NFTs

Are NFTs a bubble? Let’s discover the truth of digital art

Uncovering the NFT Bubble: Examining the Truth Behind Digital Art

What are NFTs?

NFTs are unique digital tokens that exist on a blockchain, a decentralized ledger that records transactions. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged individually, NFTs are non-fungible, meaning each token is unique and cannot be exchanged like for like. This uniqueness makes NFTs ideal for representing ownership of digital assets such as artwork, music, videos, and other collectibles.

The rise of NFTs

The concept of NFTs is familiar, but their popularity increased in late 2020 and early 2021. Several factors contributed to this increase:

Blockchain Technology: The advancement and widespread adoption of blockchain technology has provided a secure and transparent way to verify and transfer ownership of digital assets.

Digital art boom: The COVID-19 pandemic has accelerated the shift to digital interactions, including the consumption and creation of digital art. Artists sought new ways to monetize their work, and NFTs offered a promising solution.

Celebrity support: High-profile endorsements and participation from celebrities and influencers have brought public attention to NFTs. Artists like Beeple, who sold an NFT for $69 million, and musicians like Grimes, who sold digital art for millions, fueled the hype.

Speculative investment: The potential for significant returns has attracted investors and speculators, leading to a surge in NFT transactions and prices.

How do NFTs work?

NFTs are created through a process called minting, which involves publishing a digital asset on a blockchain. Here’s a simplified breakdown of how NFTs work:

Creation: An artist or creator creates a digital file (e.g. an image, video or music track) and converts it into an NFT by minting it on a blockchain platform like Ethereum.

Verification: The blockchain records the creation of the NFT, providing a unique identifier and metadata that cannot be changed.

Property transfer: NFTs can be bought and sold on various marketplaces such as OpenSea, Rarible, and Foundation. Ownership is transferred through blockchain transactions, ensuring transparency and security.

Royalties: Smart contracts, which are self-executing contracts with the terms written directly into the code, can be incorporated into NFTs. These contracts may include royalty clauses, ensuring that creators receive a percentage of sales whenever the NFT is resold.

The bubble argument

The notion that NFTs are a bubble arises from several factors reminiscent of historical speculative bubbles such as the dot-com bubble and tulip mania. Here are the key points that fuel the bubble argument:

Speculative Frenzy: The rapid rise in NFT prices, driven by hype and speculation, reflects previous market bubbles. Examples include digital art of Beeple selling for $69 million and tweets selling as NFTs for thousands of dollars.

Market volatility: The NFT market is highly volatile, with the prices of certain NFTs skyrocketing and then plummeting over short periods. This volatility suggests a lack of intrinsic value and a market driven by speculation.

Scarcity and Exclusivity: The artificial scarcity created by limiting the number of NFTs for a digital asset can inflate prices beyond reasonable levels. Critics argue that this scarcity does not equate to real-world value.

Lack of regulation: The NFT market operates with minimal regulation, increasing the risk of fraud, market manipulation and investment loss. The lack of oversight has raised concerns about the sustainability of the market.

Counterarguments: While the bubble argument has merit, there are also compelling reasons to believe in the value and long-term potential of NFTs:

Provenance and Authenticity: NFTs provide a secure way to establish the provenance and authenticity of digital assets. This is particularly valuable in the art world, where verifying a piece’s originality can be a challenge.

The future of NFTs: bubble or revolution?

Determining whether NFTs are a bubble or a disruptive technology requires a nuanced understanding of their current state and future potential. Several factors will influence the trajectory of NFTs:

Market Maturity: As the NFT market matures, it is likely to undergo corrections that eliminate speculative excesses. A more stable and regulated market could emerge, similar to the evolution of the cryptocurrency market.

Technological advancements: Continued advances in blockchain technology, including scalability and energy efficiency, will play a crucial role in the sustainability of NFTs. Solutions to current problems, such as high transaction fees and environmental impact, will be fundamental.

Regulatory Frameworks: Introducing regulatory frameworks can help protect investors and ensure fair practices in the NFT market. Regulation could also legitimize NFTs, attracting more institutional investment.

Wider Adoption: The integration of NFTs into mainstream applications and industries will drive their adoption and longevity. For example, NFTs could revolutionize industries like real estate, music, gaming and fashion.

The debate over whether NFTs are a bubble or a lasting innovation has not yet been resolved. The rapid increase in its popularity and the speculative nature of the market present characteristics of a bubble. However, the underlying technology and potential benefits of NFTs suggest that they could represent a significant advancement in digital ownership and monetization.

NFTs provide a new way for artists and creators to interact with their audiences, establish ownership, and create sustainable revenue streams. While the market can experience volatility and corrections, the fundamental principles of NFTs offer valuable solutions to long-standing problems across multiple industries.

Ultimately, the truth about NFTs lies in their ability to evolve and integrate into broader applications beyond the current hype. As the market matures, we could see NFTs become a fundamental technology for digital property and a crucial component of the digital economy. Only time will tell if NFTs are a passing bubble or the beginning of a new era in digital art and beyond.

Common questions

1. Is NFT legal in India?

As of now, NFTs (Non-Fungible Tokens) operate in a legal gray area in India. While there are no specific regulations that directly address NFTs, they fall into the broader category of digital assets and cryptocurrencies, which are not explicitly banned but are subject to scrutiny from financial regulators. The Reserve Bank of India (RBI) had previously imposed restrictions on cryptocurrency transactions, but the Supreme Court of India lifted this ban in March 2020.

2. How does an NFT make money?

Artists and creators can mint NFTs and sell them directly to collectors on NFT marketplaces like OpenSea, Rarible, and Foundation. The initial sale price may vary depending on the creator’s reputation, the uniqueness of the asset, and market demand.

Many NFTs are programmed with smart contracts that include royalty clauses. This means the original creator receives a percentage (usually 5-10%) of the sale price each time the NFT is resold. This provides ongoing revenue streams for artists and creators.

3. Is NFT a good investment?

The NFT market is highly volatile, with prices fluctuating significantly over short periods, which can lead to substantial gains or losses. Many NFT investments are speculative, driven by market enthusiasm and sentiment rather than intrinsic value, which can lead to bubble-like conditions. For collectors and investors who understand the digital art and collectibles market, NFTs can offer unique investment opportunities, especially for rare and sought-after items.

4.How much does 1 NFT cost?

The cost of an NFT varies widely depending on factors such as the popularity of the creator, the uniqueness of the digital asset, the platform it is sold on, and current market demand. Prices can range from a few dollars to millions. Many NFTs sell for a few dollars to a few hundred dollars, especially those from lesser-known artists or those that are part of a larger collection.

Next-generation NFTs: Unique pieces from well-known artists or those with significant cultural impact can sell for thousands or even millions of dollars.

5.What is the most expensive NFT ever sold?

As of now, the most expensive NFT ever sold is “Everydays: The First 5000 Days” by Beeple. This digital artwork, a collage of 5,000 individual images created by Beeple (real name: Mike Winkelmann) over 13 years, was auctioned by Christie’s in March 2021 for an astonishing $69.3 million.

NFTs

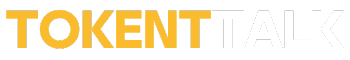

RTFKT Announces Project Animus Reveal, Launches Egg Unboxing Event Amid Mixed Reactions | NFT CULTURE | NFT News | Web3 Culture

RTFKT, the innovative creator-led company renowned for its cutting-edge sneakers and metaverse collectibles, has officially unveiled its highly anticipated collection, Project Animus. This project marks a significant milestone in RTFKT’s journey, introducing a new dimension to its digital universe after a long period of development. However, the initial market response has been disappointing, with the revealed Animi trading at a floor price of 0.05 ETH, significantly lower than the eggs’ floor price of 0.09 ETH.

The Genesis of the Project Animus

Initially introduced in October 2022, Project Animus introduces a unique ecosystem of digital creatures called Animi. These Animi are designed to enhance Clone X’s avatars, offering an immersive and engaging experience for the community. The recent reveal showcased a diverse range of Animi species, each with distinct design traits and elemental attributes, breaking away from traditional trait-based rarity systems.

A New Digital Frontier: The History and Evolution of Project Animus

The Animus Project is RTFKT’s latest intellectual property, promising to revolutionize the NFT space with its unique digital creatures. The journey kicked off on October 8, 2022, with an interactive teaser event called “The Eggsperience.” This livestream event allowed attendees to explore a virtual Animus Research Facility, generating intrigue and excitement among the community.

Renowned artist Takashi Murakami played a significant role in the project, revealing the first Murakami-themed Animus creature, Saisei, on April 30, 2023. This collaboration added a layer of artistic prestige to the project, further elevating its status within the NFT community.

Animus Egg Incubation: A Journey from Egg to Animi

Clone X NFT holders had the opportunity to claim an Animus Egg until March 1, 2024. This was followed by the Animus Egg Hatching event, which ran from May 7 to June 4, 2024. During this period, holders of several RTFKT NFTs, including Clone X, Space Pod, Loot Pod, Exo Pod, and Lux Pod, were able to use a points-based system to increase their chances of hatching rarer Animi. The limited supply of Project Animus Eggs is capped at 20,000, with no public sale planned.

Mixed market reception

Despite the excitement and innovative features, the market reaction to the reveal of Project Animus has been lukewarm. Animi is currently trading at a floor price of 0.05 ETH, significantly lower than the eggs’ floor price of 0.09 ETH. This discrepancy has led to disappointment among some collectors who had high expectations for the project.

What Awaits Us: The Future of Project Animus

Following the reveal, RTFKT plans to release a collection of exclusive Animus Artist Edition characters. Holders of Clone X Artist Edition NFTs are guaranteed to get one of these special editions. The distribution will include 88 Special Edition Animus, with 8 Mythic (Dragon Sakura), 40 Shiny, and 40 Ghost Animus. The odds of receiving a Special Edition Animus are the same for all Eggs hatched, regardless of the points accumulated.

The remaining Animus characters will be distributed among unhatched Eggs, encompassing Special Edition Animus, as well as Cosmic Animus and Murakami Element from Generation 1, Generation 2, and Generation 3.

Conclusion

RTFKT’s Project Animus represents a bold step forward in the NFT space, combining cutting-edge technology with artistic collaboration to create an immersive and innovative digital ecosystem. However, the initial market reception highlights the challenges of living up to high expectations in the ever-evolving NFT landscape. As the project continues to evolve, it promises to deliver unique experiences and opportunities for its community, solidifying RTFKT’s position as a leader in the metaverse and digital collectibles arena.

Summary: RTFKT has unveiled Project Animus, introducing a unique ecosystem of digital creatures called Animi designed to enhance Clone X avatars. Despite the excitement, market response has been mixed, with Animi trading at a lower floor price than eggs. The project kicked off with an interactive event in October 2022, featuring collaborations with artist Takashi Murakami. Following the reveal, RTFKT will release special edition Animus characters. The total supply of Animus Eggs is limited to 20,000, with no public sale planned.

NFTs

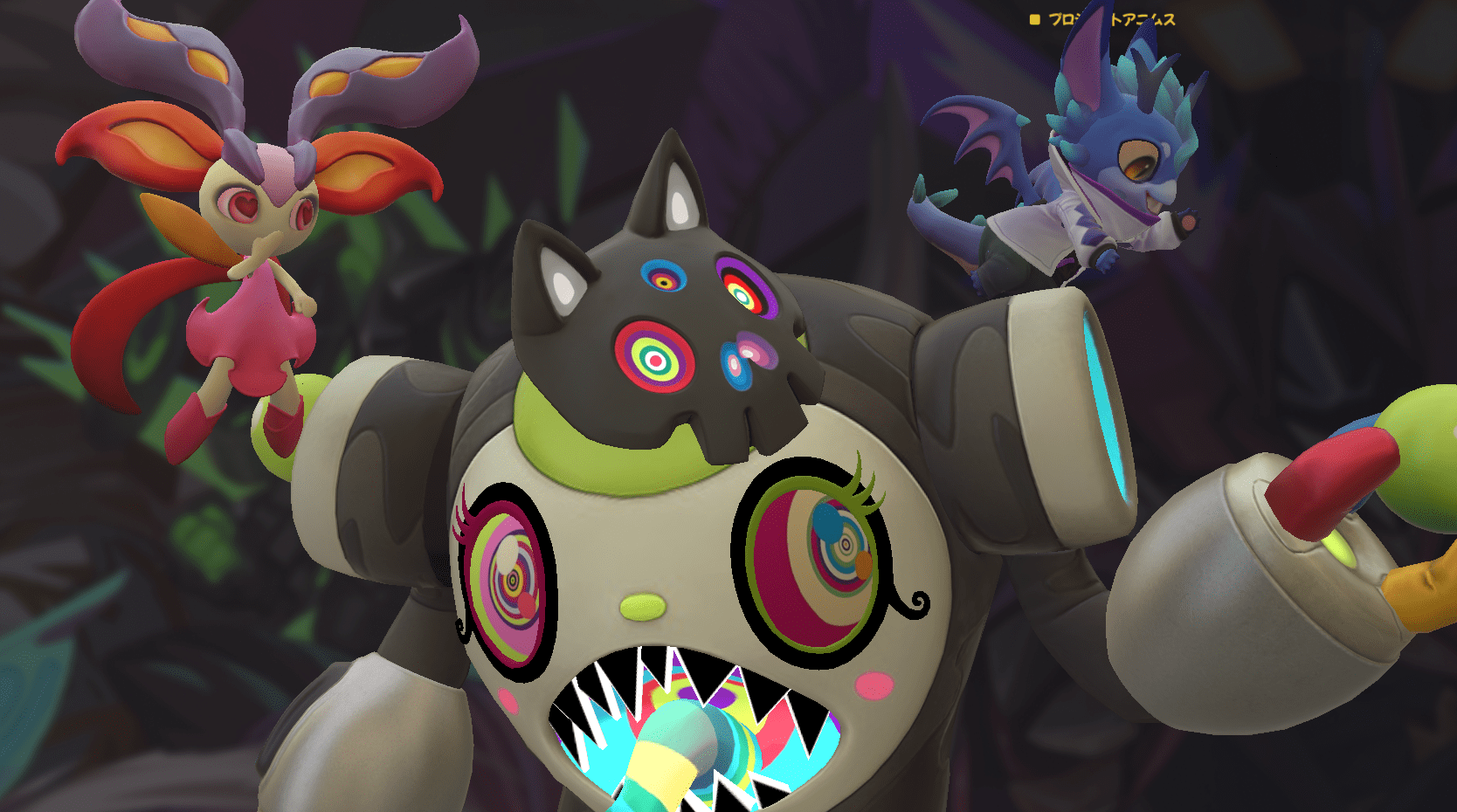

The Olympics have reportedly ditched Mario and Sonic games in favor of mobile and NFTs

The long and historic partnership between Nintendo and Sega to create video games for the Olympics reportedly ended in 2020 as event organizers sought opportunities elsewhere.

Lee Cocker, who served as executive producer on several Mario & Sonic Olympics titles, said Eurogamer the International Olympic Committee let the licensing agreement lapse because it “wanted to look at other partners, NFTs and esports.”

“Basically, the IOC wanted to bring [it] “Turn inward and look for other partners so you can get more money,” Cocker added.

The 2024 Summer Olympics kicked off in Paris last week, but there were no Mario & Sonic games available in time for the event to begin – the first time this has happened since the original release in 2007 to coincide with the 2008 Beijing Summer Olympics.

Over the past two decades, there have been four Mario and Sonic adaptations for the Summer Olympics, as well as two for the Winter Olympics.

This year, instead of a Nintendo/Sega title, the IOC released Olympics Go! Paris 2024, a free-to-play mobile and PC title developed by nWay, which has worked on several Power Rangers games.

Olympics Go! allows players to compete in 12 sports and unlock NFTs from the Paris 2024 digital pin collection.

The original Mario & Sonic at the Olympic Games was announced in March 2007 and marked the first time the two mascots – once archrivals in the console wars of the 1990s – appeared together in a game.

NFTs

DraftKings abruptly shuts down NFT operation, leaving collectors panicking over vast holdings of digital tokens

DraftKings, the daily fantasy sports and sports betting company, abruptly shut down a program called Reignmakers on Tuesday, posting a notice on its website and associated app and sending a mass email to some subset of its user base. Reignmakers, which the company launched in 2021, offered pay-to-play competitions in NFL football, PGA Tour golf and UFC mixed martial arts. The decision to eliminate the entire program, DraftKings says, was not made lightly but was forced “due to recent legal developments.”

DraftKings has yet to specify what “recent legal developments” are troubling its now-dead Reignmakers product. The company was sued in U.S. District Court in 2023 by a Reignmakers player named Justin Dufoe, who accuses the company of dealing in unregistered securities, taking advantage of relatively unsophisticated “retail investors,” and failing to market and support Reignmakers to the degree necessary to return to its users the financial benefits expected. DraftKings filed a motion in September to dismiss Dufoe’s complaint, but that motion was denied on July 2. A scheduling conference was held by the parties on July 29; Reignmakers was permanently shut down on July 30. A DraftKings spokesperson reached by Defector on Wednesday declined to confirm whether Dufoe’s complaint is the “recent legal development” that forced the company’s hand.

Users of the Reignmakers NFL product, who in recent days began murmuring on social channels about a notable lack of DraftKings activity so close to the start of the NFL preseason schedule, were caught off guard and, in some cases, devastated by the news. Members of the DraftKings Discord server, where all Reignmakers-related channels were abruptly shut down and locked following the announcement, flooded a general channel in various states of panic, sharing news, theorizing, lamenting, and, in some cases, openly worrying about whether it would be possible to recoup any decent fraction of the genuinely impressive sums of money they had invested in this DraftKings product.

Reignmakers is nominally a daily fantasy contest—users build lineups of players and then pit those lineups against other users’ lineups for cash prizes—but it’s actually a distributor of nonfungible digital tokens (NFTs), originated and sold by DraftKings, and then frequently resold on a dedicated secondary marketplace also hosted by DraftKings. At the lineup-building level, Reignmakers functions like a card-collecting game, with artificial scarcity driving the prices of the most coveted cards to insane, eye-popping heights. Reignmakers NFTs are tiered and offered in timed drops designed to heighten the sense of scarcity. A user can enter a lower-tier contest using a collection of NFTs that may have cost a few hundred dollars in total (or that were earned by purchasing random packs of NFTs that offer generally low odds of scoring top assets) and throw their lot in with hundreds of casual users competing for relatively unimpressive rewards. Random packs at the lowest tier would have prices as low as a few dollars; mid-tier cards—Star and Elite tiers, I’d guess—could cost a player upwards of $1,000.

But players interested in hunting down the biggest payouts, not just from games but from leaderboard prizes and other assorted prizes, would need to enter higher-tier games, and to enter the higher-tier games, a user’s collection needed to include higher-tier NFTs. DraftKings ensured that these cards were extremely scarce and could only be purchased directly on the marketplace at prices that any reasonable person would consider utterly insane.

For example, the highest-tier Reignmaker contests (called the Reignmakers tier, of course) have in the past been limited to listings with at least two of the highest-tier, rarest NFTs (also the Reignmaker tier) plus three NFTs from the second-highest tier (Legendary). NFTs at these tiers are expensive. Not just expensive in the way that, like, a steak dinner is expensive, but expensive in the way that buying even one of them should trigger a mandatory visit to a gambling addiction counselor, if not sirens and a straitjacket. Back in 2022a Reignmaker-level Ja’Marr Chase NFT from something called the Field Pass Promo Set could be purchased directly from the DraftKings Reignmaker Marketplace for a whopping $32,100.

Reignmakers users purchased NFTs at various levels with the expectation that owning them would convey better odds of winning contests hosted on DraftKings. This was the gamification element of Reignmakers, which emerged several months after DraftKings began trading and minting its NFTs. But as with all NFTs, a very large part of the real appeal for its buyers was the expectation, however insane, that these worthless, virtually worthless, infinitely duplicable digital images would increase in value over time. Now that both the Reignmakers game and the Reignmakers marketplace have been shut down, Reignmakers NFT holders are worried that their investments may have suddenly lost all monetary value. One Discord user described Tuesday as “a bad day to wake up and realize you have $2,000 worth of unopened NFL Rookie Packs”; Another user asked the group if they should expect “a refund” on the $10,000 they’ve already spent on Reignmakers NFTs this year. A pessimistic Reddit user posted tuesday that they would sue DraftKings if they were forced to take a total loss on a Reignmakers NFT collection worth approximately $100,000.

The game (scam?) was built to make numbers like these not only possible, but somewhat easily achievable. A user who intended to compete from a position of strength in multiple overlapping high-profile contests at the same time, and who had been in the blockchain madhouse for a period of years, could easily have spent six figures on Reignmakers NFTs. DraftKings used non-gaming incentives to entice players to spend more and more money, much like casinos give away free suites to players who over-bet on blackjack. Another Reddit user lamented the loss of the additional prizes and ranking bonuses he had hoped to earn in the upcoming NFL season by having a portfolio of NFTs that had reached the highest levels of value and prestige. “I was already loaded up on 2024 creation tokens and rookie debut cards,” said this Reignmakers userwho claimed his portfolio was finally “close to the top 250 overall.”

Dufoe’s complaint says the NFTs minted by DraftKings for Reignmakers qualify as securities, function like securities, and should be regulated as securities. In its motion to dismiss, DraftKings attempted to position its NFTs as game pieces — eye-wateringly expensive, yes, but essentially the same thing as Magic: The Gathering cards or Monopoly hotels. The court, in resolving these arguments, applied what’s known as “the Howey test,” referencing a case from 1946 in which the U.S. Supreme Court established a standard for determining whether a specific instrument qualifies as an investment contract. Judge Dennis J. Casper, in ruling against DraftKings’ motion, concluded that Dufoe could plausibly argue that Reignmakers’ NFT transactions represent “the pooling of assets from multiple investors in such a manner that all share in the profits and risks of the enterprise,” arguing that DraftKings’ absolute control over the game and marketplace effectively binds the financial interests of the company and the buyers, the latter of whom depend on the viability of both for their NFTs to retain any value.

Reignmakers users are different from Monopoly players in at least one crucial way: A person who buys a Monopoly board has no expectation from Hasbro that those little red and green pieces will appreciate in value. It’s a game! No matter what any hysterically conflicted party may say to the contrary, that’s not what NFT collecting is. DraftKings had been selling Reignmakers NFTs for months before they were gamified, and Dufoe, in his complaint, cites public comments made by DraftKings spokespeople that seem to explicitly position Reignmakers NFTs as assets with independent monetary value beyond their utility in Reignmakers contests. Judge Casper, in his ruling on the motion to dismiss, cites a Twitter account associated with a podcast run by DraftKings CEO Matthew Kalish, who in a tweet described NFTs as “the opportunity to invest in startups, artists, operations, and entrepreneurs all at once.” This is probably the kind of thing that NFT peddlers should stop saying. This advice assumes, of course, that NFTs will continue to exist as instruments on the other side of this and other lawsuits.

DraftKings has posted a worryingly sparse FAQ at the bottom of the your ad Tuesday, anticipating but largely failing to address questions from players who see this as yet another in a long line of brutal blockchain rug pulls. In a hilarious reversal of existing Reignmakers policy, Reignmakers users are now allowed by DraftKings to withdraw their Reignmakers NFTs from their DraftKings portfolios and into their personal NFT wallets, where those NFTs will have precisely zero value, to anyone, for the rest of all time. There’s also vague language about Reignmakers users having the option to “relinquish” their NFTs back to DraftKings in exchange for “cash payments,” subject to “certain conditions” and according to an as-yet-unspecified formula that will take into account, among other things, the “size and quality” of a player’s collection.

Reignmakers users are not optimistic. Those who claim to have been victims of other blockchain market crashes are warning their peers on Discord and Reddit to expect payouts that amount to pennies on the dollar; in the absence of any clarifying information, users are unsure whether cashing out their NFTs from Reignmakers to their personal NFT wallets, for reasons that completely pass any and all understanding, would effectively preclude the possibility of delivering these silly digital tokens back to DraftKings. It remains to be seen what exactly DraftKings has in mind with the “certain conditions” attached to the delivery process. There is much that has yet to be resolved. A DraftKings spokesperson contacted by Defector indicated that more time would be needed to answer a list of specific questions and issued a statement noting that it is “in DraftKings’ DNA to innovate and disrupt to provide the best possible gaming experiences for our customers.” The original complaint is embedded below.

Do you know anything about the demise of Reignmakers, either from the consumer side or from the DraftKings side? We’d love to hear from you. Get it in touch!

Recommended

NFTs

There Will Be No More ‘Mario & Sonic’ Olympics Because of NFTs

Nintendo and SEGA have been teaming up with the Olympics for several years now in the popular Mario & sonic in the Olympic Games series, but a new report claims the International Olympic Committee has abandoned the series in favor of new deals in eSports and NFTs.

According to Eurogamer“A veteran behind the series,” Lee Cocker, told the outlet that the IOC chose not to renew its license with SEGA and Nintendo, letting it expire in 2020. “They wanted to look at other partners and NFTs and eSports,” Cocker told Eurogamer. “Basically, the IOC wanted to bring [it] turn inward and look for other partners so they could get more money.”

Mario & Sonic at the Olympic Games is a series that has been running since 2008, with six main games covering the regular and Winter Olympics. In the games, players could control various characters from the Mario and Sonic franchises and compete in Olympic sporting events.

It’s no secret that NFTs are a big part of this year’s Paris 2024 Olympics. Olympics Go! Paris 2024 is a mobile and mobile-connected game your site states that players can “join the excitement of the Paris 2024 Olympic Games with nWay’s officially licensed, commemorative NFT Digital Pins collection honoring Paris 2024!”

As for eSports, Saudi Arabia will host the ESports Olympic Games in 2025. This is part of a partnership with the Saudi National Olympic Committee (NOC) that is expected to last for the next 12 years and is expected to feature regular events.

IOC President Thomas Bach said: “By partnering with the Saudi NOC, we also ensure that Olympic values are respected, in particular with regard to the game titles on the programme, the promotion of gender equality and the engagement with young audiences who are embracing esports.”

In other news, Someone claimed they’re suing Bandai Namco because Elden Ring is too difficult.

-

News7 months ago

News7 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

News7 months ago

News7 months agoOver 1 million new tokens launched since April

-

Videos8 months ago

Videos8 months agoMoney is broke!! The truth about our financial system!

-

Altcoins7 months ago

Altcoins7 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

Memecoins7 months ago

Memecoins7 months agoChatGPT Analytics That Will Work Better in 2024

-

NFTs8 months ago

NFTs8 months agoSurprisingly, Bored Apes is now laying off employees as the NFT market disintegrates

-

Altcoins7 months ago

Altcoins7 months agoAltcoin Investments to create millionaires in 2024

-

Videos7 months ago

Videos7 months agoFantom: Potential FTM Price and BIG Updates – The Latest!!

-

News5 months ago

News5 months agoInvest Now: The Hottest New Cryptocurrencies of August 2024 That Could Skyrocket

-

Memecoins5 months ago

Memecoins5 months agoMemecoins dominate major derivatives in terms of open interest | Flash News Detail

-

Altcoins5 months ago

Altcoins5 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

Videos7 months ago

Videos7 months agoCrypto News: ETH ETFs, Pro-Crypto Politics, UNI, DOGE & MORE!