocurrencies that are based on the development of projects to provide up to 1000x returns in the near future. In this article, we will explore 5 upcoming cryptocurrencies for long-term earnings that can turn your $100 into $1000 – the only key is strategic investing with a lot of patience!

Best Upcoming Cryptocurrencies For Long Term Profits

Below we list the top 5 cryptocurrencies for long-term gains, which are set to give you returns of up to 1000 times in the coming times.

- 5th Landscape (5LANDSCAPE)

- Dark light (DISGUST)

- BlockDAG (BDAG)

- eTukTuk (TUK)

- WienerAI (WAI)

Take a deeper look at the background of these 5 upcoming cryptocurrencies for long-term gains and see why they could be viable options for your cryptocurrency portfolio.

1. 5° Landscape (5SCAPE)

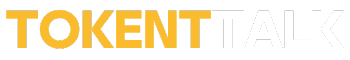

5thScape is changing the face of entertainment by merging augmented and virtual reality with blockchain technology, offering a VR content ecosystem unlike any other destination on the internet. Its native token, 5SCAPE, is the cornerstone of this innovative ecosystem. With a limited supply of 5.21 billion tokens, 5SCAPE offers early investors a unique opportunity to participate in the growth of a potentially transformative platform.

Combining the immersive experiences of VR technology with a cryptocurrency that has a real-world use case, 5thScape presents a compelling investment proposition. The project’s focus on providing unparalleled user experiences, coupled with its potential to generate substantial returns, makes 5SCAPE an ideal new cryptocurrency to have in your portfolio for long-term gains.

Click here to invest in 5thScape today >>

2. DarkLume (DLUME)

DarkLume is a meticulously crafted metaverse where users can experience a lavish digital lifestyle. At its core is the DLUME token, the currency that powers this virtual economy. By owning DLUME, users gain access to exclusive experiences, from owning virtual properties to attending high-society events and hosting virtual celebrations with their friends.

The metaverse is divided into virtual countries, each with its own citizenship requirements. To become a citizen, users must possess a specific amount of DLUME. Maintaining citizenship involves paying taxes in DLUME and creating a sense of community and responsibility among users.

Unlike other metaverse platforms that are limited to digital interactions only, DarkLume offers a wide range of activities, from leisure and entertainment to social interactions and exciting experiences. The platform’s focus on luxury ensures that every aspect of the metaverse is designed to exceed expectations. As DarkLume continues to grow, its DLUME token is expected to be in high demand. The metaverse concept is supported by renowned names such as Mark Zuckerberg and Satya Nadella. As it is the future of immersive socialization, the DLUME token is expected to appreciate in value over time.

Explore DarkLume’s website to learn more

3. BlockDAG (BDAG)

BlockDAG is an innovative blockchain platform that uses a Directed Acyclic Graph (DAG) structure together with blockchain technology to offer fast transaction speeds, lower fees, and better scalability.

Unlike traditional blockchains that process transactions sequentially, BlockDAG processes them in parallel, which allows it to handle a much higher transaction volume. This approach makes BlockDAG an ideal platform for applications that require high throughput and low latency, such as DeFi, gaming, and IoT. Its presale has been a great success so far, and BlockDAG’s adaptability may be an optimistic sign for early investors in the BDAG token.

4. eTukTuk (TUK)

eTukTuk is a new leading crypto project that combines sustainable transportation with blockchain technology. Its main goal is to electrify the famous “tuk-tuk” industry, reducing carbon emissions that cause environmental damage while creating a thriving ecosystem. Its TUK token powers the entire platform.

One of the most notable features of eTukTuk is its Play-to-Earn (P2E) gameplay. Players can earn TUK tokens by completing challenges and missions in the game. This gamified approach not only makes the platform engaging but also incentivizes user participation in building the eTukTuk ecosystem. The primary utility of the TUK token is as a mode of payment for tuk-tuk drivers who use EV charging stations for their vehicles installed across Sri Lanka. The project will soon expand to other countries.

Overall, the value proposition of the TUK crypto token is strengthened by its utility within the platform. It can be used to purchase electric tuk-tuks, charge them at the network’s charging stations, and access various platform services. As eTukTuk adoption grows, demand for TUK tokens is expected to increase, potentially resulting in significant appreciation in the token’s value.

5. WienerAI (WAI)

WienerAI is a new blockchain-based platform that uses next-generation artificial intelligence (AI) technology to transform the cryptocurrency trading space. Its flagship product is an AI trading bot (with a sausage-themed mascot) designed to analyze market trends, identify potential opportunities, and execute trades with zero errors. With the power of AI, WienerAI provides users with a market edge in the complex and dynamic world of investing.

The platform’s native WAI token is a digital asset that underpins the entire ecosystem. Token holders can enjoy various benefits, including discounted trading fees, priority access to new features, and even a share of the platform’s profits. As WienerAI gains traction and its AI trading bot proves successful, the continued flow of demand for the WAI token will fuel its price.

Final Thoughts: Best Cryptocurrencies for Long-Term Profits

Each cryptocurrency project explored in this article brings a unique and innovative perspective to the blockchain industry. From the immersive worlds of 5thScape and DarkLume to the efficiency gains of BlockDAG and the sustainability focus of eTukTuk, not to mention WienerAI’s AI-powered trading bot with a new approach to investing, these projects are pushing the boundaries of what’s possible with blockchain technology.

While all of these projects are promising, 5thScape and DarkLume stand out as particularly interesting investment opportunities. The combination of 5thScape’s robust VR ecosystem tokenomics and unique AR/VR offeringstogether with the fantasy world of the DarkLume metaversehas the potential to appeal to a wide range of investors who may be entertainment lovers, not just cryptocurrency enthusiasts. Given their current presale stages, acquiring 5SCAPE and DLUME tokens at these early-bird prices could prove to be a strategic move for those seeking substantial returns.

This is a sponsored article. The opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on the information presented in this article.

News

Avalanche Predicts ‘Most Bullish Unlock’ in Broader Market $1 Billion in Token Release

Token Unlocks data shows that several crypto projects:AvalancheWormhole, Aptos, SandboxArbitrum, Optimism and others are set to unlock around $1 billion worth of tokens in August.

Approximately $260 million will be allocated in the first three days of the month.

Crypto projects often schedule token unlocks to control the asset supply and prevent market oversaturation. This gradual release helps avoid significant sell-offs by early investors or team members who hold large amounts of crypto assets.

Wormhole and Avalanche to Release Over $400 Million in Tokens

The biggest news this month will be Wormhole and Avalanche.

On August 3rd, Hole in the walla cross-chain messaging protocol, will release 600 million tokens worth $151.67 million, or 33.33% of its circulating supply.

Avalanche will follow on August 20, unlocking 9.54 million AVAX tokens worth approximately $251 million, or 2.42% of its circulating supply.

The Token Unlocks dashboard shows that 4.5 million AVAX, worth $118.53 million, will go to the Avalanche team, 2.25 million AVAX, worth $59.27 million, will go to strategic partners, and the remainder will go to the Foundation and as an airdrop.

Farid Rached, former head of ecosystem growth at Avalanche, underlined that this planned unlock would be the most bullish in its history because “it is the last big step for the team and public/private investors.”

Other important unlocks

Sui, a layer 1 network, will unlock 64 million tokens worth $50 million, or 2.56% of its circulating supply, on August 1.

Similarly, decentralized exchange dYdX will issue 8.33 million tokens worth nearly $11 million, or 3.65% of its circulating supply. These tokens will be distributed to investors, founders, staff, and future employees.

Aptos will unlock 11.31 million APT tokens worth $74.64 million on August 12. These will be allocated to the Aptos community, top contributors, the foundation, and investors, with top contributors receiving the largest share: 3.96 million APT worth $26 million.

On August 14, Sandbox will release 205.6 million SAND tokens worth $66.75 million. This issuance will be split between the team, advisors, and a corporate reserve.

Finally, Ethereum’s layer 2 networks Referee AND Optimism will collectively unlock over $110 million worth of tokens by August 16 and 31, respectively.

Mentioned in this article

Latest Alpha Market Report

News

Big Tech Beats Bitcoin (BTC) as Trump’s Trade Cancellation Weakens Token

Bitcoin has failed to join the cross-asset rally fueled by dovish comments from the Federal Reserve, as the tight US election race casts doubt on Donald Trump’s ability to implement his pro-cryptocurrency agenda.

The digital asset slipped 2.4% on Wednesday, tracking a Fed-fueled surge in an index of the Magnificent Seven large-cap tech stocks by one of the widest margins in 2024. The token fell further on Thursday, changing hands at $63,750 by 6:10 a.m. in London.

-

News7 months ago

News7 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

News7 months ago

News7 months agoOver 1 million new tokens launched since April

-

Videos8 months ago

Videos8 months agoMoney is broke!! The truth about our financial system!

-

Altcoins7 months ago

Altcoins7 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Memecoins7 months ago

Memecoins7 months agoChatGPT Analytics That Will Work Better in 2024

-

NFTs8 months ago

NFTs8 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

Altcoins7 months ago

Altcoins7 months agoAltcoin Investments to create millionaires in 2024

-

Videos7 months ago

Videos7 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News5 months ago

News5 months agoInvest Now: The Hottest New Cryptocurrencies of August 2024 That Could Skyrocket

-

Memecoins5 months ago

Memecoins5 months agoMemecoins dominate major derivatives in terms of open interest | Flash News Detail

-

Altcoins5 months ago

Altcoins5 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

Videos7 months ago

Videos7 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!