NFTs

eles são bons para a carreira dos atletas?

Com Cristiano Ronaldo enfrentando um processo de US$ 1 bilhão por promover NFTs da Binance, analisamos atentamente como as personalidades do esporte interagiram com os NFTs.

Os tokens não fungíveis (NFTs) percorreram um longo caminho desde a criação do Quantum em 2014, passando de ativos inicialmente vinculados exclusivamente a moedas virtuais para tokens influenciados pelo que vemos na vida real, como filmes, brinquedos e jogos.

Porém, uma das áreas onde esses tokens têm se destacado é no esporte. Entrando no panorama geral como memorabilia e itens colecionáveis, os NFTs esportivos foram introduzidos pela primeira vez no início de 2021, quando o renomado superastro da NFL Rob Gronkowski lançou uma coleção de cartões do Super Bowl.

Em 2023, houve vários lançamentos notáveis de NFTs esportivos, destacando a popularidade crescente das plataformas NFT de esportes de fantasia. De acordo com o mercado NFT do METAV.RS 2021-2023 relatóriocerca de 35% dos entusiastas dos esportes eletrônicos expressaram interesse em coletar NFTs para diversão ou ganhos financeiros potenciais, enquanto outros 20% demonstraram entusiasmo significativo.

Embora os NFTs esportivos sejam “memoráveis”, eles receberam muitas críticas de reguladores e grandes participantes da própria indústria. Em janeiro, a Associação de Torcedores de Futebol criticado a Premier League inglesa por colaborar com Sorare. O grupo falou contra os ativos, dizendo que eles “levantaram repetidamente preocupações sobre a proliferação de parcerias criptográficas no jogo”.

Este artigo discutirá o aumento acentuado dos NFTs nos esportes e o quanto eles impactaram personalidades e entidades do setor.

Compreendendo os NFTs esportivos

NFTs esportivos são ativos digitais distintos criados em um blockchain, representando diferentes itens, momentos significativos ou vários elementos da indústria esportiva. Esses ativos abrangem cartões de jogadores virtuais, recordações de times, momentos esportivos icônicos apresentados como imagens, GIFs, vídeos, ingressos virtuais e outros itens valiosos relacionados ao esporte. Os NFTs esportivos estão disponíveis em mercados NFT, como o OpenSea.

Isso é exatamente o que estamos trazendo para o Pro Sports @LockerToken forneceremos equipes profissionais para usar NFTs para que os fãs votem em coisas como escalação inicial. Estrelas dos jogos. Crie momentos ao vivo, como destaques do jogo! Bilhetes peer to peer são um serviço web3 de luva branca em grande escala. Verificar… pic.twitter.com/4TiGxdp71F

-Pat Curcio (@Curciopat) 29 de março de 2023

De acordo com pesquisar realizado pelo grupo RBC Sports Professionals, a carreira de um atleta profissional em uma liga dura em média de cinco a sete anos. Os atletas geralmente são produtivos nos primeiros anos de suas carreiras, com exceção de esportes como a NBA ou a WWE. Porém, alguns atletas “cruzam a linha de chegada” endividados e com pouco apoio financeiro.

Como tal, um número crescente de atletas tem procurado alavancar NFTs, cunhando e leiloando destaques de suas carreiras, números de camisas famosas ou mercadorias e ganhando royalties pelas vendas.

Para os fãs, adquirir um colecionável esportivo NFT representa uma oportunidade de possuir um fragmento único da história. O fascínio emocional causado por estes itens é particularmente evidente entre os fãs devotos, como aqueles que ainda nostálgicos pelo bloqueio de Lebron James a Andre Iguodala nas finais da NBA de 2016.

Como os NFTs e os esportes devem funcionar:

1. Você compra um ingresso NFT para um evento

2. Algo incrível acontece naquele evento esportivo

3. A foto é tirada, todos no evento têm 24 horas para cunhar uma cópia da foto épica por US$ 10, aberta apenas para pessoas que estiveram fisicamente presentes pic.twitter.com/agDWgVhlVx

-Josh Bobrowsky (@JoshBobrowsky) 9 de abril de 2023

O NBA Top Shot cunhou o bloco das finais de 2016 de LBJ no Coleção de antologia de LeBron Jamesdando aos fãs da NBA a chance de guardar a memória por muitos e muitos anos.

Tokens de fãs

Os tokens de torcedor são ativos digitais que dão aos fãs de esportes uma parcela simbólica de influência sobre as decisões do clube. Geralmente são criados e distribuídos por meio de plataformas de tecnologia blockchain como Socios.com.

A ideia por trás do desenvolvimento do Fan token é preencher a lacuna entre os torcedores e seus times favoritos, permitindo-lhes votar em várias decisões do clube, como a escolha do design da camisa do time, o local para um amistoso e a música do estádio, entre outros.

Além dos direitos de voto, os fan tokens podem dar aos titulares acesso a recompensas exclusivas, mercadorias, competições e experiências únicas. Algumas equipes ainda oferecem oportunidades de encontro com jogadores ou assentos VIP nas partidas.

De acordo com Coingecko, os fan tokens têm um valor de mercado de mais de US$ 300 milhões. O crescimento significativo coincidiu com o lançamento da rede Chilliz 2.0, que permite aos torcedores adquirir ingressos NFT para os jogos. Redes como a Polygon também adotaram a tecnologia, ajudando entidades como a Sports Illustrated a desenvolver plataformas de emissão de ingressos NFT no processo.

TRENDING: Sports Illustrated Launches NFT Ticketing Platform on Polygon

Sports Illustrated's ticketing marketplace SI Tickets has developed "Box Office" in partnership with Ethereum software company ConsenSys.#NFTs #NFTNews #NFTCommunity

— rarity.tools (@raritytools) May 3, 2023

NFTs de esportes de fantasia de Sorare

Sorare, um mercado de negociação de cartas e liga de esportes de fantasia NFT baseada em competições como La Liga, Premier League, NBA e Bundesliga, foi lançado em 2019. A plataforma ocupa atualmente a 10ª posição no volume de vendas de todos os tempos entre coleções NFT, com US$ 734 milhões, por CriptoSlam dados.

Em Sorare, os jogadores coletam cartas de jogador NFT para concorrer a prêmios em formato de liga fantasia. De acordo com Preço mínimo NFTexistem atualmente mais de 16 mil proprietários únicos de Sorare NFTs, que têm um fornecimento total de 330 mil.

No início deste ano, a plataforma assinou um contrato de quatro anos parceria com a Premier League inglesa. Embora a mudança tenha sido muito apreciada pela comunidade criptográfica, os fãs e especialistas em futebol não a aceitaram bem.

Welcome to the House of Sorare.

Your @premierleague legacy starts now. #BuildYourLegacy: https://t.co/q4bDnlT2qq pic.twitter.com/c2m0j0gqwz

— Sorare (@Sorare) January 30, 2023

Em 2021, as preocupações dos grupos de apoio ao futebol inglês levaram a Comissão de Jogos do Reino Unido a fazer investigações sobre “se Sorare.com exige uma licença de operação”. Desde então, não houve uma orientação clara sobre se a plataforma deveria ou não adquirir licenças, para grande consternação da Associação de Adeptos do Futebol Inglês.

A ascensão dos NFTs nos esportes

Muitos consideram a data de lançamento da coleção de Gronkowski como o dia que abriu as comportas para o desenvolvimento de colecionáveis de diversos esportes. Apenas um mês depois que a estrela da NFL abandonou seus cartões NFT, a franquia de basquete Golden State Warriors lançou sua coleção de times e, a partir daí, tudo foi difícil para os NFTs esportivos.

Embora o mercado esportivo de NFT não tenha contabilizado números impressionantes este ano, os analistas acham que deixou uma impressão suficiente para chamar a atenção dos traders em 2024. De acordo com um relatório pela MarketDecipher, o valor do mercado de cromos esportivos em 2023 ultrapassou US$ 14 bilhões, enquanto o mercado de itens colecionáveis de memorabilia esportiva atingiu uma avaliação de US$ 32 bilhões.

Personalidades do esporte e atletas renomados não têm vergonha de se envolver com NFTs. Serena Williams, Michael Jordan, Stephen Curry, Shaquille O’Neal e Neymar Jr estão entre as pessoas mais famosas a declarar publicamente que possuem NFTs, mostrando o quão populares esses ativos digitais se tornaram desde 2021.

No final de 2021, 7 vezes vencedor do Super Bowl Tom Brady lançou uma plataforma NFT chamada Autograph, que permitiu que celebridades vendessem NFTs para seus fãs. Por meio do Autograph, Brady lançou uma coleção de 16 mil NFTs da Tom Brady Origins Collection que supostamente se esgotou em 10 minutos. A coleção foi composta por momentos da carreira de Brady.

Lionel Messi, oito vezes vencedor da Bola de Ouro, em conjunto com a Ethernity, também tem uma coleção de NFTs proveniente do projeto “The Messiverse”. Apenas uma semana após sua estreia, uma peça particularmente rara chamada “The Golden One” foi revendida no mercado secundário por mais de US$ 9 milhões.

No entanto, os atletas mencionados acima têm recebido muitas críticas pela sua associação com NFTs e moedas digitais em geral, uma vez que as organizações desportivas sentem que estas personalidades estão a aproveitar o “apelo dos fãs” para obter lucros às custas dos seus fãs.

Impacto na reputação de personalidades esportivas

Os atletas veem os NFTs como uma ótima forma de interagir com seus fãs, oferecendo acesso exclusivo a experiências, itens, troféus e história em geral. Com a criação de fan tokens, os clubes esportivos estão encontrando mais maneiras de envolver seus torcedores, oferecendo-lhes oportunidades de tomar decisões em suas organizações, assim como os membros do conselho.

Os NFTs também aumentaram as marcas de personalidades do esporte, dando-lhes uma maneira de obter renda em royalties e, ao mesmo tempo, dando aos fãs mercadorias e memorabilia esportivas autênticas, como o CR7 de Cristiano Ronaldo, a camisa 23 de Lebron James ou a icônica foto de enterrada de Michael Jordan.

No entanto, as coisas nem sempre são raios de sol e arco-íris quando os NFTs estão envolvidos no mundo dos esportes. Atletas envolvidos com NFTs enfrentam advertências e ações judiciais, sendo o principal ponto de preocupação a “propaganda fraudulenta”.

Deputados do Reino Unido contra fan tokens

Em Outubro, os legisladores do Reino Unido divulgaram um relatório que afirmou que a relação entre clubes e torcedores facilitaria a alta especulação sobre ativos digitais baseados no esporte, o que representa um risco financeiro colossal para os torcedores e poderia destruir a reputação dos clubes.

Além disso, os deputados do Reino Unido levantaram preocupações sobre a utilização de tokens de adepto, dizendo que os clubes podem dar aos adeptos a impressão de que os tokens são “uma forma apropriada de envolvimento dos adeptos no futuro”, ignorando a sua volatilidade de preços. Eles recomendaram que os tokens de torcedor fossem totalmente excluídos de qualquer medida de envolvimento dos torcedores nos esportes.

Problemas de publicidade

Também houve um esforço para desencorajar personalidades esportivas de se envolverem em qualquer forma de publicidade criptográfica, devido a casos como a queda da FTX, onde vários atletas como Stephen Curry e Shaquille O’Neal enfrentaram acusações por supostamente promoverem a sitiada exchange.

Para colocar lenha na fogueira está o processo de US$ 1 bilhão de Cristiano Ronaldo pela suposta promoção de Binance e seu Coleção NFT “CR7”. Os reguladores poderiam estar tentando fazer do caso de Ronaldo um exemplo, que é indiscutivelmente o nome mais famoso do esporte atualmente.

Orgulho de fazer parceria com @binance

Juntos, daremos a você a oportunidade de possuir uma peça icônica da história do esporte.

Estou animado para fazer esta jornada com todos vocês. Vamos mudar o jogo NFT com #Binance. pic.twitter.com/SNSCMHggct

-Cristiano Ronaldo (@Cristiano) 23 de junho de 2022

Segundo a BBC, os demandantes acreditam que a mensagem promocional de Ronaldo sobre Binância e seus NFTs fizeram as buscas da exchange crescerem 500%. Além disso, de acordo com a Comissão de Valores Mobiliários dos EUA, que classifica os NFTs como títulos, as celebridades devem divulgar quanto recebem para anunciá-los. Ronaldo supostamente não compartilhou quanto a Binance lhe pagou pelos anúncios.

Dado o atual cenário regulatório no mercado de moeda digital em geral, alguns acham que o processo de Ronaldo é um pouco exagerado. Eles sugerem que, em vez de tentar combater o crescimento dos NFTs, os reguladores financeiros globais deveriam concentrar-se no estabelecimento de diretrizes claras sobre como supervisionar a propriedade e as negociações destes ativos digitais.

“É crucial reconhecer que culpar apenas Ronaldo simplifica excessivamente uma questão complexa… Em vez disso, a atenção também deve ser dirigida aos reguladores globais que têm sido lentos em estabelecer diretrizes claras para este cenário financeiro em evolução.”

Nigel Green, chefe da consultoria DeVere Group, disse à BBC News.

Mais personalidades do esporte adotarão os NFTs?

Embora Ronaldo e Binance enfrentem um processo que pode custar-lhes mais de US$ 1 bilhão, este último anunciou no X que os dois ainda estão trabalhando em algo.

Isso sugeriria que pode haver luz no fim do túnel, mas as preocupações e controvérsias que se acumulam sobre os NFTs esportivos estão se tornando difíceis de ignorar.

Se o mercado continuar não regulamentado, a maioria das personalidades do esporte poderá ficar mais cautelosa ao se envolver com NFTs, pois procurariam evitar ações judiciais que poderiam fazê-los perder parcerias, patrocinadores e o apoio das organizações que representam.

NFTs

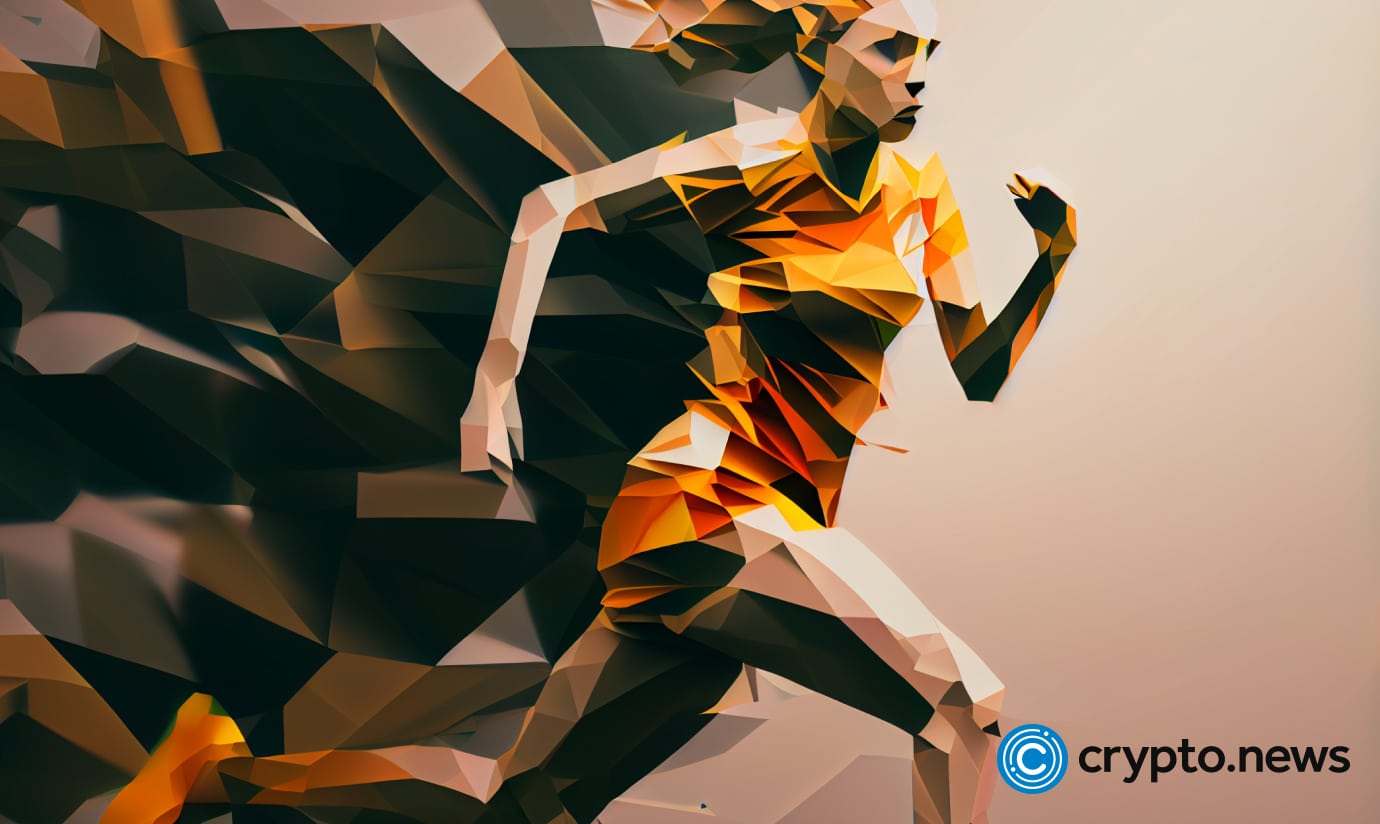

RTFKT Announces Project Animus Reveal, Launches Egg Unboxing Event Amid Mixed Reactions | NFT CULTURE | NFT News | Web3 Culture

RTFKT, the innovative creator-led company renowned for its cutting-edge sneakers and metaverse collectibles, has officially unveiled its highly anticipated collection, Project Animus. This project marks a significant milestone in RTFKT’s journey, introducing a new dimension to its digital universe after a long period of development. However, the initial market response has been disappointing, with the revealed Animi trading at a floor price of 0.05 ETH, significantly lower than the eggs’ floor price of 0.09 ETH.

The Genesis of the Project Animus

Initially introduced in October 2022, Project Animus introduces a unique ecosystem of digital creatures called Animi. These Animi are designed to enhance Clone X’s avatars, offering an immersive and engaging experience for the community. The recent reveal showcased a diverse range of Animi species, each with distinct design traits and elemental attributes, breaking away from traditional trait-based rarity systems.

A New Digital Frontier: The History and Evolution of Project Animus

The Animus Project is RTFKT’s latest intellectual property, promising to revolutionize the NFT space with its unique digital creatures. The journey kicked off on October 8, 2022, with an interactive teaser event called “The Eggsperience.” This livestream event allowed attendees to explore a virtual Animus Research Facility, generating intrigue and excitement among the community.

Renowned artist Takashi Murakami played a significant role in the project, revealing the first Murakami-themed Animus creature, Saisei, on April 30, 2023. This collaboration added a layer of artistic prestige to the project, further elevating its status within the NFT community.

Animus Egg Incubation: A Journey from Egg to Animi

Clone X NFT holders had the opportunity to claim an Animus Egg until March 1, 2024. This was followed by the Animus Egg Hatching event, which ran from May 7 to June 4, 2024. During this period, holders of several RTFKT NFTs, including Clone X, Space Pod, Loot Pod, Exo Pod, and Lux Pod, were able to use a points-based system to increase their chances of hatching rarer Animi. The limited supply of Project Animus Eggs is capped at 20,000, with no public sale planned.

Mixed market reception

Despite the excitement and innovative features, the market reaction to the reveal of Project Animus has been lukewarm. Animi is currently trading at a floor price of 0.05 ETH, significantly lower than the eggs’ floor price of 0.09 ETH. This discrepancy has led to disappointment among some collectors who had high expectations for the project.

What Awaits Us: The Future of Project Animus

Following the reveal, RTFKT plans to release a collection of exclusive Animus Artist Edition characters. Holders of Clone X Artist Edition NFTs are guaranteed to get one of these special editions. The distribution will include 88 Special Edition Animus, with 8 Mythic (Dragon Sakura), 40 Shiny, and 40 Ghost Animus. The odds of receiving a Special Edition Animus are the same for all Eggs hatched, regardless of the points accumulated.

The remaining Animus characters will be distributed among unhatched Eggs, encompassing Special Edition Animus, as well as Cosmic Animus and Murakami Element from Generation 1, Generation 2, and Generation 3.

Conclusion

RTFKT’s Project Animus represents a bold step forward in the NFT space, combining cutting-edge technology with artistic collaboration to create an immersive and innovative digital ecosystem. However, the initial market reception highlights the challenges of living up to high expectations in the ever-evolving NFT landscape. As the project continues to evolve, it promises to deliver unique experiences and opportunities for its community, solidifying RTFKT’s position as a leader in the metaverse and digital collectibles arena.

Summary: RTFKT has unveiled Project Animus, introducing a unique ecosystem of digital creatures called Animi designed to enhance Clone X avatars. Despite the excitement, market response has been mixed, with Animi trading at a lower floor price than eggs. The project kicked off with an interactive event in October 2022, featuring collaborations with artist Takashi Murakami. Following the reveal, RTFKT will release special edition Animus characters. The total supply of Animus Eggs is limited to 20,000, with no public sale planned.

NFTs

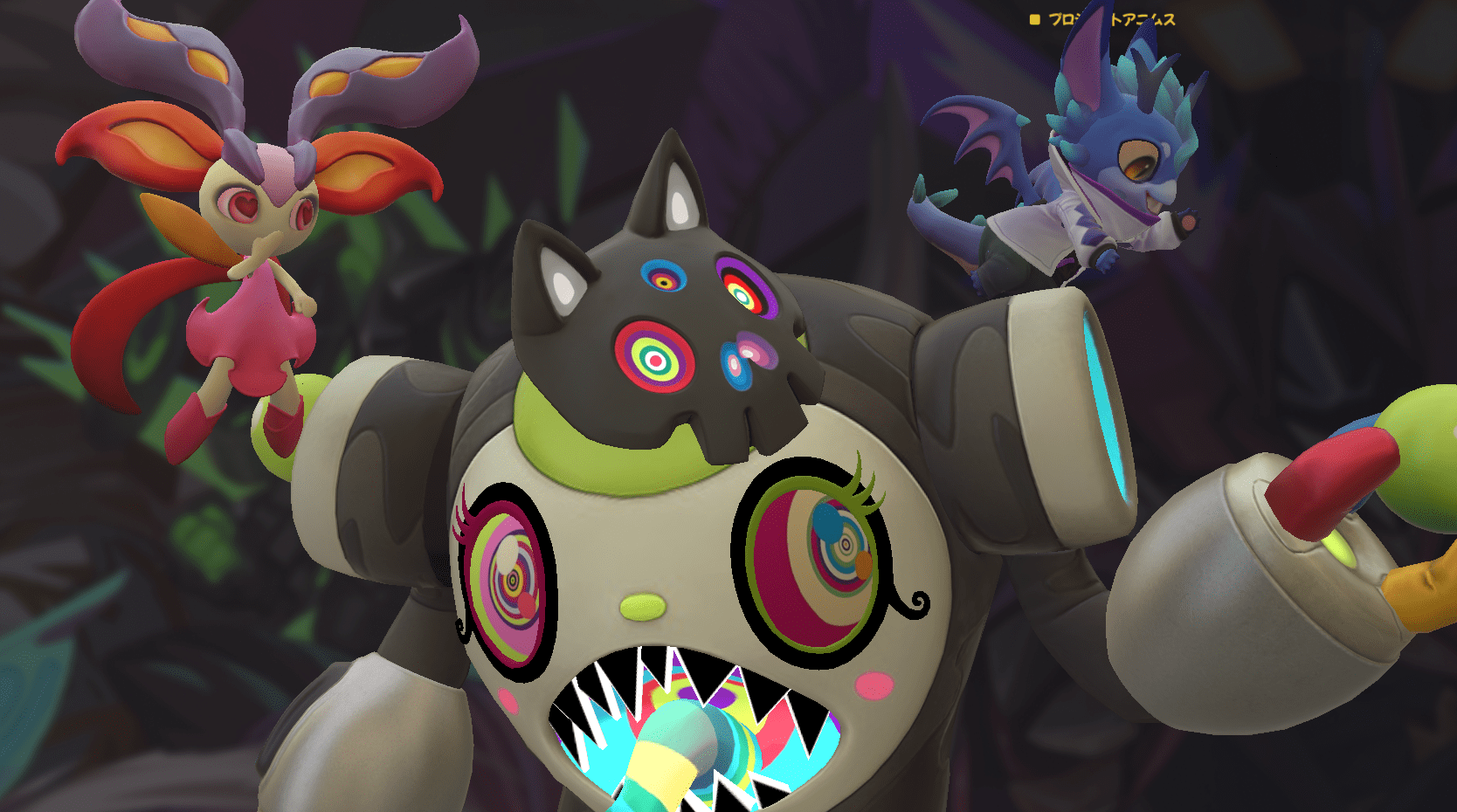

The Olympics have reportedly ditched Mario and Sonic games in favor of mobile and NFTs

The long and historic partnership between Nintendo and Sega to create video games for the Olympics reportedly ended in 2020 as event organizers sought opportunities elsewhere.

Lee Cocker, who served as executive producer on several Mario & Sonic Olympics titles, said Eurogamer the International Olympic Committee let the licensing agreement lapse because it “wanted to look at other partners, NFTs and esports.”

“Basically, the IOC wanted to bring [it] “Turn inward and look for other partners so you can get more money,” Cocker added.

The 2024 Summer Olympics kicked off in Paris last week, but there were no Mario & Sonic games available in time for the event to begin – the first time this has happened since the original release in 2007 to coincide with the 2008 Beijing Summer Olympics.

Over the past two decades, there have been four Mario and Sonic adaptations for the Summer Olympics, as well as two for the Winter Olympics.

This year, instead of a Nintendo/Sega title, the IOC released Olympics Go! Paris 2024, a free-to-play mobile and PC title developed by nWay, which has worked on several Power Rangers games.

Olympics Go! allows players to compete in 12 sports and unlock NFTs from the Paris 2024 digital pin collection.

The original Mario & Sonic at the Olympic Games was announced in March 2007 and marked the first time the two mascots – once archrivals in the console wars of the 1990s – appeared together in a game.

NFTs

DraftKings abruptly shuts down NFT operation, leaving collectors panicking over vast holdings of digital tokens

DraftKings, the daily fantasy sports and sports betting company, abruptly shut down a program called Reignmakers on Tuesday, posting a notice on its website and associated app and sending a mass email to some subset of its user base. Reignmakers, which the company launched in 2021, offered pay-to-play competitions in NFL football, PGA Tour golf and UFC mixed martial arts. The decision to eliminate the entire program, DraftKings says, was not made lightly but was forced “due to recent legal developments.”

DraftKings has yet to specify what “recent legal developments” are troubling its now-dead Reignmakers product. The company was sued in U.S. District Court in 2023 by a Reignmakers player named Justin Dufoe, who accuses the company of dealing in unregistered securities, taking advantage of relatively unsophisticated “retail investors,” and failing to market and support Reignmakers to the degree necessary to return to its users the financial benefits expected. DraftKings filed a motion in September to dismiss Dufoe’s complaint, but that motion was denied on July 2. A scheduling conference was held by the parties on July 29; Reignmakers was permanently shut down on July 30. A DraftKings spokesperson reached by Defector on Wednesday declined to confirm whether Dufoe’s complaint is the “recent legal development” that forced the company’s hand.

Users of the Reignmakers NFL product, who in recent days began murmuring on social channels about a notable lack of DraftKings activity so close to the start of the NFL preseason schedule, were caught off guard and, in some cases, devastated by the news. Members of the DraftKings Discord server, where all Reignmakers-related channels were abruptly shut down and locked following the announcement, flooded a general channel in various states of panic, sharing news, theorizing, lamenting, and, in some cases, openly worrying about whether it would be possible to recoup any decent fraction of the genuinely impressive sums of money they had invested in this DraftKings product.

Reignmakers is nominally a daily fantasy contest—users build lineups of players and then pit those lineups against other users’ lineups for cash prizes—but it’s actually a distributor of nonfungible digital tokens (NFTs), originated and sold by DraftKings, and then frequently resold on a dedicated secondary marketplace also hosted by DraftKings. At the lineup-building level, Reignmakers functions like a card-collecting game, with artificial scarcity driving the prices of the most coveted cards to insane, eye-popping heights. Reignmakers NFTs are tiered and offered in timed drops designed to heighten the sense of scarcity. A user can enter a lower-tier contest using a collection of NFTs that may have cost a few hundred dollars in total (or that were earned by purchasing random packs of NFTs that offer generally low odds of scoring top assets) and throw their lot in with hundreds of casual users competing for relatively unimpressive rewards. Random packs at the lowest tier would have prices as low as a few dollars; mid-tier cards—Star and Elite tiers, I’d guess—could cost a player upwards of $1,000.

But players interested in hunting down the biggest payouts, not just from games but from leaderboard prizes and other assorted prizes, would need to enter higher-tier games, and to enter the higher-tier games, a user’s collection needed to include higher-tier NFTs. DraftKings ensured that these cards were extremely scarce and could only be purchased directly on the marketplace at prices that any reasonable person would consider utterly insane.

For example, the highest-tier Reignmaker contests (called the Reignmakers tier, of course) have in the past been limited to listings with at least two of the highest-tier, rarest NFTs (also the Reignmaker tier) plus three NFTs from the second-highest tier (Legendary). NFTs at these tiers are expensive. Not just expensive in the way that, like, a steak dinner is expensive, but expensive in the way that buying even one of them should trigger a mandatory visit to a gambling addiction counselor, if not sirens and a straitjacket. Back in 2022a Reignmaker-level Ja’Marr Chase NFT from something called the Field Pass Promo Set could be purchased directly from the DraftKings Reignmaker Marketplace for a whopping $32,100.

Reignmakers users purchased NFTs at various levels with the expectation that owning them would convey better odds of winning contests hosted on DraftKings. This was the gamification element of Reignmakers, which emerged several months after DraftKings began trading and minting its NFTs. But as with all NFTs, a very large part of the real appeal for its buyers was the expectation, however insane, that these worthless, virtually worthless, infinitely duplicable digital images would increase in value over time. Now that both the Reignmakers game and the Reignmakers marketplace have been shut down, Reignmakers NFT holders are worried that their investments may have suddenly lost all monetary value. One Discord user described Tuesday as “a bad day to wake up and realize you have $2,000 worth of unopened NFL Rookie Packs”; Another user asked the group if they should expect “a refund” on the $10,000 they’ve already spent on Reignmakers NFTs this year. A pessimistic Reddit user posted tuesday that they would sue DraftKings if they were forced to take a total loss on a Reignmakers NFT collection worth approximately $100,000.

The game (scam?) was built to make numbers like these not only possible, but somewhat easily achievable. A user who intended to compete from a position of strength in multiple overlapping high-profile contests at the same time, and who had been in the blockchain madhouse for a period of years, could easily have spent six figures on Reignmakers NFTs. DraftKings used non-gaming incentives to entice players to spend more and more money, much like casinos give away free suites to players who over-bet on blackjack. Another Reddit user lamented the loss of the additional prizes and ranking bonuses he had hoped to earn in the upcoming NFL season by having a portfolio of NFTs that had reached the highest levels of value and prestige. “I was already loaded up on 2024 creation tokens and rookie debut cards,” said this Reignmakers userwho claimed his portfolio was finally “close to the top 250 overall.”

Dufoe’s complaint says the NFTs minted by DraftKings for Reignmakers qualify as securities, function like securities, and should be regulated as securities. In its motion to dismiss, DraftKings attempted to position its NFTs as game pieces — eye-wateringly expensive, yes, but essentially the same thing as Magic: The Gathering cards or Monopoly hotels. The court, in resolving these arguments, applied what’s known as “the Howey test,” referencing a case from 1946 in which the U.S. Supreme Court established a standard for determining whether a specific instrument qualifies as an investment contract. Judge Dennis J. Casper, in ruling against DraftKings’ motion, concluded that Dufoe could plausibly argue that Reignmakers’ NFT transactions represent “the pooling of assets from multiple investors in such a manner that all share in the profits and risks of the enterprise,” arguing that DraftKings’ absolute control over the game and marketplace effectively binds the financial interests of the company and the buyers, the latter of whom depend on the viability of both for their NFTs to retain any value.

Reignmakers users are different from Monopoly players in at least one crucial way: A person who buys a Monopoly board has no expectation from Hasbro that those little red and green pieces will appreciate in value. It’s a game! No matter what any hysterically conflicted party may say to the contrary, that’s not what NFT collecting is. DraftKings had been selling Reignmakers NFTs for months before they were gamified, and Dufoe, in his complaint, cites public comments made by DraftKings spokespeople that seem to explicitly position Reignmakers NFTs as assets with independent monetary value beyond their utility in Reignmakers contests. Judge Casper, in his ruling on the motion to dismiss, cites a Twitter account associated with a podcast run by DraftKings CEO Matthew Kalish, who in a tweet described NFTs as “the opportunity to invest in startups, artists, operations, and entrepreneurs all at once.” This is probably the kind of thing that NFT peddlers should stop saying. This advice assumes, of course, that NFTs will continue to exist as instruments on the other side of this and other lawsuits.

DraftKings has posted a worryingly sparse FAQ at the bottom of the your ad Tuesday, anticipating but largely failing to address questions from players who see this as yet another in a long line of brutal blockchain rug pulls. In a hilarious reversal of existing Reignmakers policy, Reignmakers users are now allowed by DraftKings to withdraw their Reignmakers NFTs from their DraftKings portfolios and into their personal NFT wallets, where those NFTs will have precisely zero value, to anyone, for the rest of all time. There’s also vague language about Reignmakers users having the option to “relinquish” their NFTs back to DraftKings in exchange for “cash payments,” subject to “certain conditions” and according to an as-yet-unspecified formula that will take into account, among other things, the “size and quality” of a player’s collection.

Reignmakers users are not optimistic. Those who claim to have been victims of other blockchain market crashes are warning their peers on Discord and Reddit to expect payouts that amount to pennies on the dollar; in the absence of any clarifying information, users are unsure whether cashing out their NFTs from Reignmakers to their personal NFT wallets, for reasons that completely pass any and all understanding, would effectively preclude the possibility of delivering these silly digital tokens back to DraftKings. It remains to be seen what exactly DraftKings has in mind with the “certain conditions” attached to the delivery process. There is much that has yet to be resolved. A DraftKings spokesperson contacted by Defector indicated that more time would be needed to answer a list of specific questions and issued a statement noting that it is “in DraftKings’ DNA to innovate and disrupt to provide the best possible gaming experiences for our customers.” The original complaint is embedded below.

Do you know anything about the demise of Reignmakers, either from the consumer side or from the DraftKings side? We’d love to hear from you. Get it in touch!

Recommended

NFTs

There Will Be No More ‘Mario & Sonic’ Olympics Because of NFTs

Nintendo and SEGA have been teaming up with the Olympics for several years now in the popular Mario & sonic in the Olympic Games series, but a new report claims the International Olympic Committee has abandoned the series in favor of new deals in eSports and NFTs.

According to Eurogamer“A veteran behind the series,” Lee Cocker, told the outlet that the IOC chose not to renew its license with SEGA and Nintendo, letting it expire in 2020. “They wanted to look at other partners and NFTs and eSports,” Cocker told Eurogamer. “Basically, the IOC wanted to bring [it] turn inward and look for other partners so they could get more money.”

Mario & Sonic at the Olympic Games is a series that has been running since 2008, with six main games covering the regular and Winter Olympics. In the games, players could control various characters from the Mario and Sonic franchises and compete in Olympic sporting events.

It’s no secret that NFTs are a big part of this year’s Paris 2024 Olympics. Olympics Go! Paris 2024 is a mobile and mobile-connected game your site states that players can “join the excitement of the Paris 2024 Olympic Games with nWay’s officially licensed, commemorative NFT Digital Pins collection honoring Paris 2024!”

As for eSports, Saudi Arabia will host the ESports Olympic Games in 2025. This is part of a partnership with the Saudi National Olympic Committee (NOC) that is expected to last for the next 12 years and is expected to feature regular events.

IOC President Thomas Bach said: “By partnering with the Saudi NOC, we also ensure that Olympic values are respected, in particular with regard to the game titles on the programme, the promotion of gender equality and the engagement with young audiences who are embracing esports.”

In other news, Someone claimed they’re suing Bandai Namco because Elden Ring is too difficult.

-

News11 months ago

News11 months agoMore Crypto AI Alliances Emerge Following $7.5 Billion Token Merger — TradingView News

-

News11 months ago

News11 months agoOver 1 million new tokens launched since April

-

Altcoins11 months ago

Altcoins11 months agoAltcoin Investments to create millionaires in 2024

-

Memecoins9 months ago

Memecoins9 months agoMemecoins dominate major derivatives in terms of open interest | Flash News Detail

-

News9 months ago

News9 months agoInvest Now: The Hottest New Cryptocurrencies of August 2024 That Could Skyrocket

-

Altcoins9 months ago

Altcoins9 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

NFTs9 months ago

NFTs9 months agoRTFKT Announces Project Animus Reveal, Launches Egg Unboxing Event Amid Mixed Reactions | NFT CULTURE | NFT News | Web3 Culture

-

Altcoins9 months ago

Altcoins9 months agoHot New Altcoin: Memeinator’s Price Upside Potential in July

-

Videos12 months ago

Videos12 months agoMoney is broke!! The truth about our financial system!

-

Memecoins11 months ago

Memecoins11 months agoChatGPT Analytics That Will Work Better in 2024

-

Altcoins11 months ago

Altcoins11 months agoRender vs. Theta; Which DePIN Altcoin to buy in May

-

News11 months ago

News11 months ago5 Crypto Airdrops After Notcoin to Watch Out for in June 2024